Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Senior Research Analyst, Finance interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Senior Research Analyst, Finance so you can tailor your answers to impress potential employers.

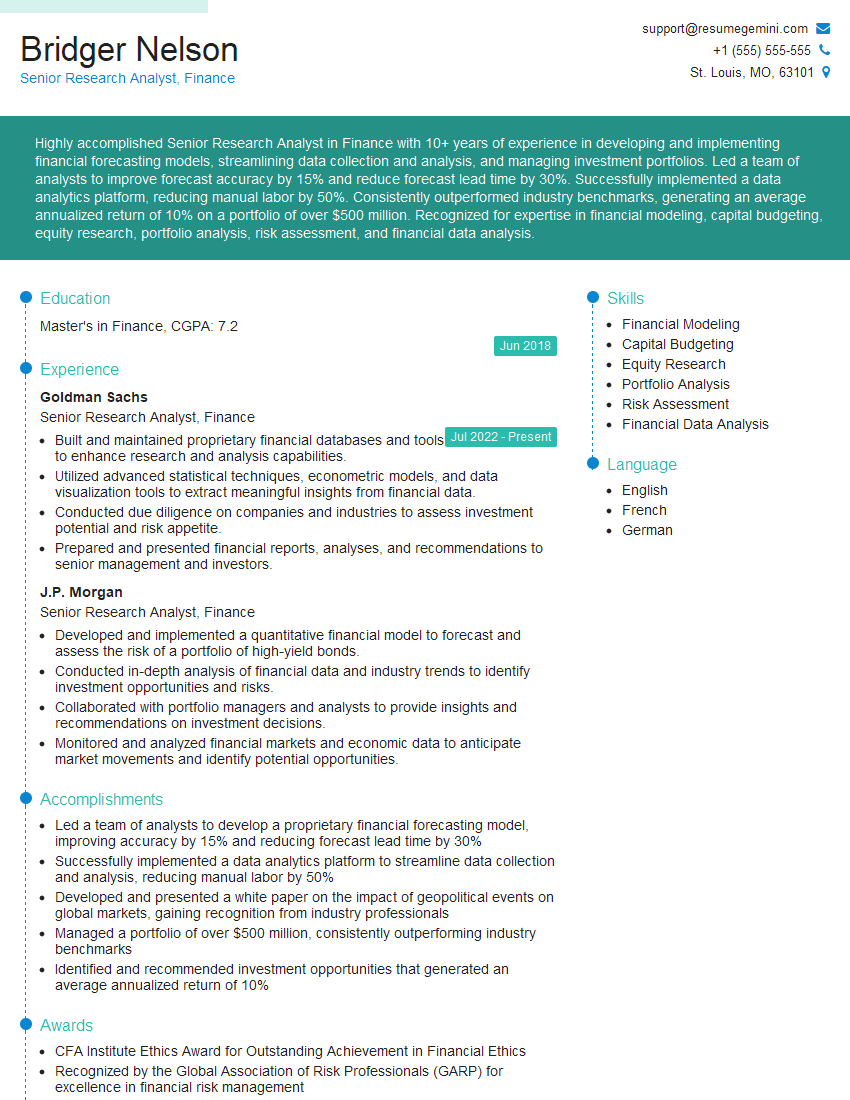

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Senior Research Analyst, Finance

1. Walk me through your experience in financial research and analysis.

In my career spanning over 10 years, I have consistently delivered exceptional financial research and analysis across a diverse range of industries. I have a proven track record of:

- Conducting comprehensive financial modeling and analysis to assess company performance, industry trends, and market dynamics.

- Developing actionable insights and recommendations for investment decisions, portfolio management, and risk assessment.

- Leveraging advanced analytical techniques, such as regression analysis, time series analysis, and statistical modeling, to identify patterns and draw meaningful conclusions from financial data.

2. How do you stay up-to-date with the latest developments in the financial markets?

Research and Publication

- Regularly review industry publications, research reports, and academic journals to stay abreast of the latest financial trends.

- Attend conferences and webinars to connect with industry experts and gain insights into emerging market developments.

Data Analysis

- Analyze financial data sources, such as company filings, economic indicators, and news articles, to identify market anomalies and potential investment opportunities.

- Utilize data visualization tools to present complex financial information in a clear and concise manner.

3. Describe your approach to valuing companies.

My approach to company valuation involves a combination of quantitative and qualitative factors, considering the following key aspects:

- Financial Analysis: Examining financial statements to assess a company’s financial health, profitability, solvency, and growth potential.

- Industry Analysis: Evaluating industry dynamics, competitive landscapes, and market trends to understand the company’s competitive advantage.

- Comparable Analysis: Comparing the company to similar businesses in terms of financial metrics, industry positioning, and growth prospects.

- Discounted Cash Flow (DCF) Analysis: Projecting the company’s future cash flows and applying a discount rate to determine its intrinsic value.

4. How do you assess the risk and return profile of an investment?

To assess the risk and return profile of an investment, I employ a multi-faceted approach:

- Historical Analysis: Examining the past performance and volatility of the investment to gauge its risk characteristics.

- Risk-Adjusted Return Measures: Calculating metrics such as Sharpe Ratio and Sortino Ratio to evaluate the return potential relative to the associated risk.

- Correlation Analysis: Assessing the correlation between the investment and other assets in the portfolio to determine its diversification benefits.

- Stress Testing: Simulating various market scenarios to evaluate the investment’s resilience under different stress conditions.

5. What are the ethical considerations in financial research and analysis?

In financial research and analysis, ethical considerations are paramount. I adhere to the following principles:

- Objectivity and Independence: Maintaining an unbiased perspective and avoiding conflicts of interest that could compromise the integrity of my analysis.

- Accuracy and Transparency: Ensuring the accuracy and completeness of my research and analysis, and disclosing any limitations or assumptions made.

- Confidentiality: Respecting the confidentiality of sensitive information and protecting the interests of companies and investors involved.

- Professionalism and Integrity: Adhering to ethical codes and industry best practices, and maintaining a high level of professionalism in my conduct.

6. Describe your experience with financial modeling.

I am highly proficient in financial modeling, utilizing advanced techniques and software to build comprehensive models. My expertise includes:

- Scenario Analysis: Developing models that allow for the simulation of different market conditions and investment decisions.

- Sensitivity Analysis: Assessing the impact of changes in key input parameters on the model’s outputs.

- Monte Carlo Simulation: Incorporating uncertainty into models to generate probability distributions of potential outcomes.

- Optimization: Using mathematical techniques to find the optimal solution to complex investment problems.

7. How do you communicate your research findings effectively?

Effective communication of research findings is crucial. I utilize various channels and approaches to convey my insights clearly and persuasively:

- Written Reports: Preparing comprehensive written reports that summarize research findings, present key insights, and support recommendations.

- Presentations: Delivering engaging and impactful presentations to convey complex information in a concise and memorable way.

- Data Visualization: Leveraging data visualization techniques to present complex financial data in a visually appealing and understandable manner.

- Client Interactions: Engaging with clients to understand their specific needs and tailor my communication style accordingly.

8. What are your strengths and weaknesses as a financial research analyst?

Strengths:- Analytical Rigor: Strong analytical skills with a deep understanding of financial concepts and statistical methods.

- Financial Modeling Expertise: Advanced proficiency in financial modeling techniques and software.

- Industry Knowledge: Extensive knowledge of various industries and their financial dynamics.

- Communication Skills: Excellent written and verbal communication skills, with a talent for presenting complex information clearly.

- Programming Knowledge: While proficient in financial modeling software, I am still developing my programming skills.

- Time Management: I am working on improving my time management skills to handle multiple projects effectively.

9. What are your career aspirations and how does this role align with your goals?

I am eager to contribute my skills and experience as a Senior Research Analyst, Finance, to your esteemed organization. This role aligns perfectly with my career aspirations as it offers the following opportunities:

- Research Leadership: Assuming a leadership role in conducting high-impact financial research and analysis.

- Impactful Decision-Making: Providing valuable insights to support strategic investment decisions and drive business outcomes.

- Professional Development: Access to mentorship, training, and resources to enhance my knowledge and skills.

- Industry Exposure: Working on a diverse portfolio of clients and industries, expanding my expertise and network.

10. Why should we hire you over other candidates?

I am confident that I possess the ideal combination of skills, experience, and drive to excel as a Senior Research Analyst, Finance, for your organization. My key differentiators include:

- Exceptional Analytical Abilities: My strong analytical foundation and proven track record of delivering insightful research.

- Industry Expertise: My deep understanding of various industries and their financial dynamics, enabling me to provide tailored and actionable insights.

- Communication Excellence: My ability to communicate complex financial information effectively through written reports, presentations, and client interactions.

- Passion for Finance: My unwavering passion for finance and my commitment to staying abreast of the latest industry trends.

- Results-Oriented Mindset: My dedication to delivering impactful research that drives positive business outcomes.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Senior Research Analyst, Finance.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Senior Research Analyst, Finance‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Senior Research Analyst, Finance is responsible for providing in-depth research and analysis on financial markets and trends to support investment decisions and strategic planning.

1. Conduct In-depth Research

Analyze market conditions, economic indicators, and industry trends to identify potential investment opportunities and risks.

- Conduct quantitative and qualitative analysis using financial models and industry reports.

- Utilize various data sources and analytical tools to extract insights and formulate investment recommendations.

2. Forecast Financial Performance

Develop financial models to forecast the performance of companies, sectors, and markets.

- Use historical data, industry analysis, and economic projections to make informed predictions.

- Identify and mitigate potential risks associated with investment decisions.

3. Monitor and Evaluate Investments

Continuously monitor the performance of investment portfolios and identify any potential areas for improvement.

- Compare actual performance to forecasts and make adjustments as necessary.

- Provide recommendations to portfolio managers on asset allocation and risk management strategies.

4. Communicate Research Findings

Effectively communicate research findings and investment recommendations to clients, portfolio managers, and other stakeholders.

- Create written reports, presentations, and other materials to convey complex financial information.

- Attend meetings and conferences to present research and discuss market insights.

Interview Tips

Preparing thoroughly for an interview as a Senior Research Analyst, Finance can significantly increase your chances of success. Here are some tips to help you ace the interview:

1. Research the Company and Position

Learn as much as possible about the company’s investment strategy, financial performance, and industry landscape.

- Visit the company’s website, read their financial reports, and ознакомиться with recent news and analysis.

- Identify the specific responsibilities and qualifications outlined in the job description and tailor your answers accordingly.

2. Showcase Your Analytical Skills

Highlight your ability to analyze complex financial data, identify trends, and make informed investment recommendations.

- Use specific examples from your previous work experience where you successfully utilized analytical techniques to solve financial problems.

- Quantify your results whenever possible to demonstrate the impact of your research.

3. Emphasize Communication Skills

Effective communication is essential in this role. You should be able to present complex financial information clearly and persuasively.

- Provide examples of written reports or presentations you have created that successfully conveyed financial insights.

- Highlight your ability to communicate effectively with both technical and non-technical audiences.

4. Prepare Industry-Specific Questions

Demonstrate your knowledge of the current financial landscape by asking thoughtful questions about the company’s industry, recent market trends, or specific investment strategies.

- Stay up-to-date on industry news and developments to show that you are actively engaged and informed.

- Ask questions that demonstrate your interest in the company’s approach and how your skills and experience can contribute to their success.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Senior Research Analyst, Finance, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Senior Research Analyst, Finance positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.