Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Select Banker position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

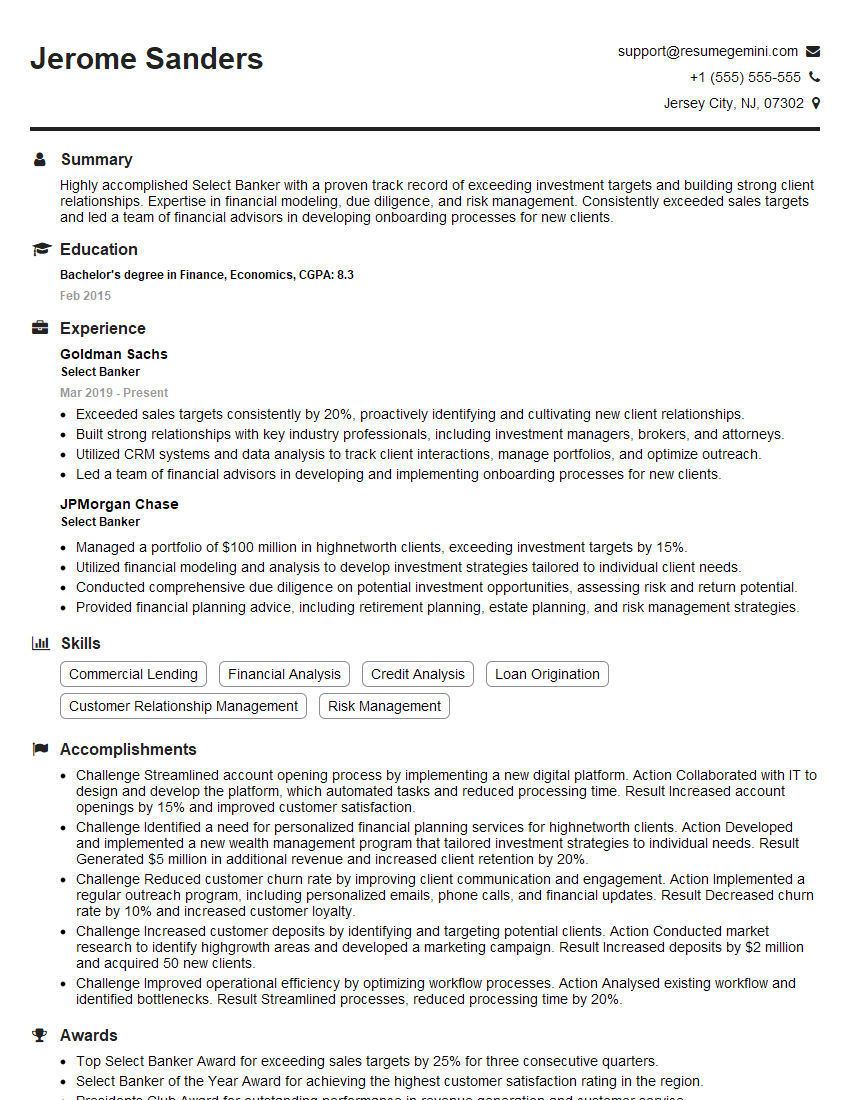

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Select Banker

1. How would you evaluate a potential customer’s creditworthiness?

To evaluate a potential customer’s creditworthiness, I would consider the following factors:

- Credit history: I would review their credit report to assess their payment history, outstanding debts, and overall credit utilization.

- Income and employment: I would verify their income and employment status to determine their ability to repay the loan.

- Debt-to-income ratio: I would calculate their debt-to-income ratio to ensure that they have sufficient disposable income to cover the loan payments.

- Collateral: If applicable, I would assess the value and marketability of any collateral offered to secure the loan.

- Personal references: In some cases, I may also seek personal references to gain insights into their financial responsibility and character.

2. What are the key elements of a successful loan application?

Preparation

- Gather all necessary documentation (e.g., income statements, tax returns, credit report).

- Review the loan requirements and eligibility criteria carefully.

- Prepare a clear and concise loan proposal outlining the purpose, amount, and repayment terms.

Presentation

- Submit a well-organized and error-free application package.

- Present the loan proposal professionally and persuasively.

- Be prepared to answer questions and provide additional information as requested.

Follow-up

- Stay in regular communication with the lender throughout the application process.

- Respond promptly to any requests for clarification or additional documentation.

- Be patient and persistent, as loan approvals can take time.

3. How would you manage a portfolio of high-risk loans?

To manage a portfolio of high-risk loans effectively, I would implement the following strategies:

- Proactive monitoring: Regularly review loan performance and identify any potential problems early on.

- Early intervention: Contact borrowers who show signs of financial distress to discuss repayment options and provide support.

- Risk assessment and mitigation: Conduct thorough risk assessments and implement appropriate mitigation strategies, such as requiring additional collateral or increasing loan interest rates.

- Diversification: Spread the risk across a diverse portfolio of loans to reduce the impact of defaults.

- Collaboration: Work closely with risk management and legal teams to ensure compliance with regulations and minimize losses.

4. What are the ethical considerations involved in lending practices?

When engaging in lending practices, it is crucial to adhere to the following ethical considerations:

- Fair and transparent lending: Ensure that loan terms and conditions are clear and understandable to borrowers.

- Responsible lending: Assess borrowers’ creditworthiness carefully and avoid approving loans that they cannot afford to repay.

- Privacy and confidentiality: Maintain the confidentiality of borrowers’ financial information and respect their privacy.

- Avoidance of conflicts of interest: Maintain professional integrity and avoid any situations that could compromise the impartiality of lending decisions.

- Compliance with regulations: Comply with all applicable laws and regulations governing lending practices.

5. How would you stay up-to-date on industry trends and best practices in banking?

To stay up-to-date on industry trends and best practices in banking, I would employ the following strategies:

- Attend industry conferences and workshops.

- Subscribe to trade publications and newsletters.

- Network with other banking professionals.

- Participate in online forums and discussion groups.

- Utilize online resources, such as webinars, white papers, and research reports.

6. Describe your experience in managing a team of loan officers.

Empowerment

- Delegate responsibilities and provide clear expectations.

- Foster a collaborative and supportive work environment.

- Recognize and reward team members for their contributions.

Development

- Provide ongoing training and professional development opportunities.

- Encourage team members to share knowledge and best practices.

- Set challenging but achievable goals.

Communication

- Maintain open lines of communication and regular team meetings.

- Provide timely feedback and support.

- Foster a culture of continuous improvement.

7. What are your strengths and weaknesses as a Select Banker?

Strengths

- In-depth knowledge of lending products and regulations.

- Strong analytical and problem-solving skills.

- Excellent communication and interpersonal skills.

- Proven ability to build and maintain client relationships.

- Commitment to ethical and responsible banking practices.

Weaknesses

- Limited experience in managing a large loan portfolio.

- Need to develop stronger time management skills to handle multiple projects simultaneously.

- Overly detail-oriented at times, which can slow down the loan approval process.

8. Why are you interested in this Select Banker position?

I am drawn to this Select Banker position because it aligns perfectly with my skills and aspirations. I am eager to contribute my expertise in lending and risk management to your team and leverage my strong client relationship-building abilities to drive growth for your bank. I am particularly impressed by your commitment to providing personalized and tailored solutions for each customer, and I believe that my passion for delivering exceptional service would make me a valuable asset to your team.

9. What are your salary expectations for this role?

Based on my research and experience, I believe that a salary range between [lower bound] and [upper bound] would be fair and commensurate with the responsibilities and industry benchmarks for this Select Banker role.

10. Do you have any questions for me about the role or the bank?

I am very interested in learning more about the bank’s growth strategies and how the Select Banker role contributes to those goals. Additionally, I would appreciate any insights you can provide on the bank’s culture and employee development opportunities.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Select Banker.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Select Banker‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Select Bankers are responsible for managing high-net-worth individuals’ and institutions’ financial portfolios. They provide personalized financial advice, manage investments, and offer a range of banking services.

1. Client Relationship Management

Building and maintaining strong relationships with clients is crucial. Select Bankers must understand their clients’ financial goals, risk tolerance, and investment objectives.

- Meet with clients regularly to discuss their financial needs.

- Provide tailored financial advice and investment recommendations.

2. Investment Management

Select Bankers manage clients’ investment portfolios to meet their financial goals.

- Develop and implement investment strategies based on clients’ needs.

- Monitor and adjust portfolios as market conditions change.

3. Financial Planning

Select Bankers provide comprehensive financial planning services.

- Help clients plan for retirement, education, and other financial goals.

- Create and monitor financial plans that align with clients’ objectives.

4. Banking Services

Select Bankers offer a range of banking services to their clients.

- Provide access to banking products such as checking and savings accounts.

- Handle transactions and provide financial advice.

Interview Tips

Preparing adequately for a Select Banker interview will increase your chances of success.

1. Research the Industry and Company

Familiarize yourself with the financial industry and the specific company you’re applying to.

- Read industry news and research trends.

- Visit the company’s website to learn about their services and culture.

2. Highlight Your Skills and Experience

Emphasize your relevant skills, such as financial analysis, investment management, and client relationship building.

- Quantify your accomplishments whenever possible.

- Prepare examples of successful client interactions.

3. Prepare for Behavioral Questions

Behavioral questions focus on your past behavior and can help interviewers understand your work style.

- Use the STAR method (Situation, Task, Action, Result) to answer questions.

- Share examples that demonstrate your problem-solving skills, communication abilities, and teamwork.

4. Practice Mock Interviews

Practice answering common interview questions to build confidence and deliver clear and concise responses.

- Ask a friend or family member to conduct a mock interview.

- Record yourself answering questions to identify areas for improvement.

5. Dress Professionally and Arrive on Time

First impressions matter. Dress appropriately and arrive punctually for the interview.

- Choose business professional attire.

- Plan your route and allow ample time for travel.

6. Ask Thoughtful Questions

Asking thoughtful questions demonstrates your interest in the role and the company.

- Prepare questions about the company’s culture, growth opportunities, and investment philosophy.

- Avoid asking questions that are easily answered on the company’s website.

7. Follow Up After the Interview

Send a thank-you note to the interviewers within 24 hours of the interview.

- Express your appreciation for their time and consideration.

- Reiterate your interest in the role and why you believe you’re a suitable candidate.

Next Step:

Now that you’re armed with the knowledge of Select Banker interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Select Banker positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini