Feeling lost in a sea of interview questions? Landed that dream interview for Selling Underwriter but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Selling Underwriter interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

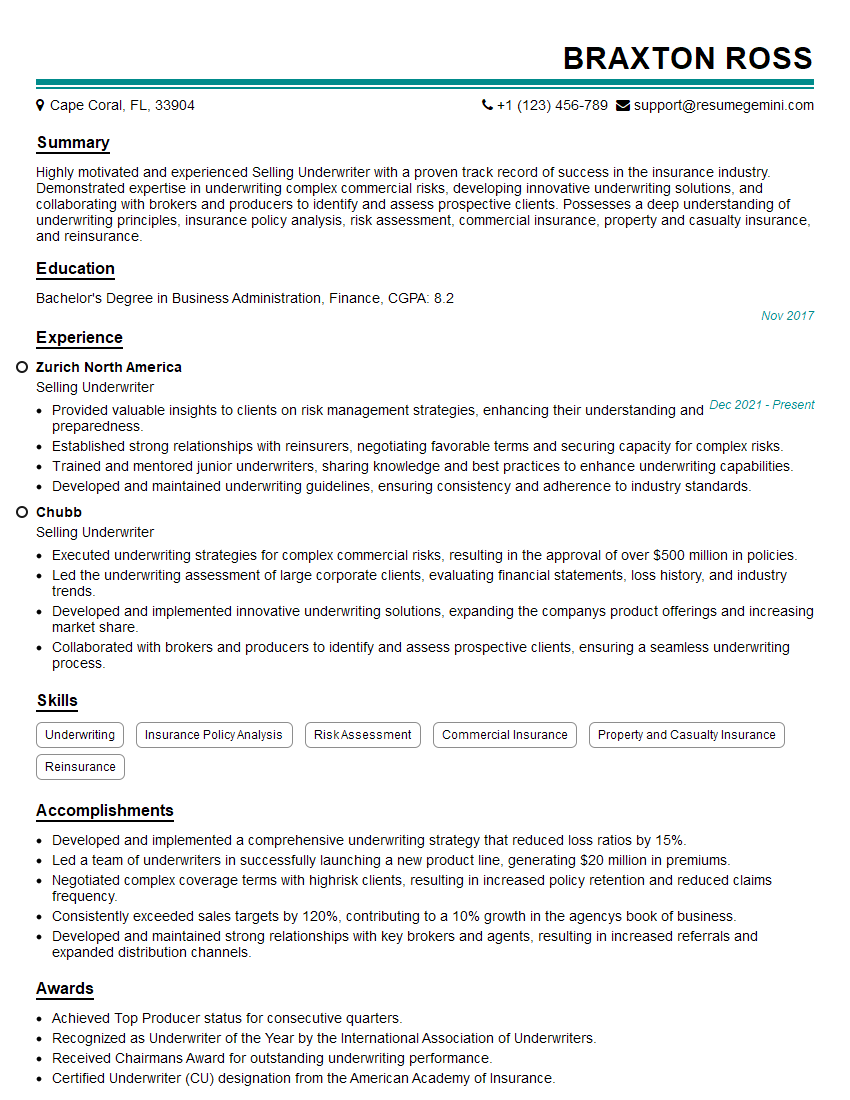

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Selling Underwriter

1. Explain the role of a Selling Underwriter in the insurance industry?

As a Selling Underwriter, my primary responsibilities include:

- Develop and maintain relationships with brokers, agents, and clients to identify and assess insurance needs.

- Analyze risk factors, assess policies, and determine appropriate coverage, limits, and premiums.

- Negotiate and issue insurance policies, ensuring compliance with underwriting guidelines and regulations.

- Evaluate and manage risk exposures, recommending strategies to mitigate potential losses.

- Collaborate with underwriters, actuaries, and legal counsel to ensure sound underwriting decisions.

2. Describe the underwriting process you follow when evaluating a potential risk?

Risk Assessment

- Gather information about the applicant, including their financial history, claims history, and industry experience.

- Analyze the nature and scope of the risk, considering factors such as location, hazards, and potential liabilities.

Policy Analysis

- Review the proposed policy terms and conditions to ensure they align with the risk assessment.

- Determine appropriate coverage, limits, and premiums based on the risk profile and industry benchmarks.

Decision-Making

- Evaluate the risk-reward ratio and make a decision on whether to accept or decline the application.

- Communicate the decision to the broker or agent, providing clear reasons for acceptance or denial.

3. How do you stay up-to-date on the latest industry trends and regulatory changes?

To remain current, I actively engage in professional development activities, such as:

- Attending industry conferences and seminars to learn about new products, underwriting practices, and regulatory updates.

- Reading trade publications, insurance journals, and online resources to stay informed about industry trends and best practices.

- Participating in online forums and discussion groups to connect with other underwriters and exchange knowledge.

- Completing continuing education courses and obtaining industry certifications to enhance my skills and credibility.

4. What are some of the key challenges you have faced as a Selling Underwriter?

- Assessing complex risks in emerging industries with limited historical data

- Balancing the need for profitability with maintaining competitive premiums

- Managing underwriting capacity constraints during periods of high demand

- Navigating regulatory changes that impact underwriting guidelines

- Collaborating effectively with clients and brokers to understand their unique needs and concerns

5. How do you build strong relationships with brokers and agents?

- Establishing clear communication channels and responding promptly to inquiries

- Providing timely and accurate quotes and underwriting decisions

- Hosting educational workshops and training sessions to share industry knowledge

- Attending industry events and participating in networking opportunities

- Offering support and guidance to brokers and agents in complex underwriting situations

6. What software and tools do you use in your day-to-day work?

- Underwriting management systems for policy administration and risk assessment

- Spreadsheets and databases for data analysis and reporting

- Industry-specific software for risk modeling and pricing

- Communication tools such as email, instant messaging, and video conferencing

- Project management software for tracking and managing underwriting processes

7. How do you prioritize multiple underwriting tasks and manage your workload?

- Using task management software to organize and track assignments

- Setting clear priorities based on urgency and importance

- Delegating tasks to support staff when necessary

- Negotiating deadlines with brokers and agents to ensure timely completion

- Effectively communicating progress updates to stakeholders

8. Describe a situation where you had to make a difficult underwriting decision?

I was presented with a complex risk from a high-growth tech company seeking a significant insurance policy. The company had a strong financial performance but limited industry-specific experience. After careful analysis, I determined that the risk profile was acceptable, albeit slightly higher than our standard underwriting guidelines. I collaborated with the client and broker to develop tailored coverage and risk mitigation strategies. The decision was ultimately successful, and the company has become a valuable long-term client.

9. What are your strengths and weaknesses as a Selling Underwriter?

Strengths

- Strong technical underwriting skills and risk assessment capabilities

- Excellent communication and relationship-building abilities

- Ability to balance risk and profitability considerations

- Proactive approach to underwriting and industry knowledge

Weaknesses

- Limited experience in underwriting certain specialized industries

- Desire to enhance my knowledge of actuarial science and risk modeling

10. Why are you interested in joining our company?

I am drawn to your company’s reputation for underwriting excellence and commitment to client satisfaction. The company’s focus on innovation and its strong team of underwriters aligns well with my career aspirations. I believe that my skills and experience would be a valuable asset to your team, and I am eager to contribute to the company’s continued success.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Selling Underwriter.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Selling Underwriter‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Selling Underwriters are responsible for marketing and distributing new insurance policies to businesses and individuals. They collaborate with agents and brokers to assess risk, evaluate applications, and determine premiums. Furthermore, they ensure compliance with regulations and guidelines, maintaining a deep understanding of insurance products and industry best practices.

1. Marketing and Sales

Intro paragraph

- Developing and implementing strategies to market and promote insurance products

- Identifying and targeting potential clients

- Negotiating and closing deals

2. Underwriting

Intro paragraph

- Assessing risk and underwriting insurance policies

- Evaluating applications and determining premiums

- Issuing policies and ensuring compliance with regulations

3. Customer Service

Intro paragraph

- Providing excellent customer service and support

- Responding to inquiries and resolving issues

- Building and maintaining relationships with clients

4. Professional Development

Intro paragraph

- Staying up-to-date on industry trends and regulations

- Attending training and development programs

- Obtaining and maintaining relevant certifications

Interview Tips

Preparing for an interview for a Selling Underwriter position requires a combination of industry knowledge, technical expertise, and effective communication skills. Below are some tips to help you ace your interview:

1. Research the Company and Role

Thoroughly research the insurance company and the specific Selling Underwriter role. Understand their products, target market, and industry reputation. This knowledge will enable you to tailor your answers and demonstrate your alignment with the company’s goals.

- Example: “I’m impressed by your company’s commitment to providing innovative insurance solutions to small businesses.”

2. Highlight Your Underwriting Expertise

Emphasize your strong underwriting skills and experience. Discuss your ability to assess risk, evaluate applications, and determine appropriate premiums. Provide specific examples of successful underwriting decisions you’ve made.

- Example: “In my previous role, I developed a new underwriting model that increased policy profitability by 15% while maintaining a low loss ratio.”

3. Showcase Your Sales Acumen

Selling Underwriters must possess strong sales skills. Highlight your ability to build relationships, negotiate effectively, and close deals. Share examples of how you’ve successfully marketed insurance products and exceeded sales targets.

- Example: “I have a proven track record of exceeding sales quotas by 20% through effective lead generation and relationship management.”

4. Emphasize Compliance and Regulatory Knowledge

Selling Underwriters must ensure compliance with insurance regulations. Demonstrate your understanding of relevant laws and industry standards. Discuss your experience in identifying and mitigating regulatory risks.

- Example: “I’m well-versed in the latest insurance regulations and have implemented processes to ensure compliance throughout the underwriting process.”

5. Prepare for Behavioral Questions

Many interviews include behavioral questions that focus on your past experiences and behaviors. Practice answering questions using the STAR method (Situation, Task, Action, Result). This method provides a structured approach for highlighting your skills and accomplishments.

- Example: “Tell me about a time you had to resolve a complex underwriting issue.” (STAR answer: “Situation: I was underwriting a large commercial property policy for a manufacturing plant. Task: I needed to assess the risk factors associated with the plant’s operations. Action: I conducted a thorough site inspection and reviewed the company’s safety protocols. Result: I was able to assess the risk accurately and determine a fair premium while maintaining compliance with regulations.”)

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Selling Underwriter interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.