Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted State Auditor position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

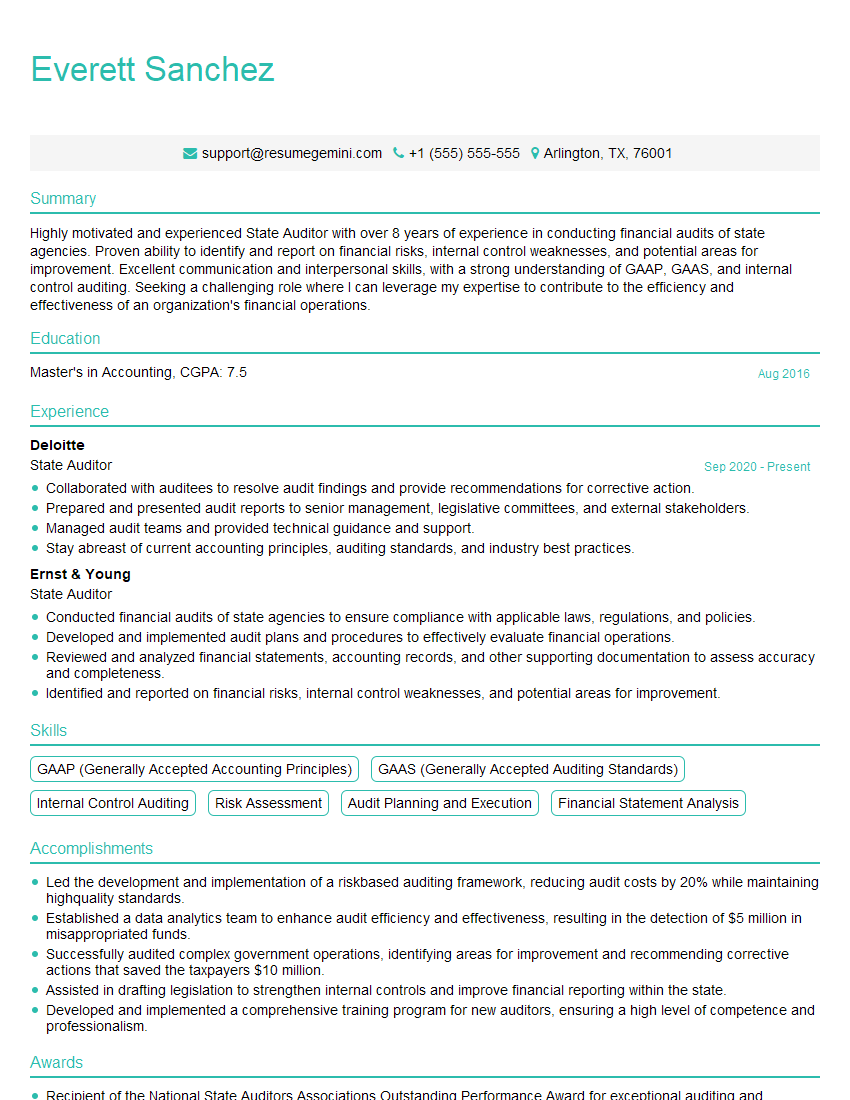

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For State Auditor

1. How would you approach an audit of a state agency that has a history of financial irregularities?

- Establish a risk assessment to identify areas of concern

- Review previous audit reports and identify any outstanding issues or recommendations

- Conduct a preliminary review to gather information and assess the agency’s financial controls and processes

- Develop an audit plan that focuses on the areas of greatest risk

- Assign experienced auditors to the engagement and provide them with appropriate training

2. What are the key considerations when assessing the internal control environment of a state agency?

Control Environment

- Management’s philosophy and operating style

- The board of directors or oversight body’s involvement in internal control

- Integrity and ethical values

- Assignment of authority and responsibility

Information and Communication

- The accounting system, including the chart of accounts

- The budgeting process

- Financial reporting

- Communications with those charged with governance

Control Activities

- Authorization, approval, and recording of transactions

- Reconciliations and account analyses

- Physical controls

- Information technology controls

Monitoring

- Internal audit function

- Management’s monitoring of internal control

- External audit function

3. How would you communicate audit findings and recommendations to senior management and the audit committee?

- Prepare a clear and concise audit report that outlines the findings and recommendations

- Present the report to senior management and the audit committee in a meeting

- Explain the findings and recommendations in a clear and understandable way

- Answer any questions that senior management and the audit committee have about the report

- Discuss the implications of the findings and recommendations with senior management and the audit committee

4. What are the most common challenges you have encountered in your previous audit experience and how did you overcome them?

- Lack of cooperation from auditees

- Insufficient documentation

- Complex accounting issues

- Time constraints

- Budget constraints

5. What are your thoughts on the use of data analytics in auditing?

- Data analytics can be a valuable tool for auditors

- Data analytics can help auditors to identify trends and patterns that would not be apparent from a manual review of the data

- Data analytics can help auditors to focus their audit efforts on areas of greatest risk

- Data analytics can help auditors to improve the efficiency and effectiveness of their audits

6. What are the ethical responsibilities of an auditor?

- Integrity

- Objectivity

- Professional competence and due care

- Confidentiality

- Professional behavior

7. How do you stay up-to-date on the latest auditing standards and best practices?

- Attend continuing professional education courses

- Read professional journals and articles

- Participate in professional organizations

- Network with other auditors

8. What are your strengths and weaknesses as an auditor?

Strengths

- Strong analytical skills

- Excellent communication and interpersonal skills

- Ability to work independently and as part of a team

- Proficient in the use of auditing software

- Certified Public Accountant (CPA) license

Weaknesses

- Limited experience in auditing government agencies

- Not yet fluent in Spanish

9. Why are you interested in this position?

- I am passionate about public service and believe that auditing is a vital part of ensuring that government agencies are operating efficiently and effectively

- I am confident that my skills and experience would make me a valuable asset to your team

- I am eager to learn more about the challenges and opportunities facing state auditors

10. Where do you see yourself in five years?

- I hope to be a senior auditor in five years

- I would also like to be more involved in the professional development of other auditors

- I believe that my experience in this position will provide me with the skills and knowledge necessary to achieve my career goals

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for State Auditor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the State Auditor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

State Auditors are responsible for performing financial audits of state agencies and entities, including departments, boards, commissions, and public authorities.

1. Planning and Executing Audits

Auditors plan and execute audits to evaluate the financial condition of state agencies and entities. They review financial statements, internal controls, and other relevant documentation to assess the accuracy and reliability of financial reporting.

- Plan and scope audits based on risk assessments and audit objectives.

- Develop and implement audit programs to gather and analyze audit evidence.

- Perform audit procedures to assess internal controls, financial reporting, and compliance with laws and regulations.

2. Evaluating Audit Results

Auditors evaluate audit results to determine the extent to which state agencies and entities are meeting their financial reporting responsibilities. They assess the adequacy of internal controls, the accuracy of financial statements, and compliance with applicable laws and regulations.

- Analyze audit findings to identify areas of concern or improvement.

- Prepare audit reports that summarize audit findings and recommendations.

- Present audit findings and recommendations to state agencies and entities.

3. Monitoring Agency and Entity Responses

Auditors monitor the responses of state agencies and entities to audit findings and recommendations. They follow up on corrective actions taken by agencies and entities to ensure that weaknesses identified in audits are addressed.

- Review agency and entity responses to audit findings and recommendations.

- Monitor the implementation of corrective actions.

- Conduct follow-up audits to assess the effectiveness of corrective actions.

4. Providing Consulting and Advisory Services

Auditors may also provide consulting and advisory services to state agencies and entities. They can assist agencies with developing and implementing internal controls, improving financial management practices, and complying with applicable laws and regulations.

- Provide guidance on accounting and financial reporting issues.

- Assist agencies with developing and implementing internal controls.

- Provide training on financial management and compliance topics.

Interview Tips

To successfully navigate an interview, it’s important to prepare thoroughly. Practice answering frequently asked questions, research the organization and demonstrate your expertise in key areas.

1. Research the Organization

Before the interview, learn about the organization’s mission, values, and strategic goals. This will help you understand the role of the State Auditor and how your skills and experience align with their needs.

- Visit the organization’s website and read about their history, mission, and services.

- Review their latest annual report or strategic plan to understand their goals and objectives.

- Follow the organization on social media to stay informed about recent news and developments.

2. Practice Answering Common Interview Questions

Anticipate questions about your experience, skills, and motivations. Prepare concise and articulate answers that highlight your qualifications for the role.

- Tell me about your experience in financial auditing.

- What are your strengths and weaknesses as an auditor?

- Why are you interested in this role with our organization?

3. Highlight Your Expertise in Key Areas

State Auditors must possess a deep understanding of accounting principles, auditing standards, and government regulations. Emphasize your expertise in these areas and provide examples of your work that demonstrate your proficiency.

- Discuss your experience in applying Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS).

- Explain your knowledge of the Government Auditing Standards (GAS) or International Standards on Auditing (ISA).

- Provide examples of your experience in auditing government entities, including compliance with federal and state laws and regulations.

4. Demonstrate Your Communication and Interpersonal Skills

State Auditors must be able to communicate effectively with a wide range of stakeholders, including agency heads, legislators, and the public. Highlight your abilities in written and verbal communication, as well as your interpersonal skills.

- Describe your experience in writing audit reports, presenting findings, and communicating with senior management.

- Provide examples of your ability to build relationships with clients and gain their trust.

- Explain how you maintain a professional and ethical demeanor in your interactions with others.

5. Ask Thoughtful Questions

The interview is a two-way street. Don’t hesitate to ask thoughtful questions that demonstrate your interest in the role and the organization. This shows that you are engaged and eager to learn more.

- Can you tell me more about the current audit priorities of the organization?

- What are the major challenges facing the organization in the coming years?

- How does the organization support the professional development of its auditors?

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the State Auditor interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!