Are you gearing up for a career in Staff Accountant? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Staff Accountant and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Staff Accountant

1. Explain the process of bank reconciliation?

Bank reconciliation is the process of matching the transactions recorded in a company’s accounting system to the transactions recorded on its bank statement. The purpose of bank reconciliation is to ensure that the company’s accounting records are accurate and that there are no errors or omissions.

- Gather necessary documents: bank statement, general ledger, and supporting documentation.

- Compare the bank statement balance to the general ledger balance.

- Identify and investigate any differences between the two balances.

- Record any necessary adjustments to the accounting records.

- Prepare a bank reconciliation statement.

2. What are the different types of adjusting entries?

Accruals

- Expenses incurred but not yet recorded.

- Revenue earned but not yet recorded.

Deferrals

- Expenses paid in advance.

- Revenue received in advance.

Estimates

- Depreciation.

- Amortization.

- Bad debt expense.

3. Describe the process of closing the books?

Closing the books is the process of transferring the balances of temporary accounts to permanent accounts at the end of an accounting period.

- Post adjusting entries to the general ledger.

- Calculate the net income or loss for the period.

- Close the revenue, expense, and other temporary accounts to the retained earnings account.

- Prepare a post-closing trial balance.

4. What are the different types of financial statements?

- Balance sheet

- Income statement

- Statement of cash flows

- Statement of retained earnings

5. What are the different types of accounting methods?

- Cash basis accounting

- Accrual basis accounting

6. What are the different types of internal controls?

- Preventive controls

- Detective controls

- Compensating controls

7. What is the purpose of an audit?

An audit is an independent examination of an organization’s financial statements and accounting records. The purpose of an audit is to provide assurance that the financial statements are accurate and that the organization’s financial reporting is in accordance with generally accepted accounting principles.

8. What are the different types of audits?

- Financial audits

- Operational audits

- Compliance audits

- Forensic audits

- IT audits

9. What are the responsibilities of a staff accountant?

- Preparing financial statements

- Recording transactions

- Performing bank reconciliations

- Assisting with audits

- Preparing tax returns

10. What are the qualifications for a staff accountant?

- Bachelor’s degree in accounting

- 1-3 years of experience in accounting

- Strong understanding of accounting principles

- Excellent communication and interpersonal skills

- Attention to detail

- Teamwork skills

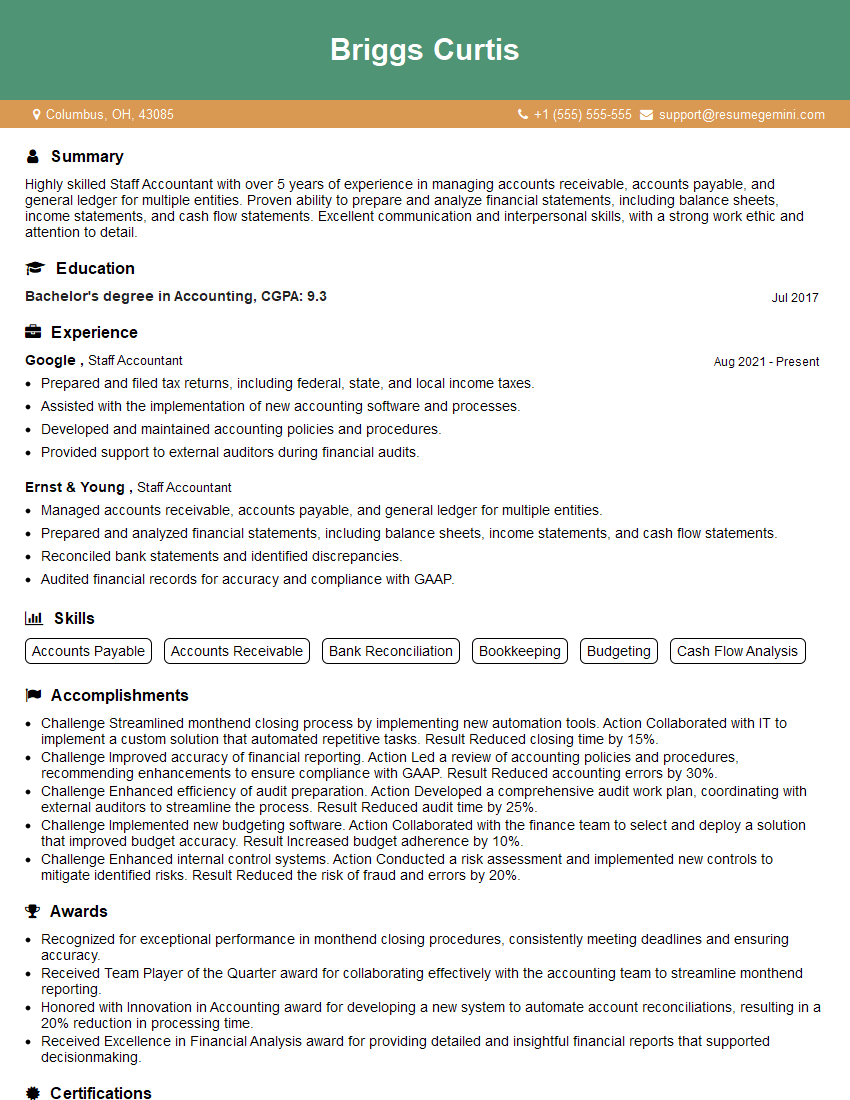

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Staff Accountant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Staff Accountant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Staff accountants are crucial members of any accounting team, responsible for maintaining and interpreting financial records. They work alongside senior accountants and controllers to ensure the accuracy and integrity of financial data, contributing to the overall financial health of an organization.

1. Account Reconciliation

Reconciling accounts ensures that the balances in the general ledger match those of external records, such as bank statements and vendor invoices. This process involves identifying and correcting any discrepancies, ensuring that the financial records are accurate and reliable.

2. Financial Reporting

Staff accountants assist in preparing financial statements, including balance sheets, income statements, and cash flow statements. These statements provide a comprehensive overview of an organization’s financial performance and position, and are vital for decision-making by management and stakeholders.

3. Journal Entry Processing

Journal entries are used to record financial transactions in the general ledger. Staff accountants analyze transactions and prepare the necessary journal entries, ensuring that all transactions are properly recorded and accounted for.

4. Internal Control Procedures

Maintaining internal control procedures is essential for safeguarding an organization’s assets and ensuring the integrity of its financial records. Staff accountants assist in implementing and monitoring these procedures, helping to prevent fraud and errors.

5. Payroll Processing

In some organizations, staff accountants may also be responsible for processing payroll. This involves calculating employee salaries, withholding taxes, and generating paychecks. Accurate payroll processing is crucial for employee morale and compliance with labor laws.

Interview Tips

Preparing for an interview for a staff accountant position requires thorough research and practice. Here are some tips to help you ace the interview:

1. Research the Company and Role

Familiarize yourself with the company’s industry, products or services, and financial performance. Understanding the role’s specific responsibilities and how it contributes to the organization’s goals will help you demonstrate your interest and knowledge.

2. Practice Common Interview Questions

Anticipate common interview questions such as “Tell me about yourself” and “Why are you interested in this role?” Prepare concise and engaging answers that highlight your relevant skills and experience. Practice these answers out loud to build confidence and fluency.

3. Demonstrate Your Technical Skills

Be prepared to discuss your technical accounting skills, including proficiency in accounting software, knowledge of GAAP or IFRS, and experience in preparing financial statements. Use specific examples to showcase your abilities and quantify your accomplishments.

4. Emphasize Your Attention to Detail

Accuracy and attention to detail are essential for a staff accountant. Highlight your strong organizational skills, ability to handle multiple tasks simultaneously, and meticulousness in your work. Provide examples of how you have ensured accuracy and completeness in your previous roles.

5. Ask Thoughtful Questions

Asking thoughtful questions at the end of the interview shows that you are engaged and interested in the position. Prepare questions about the company’s accounting practices, growth plans, or industry trends. This demonstrates your enthusiasm and eagerness to learn more.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Staff Accountant interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!