Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Securities Consultant position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

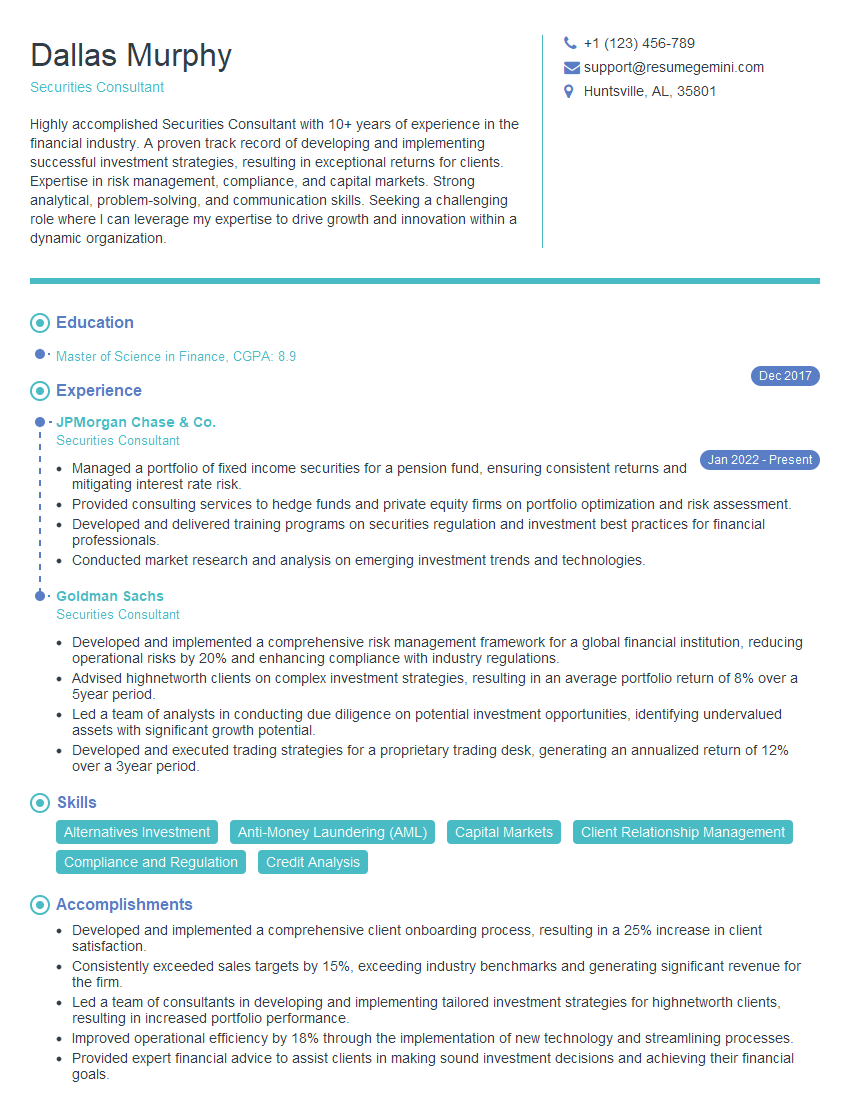

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Securities Consultant

1. How do you stay updated with the latest trends and regulations in the securities industry?

I make it a point to regularly attend industry conferences, webinars, and training programs to stay abreast of the latest developments. I also subscribe to industry publications and follow thought leaders on social media to keep up with current trends and best practices.

2. Tell me about a complex securities transaction you’ve worked on.

IPO Execution

- Advised a technology startup on its initial public offering (IPO). This involved conducting due diligence, preparing the prospectus, and working with underwriters to market and sell the shares.

- Successfully guided the company through the IPO process, resulting in a successful offering that exceeded expectations.

Merger and Acquisition

- Represented a private equity firm in the acquisition of a healthcare company. This involved negotiating the terms of the transaction, conducting due diligence, and obtaining regulatory approvals.

- Successfully closed the acquisition, which allowed the private equity firm to expand its portfolio and the healthcare company to access additional resources.

3. How do you assess the risk and return profile of a security?

I consider factors such as:

- Market conditions

- Issuer’s financial health

- Security’s historical performance

- Industry trends

- Economic outlook

I use quantitative and qualitative analysis techniques to evaluate these factors and form an opinion on the risk and return potential of the security.

4. How do you develop and implement investment strategies for clients?

I first gather information about the client’s investment goals, risk tolerance, and time horizon. Then, I develop a customized investment strategy that meets their specific needs.

I consider factors such as:

- Asset allocation

- Security selection

- Risk management

I monitor the performance of the investment strategy and make adjustments as needed to ensure that it remains aligned with the client’s objectives.

5. How do you manage client relationships and build trust?

I believe that building strong client relationships is essential for success in this industry. I make it a point to:

- Communicate regularly with clients

- Be transparent about investment decisions

- Respond promptly to inquiries

- Go the extra mile to meet client needs

I believe that by consistently delivering value and building trust, I can retain clients and grow my business.

6. How do you use technology to enhance your work as a Securities Consultant?

I use a variety of technology tools to enhance my work, including:

- CRM systems to manage client relationships

- Portfolio management software to track and analyze investments

- Research platforms to access real-time market data and analysis

- Communication tools to stay connected with clients and colleagues

By leveraging technology, I am able to work more efficiently and effectively, and provide better service to my clients.

7. How do you stay motivated and continue to develop your skills as a Securities Consultant?

I am passionate about the securities industry and I am always looking for ways to improve my skills and knowledge. I regularly attend training programs and workshops, and I read industry publications to stay up-to-date on the latest trends.

I am also motivated by the challenges of the job. I enjoy working with clients to help them achieve their financial goals, and I am constantly looking for new ways to add value to their lives.

8. Tell me about a time you had to deal with a difficult client.

I once had a client who was very demanding and often made unreasonable requests. I remained professional and patient, and I always tried to meet their needs to the best of my ability.

Eventually, the client came to appreciate my dedication and hard work, and they became one of my most loyal clients.

9. What are some of the ethical challenges you face as a Securities Consultant?

As a Securities Consultant, I have a fiduciary duty to my clients. This means that I must always act in their best interests, even if it means sacrificing my own personal gain.

Some of the ethical challenges I face include:

- Conflicts of interest

- Insider trading

- Misrepresentation of information

I am committed to upholding the highest ethical standards in my work, and I always put the interests of my clients first.

10. What are your career goals for the next 5 years?

In the next 5 years, I hope to continue to grow my skills and knowledge as a Securities Consultant. I would like to take on more leadership roles within my firm, and I am also interested in developing my own investment strategies.

I am committed to providing excellent service to my clients, and I am confident that I can continue to be a valuable asset to my firm.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Securities Consultant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Securities Consultant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Securities Consultants play a crucial role in advising clients on investment strategies, managing portfolios, and developing financial plans. They possess a deep understanding of financial markets, regulations, and products.

1. Investment Advisory and Portfolio Management

Analyze clients’ financial situations, risk tolerance, and investment objectives

- Develop tailored investment strategies and asset allocation plans

- Recommend and execute trades, monitor portfolio performance, and make necessary adjustments

2. Financial Planning and Wealth Management

Provide comprehensive financial advice and guidance on estate planning, tax optimization, and retirement planning

- Create comprehensive financial plans that align with clients’ goals

- Implement and monitor financial strategies to maximize wealth and minimize risk

3. Market Research and Analysis

Keep abreast of financial news, market trends, and industry developments

- Conduct in-depth research to identify investment opportunities and potential risks

- Provide clients with timely and accurate market insights and recommendations

4. Client Relationship Management

Establish and maintain strong relationships with clients

- Provide exceptional customer service and address client inquiries promptly

- Communicate investment strategies, portfolio updates, and market trends effectively

Interview Tips

Thoroughly prepare for your Securities Consultant interview to showcase your skills and knowledge. Here are some valuable tips:

1. Research the Company and Industry

Learn about the firm’s history, values, services, and recent developments.

2. Review Basic Securities Concepts

Refresh your understanding of investment terminology, financial ratios, and market dynamics.

3. Practice Your Problem-Solving Abilities

Be prepared to discuss hypothetical scenarios involving client consultations, investment analysis, or financial planning.

4. Showcase Your Communication and Interpersonal Skills

Emphasize your ability to clearly convey complex financial concepts and build strong client relationships.

5. Prepare Questions

Asking thoughtful questions demonstrates your engagement and interest in the firm and position.

6. Practice and Seek Feedback

Conduct mock interviews to practice your answers, receive feedback, and improve your delivery.

7. Dress Professionally and Arrive Punctually

First impressions matter, so present yourself formally and arrive on time for your interview.

8. Research Regulations and Compliance

Demonstrate your knowledge of industry regulations, such as FINRA and SEC requirements.

9. Highlight Your Ethics and Integrity

Emphasize your commitment to ethical practices and maintaining the confidentiality of client information.

10. Express Your Passion for Finance

Convey your enthusiasm for the financial markets and your desire to help clients achieve their financial goals.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Securities Consultant role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.