Are you gearing up for an interview for a Small Business Banking Officer position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Small Business Banking Officer and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

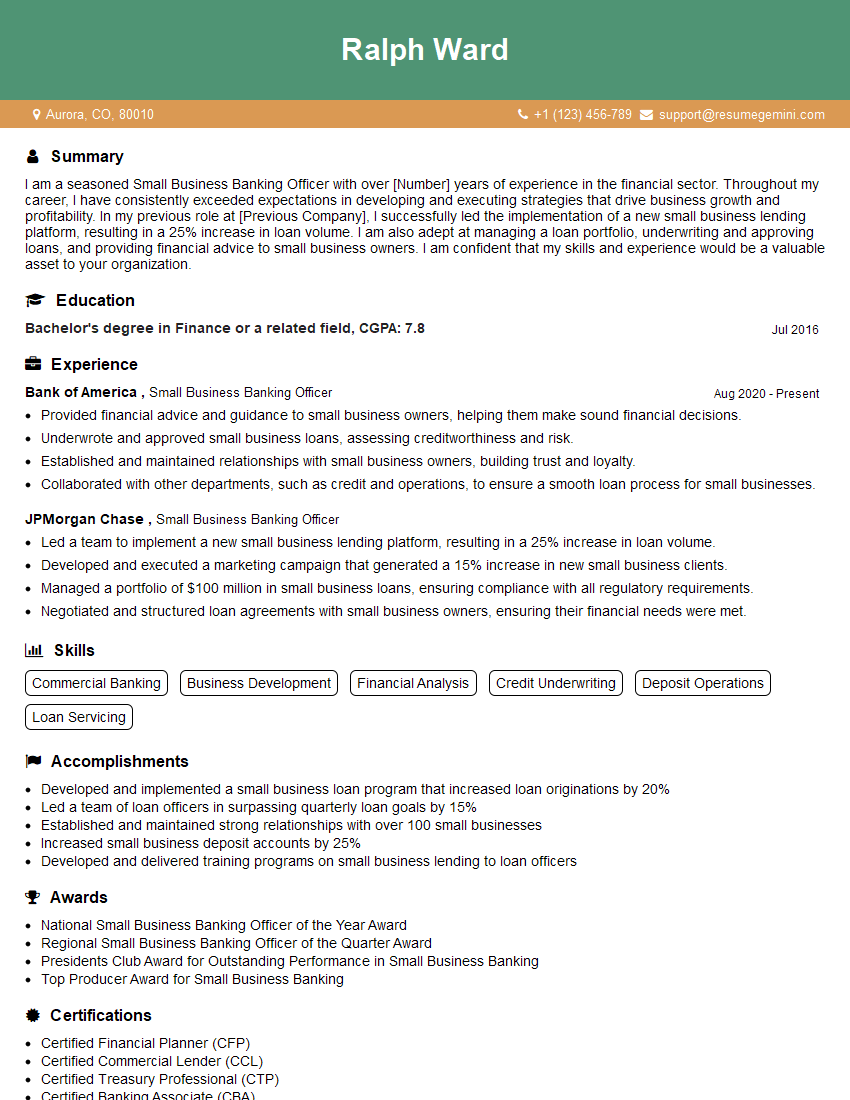

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Small Business Banking Officer

1. How do you assess a small business’s financial health?

In assessing a small business’ financial health, key metrics and documents I would review include:

- Income Statement and Balance Sheet: Analyzing revenue, expenses, assets, and liabilities to determine profitability and financial position.

- Cash Flow Statement: Evaluating the business’ cash inflows and outflows to assess its liquidity and ability to meet financial obligations.

- Credit Reports and Payment History: Checking for any outstanding debts, delinquencies, or defaults that may indicate financial distress.

- Industry Benchmarks: Comparing the business’s financial performance to similar businesses in the same industry to gauge its competitiveness and financial health.

- Business Plan and Projections: Reviewing the business’s financial projections and assessing the feasibility of its growth plans and financial goals.

2. What types of financing options are available to small businesses, and how do you determine the best fit for a particular business?

Types of Financing Options:

- Loans (Term Loans, Lines of Credit, Equipment Financing)

- Grants

- Venture Capital and Angel Investment

Determining the Best Fit:

- Assess the business’s financial needs and objectives.

- Evaluate the business’s creditworthiness and ability to repay the financing.

- Consider the business’s industry, growth potential, and risk factors.

- Compare the terms, interest rates, and fees of different financing options.

- Consult with financial advisors or lending specialists for guidance.

3. How do you manage risk in small business lending?

- Thorough Credit Analysis: Assess the borrower’s credit history, financial statements, and business plan.

- Collateral Evaluation: Requesting and evaluating collateral, such as property or equipment, to mitigate risk.

- Covenants and Restrictions: Including provisions in the loan agreement that restrict the borrower’s actions and ensure financial prudence.

- Regular Monitoring: Monitoring the borrower’s financial performance and business operations to identify any potential issues.

- Risk-Based Pricing: Adjusting loan terms and interest rates based on the borrower’s risk profile.

4. What are the key factors you consider when evaluating a small business loan application?

- Creditworthiness: Assessing the borrower’s credit history, debt-to-income ratio, and overall financial stability.

- Business Plan: Reviewing the business’s financial projections, growth strategies, and market analysis.

- Industry and Market Conditions: Analyzing the industry trends, competition, and growth potential.

- Collateral: Evaluating the type and value of collateral offered by the borrower to mitigate risk.

- Management Team: Assessing the experience, skills, and track record of the business’s management team.

5. How do you build strong relationships with small business clients?

- Proactive Communication: Regularly reaching out to clients, understanding their business needs, and offering support.

- Tailored Financial Solutions: Providing customized financing and advisory services that align with the client’s goals.

- Educational Resources: Sharing financial insights, industry updates, and resources to empower clients.

- Community Involvement: Participating in local business events and supporting community initiatives.

- Personal Connection: Establishing trust and rapport by understanding the client’s values and business aspirations.

6. What are the ethical considerations involved in small business banking?

- Fair Lending Practices: Ensuring equal access to financing for all small businesses, regardless of race, gender, or background.

- Privacy and Confidentiality: Maintaining the confidentiality of client financial information and respecting their privacy.

- Conflicts of Interest: Disclosing any potential conflicts of interest and taking measures to avoid compromising the client’s best interests.

- Transparency and Communication: Providing clear and accurate information about loan terms, fees, and other relevant matters.

- Adherence to Regulatory Standards: Complying with all applicable banking laws and regulations.

7. How do you stay up-to-date on industry trends and best practices in small business banking?

- Attending Industry Conferences and Events: Participating in banking conferences and workshops to learn about new products, regulations, and industry insights.

- Professional Development and Training: Pursuing professional certifications and training programs to enhance knowledge and skills.

- Reading Industry Publications and Research: Staying informed through trade journals, financial news, and research reports.

- Networking with Peers and Mentors: Connecting with other banking professionals and industry experts to exchange ideas and best practices.

- Utilizing Online Resources and Webinars: Accessing online portals and attending webinars to acquire industry knowledge.

8. How do you assess a small business’s ability to repay a loan?

- Analyzing Cash Flow: Reviewing the business’s cash flow statement to determine its ability to generate sufficient cash to meet debt obligations.

- Debt-to-Income Ratio: Calculating the ratio of the business’s total debt to its income to assess its debt burden.

- Financial Projections: Evaluating the business’s financial projections to assess its future cash flow and repayment capacity.

- Industry Trends and Competition: Analyzing industry trends and the competitive landscape to evaluate the business’s potential for growth and profitability.

- Management Team: Assessing the experience, skills, and track record of the business’s management team in managing financial resources.

9. What is your approach to managing non-performing loans?

- Proactive Outreach: Establishing early contact with the borrower to understand the reasons for non-performance and explore options.

- Loan Modification: Restructuring the loan terms, such as extending the repayment period or reducing the interest rate, to make it more manageable.

- Forbearance or Deferral: Allowing the borrower to pause or reduce loan payments for a temporary period due to extenuating circumstances.

- Workout Plans: Collaborating with the borrower to develop and implement a plan to improve the business’s financial performance and repay the loan.

- Negotiating a Settlement: Exploring options to settle the loan for a reduced amount, if necessary, to mitigate losses.

10. How do you handle objections or concerns raised by small business owners during the loan application process?

- Active Listening: Pay attention to the borrower’s concerns and ask clarifying questions to fully understand their perspective.

- Empathy and Understanding: Show empathy for the borrower’s situation and acknowledge their concerns.

- Providing Information: Clearly explain the loan terms, fees, and other relevant aspects of the application process.

- Addressing Concerns: Address the borrower’s concerns directly and provide supporting evidence or examples to clarify any misconceptions.

- Negotiating and Compromising: If necessary, be willing to negotiate or compromise on certain terms to meet the borrower’s needs while ensuring the bank’s risk tolerance.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Small Business Banking Officer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Small Business Banking Officer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Small Business Banking Officer serves as the primary banking contact for small businesses, providing personalized financial solutions and guidance. Key responsibilities include:

1. Business Development

Generate and qualify leads, and develop and maintain relationships with small business owners and entrepreneurs.

- Identify and target potential clients based on market analysis and industry expertise.

- Conduct site visits, meetings, and networking events to establish connections and build rapport.

2. Financial Analysis and Consulting

Analyze financial statements, cash flow, and other business data to assess financial health and identify opportunities for growth.

- Provide financial advice, recommendations, and customized solutions to help businesses achieve their goals.

- Develop and implement tailored financial plans, including budgeting, cash management, and investment strategies.

3. Loan Origination and Management

Originate, underwrite, and manage commercial loans to support business growth and expansion.

- Evaluate loan applications, assess creditworthiness, and determine loan terms and conditions.

- Monitor loan performance, manage risk, and provide ongoing support to borrowers.

4. Relationship Management

Build and maintain strong relationships with customers through regular communication, personalized service, and tailored solutions.

- Understand customer needs, goals, and concerns to provide proactive support and exceed expectations.

- Identify cross-selling opportunities and provide referrals to other bank products and services.

Interview Tips

To ace the interview for a Small Business Banking Officer position, consider the following tips:

1. Research the Industry and Company

Demonstrate your knowledge of the small business banking industry, key trends, and the bank’s specific products and services.

- Review the bank’s website, annual reports, and industry publications.

- Understand the specific focus and target market of the small business banking division.

2. Highlight Your Technical Skills

Emphasize your proficiency in financial analysis, loan underwriting, and relationship management. Provide examples of how you have applied these skills in previous roles.

- Quantify your accomplishments and use specific metrics to demonstrate your impact.

- Be prepared to discuss case studies or projects where you successfully provided financial guidance or loan solutions to small businesses.

3. Showcase Your Business Development Abilities

Demonstrate your ability to identify potential customers, build relationships, and generate leads. Highlight your networking skills and success in acquiring new clients.

- Share examples of how you have utilized market research and industry knowledge to identify target businesses.

- Describe your approach to building trust and rapport with small business owners.

4. Emphasize Your Relationship-Building Skills

Convey your commitment to providing exceptional customer service and building long-term relationships. Highlight your communication, interpersonal, and problem-solving abilities.

- Provide examples of how you have proactively addressed customer needs and exceeded their expectations.

- Explain how you have successfully managed challenging situations and resolved conflicts professionally.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Small Business Banking Officer interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!