Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Settlement Clerk position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

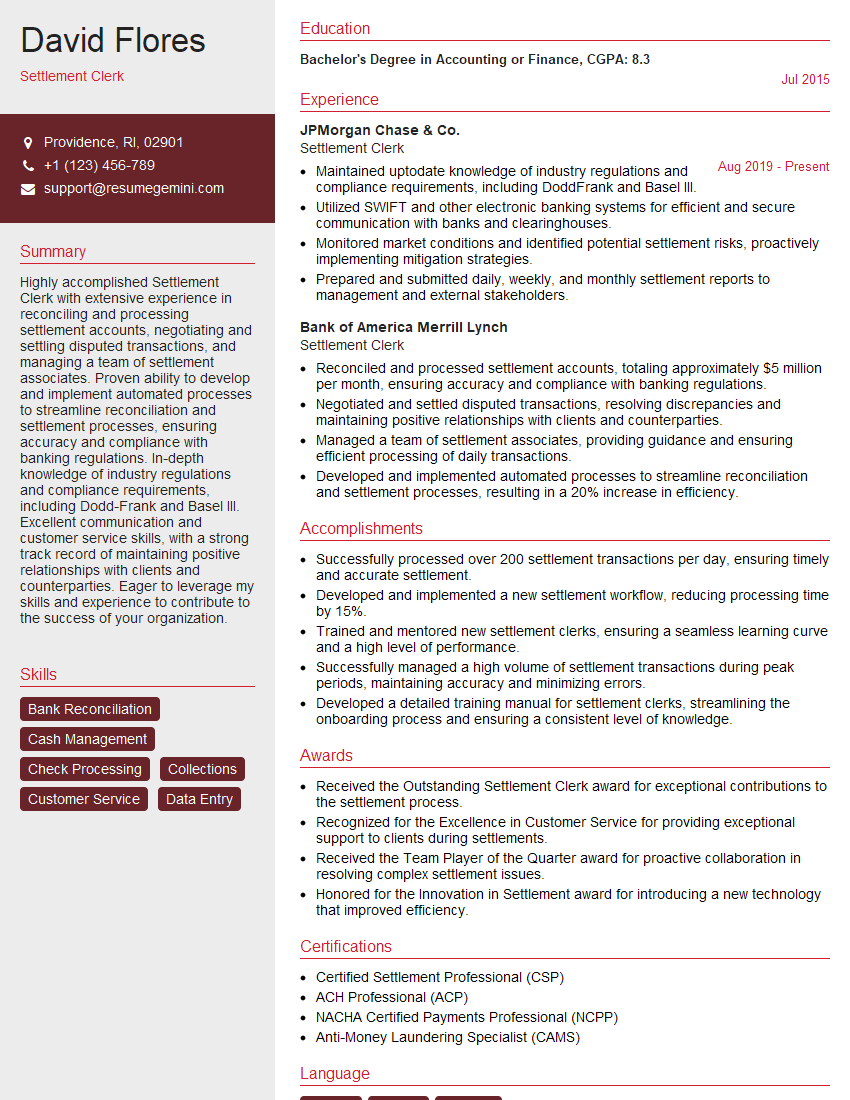

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Settlement Clerk

1. Describe your understanding of the role and responsibilities of a Settlement Clerk?

- Prepare and process settlement statements for real estate transactions

- Review and verify loan documents

- Calculate closing costs and disbursements

- Disburse funds to appropriate parties

- Maintain accurate records and documentation

2. Can you walk me through the steps involved in preparing a settlement statement?

Preparing for Closing

- Review loan documents and title search

- Calculate closing costs

- Gather required signatures

Closing Day

- Attend closing meeting

- Review settlement statement with parties

- Disburse funds

Post-Closing

- Record documents

- File settlement statement with appropriate agencies

3. What are the most common issues or challenges you have encountered as a Settlement Clerk?

- Errors in loan documents

- Delays in obtaining signatures

- Unexpected closing costs

- Disputes between parties

- Tight deadlines

4. How do you stay up-to-date on changes in real estate settlement regulations?

- Attend industry conferences and seminars

- Read real estate publications and newsletters

- Participate in online forums and discussion groups

- Consult with attorneys and other professionals

5. What software or applications are you proficient in using for settlement preparation?

- Settlement calculation software

- Document management systems

- Email and calendaring software

- Microsoft Office Suite

6. How do you ensure the accuracy and confidentiality of sensitive financial information?

- Follow established security protocols

- Use secure software and technology

- Limit access to confidential information

- Maintain confidentiality agreements with vendors and partners

7. What is your experience in working as part of a team?

Describe experiences working on team projects and collaborating with colleagues to achieve common goals.

8. How do you prioritize and manage multiple tasks and deadlines?

- Use task management tools

- Set priorities based on urgency and importance

- Delegate tasks when appropriate

- Communicate regularly with colleagues and clients

9. Can you describe a time when you had to deal with a difficult client?

Explain how you handled the situation professionally and maintained a positive relationship with the client.

10. Why are you interested in working as a Settlement Clerk for our company?

Research the company and industry to tailor your answer to the specific organization and role.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Settlement Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Settlement Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Settlement Clerks play a crucial role in the settlement process, ensuring smooth transactions and timely payments. Their primary responsibilities include:

1. Transaction Processing

The primary role of a Settlement Clerk involves processing a high volume of transactions, including purchase and sale orders, invoices, and payment requests.

- Review all incoming transactions for accuracy and completeness.

- Verify prices, quantities, and payment details.

- Process payments and issue invoices.

2. Account Reconciliation

Settlement Clerks ensure that all accounts are reconciled and balanced daily. This involves matching payments with invoices, identifying discrepancies, and resolving any errors.

- Reconcile bank statements and balance accounts.

- Investigate and resolve any discrepancies.

- Prepare reports on account balances and transactions.

3. Customer Support

Settlement Clerks often interact with customers to answer queries, provide updates, and resolve any issues related to settlements.

- Respond to customer inquiries and provide support.

- Resolve customer disputes and complaints.

- Maintain positive relationships with customers.

4. Compliance and Reporting

Settlement Clerks ensure compliance with all relevant regulations and internal policies. They also prepare reports and provide data for audits and financial reporting.

- Maintain compliance with settlement regulations.

- Prepare reports and provide data for financial reporting.

- Cooperate with auditors during reviews and audits.

Interview Tips

Preparing for an interview for a Settlement Clerk position requires a combination of technical knowledge and interpersonal skills. Here are a few tips to help candidates ace the interview:

1. Know the Industry and Company

Research the financial industry, especially the settlement process, and the company you’re interviewing with. This will demonstrate your interest and understanding of the role.

- Read industry publications and news.

- Visit the company’s website to learn about their products, services, and culture.

2. Highlight Relevant Skills

Emphasize your proficiency in transaction processing, account reconciliation, and customer service. Quantify your accomplishments and provide specific examples of how you contributed to the settlement process.

- Mention the number of transactions you processed per day or month.

- Share examples of how you successfully resolved customer disputes or streamlined processes.

3. Be Confident and Professional

Confidence and professionalism are key to making a good impression. Dress appropriately, maintain eye contact, and speak clearly and concisely.

- Practice your answers to common interview questions.

- Prepare questions to ask the interviewer, demonstrating your interest in the role and company.

4. Prepare for Technical Questions

Expect technical questions about transaction processing, account reconciliation, and compliance. Be prepared to discuss your knowledge of these topics and any related software or systems you have used.

- Review the key job responsibilities outlined earlier.

- Practice answering questions about specific settlement processes and procedures.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Settlement Clerk interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!