Are you gearing up for an interview for a Statement Processor position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Statement Processor and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

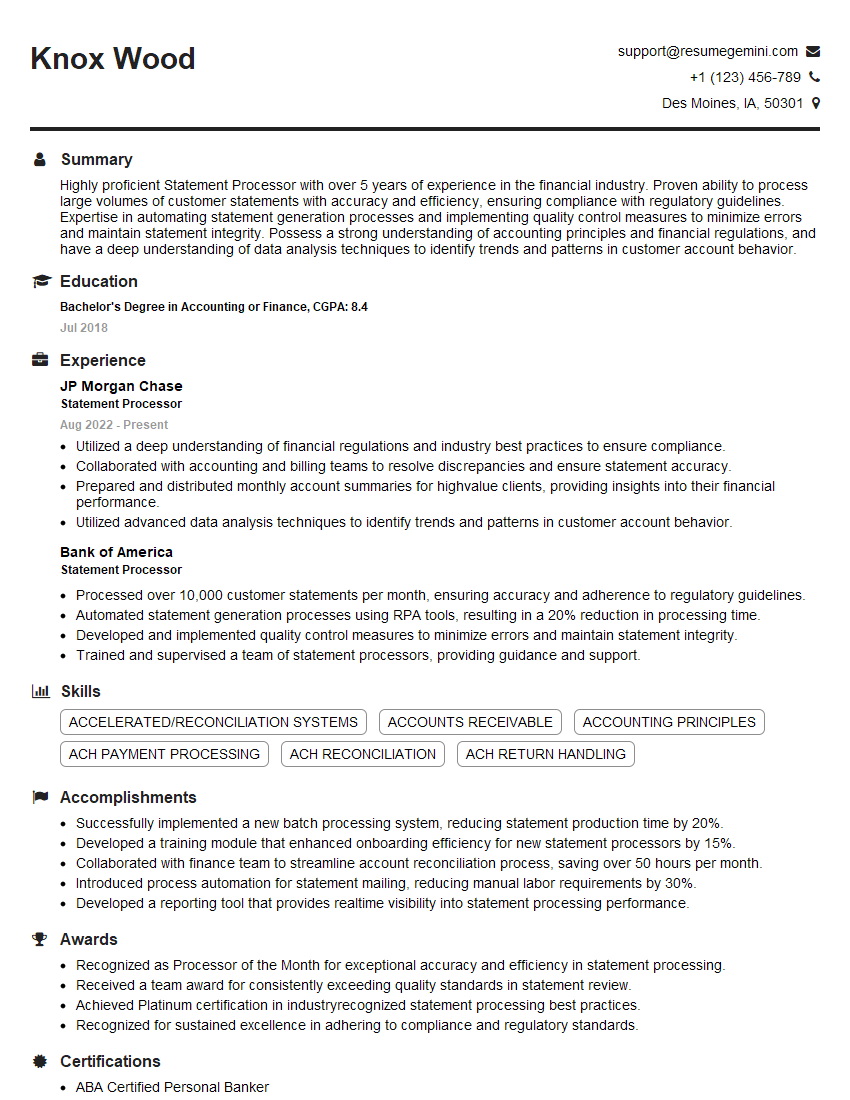

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Statement Processor

1. Explain the process of statement processing in detail.

The process of statement processing involves the following steps:

- Data extraction: Extracting relevant data from various sources, such as bank statements, credit card statements, and invoices.

- Data cleansing and validation: Checking for errors and inconsistencies in the extracted data and making necessary corrections.

- Data transformation: Converting the data into a format that is compatible with the accounting system or other downstream applications.

- Data loading: Importing the transformed data into the accounting system or other relevant destination.

2. What are the key challenges you have faced in statement processing? How did you overcome them?

Overcoming data quality issues

- Challenge: Dealing with incomplete or inaccurate data in statements.

- Solution: Implemented data validation rules and collaborated with data providers to improve data quality.

Handling high volumes of data

- Challenge: Processing large volumes of statements efficiently.

- Solution: Automated the statement processing workflow using technology and optimized processes.

3. How do you ensure accuracy and completeness in statement processing?

I employ the following strategies to ensure accuracy and completeness:

- Data validation: Implementing validation rules to check for missing or invalid data.

- Regular reconciliation: Reconciling processed data with source documents and other relevant data.

- Quality control: Establishing a quality control process to review and verify the processed data.

- Continuous monitoring: Monitoring statement processing metrics to identify potential errors or areas for improvement.

4. What tools or technologies are you familiar with for statement processing?

I am proficient in the following tools and technologies for statement processing:

- Data extraction tools: Such as Optical Character Recognition (OCR) and intelligent data capture solutions.

- Data transformation tools: Such as ETL (Extract, Transform, Load) tools and data mapping tools.

- Accounting software: Such as QuickBooks, NetSuite, and SAP.

- Cloud-based platforms: Such as AWS and Azure, which offer statement processing services.

5. How do you stay up-to-date with the latest developments in statement processing?

To stay up-to-date with the latest developments in statement processing, I engage in the following activities:

- Attending industry conferences and webinars: Participating in events and online sessions to learn about new technologies and best practices.

- Reading industry publications and blogs: Keeping abreast of the latest news, articles, and research in the field.

- Networking with professionals: Connecting with other statement processors and industry experts to exchange knowledge and insights.

6. What performance metrics do you use to evaluate the effectiveness of your statement processing?

I track the following performance metrics to evaluate the effectiveness of my statement processing:

- Accuracy rate: Percentage of statements processed with no errors.

- Completeness rate: Percentage of statements processed with all required data.

- Timeliness: Average time taken to process a statement.

- Cost per statement: Average cost incurred to process a statement.

- Customer satisfaction: Feedback and reviews from customers regarding the quality and timeliness of statement processing.

7. How do you prioritize statement processing tasks when there are multiple statements to be processed?

I prioritize statement processing tasks based on the following criteria:

- Due date: Statements with earlier due dates receive higher priority.

- Importance: Statements from critical accounts or vendors are prioritized.

- Volume: Statements with a high number of transactions are processed first to minimize backlogs.

- Resource availability: I consider the availability of resources, such as staff and technology, when assigning priorities.

8. What steps do you take to ensure the security of sensitive financial data during statement processing?

I adhere to the following security measures to protect sensitive financial data during statement processing:

- Data encryption: Encrypting data at rest and in transit using industry-standard encryption algorithms.

- Access control: Limiting access to sensitive data to authorized personnel only.

- Regular security updates: Applying security updates and patches to software and systems promptly.

- Compliance with regulations: Ensuring compliance with relevant data protection regulations and industry standards.

9. How do you handle discrepancies or errors identified during statement processing?

I follow these steps when handling discrepancies or errors during statement processing:

- Identification: Identifying the discrepancy or error through data validation or reconciliation.

- Investigation: Investigating the root cause of the discrepancy or error by comparing to source documents or contacting the relevant parties.

- Resolution: Correcting the discrepancy or error by making necessary adjustments or reaching out to the appropriate stakeholders.

- Documentation: Documenting the discrepancy or error, the investigation process, and the resolution for future reference.

10. How do you approach continuous improvement in statement processing?

I actively engage in continuous improvement in statement processing through the following practices:

- Regular performance monitoring: Tracking key performance metrics and identifying areas for improvement.

- Process analysis: Reviewing existing processes to identify bottlenecks and inefficiencies.

- Technology evaluation: Exploring new technologies and tools that can enhance statement processing efficiency and accuracy.

- Feedback from stakeholders: Gathering feedback from customers and internal stakeholders to understand their needs and pain points.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Statement Processor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Statement Processor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Statement Processors play a pivotal role in ensuring the accuracy and efficiency of financial transactions by processing bank statements and reconciling them with internal records. Their responsibilities encompass a wide range of tasks crucial for maintaining financial integrity.

1. Bank Statement Processing

Statement Processors meticulously review and process bank statements on a regular basis. They analyze transactions, identify discrepancies, and ensure that all deposits and withdrawals are properly recorded.

- Matching transactions with internal records to identify discrepancies.

- Investigating and resolving errors or inconsistencies in bank statements.

- Verifying and recording bank charges and fees.

2. Account Reconciliation

Statement Processors perform regular account reconciliations to ensure that the balances in the company’s financial records match those in the bank statements. They identify and correct any discrepancies between the two sets of records.

- Reconciling bank accounts with internal accounting records.

- Investigating and resolving discrepancies between bank statements and internal records.

- Adjusting accounting entries to ensure accurate financial reporting.

3. Reporting and Analysis

Statement Processors prepare reports and perform analysis based on the processed bank statements. They provide insights into the company’s financial position and identify potential areas of concern.

- Generating reports on bank account activity and balances.

- Analyzing financial data to identify trends and patterns.

- Identifying and reporting any unusual or suspicious transactions.

4. Customer Service

Statement Processors may interact with customers to resolve inquiries related to bank statements and account reconciliations. They provide clear and accurate information to customers, ensuring their satisfaction.

- Answering customer questions about bank statements and account balances.

- Providing guidance and support on account reconciliation processes.

- Resolving customer disputes and complaints.

Interview Tips

Interview preparation is crucial for success in any interview, and the Statement Processor role is no exception. Here are some essential tips and hacks to help you ace your interview and stand out from other candidates:

1. Research the Company and Position

Before the interview, thoroughly research the company, its industry, and the specific role you are applying for. This will demonstrate your interest and enthusiasm for the position and enable you to ask informed questions during the interview.

- Visit the company’s website and read about its mission, values, and financial performance.

- Identify the key responsibilities of the Statement Processor role and prepare examples of your relevant skills and experience.

2. Practice Answering Common Interview Questions

Prepare answers to common interview questions, such as “Tell me about yourself,” “Why are you interested in this role?” and “What are your strengths and weaknesses?” Practice your answers out loud to ensure they are clear, concise, and relevant to the position.

- Use the STAR method (Situation, Task, Action, Result) to structure your answers and provide specific examples of your work experience.

- Tailor your answers to the specific job requirements and demonstrate how your skills and experience align with the company’s needs.

3. Highlight Your Analytical and Attention to Detail

Statement Processors require strong analytical skills and a keen eye for detail. During the interview, emphasize your ability to analyze financial data, identify discrepancies, and ensure accuracy in your work.

- Provide examples of how you have used your analytical skills to solve problems or improve processes.

- Share an instance where your attention to detail helped you identify and correct an error.

4. Showcase Your Customer Service Skills

Customer service is an essential aspect of the Statement Processor role. In the interview, highlight your ability to communicate effectively, handle customer inquiries professionally, and resolve disputes.

- Describe a situation where you successfully resolved a customer issue.

- Emphasize your empathy and ability to understand and address customer concerns.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Statement Processor interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.