Are you gearing up for an interview for a Senior Portfolio Manager position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Senior Portfolio Manager and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

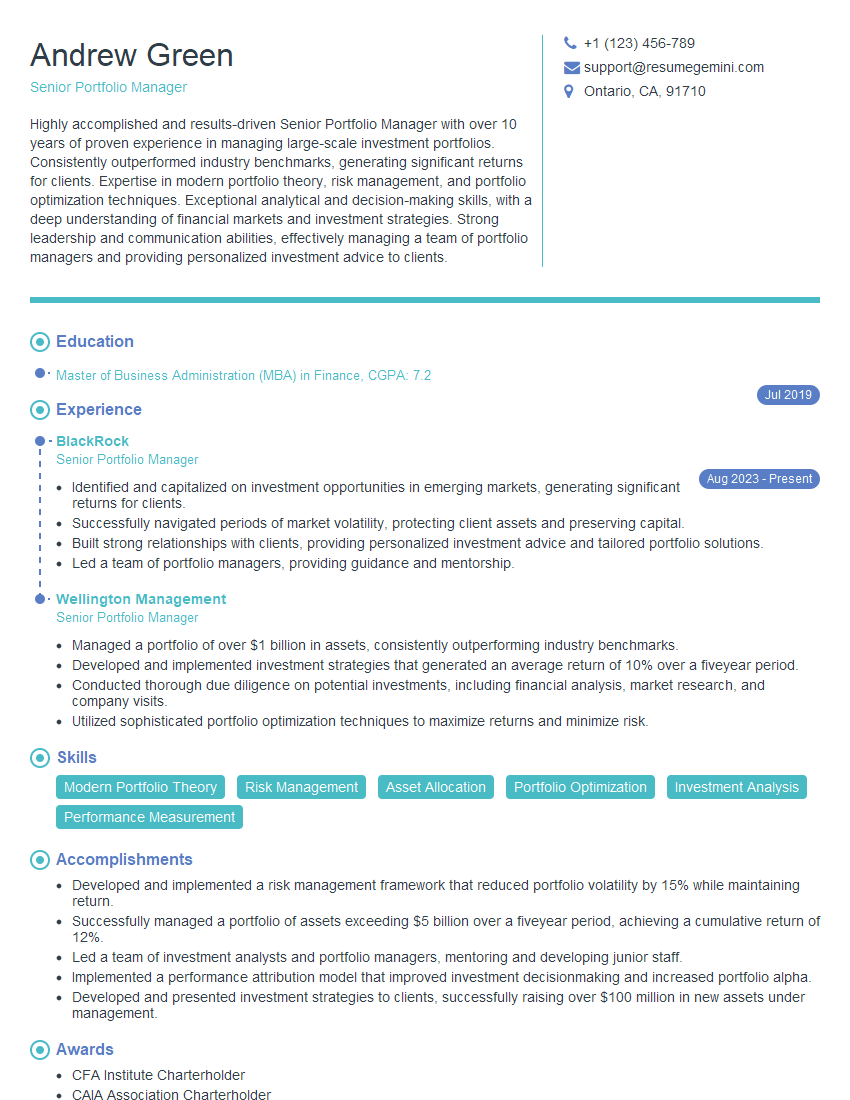

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Senior Portfolio Manager

1. Describe your investment philosophy and how it has influenced your investment decisions in the past.

My investment philosophy is rooted in the belief that long-term growth and value creation can be achieved through a disciplined approach to asset allocation, risk management, and security selection. I believe in investing in high-quality companies with strong fundamentals, sustainable competitive advantages, and attractive valuations.

- In practice, this has led me to focus on companies with consistent earnings growth, strong cash flow generation, and low debt levels.

- I also consider industry dynamics, macroeconomic trends, and geopolitical factors when making investment decisions.

2. How do you manage risk in your portfolio?

Risk Assessment and Management

- I employ a comprehensive risk management framework that involves identifying, assessing, and mitigating potential risks.

- This includes conducting thorough due diligence on investment opportunities, stress testing portfolios under various market conditions, and implementing diversification strategies.

Close Monitoring and Rebalancing

- I continuously monitor portfolio performance and market conditions to identify any potential risks or opportunities.

- I also regularly rebalance portfolios to maintain desired risk levels and asset allocations.

3. How do you evaluate the performance of your portfolio?

I evaluate portfolio performance against a set of predefined benchmarks and investment objectives. This includes measures such as:

- Total return

- Risk-adjusted return

- Volatility

- Correlation to the broader market

I also conduct regular performance reviews with clients to discuss portfolio performance, risk appetite, and any necessary adjustments.

4. What are some of the most challenging aspects of portfolio management?

Some of the most challenging aspects of portfolio management include:

- Navigating volatile and uncertain market conditions.

- Managing risk while seeking growth opportunities.

- Staying ahead of market trends and identifying undervalued investments.

- Making timely and informed investment decisions based on a vast amount of information.

5. What do you think are the most important qualities of a successful portfolio manager?

In my view, the most important qualities of a successful portfolio manager are:

- Strong analytical and problem-solving skills.

- Excellent communication and interpersonal skills.

- A deep understanding of financial markets and investment strategies.

- A commitment to ethical and responsible investing.

- A passion for continuous learning.

6. How do you stay up-to-date with the latest investment trends and research?

I stay up-to-date with the latest investment trends and research through a combination of:

- Reading industry publications and reports.

- Attending conferences and seminars.

- Networking with other investment professionals.

- Conducting my own independent research and analysis.

7. What are your thoughts on the current market environment?

The current market environment is characterized by a number of factors, including:

- Rising interest rates.

- Inflationary pressures.

- Geopolitical uncertainties.

- Economic growth concerns.

I believe that investors need to be cautious in this environment and should focus on investing in high-quality assets with strong fundamentals and attractive valuations.

8. What do you see as the biggest opportunities and challenges for investors in the coming year?

Opportunities

- Potential for growth in emerging markets.

- Investment in alternative assets, such as private equity and real estate.

- Fixed income opportunities in a rising rate environment.

Challenges

- Managing volatility and risk.

- Navigating geopolitical uncertainties.

- Achieving returns in a low yield environment.

9. What is your opinion on the role of technology in portfolio management?

Technology is playing an increasingly important role in portfolio management. I believe that technology can be used to:

- Enhance investment research and analysis.

- Automate portfolio construction and trading.

- Improve risk management and compliance.

- Enhance client communication and reporting.

I am excited about the potential of technology to further transform the investment management industry.

10. What are your career goals and aspirations?

My career goal is to continue to grow and develop as a portfolio manager. I am passionate about investing and helping my clients achieve their financial goals. I aspire to one day manage a large and successful portfolio and make a significant contribution to the investment management industry.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Senior Portfolio Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Senior Portfolio Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Senior Portfolio Managers oversee the management of multiple investment portfolios, ensuring maximum returns and adherence to investment objectives. Their responsibilities include:

1. Investment Management

Analyze market trends, conduct research, and identify suitable investments to diversify portfolios.

- Monitor market performance and make timely adjustments to portfolio allocations.

- Stay abreast of economic news and regulatory changes affecting investment decisions.

2. Performance Reporting and Analysis

Provide regular updates and detailed reports on portfolio performance to clients and stakeholders.

- Analyze and review investment returns and risk levels.

- Identify areas of improvement and make recommendations for enhancing portfolio performance.

3. Client Relationship Management

Build and maintain strong relationships with clients, understanding their investment objectives and risk appetite.

- Communicate complex investment strategies and market insights to clients in a clear and concise manner.

- Address client concerns and inquiries promptly and professionally.

4. Team Leadership and Supervision

Lead and supervise a team of portfolio managers and analysts, mentoring and guiding their professional development.

- Delegate responsibilities effectively and provide constructive feedback to team members.

- Foster a collaborative and productive work environment.

Interview Tips

To ace the interview for a Senior Portfolio Manager position, follow these preparation tips:

1. Research the Company and Role

Thoroughly research the investment firm, its investment philosophy, and the specific role you are applying for. This will demonstrate your genuine interest and understanding of their business.

- Review the company’s website, annual reports, and news articles.

- Identify any commonalities between the company’s goals and your own career aspirations.

2. Quantify Your Accomplishments

When describing your relevant experience and skills, focus on quantifying your accomplishments using specific metrics and results. This will provide tangible evidence of your impact and value.

- Example: “Increased portfolio returns by 15% over a three-year period, outperforming the benchmark by 5%.”

- Avoid vague statements such as “Managed large investment portfolios.”

3. Demonstrate Industry Knowledge and Expertise

Highlight your in-depth knowledge of the investment industry and ability to analyze market trends. Share examples of successful investments or strategies you implemented that demonstrate your expertise.

- Discuss your understanding of different asset classes, investment vehicles, and risk management techniques.

- Be prepared to discuss current market trends and their potential impact on investment portfolios.

4. Showcase Your Communication and Interpersonal Skills

Effective communication and interpersonal skills are crucial for success in this role. Showcase your ability to clearly articulate complex investment concepts, build rapport with clients, and work effectively as part of a team.

- Provide examples of successful client presentations or negotiations where you demonstrated your communication skills.

- Highlight your ability to collaborate with colleagues and build strong working relationships.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Senior Portfolio Manager interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.