Feeling lost in a sea of interview questions? Landed that dream interview for Spa Director/Finance but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Spa Director/Finance interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

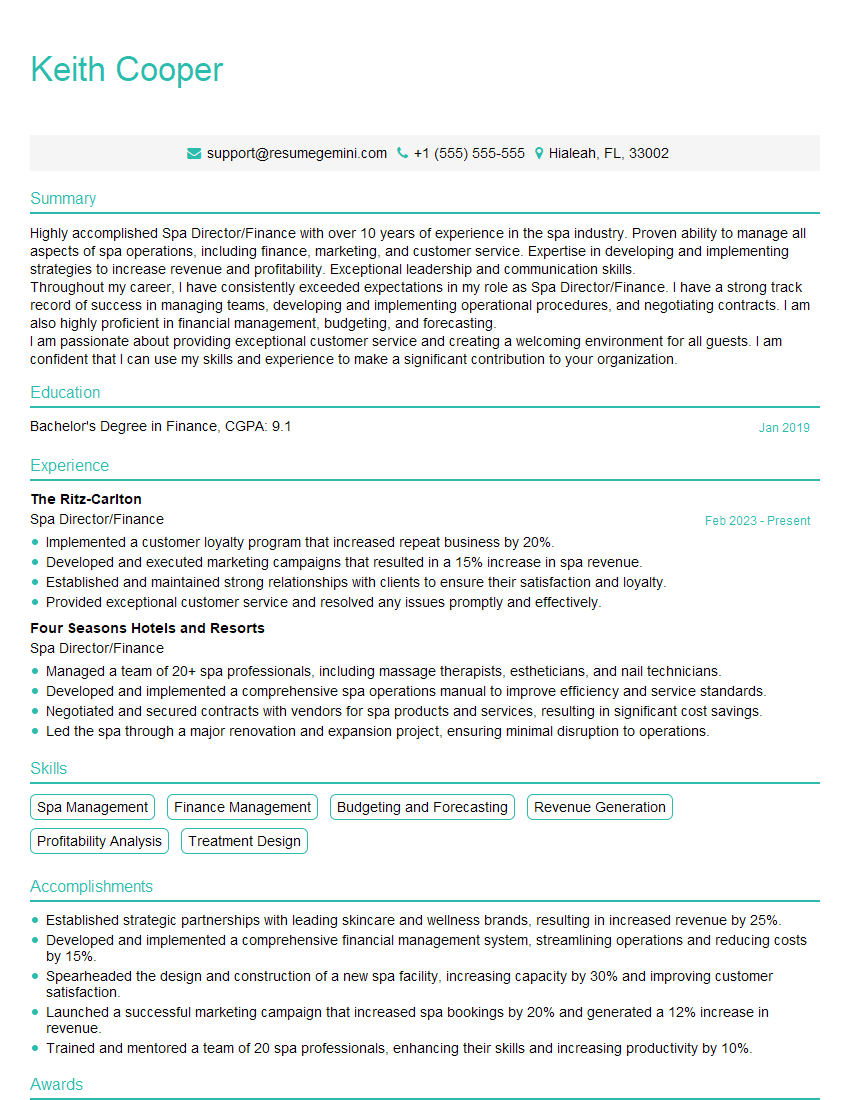

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Spa Director/Finance

1. What are the key financial metrics that you track to measure the performance of a spa?

As a Spa Director/Finance, I closely monitor several key financial metrics to evaluate the spa’s performance.

- Revenue: Total sales generated from treatment packages, individual services, and product retail.

- Gross Profit Margin: The percentage of revenue remaining after subtracting direct costs such as salaries, supplies, and commissions.

2. How do you develop the spa’s budget and what are the key factors that you consider?

Budget Development Process

- Review historical financial data and industry benchmarks.

- Consult with spa staff and management to identify revenue projections and expense requirements.

- Analyze market trends and competitive offerings.

- Set realistic financial goals and objectives.

Key Factors Considered

- Historical Performance: Previous revenue and expense patterns provide a baseline for projections.

- Market Conditions: Economic indicators, competitive activity, and consumer demand can impact revenue potential.

- Staffing Costs: Salaries, benefits, and training expenses are major budget components.

- Operating Expenses: Utilities, marketing, and maintenance costs must be carefully estimated.

3. What strategies have you implemented to increase spa revenue?

- Package Development: Creating attractive packages that combine treatments and amenities to enhance value.

- Loyalty Programs: Implementing rewards systems to encourage repeat business and build customer relationships.

- Cross-Selling: Promoting spa products and services to existing clients during appointments.

- Partnerships: Collaborating with other businesses to offer joint promotions and exclusive packages.

- Data Analysis: Tracking key metrics to identify areas for improvement and revenue optimization.

4. How do you manage expenses to ensure profitability?

- Negotiation: Seeking favorable terms from vendors for supplies and services.

- Cost Control: Implementing measures to reduce waste and unnecessary spending.

- Staffing Optimization: Ensuring appropriate staffing levels to meet demand without overspending.

- Inventory Management: Implementing inventory control systems to minimize spoilage and maintain optimal stock levels.

- Technology: Utilizing technology to streamline operations and reduce labor costs.

5. What is your experience in forecasting financial performance and managing cash flow?

- Financial Forecasting: Utilizing historical data, industry trends, and assumptions to predict future revenue and expenses.

- Cash Flow Management: Monitoring cash flow to ensure sufficient liquidity and prevent overdrafts.

- Scenario Planning: Developing contingency plans to address potential financial challenges or opportunities.

- Working Capital Analysis: Assessing the spa’s ability to meet short-term obligations and maintain financial stability.

6. How do you report financial performance to stakeholders and what metrics do you present?

- Regular Reporting: Preparing monthly or quarterly financial statements and performance reports.

- Key Metrics: Presenting key financial metrics such as revenue, gross profit margin, expenses, and cash flow.

- Variance Analysis: Explaining deviations from budgeted or forecasted figures.

- Actionable Insights: Providing insights and recommendations based on financial data to support decision-making.

7. What experience do you have in implementing and maintaining internal controls?

- Policy and Procedure Development: Creating clear guidelines for financial operations and internal controls.

- Segregation of Duties: Assigning different roles and responsibilities to minimize fraud risk.

- Regular Audits: Conducting internal audits to ensure compliance and identify areas for improvement.

- Risk Management: Assessing potential financial risks and developing mitigation strategies.

8. How do you stay up-to-date on industry best practices and financial regulations?

- Professional Development: Attending conferences, seminars, and workshops.

- Industry Publications: Reading trade journals and industry magazines.

- Networking: Connecting with other spa professionals and sharing knowledge.

- Regulatory Compliance: Monitoring relevant financial regulations and ensuring compliance.

9. What is your experience in using financial software and systems?

- Accounting Software: Proficient in using accounting software for financial reporting and management.

- Budgeting Tools: Experience in using budgeting software for financial planning and analysis.

- POS Systems: Familiar with point-of-sale systems for processing spa transactions and tracking revenue.

10. How do you prioritize and manage multiple projects and responsibilities?

- Task Prioritization: Using a task management system to prioritize and organize responsibilities.

- Delegation: Assigning tasks to appropriate individuals to ensure timely completion.

- Time Management: Effectively managing time to meet deadlines and avoid burnout.

- Communication: Keeping stakeholders informed of project progress and potential issues.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Spa Director/Finance.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Spa Director/Finance‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Spa Director/Finance is a critical leadership role that oversees the strategic direction and financial performance of a spa or wellness facility. Key responsibilities include:

1. Strategic Planning and Management

Develop and implement strategic plans for the spa or wellness center, aligning with the organization’s overall goals.

- Conduct market research and analysis to identify growth opportunities.

- Set performance targets and monitor progress towards them.

2. Financial Management

Manage the spa’s or wellness center’s financial resources, ensuring profitability and solvency.

- Develop and monitor budgets, including revenue projections and cost controls.

- Prepare and analyze financial statements and reports.

3. Operations Management

Oversee the day-to-day operations of the spa or wellness center, ensuring the delivery of high-quality services and customer satisfaction.

- Hire, train, and supervise staff.

- Manage inventory and supplies.

4. Guest Relations and Marketing

Build and maintain relationships with guests, promote the spa or wellness center, and drive revenue.

- Develop and implement marketing strategies.

- Manage customer service and resolve complaints.

Interview Tips

To ace the interview for a Spa Director/Finance role, consider the following tips:

1. Research the Spa or Wellness Center

Familiarize yourself with the spa or wellness center’s services, target market, and recent performance. This will demonstrate your interest and knowledge of the industry.

- Visit the spa or wellness center’s website and social media pages.

- Read online reviews and articles about the spa or wellness center.

2. Prepare to Discuss Your Financial Acumen

Highlight your experience in financial management, budgeting, and forecasting. Quantify your accomplishments with specific results and metrics.

- Describe how you have successfully managed budgets and controlled costs.

- Provide examples of how your financial analysis has led to improved decision-making and increased profitability.

3. Understand the Spa Industry

Demonstrate your understanding of the spa industry trends, best practices, and regulatory requirements.

- Be aware of the latest spa treatments and technologies.

- Know the different types of spa memberships and pricing models.

4. Emphasize Your Leadership and Communication Skills

A Spa Director/Finance needs strong leadership and communication skills to effectively manage a team and collaborate with stakeholders.

- Provide examples of how you have successfully led and motivated a team.

- Describe your experience in communicating with clients, staff, and senior management.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Spa Director/Finance interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!