Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Securities Lending Trader interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Securities Lending Trader so you can tailor your answers to impress potential employers.

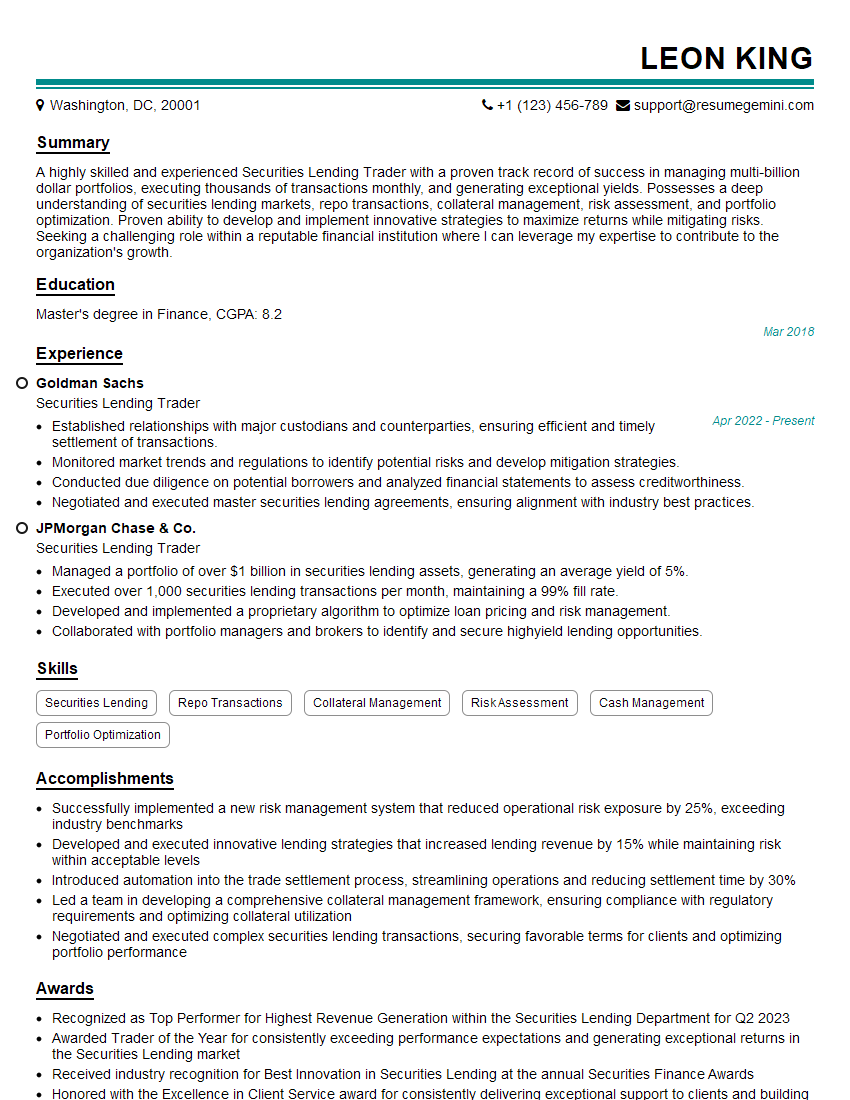

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Securities Lending Trader

1. What are the key factors you consider when evaluating a potential securities lending trade?

- Collateral requirements

- Borrower creditworthiness

- Loan term

- Interest rate

- Market liquidity

2. Describe the different types of collateral that can be used in securities lending transactions.

- Bonds

- Stocks

- Equities

- ETFs

- Mutual funds

- Closed-end funds

Cash

Marginable Securities

Non-Marginable Securities

3. What are the risks associated with securities lending?

- Counterparty default risk

- Collateral devaluation risk

- Liquidity risk

- Operational risk

4. How do you manage the risks associated with securities lending?

- Diversifying collateral portfolio

- Setting appropriate collateral haircuts

- Monitoring borrower creditworthiness

- Implementing robust operational procedures

5. What are the benefits of securities lending?

- Generate income from idle assets

- Enhance portfolio returns

- Improve liquidity

- Reduce borrowing costs

6. How do you determine the appropriate interest rate for a securities lending trade?

- Market supply and demand

- Collateral type

- Loan term

- Borrower creditworthiness

7. What are the regulatory requirements for securities lending?

- SEC Rule 10b-5

- FINRA Rule 11810

- Basel III Accord

8. How do you stay up-to-date on the latest industry developments?

- Reading trade publications

- Attending conferences

- Networking with other professionals

9. What are the ethical considerations for a securities lending trader?

- Maintaining confidentiality

- Avoiding conflicts of interest

- Acting in the best interest of clients

10. What are the key skills and qualities for a successful securities lending trader?

- Strong analytical skills

- Excellent communication skills

- In-depth understanding of the securities lending market

- Ability to make quick decisions

- Ability to work under pressure

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Securities Lending Trader.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Securities Lending Trader‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Securities Lending Traders play a pivotal role in the financial markets, facilitating the lending and borrowing of securities between institutional investors. Their primary responsibilities encompass:

1. Securities Lending

The core responsibility involves lending out firm’s own securities to other market participants who have a temporary need for them. This process generates income for the firm.

- Identifying potential borrowers and negotiating lending terms.

- Monitoring borrowed securities and ensuring timely return.

2. Securities Borrowing

Securities Lending Traders also borrow securities from other institutions to meet various trading and hedging needs. Borrowing securities enables the firm to short sell or hedge against potential losses.

- Identifying and negotiating with potential lenders to source required securities.

- Managing borrowed securities and ensuring timely return and settlement.

3. Market Analysis and Risk Management

Securities Lending Traders continuously monitor the securities lending and borrowing market. They assess supply and demand dynamics to optimize lending and borrowing strategies while managing associated risks.

- Analyzing market trends and identifying potential risks.

- Developing strategies to mitigate risks and protect firm’s assets.

4. Client Relationship Management

Building and maintaining strong relationships with clients is crucial. Traders must understand their needs and tailor solutions accordingly.

- Establishing and maintaining relationships with clients.

- Providing market insights and advisory services to clients.

Interview Tips

Preparing for an interview for a Securities Lending Trader role requires thorough research and a strategic approach. Here are some tips to help you ace the interview:

1. In-depth Industry Knowledge

Demonstrate a deep understanding of the securities lending and borrowing market, including its instruments, participants, and regulations. Stay updated on industry news and trends to showcase your expertise.

2. Technical Proficiency

Highlight your proficiency in relevant securities lending and borrowing platforms. Familiarity with trading systems, risk management tools, and market data providers is highly valued.

3. Problem-Solving Abilities

Securities Lending Traders constantly encounter challenges. Emphasize your ability to analyze complex situations, identify potential solutions, and make informed decisions under pressure.

4. Team Player with Strong Communication Skills

Securities Lending Trading often involves collaboration with colleagues and clients. Highlight your teamwork capabilities and ability to communicate effectively in both verbal and written formats.

5. Ethical Conduct and Regulatory Compliance

Emphasize your commitment to ethical practices and regulatory compliance. Highlight your adherence to industry best practices and understanding of relevant regulations.

Example Outline for Interview Questions

Prepare specific examples that demonstrate your skills and experience relevant to each key responsibility. For instance:

Question: Describe a time you successfully negotiated a complex securities lending transaction.

Example Outline:

- Briefly outline the transaction and its complexity.

- Discuss your role in identifying the borrower, negotiating terms, and managing risks.

- Highlight the positive outcome and any challenges you overcame.

Next Step:

Now that you’re armed with the knowledge of Securities Lending Trader interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Securities Lending Trader positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini