Feeling lost in a sea of interview questions? Landed that dream interview for Social Insurance Adviser but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Social Insurance Adviser interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

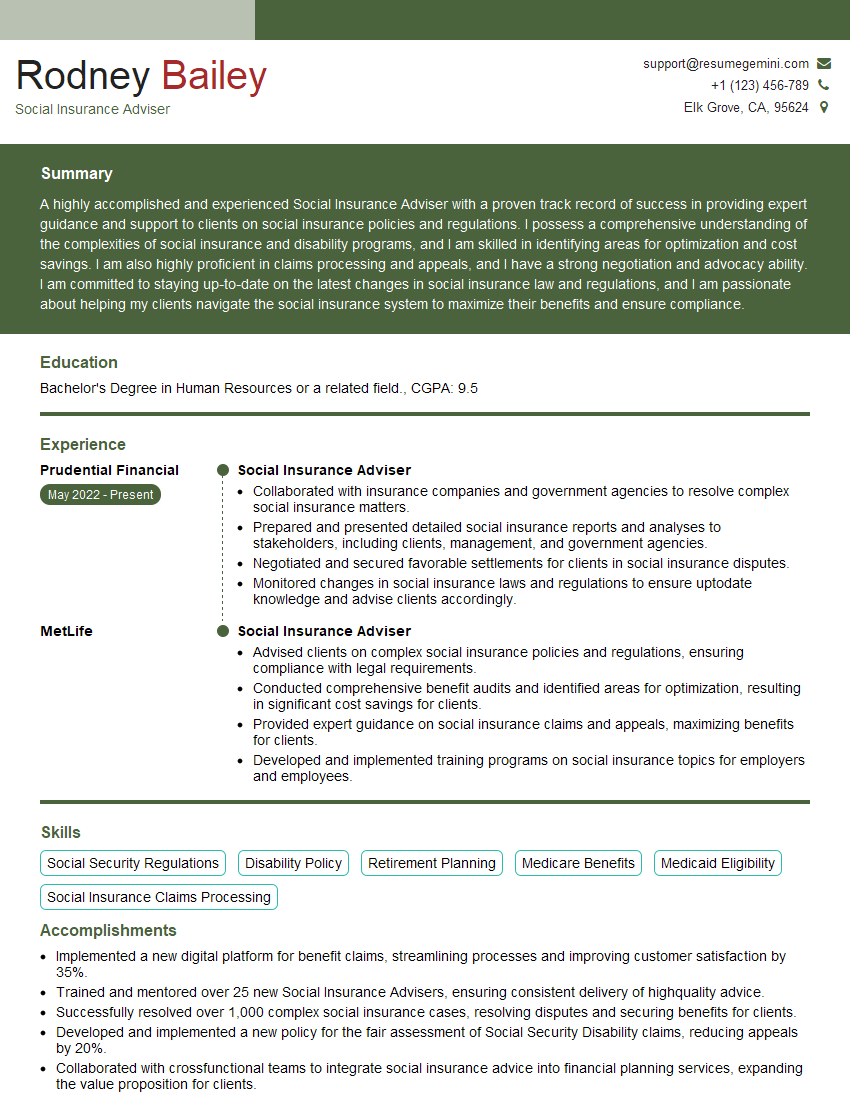

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Social Insurance Adviser

1. Explain the different types of social insurance schemes and their key features?

- Old Age Pension scheme: Provides a monthly pension to individuals who have reached retirement age.

- Disability Insurance scheme: Provides a monthly benefit to individuals who are unable to work due to a disability.

- Health Insurance scheme: Provides coverage for medical expenses, including hospitalization, doctor visits, and prescription drugs.

- Unemployment Insurance scheme: Provides temporary income replacement for individuals who have lost their jobs through no fault of their own.

- Workers’ Compensation scheme: Provides benefits to workers who are injured or become ill as a result of their job.

2. Describe the process for determining eligibility for social insurance benefits?

Understanding the qualifying criteria:

- Age, work history, and income are common factors.

- Specific requirements vary depending on the scheme and jurisdiction.

Application and documentation:

- Individuals apply for benefits by submitting an application and supporting documents.

- Documentation may include proof of age, income, and medical condition.

Review and assessment:

- Applications are reviewed by a designated authority.

- Eligibility is determined based on the qualifying criteria and supporting evidence.

Notification and appeal process:

- Applicants are notified of the decision and provided with an explanation.

- Individuals have the right to appeal if they disagree with the decision.

3. How do you stay updated on changes to social insurance regulations and policies?

- Regularly review government websites and publications: Official sources provide up-to-date information on changes to regulations and policies.

- Attend industry events and conferences: These events offer opportunities to learn about new developments and network with experts.

- Subscribe to industry newsletters and journals: Stay informed through regular updates from reputable sources.

- Consult with professional organizations: Organizations like the National Association of Social Workers provide resources and support for staying current.

- Participate in continuing education: Take courses or workshops to enhance knowledge and skills in the field.

4. Describe your experience in providing guidance and support to individuals on social insurance matters?

- Emphasize empathy and understanding: Show your ability to connect with individuals and understand their concerns.

- Highlight knowledge of regulations and policies: Demonstrate proficiency in providing accurate information and guidance.

- Showcase communication skills: Explain complex concepts in a clear and accessible manner.

- Provide examples of successful interactions: Share stories of how you helped individuals navigate the social insurance system.

- Quantify your impact: If possible, mention statistics or metrics that demonstrate the positive outcomes of your support.

5. How do you handle challenging situations when advising individuals on social insurance matters?

- Stay calm and professional: Maintain composure and avoid emotional reactions.

- Listen attentively: Allow individuals to fully express their concerns and gather all relevant information.

- Explore options and solutions: Work with individuals to identify potential solutions and discuss the pros and cons of each.

- Provide clear and concise explanations: Explain complex concepts in a way that can be easily understood.

- Offer support and resources: Connect individuals with additional resources or support services as needed.

6. Explain the ethical considerations involved in providing social insurance advice?

- Confidentiality: Maintain the privacy of individuals and protect their personal information.

- Objectivity: Provide unbiased advice based on regulations and policies, without personal bias or conflicts of interest.

- Competence: Only provide advice within your area of expertise and refer individuals to appropriate professionals when necessary.

- Integrity: Act with honesty, transparency, and accountability in all interactions.

- Respect for diversity: Be mindful of individual differences and provide culturally sensitive advice.

7. Describe how you would approach a situation where you need to communicate a negative decision to an individual?

- Start with empathy: Acknowledge the individual’s disappointment and express understanding.

- Explain the decision clearly and concisely: Provide a clear explanation of the reasons for the negative decision, referencing regulations and policies as necessary.

- Offer alternatives or resources: Explore alternative options or provide information about other resources that may be available to the individual.

- Be patient and respectful: Allow the individual time to process the information and ask questions.

- Follow up: Check in with the individual after some time to offer support or answer any additional questions they may have.

8. How do you collaborate with other professionals to provide comprehensive social insurance advice?

- Establish strong relationships: Build relationships with other professionals, such as financial advisors, lawyers, and healthcare providers.

- Share knowledge and expertise: Collaborate with colleagues to share knowledge and insights on complex cases.

- Refer clients: Refer clients to other professionals when their needs extend beyond your area of expertise.

- Attend joint meetings: Participate in joint meetings to discuss shared cases and develop collaborative solutions.

- Utilize technology: Use technology to facilitate communication and information sharing among professionals.

9. Describe your experience in using data analysis to improve social insurance programs?

- Data collection and analysis: Explain your experience in collecting and analyzing data on social insurance programs.

- Identification of trends: Highlight your ability to identify trends and patterns in the data.

- Development of recommendations: Showcase your skills in developing evidence-based recommendations for improving programs.

- Communication of findings: Describe your experience in communicating findings and insights to stakeholders.

- Evaluation of impact: Explain how you have evaluated the impact of your data analysis on social insurance programs.

10. How do you stay abreast of emerging issues and trends in the social insurance landscape?

- Industry publications and research: Stay informed through industry publications, journals, and research papers.

- Conferences and seminars: Attend conferences and seminars to learn about new developments and network with experts.

- Professional development: Participate in professional development programs and workshops to enhance knowledge and skills.

- Social media and online forums: Engage with professionals on social media and online forums to exchange ideas and stay updated.

- Collaboration with peers: Collaborate with colleagues and peers to share knowledge and insights on emerging issues.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Social Insurance Adviser.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Social Insurance Adviser‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Social Insurance Advisers play a critical role in guiding individuals and businesses through the complexities of social insurance systems. Their key responsibilities include:

1. Client Consultation and Needs Assessment

Meeting with clients, understanding their social insurance needs, and providing expert advice on relevant programs.

2. Policy and Benefit Management

Helping clients navigate social insurance policies, determine eligibility for benefits, and assist with application processes.

- Advising on pension plans, unemployment benefits, disability insurance, and other social welfare programs.

- Assisting with benefit calculations, optimizing contributions, and maximizing returns.

3. Representation and Advocacy

Representing clients before social insurance agencies, advocating for their rights and entitlements.

- Filing appeals, negotiating with decision-makers, and providing support throughout the process.

- Ensuring that clients receive fair treatment and access to appropriate benefits.

4. Regulatory Compliance

Ensuring that clients adhere to social insurance regulations and obligations.

- Guiding on payroll contributions, tax reporting, and other compliance requirements.

- Monitoring changes in legislation and regulations, and keeping clients informed of any updates.

5. Education and Outreach

Providing education and outreach programs to increase awareness about social insurance programs and benefits.

- Conducting workshops, webinars, and public speaking events.

- Developing educational materials and resources for individuals and businesses.

Interview Tips

To ace an interview for a Social Insurance Adviser position, here are some tips:

1. Research the Company and Role

Thoroughly research the insurance company and the specific role you are applying for. This demonstrates your interest and understanding of the organization’s goals and expectations.

- Visit the company’s website, read industry news, and explore their social media presence to gather information.

- Pay attention to the job description and identify the key skills and qualifications required for the role.

2. Highlight Transferable Skills

Emphasize transferable skills that are relevant to the role, even if you don’t have direct experience in social insurance. These may include:

- Communication and interpersonal skills.

- Problem-solving and analytical abilities.

- Attention to detail and accuracy.

3. Show Passion and Enthusiasm

Convey your passion for helping others and your enthusiasm for the social insurance sector. This will show the interviewer that you are genuinely interested in the role and the impact you can make.

- Share examples of how you have helped individuals or businesses in need.

- Discuss your understanding of social insurance programs and why you believe they are important.

4. Prepare for Common Interview Questions

Practice answering common interview questions, such as:

- Tell me about a time you successfully resolved a complex issue for a client.

- How do you stay up-to-date on changes in social insurance regulations?

- Why are you interested in working as a Social Insurance Adviser?

5. Dress Professionally and Be Punctual

First impressions matter. Dress professionally and arrive for your interview on time. This shows respect for the interviewer and the organization.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Social Insurance Adviser role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.