Feeling lost in a sea of interview questions? Landed that dream interview for Securities Trader but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Securities Trader interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

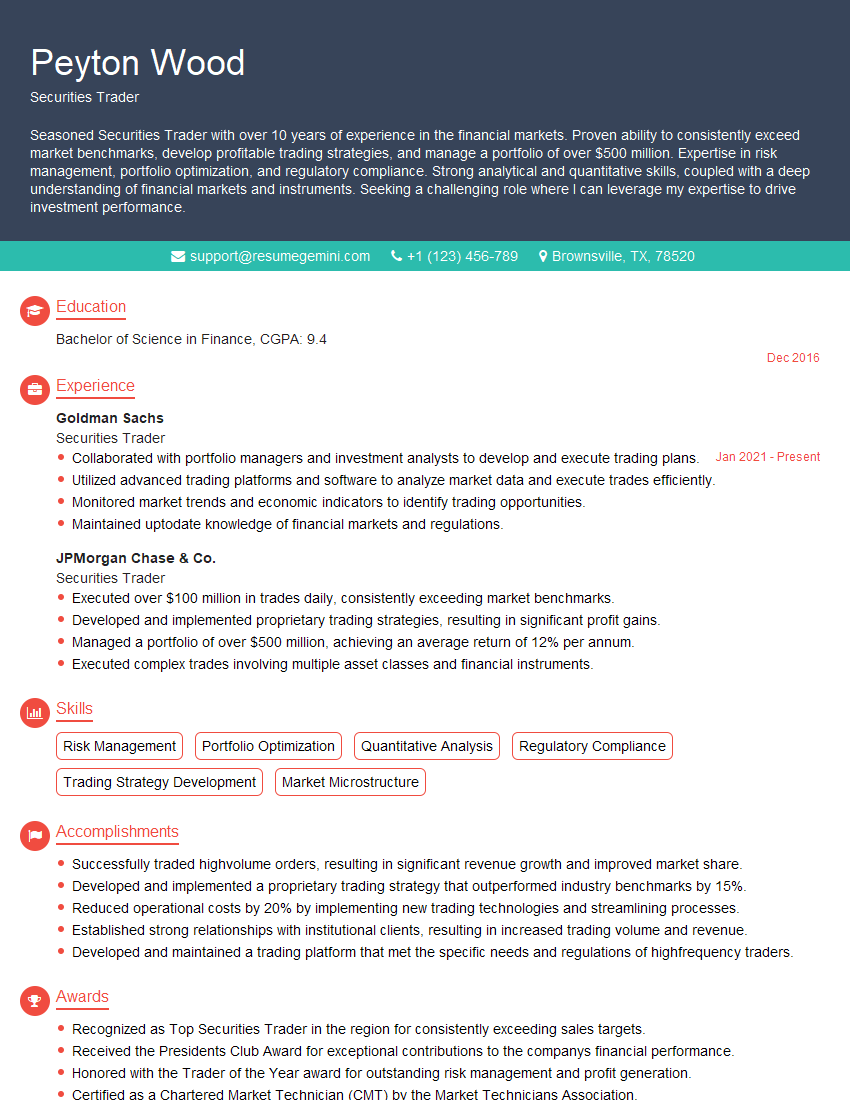

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Securities Trader

1. Explain the process of executing a trade in the secondary market?

- Identify the buyer and seller, and their respective order specifications (price, quantity, etc.).

- Match the orders based on price and quantity.

- Verify the trade details, including settlement instructions, and execute the trade.

- Clear and settle the trade through a clearinghouse or depository.

- Monitor the status of the trade and ensure timely settlement.

2. Describe the different types of order types used in securities trading, and when each type is appropriate to use?

Market Order

- Executed immediately at the current market price.

- Appropriate when speed of execution is critical and price is less important.

Limit Order

- Executed at a specified price or better.

- Appropriate when the trader wants to control the price of execution.

Stop Order

- Triggered when a security reaches a specific price.

- Appropriate when the trader wants to protect against losses or lock in profits.

3. How do you determine the fair value of a security?

- Use fundamental analysis to assess the underlying business of the issuer.

- Consider technical analysis to identify price trends and patterns.

- Take into account market conditions and macroeconomic factors.

- Reference industry benchmarks and comparable companies.

4. Describe the different types of risk involved in securities trading, and how to manage them?

- Market risk: Fluctuations in market prices, which can lead to losses on investments.

- Credit risk: The possibility that the issuer of a security will default on its obligations.

- Liquidity risk: The difficulty in buying or selling a security quickly and at a fair price.

- Operational risk: Errors or disruptions in trading systems, which can lead to financial losses.

- Risk management techniques:

- Diversification of portfolio holdings.

- Hedging strategies, such as using options or futures.

- Limit orders to control exposure to price fluctuations.

- Regular monitoring and adjustment of trading positions.

5. Explain the role of a clearinghouse in the securities trading process?

- Acts as an intermediary between buyers and sellers, guaranteeing the settlement of trades.

- Provides risk management services, such as margin calls and default protection.

- Facilitates the exchange of securities and funds between trading parties.

- Maintains a central record of all trades executed through the clearinghouse.

6. Describe the different types of trading strategies used in securities trading, and when each type is most effective?

- Trend following: Buying and selling securities that are following a trend, with the goal of profiting from price movements.

- Value investing: Buying securities that are undervalued relative to their intrinsic value, with the goal of holding them for long-term appreciation.

- Momentum trading: Trading securities that are experiencing a strong momentum in price, with the goal of profiting from short-term price moves.

- Hedging: Using financial instruments to offset the risk of another asset or investment.

7. How do you stay up-to-date with market trends and economic news that may affect your trading decisions?

- Read industry publications, financial news websites, and research reports.

- Attend industry conferences and seminars.

- Follow financial analysts and experts on social media.

- Use data analysis tools and software to monitor market trends and identify trading opportunities.

8. Describe your experience in using trading platforms and technologies, and how you stay current with the latest advancements?

- Proficient in using various trading platforms, including Bloomberg, Refinitiv, and FactSet.

- Familiar with order entry, execution, and risk management tools.

- Stay updated with new technologies through training and certification programs.

- Participate in industry discussions and forums to learn about best practices and emerging technologies.

9. How do you handle stressful and time-sensitive situations while trading?

- Maintain a calm and focused demeanor, even under pressure.

- Prioritize tasks and manage time effectively.

- Delegate responsibilities when necessary to minimize workload.

- Take breaks and practice stress management techniques to prevent burnout.

10. Why are you interested in working as a Securities Trader at our firm?

- Highlight your knowledge of and interest in the firm’s industry and business model.

- Express your alignment with the firm’s investment philosophy and trading strategies.

- Emphasize your enthusiasm for the challenges and opportunities of the role.

- Explain how your skills and experience make you a valuable asset to the team.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Securities Trader.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Securities Trader‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Securities Traders play a pivotal role in the financial markets, executing buy and sell orders for various financial instruments on behalf of clients or their own firm. Key responsibilities include:

1. Trade Execution

Executing buy and sell orders for securities such as stocks, bonds, options, and derivatives.

- Analyzing market conditions and identifying optimal trading strategies.

- Negotiating with brokers and counterparties to secure favorable prices and execution.

2. Market Analysis and Strategy

Monitoring market trends, economic indicators, and geopolitical events to identify trading opportunities.

- Developing trading strategies based on fundamental and technical analysis.

- Providing insights and recommendations to clients or portfolio managers.

3. Risk Management

Managing risk associated with trading activities, including market risk, liquidity risk, and operational risk.

- Setting and monitoring risk limits.

- Implementing risk controls and contingency plans.

4. Client Relationship Management

Building and maintaining relationships with clients, understanding their investment objectives, and providing personalized trading solutions.

- Proactively communicating with clients about market updates and trade executions.

- Resolving client inquiries and addressing any concerns.

Interview Tips

Preparing thoroughly for an interview as a Securities Trader is essential. Consider these tips to ace the interview:

1. Research the Company and Industry

Gather in-depth knowledge about the financial institution you’re applying to and the broader financial industry. Show your understanding of their business model, products, and recent developments.

- Read the company’s website, annual reports, and news articles.

- Follow industry publications and attend industry events.

2. Quantify Your Experience

In your resume and interview, quantify your achievements whenever possible. Use specific metrics to demonstrate the impact of your trading activities.

- Highlight your trading volume, profit margins, and risk management performance.

- Provide concrete examples of successful trading strategies you’ve implemented.

3. Practice Behavioral Questions

Behavioral questions are commonly asked in interviews to assess your problem-solving abilities and teamwork skills. Prepare by reflecting on your past experiences and identifying specific examples that showcase these qualities.

- Use the STAR method (Situation, Task, Action, Result) to structure your answers.

- Focus on demonstrating your critical thinking, adaptability, and interpersonal skills.

4. Technical Knowledge and Skills

Be prepared to discuss your technical knowledge and skills in detail. This may include questions about trading platforms, risk management tools, and financial modeling techniques.

- Review industry certifications and professional development programs.

- Stay up-to-date on the latest trading technologies and market trends.

5. Dress Professionally and Arrive Prepared

First impressions matter. Dress professionally and arrive at the interview prepared with all necessary materials, including copies of your resume and relevant certifications.

- Be punctual and show respect for the interviewer’s time.

- Maintain eye contact, speak clearly, and ask thoughtful questions.

Next Step:

Now that you’re armed with the knowledge of Securities Trader interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Securities Trader positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini