Are you gearing up for an interview for a Senior Capital Markets Specialist position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Senior Capital Markets Specialist and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

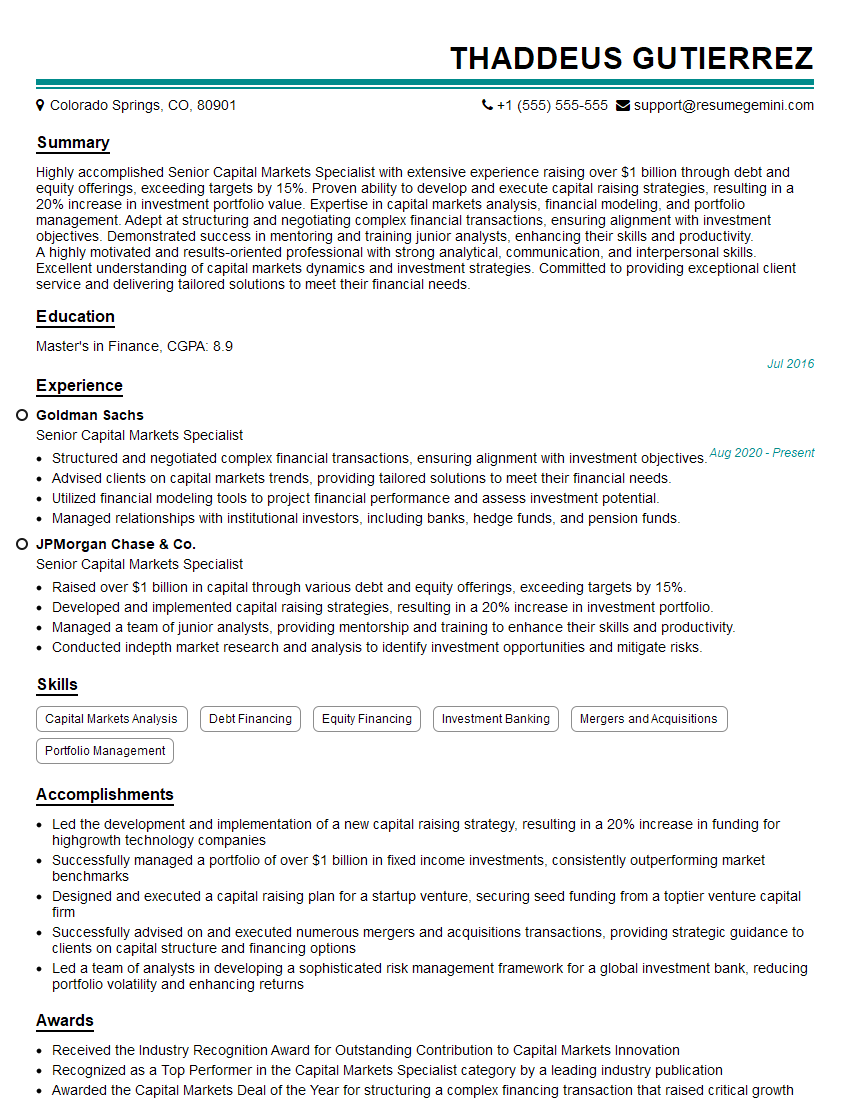

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Senior Capital Markets Specialist

1. What are the key considerations when structuring a debt financing transaction?

- Assessing the borrower’s creditworthiness and ability to repay the debt.

- Determining the appropriate debt structure, including the type of debt, maturity, and interest rate.

- Identifying and mitigating potential risks associated with the transaction.

- Developing a comprehensive legal documentation package that protects the interests of all parties involved.

2. Describe the different types of debt financing instruments available to companies.

Loan

- Term loans: Secured, fixed-rate loans with a specific repayment schedule.

- Revolving credit facilities: Flexible, unsecured loans that allow companies to borrow up to a pre-approved limit.

- Asset-backed loans: Loans secured by specific assets, such as inventory or receivables.

Debt Securities

- Bonds: Long-term debt obligations that pay interest and principal payments at specified intervals.

- Debentures: Unsecured bonds that are backed only by the issuer’s creditworthiness.

- Notes: Short-term debt securities that typically mature within 10 years.

3. What are the advantages and disadvantages of public versus private debt financing?

Public Debt Financing

Advantages:- Lower interest rates and longer maturities.

- Access to a broader pool of investors.

- Higher issuance costs and regulatory requirements.

- Public disclosure of financial information.

Private Debt Financing

Advantages:- More flexibility in terms of structure and covenants.

- Lower issuance costs and fewer regulatory requirements.

- Higher interest rates and shorter maturities.

- Access to a smaller pool of investors.

4. What are the key factors to consider when evaluating a company’s creditworthiness?

- Financial statements and historical performance.

- Industry and competitive analysis.

- Management team and track record.

- Credit ratings from rating agencies.

- Litigation and other legal risks.

5. What is the role of a capital markets specialist in the debt financing process?

- Advising clients on debt financing options and structures.

- Arranging and executing debt financing transactions.

- Monitoring and managing debt portfolios.

- Developing and maintaining relationships with lenders and investors.

6. What are the current trends in the capital markets that are impacting debt financing?

- Increased demand for debt financing from private equity firms and other alternative investors.

- Development of new debt financing products, such as covenant-lite loans and sustainability-linked bonds.

- Use of technology and data analytics to improve credit analysis and risk management.

- Regulatory changes impacting debt financing, such as Basel III and Dodd-Frank.

7. Describe your experience in managing complex debt financing transactions.

Provide specific examples of transactions you have led, including the size, type, and structure of the debt financing, as well as the challenges and successes you encountered.

8. How do you stay up-to-date on the latest developments in the capital markets?

- Reading industry publications and research reports.

- Attending conferences and webinars.

- Networking with other professionals in the field.

- Participating in continuing education programs.

9. What are your strengths and weaknesses as a capital markets specialist?

Highlight your technical skills, industry knowledge, client management abilities, and commitment to excellence. Be honest about any areas where you may need to further develop your skills.

10. Why are you interested in this position with our firm?

Research the firm and its values to demonstrate your understanding and alignment with their mission and goals. Express your interest in the specific responsibilities of the role and how your skills and experience make you a suitable candidate.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Senior Capital Markets Specialist.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Senior Capital Markets Specialist‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

As a Senior Capital Markets Specialist, you will play a pivotal role in the organization’s capital markets operations. Your key responsibilities will encompass:

1. Market Analysis and Research

Conduct in-depth analysis of capital markets, including trends, regulations, and economic factors.

- Develop and implement research methodologies to identify investment opportunities and risks.

- Monitor market performance, analyze data, and provide insights to inform investment decisions.

2. Capital Raising and Deal Execution

Manage the origination, structuring, and execution of capital raising transactions.

- Identify and target institutional investors, including banks, pension funds, and hedge funds.

- Develop marketing materials, roadshows, and presentations to promote investment opportunities.

- Negotiate and close deals, ensuring compliance with regulatory and legal requirements.

3. Portfolio Management and Risk Assessment

Monitor and manage investment portfolios to optimize returns within risk parameters.

- Conduct due diligence and evaluate potential investments based on financial performance, market trends, and regulatory compliance.

- Develop and implement risk management strategies to mitigate potential losses.

4. Relationship Management and Client Service

Build and maintain relationships with key stakeholders in the capital markets.

- Interact with clients to understand their investment goals and requirements.

- Provide personalized financial advice and support to enhance client satisfaction.

Interview Tips

To ace your interview for the Senior Capital Markets Specialist position, consider the following preparation tips:

1. Research the Company and Industry

Thoroughly research the company’s business model, capital markets operations, and key financial metrics.

- Read industry news and reports to stay up-to-date on market trends and developments.

- Identify the company’s strengths, weaknesses, and competitive landscape.

2. Highlight Your Expertise

Emphasize your knowledge and experience in capital markets analysis, deal structuring, and portfolio management.

- Quantify your accomplishments with specific metrics, such as deal flow managed, portfolio performance, and risk mitigation strategies implemented.

- Provide examples of complex transactions you executed or investment decisions you made that had a significant impact.

3. Demonstrate Your Communication and Interpersonal Skills

Show that you are effective in communicating with clients, investors, and colleagues.

- Practice presenting your research findings and investment recommendations clearly and persuasively.

- Highlight your relationship-building skills and ability to collaborate effectively in a team environment.

4. Prepare for Technical Questions

Be prepared to answer questions on technical aspects of capital markets, such as:

- Valuation techniques and financial modeling

- Debt and equity financing structures

- Regulatory compliance and best practices in capital markets

5. Follow Up and Express Interest

After the interview, send a thank-you note to the interviewers, reaffirming your interest in the position.

- Summarize key points discussed during the interview and highlight how your skills and experience align with the company’s requirements.

- Follow up after the promised response date to inquire about the status of your application.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Senior Capital Markets Specialist, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Senior Capital Markets Specialist positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.