Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Securities Analyst position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

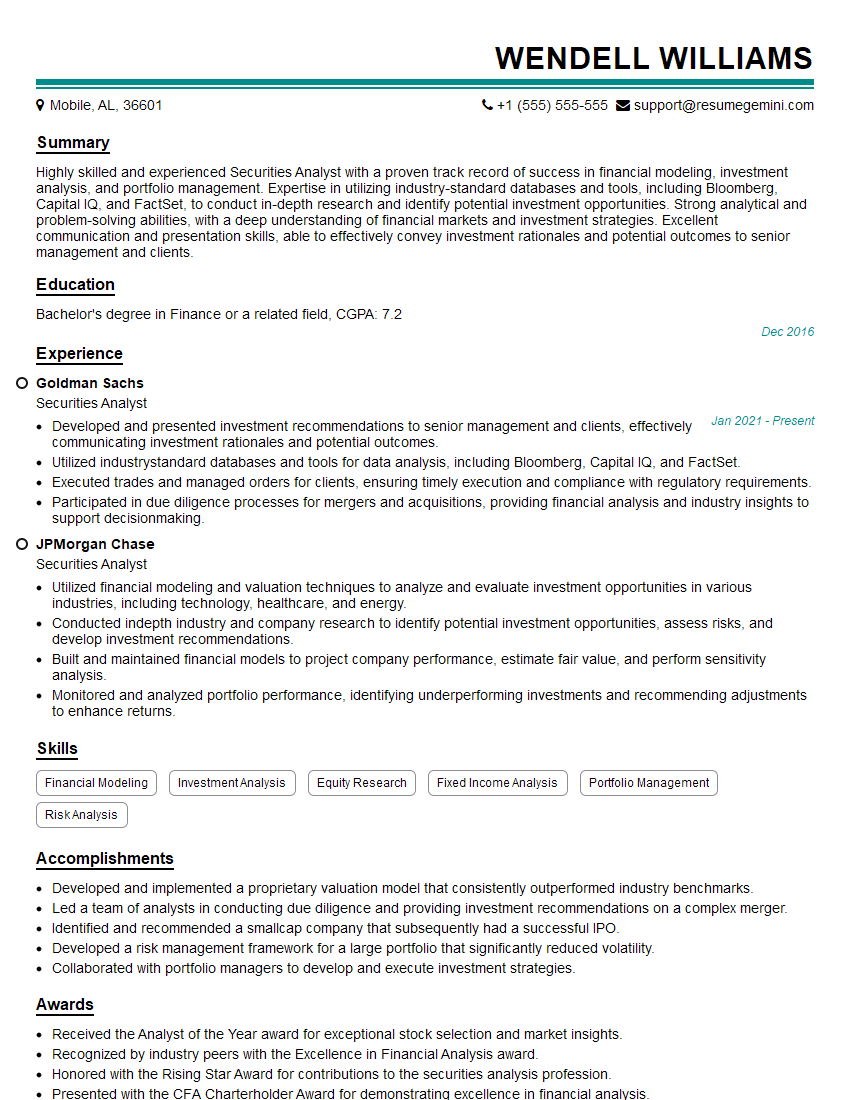

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Securities Analyst

1. How do you determine the intrinsic value of a company?

- Discounted Cash Flow (DCF) analysis

- Comparable company analysis

- Asset-based valuation

- Consideration of qualitative factors such as management team and competitive landscape

2. Explain the key financial ratios used to evaluate a company’s liquidity, profitability, and solvency.

Liquidity

- Current ratio

- Quick ratio

Profitability

- Gross profit margin

- Operating profit margin

- Net profit margin

Solvency

- Debt-to-equity ratio

- Times interest earned ratio

3. How do you incorporate macroeconomic factors into your investment analysis?

- Economic growth forecasts

- Interest rate trends

- Inflation expectations

- Currency fluctuations

4. Describe the different types of investment strategies and how you select the appropriate strategy for a client.

- Growth investing

- Value investing

- Income investing

- Factor-based investing (e.g., momentum, value)

- Consideration of client risk tolerance and investment horizon

5. How do you identify and evaluate potential investments in both domestic and international markets?

- Industry and company research

- Financial analysis using various valuation techniques

- Market and economic analysis

- Consideration of geopolitical and regulatory risks

6. Explain the role of technical analysis in your investment process.

- Trend analysis

- Chart patterns

- Support and resistance levels

- Volume analysis

- Cautions about overreliance on technical indicators

7. How do you manage risk in your investment portfolios?

- Asset allocation

- Diversification

- Hedging strategies

- Regular portfolio monitoring and rebalancing

8. Explain the ethical responsibilities of a securities analyst.

- Fiduciary duty to clients

- Confidentiality of information

- Avoidance of conflicts of interest

- Compliance with regulatory requirements

9. How do you stay up-to-date on the latest investment trends and research?

- Industry conferences and webinars

- Financial news and publications

- Academic journals

- Networking with other professionals

10. Describe a challenging investment situation you faced and how you successfully resolved it.

Explain the specific investment decision, the challenges encountered, and the steps taken to resolve the situation.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Securities Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Securities Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Securities Analysts are highly skilled professionals who play a crucial role in the financial industry by evaluating and recommending investment opportunities. Here are some key job responsibilities:

1. Market Research and Analysis

Conducting thorough research on companies, industries, and economic trends to identify potential investment opportunities.

- Analyzing financial statements, news releases, regulatory filings, and industry reports.

- Estimating future earnings, cash flows, and stock prices.

2. Investment Recommendations

Providing buy, sell, or hold recommendations to clients based on research and analysis.

- Developing investment strategies, asset allocation models, and risk management plans.

- Writing research reports, investment memos, and market commentaries.

3. Portfolio Management

Monitoring and managing investment portfolios to ensure alignment with client goals and risk tolerance.

- Tracking stock performance, market trends, and economic indicators.

- Rebalancing portfolios to optimize returns and minimize risk.

4. Client Communication and Relationship Management

Building and maintaining strong client relationships through effective communication and tailored investment advice.

- Presenting investment recommendations and market insights to clients.

- Responding to client inquiries and addressing their concerns.

Interview Tips

To ace an interview for a Securities Analyst position, candidates should consider the following tips:

1. Research the Company and Industry

Demonstrate your knowledge of the company, its business model, and the broader industry landscape.

- Review the company’s website, annual reports, and recent press releases.

- Read industry publications and attend webinars to stay up-to-date on market trends.

2. Prepare Your Resume and Cover Letter

Highlight your relevant skills, experience, and accomplishments in your resume and cover letter.

- Use keywords from the job description to tailor your application.

- Quantify your results whenever possible to demonstrate your impact.

3. Practice Your Technical Skills

Be prepared to answer technical questions related to financial analysis, valuation, and portfolio management.

- Review fundamental and technical analysis techniques.

- Practice building investment models and performing scenario analysis.

4. Develop Your Soft Skills

In addition to your technical abilities, highlight your communication, interpersonal, and problem-solving skills.

- Be prepared to discuss how you approach complex problems and communicate your findings effectively.

- Demonstrate your ability to work well in a team environment and build strong relationships.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Securities Analyst interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.