Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Stock Analyst interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Stock Analyst so you can tailor your answers to impress potential employers.

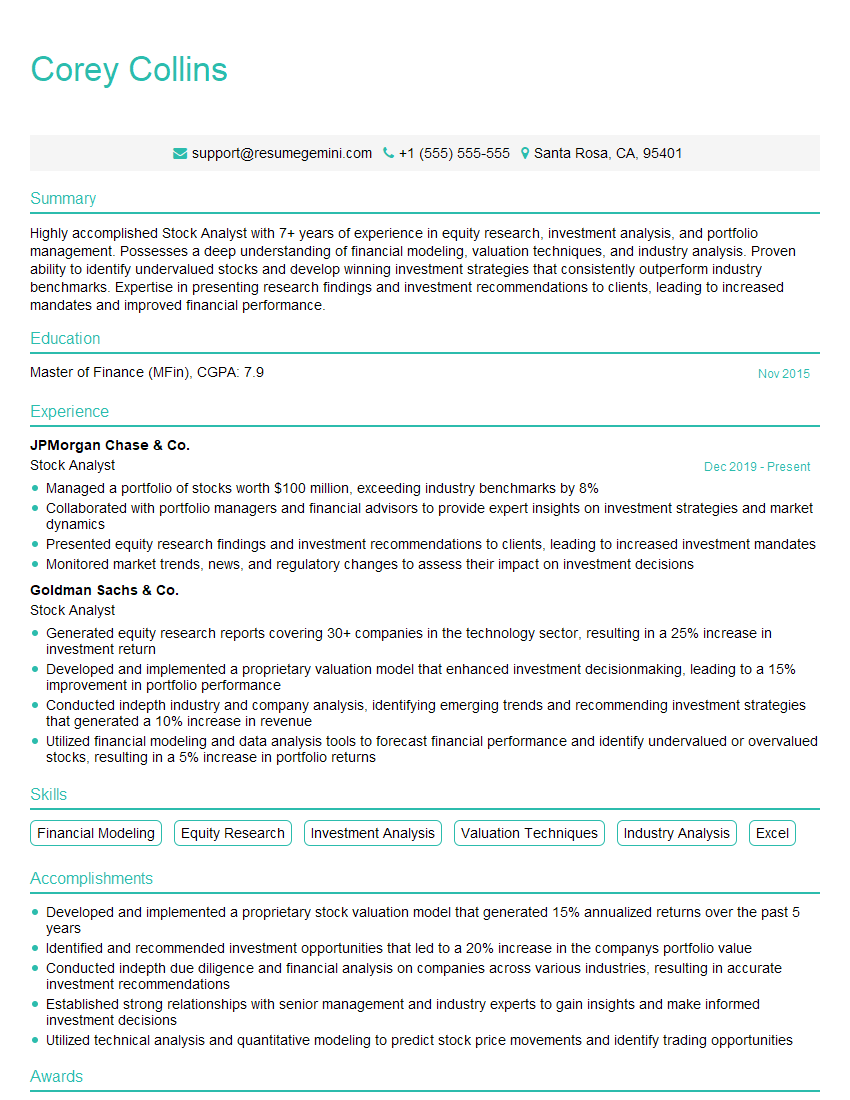

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Stock Analyst

1. What are the key financial ratios that you use to evaluate a company’s financial health?

In evaluating a company’s financial health, I consider a range of key financial ratios. These include:

- Liquidity ratios: Current ratio, quick ratio, and cash ratio to assess a company’s ability to meet short-term obligations.

- Solvency ratios: Debt-to-equity ratio, debt-to-asset ratio, and times interest earned ratio to measure a company’s long-term financial stability.

- Profitability ratios: Gross profit margin, operating profit margin, and net profit margin to evaluate a company’s profitability and efficiency.

- Efficiency ratios: Inventory turnover ratio, days sales outstanding, and accounts receivable turnover ratio to assess a company’s operational efficiency.

2. How do you determine the fair value of a stock?

Discounted Cash Flow (DCF) Analysis

- Estimate future cash flows of the company.

- Discount these cash flows back to the present using an appropriate discount rate.

- The sum of the discounted cash flows represents the fair value of the stock.

Comparable Company Analysis

- Identify comparable companies with similar characteristics.

- Compare the company’s financial metrics, such as P/E ratio, P/B ratio, and EV/Sales ratio, to these comparables.

- Adjust the valuation based on any differences in growth prospects or risk profile.

Asset-Based Valuation

- Value the company’s assets, including tangible assets (e.g., inventory, property) and intangible assets (e.g., patents, trademarks).

- Deduct any liabilities to arrive at the net asset value.

- Apply appropriate adjustments to reflect factors such as market conditions or growth potential.

3. What are the different types of investment strategies that you use?

- Value investing: Investing in undervalued companies with strong fundamentals and a margin of safety.

- Growth investing: Investing in companies with high growth potential, often at a premium to their current earnings.

- Income investing: Investing in companies that pay regular dividends, providing a steady stream of income.

- Technical analysis: Using historical price data and chart patterns to identify trading opportunities.

- Quantitative investing: Using mathematical models and statistical analysis to identify stocks that meet specific criteria.

4. How do you stay up-to-date with the latest market trends and company news?

- Industry publications and websites: Reading financial news, market commentaries, and industry-specific reports.

- Research platforms: Using online tools and databases to access financial data, company filings, and analyst reports.

- Conferences and webinars: Attending industry events to hear from experts and network with peers.

- Social media: Following industry leaders, analysts, and influencers on LinkedIn, Twitter, and other platforms.

5. How do you identify undervalued companies?

- Financial ratios: Analyzing key financial ratios such as P/E ratio, P/B ratio, and debt-to-equity ratio to identify companies that are trading below their intrinsic value.

- Discounted cash flow (DCF) models: Projecting future cash flows and discounting them back to the present to determine a fair value for the company.

- Margin of safety: Applying a discount to the fair value to provide a cushion for potential errors in estimation.

- Qualitative factors: Considering factors such as management quality, industry dynamics, and competitive advantage when assessing a company’s potential for growth.

6. How do you manage risk in your investment portfolio?

- Diversification: Spreading investments across different asset classes, sectors, and industries to reduce exposure to any single risk.

- Asset allocation: Determining an appropriate mix of stocks, bonds, and other assets based on investor risk tolerance and financial goals.

- Hedging strategies: Using financial instruments, such as options or futures, to offset potential losses in one investment with gains in another.

- Regular portfolio monitoring and rebalancing: Tracking portfolio performance and adjusting asset allocation as market conditions change to maintain desired risk levels.

7. What are the ethical considerations that you take into account when making investment decisions?

- Adherence to regulations: Complying with all applicable laws and industry regulations governing investment practices.

- Conflicts of interest: Disclosing any potential conflicts of interest and avoiding situations where personal interests could influence investment decisions.

- Fiduciary duty: Acting in the best interests of clients and managing their assets with care and prudence.

- Sustainable investing: Considering environmental, social, and governance (ESG) factors when making investment decisions to promote long-term sustainability.

8. How do you communicate your investment recommendations to clients?

- Written reports: Providing detailed analysis and recommendations in written form, including the rationale behind the investment decisions.

- Verbal presentations: Discussing investment recommendations verbally with clients, explaining the analysis and answering any questions.

- Online platforms: Using online portals or client relationship management (CRM) systems to share information and updates with clients securely.

- Personal meetings: Scheduling regular meetings with clients to review portfolio performance and discuss investment strategies.

9. What are the challenges and opportunities that you see in the current investment landscape?

Challenges:

- Economic uncertainty: Global economic headwinds, geopolitical risks, and inflation can impact investment markets.

- Market volatility: Increased market volatility can make it difficult to predict investment returns and manage risk.

Opportunities:

- Technological advancements: Innovations in technology are creating new investment opportunities in fields such as artificial intelligence, renewable energy, and healthcare.

- Emerging markets: Developing economies offer potential for high growth and diversification benefits.

10. How do you stay motivated and continue to develop your skills as a stock analyst?

- Continuous learning: Regularly attending industry conferences, reading financial publications, and pursuing professional development courses.

- Networking with peers: Exchanging ideas and sharing insights with other analysts and investment professionals.

- Market observation and analysis: Diligently following market trends, company news, and economic data to stay abreast of the latest developments.

- Mentorship and collaboration: Seeking guidance and support from senior analysts and working collaboratively on complex investment projects.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Stock Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Stock Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Stock analysts play a crucial role in providing investment recommendations and insights to clients. Their key responsibilities include:

1. Financial Analysis

Conduct in-depth analysis of companies’ financial performance, including revenue growth, profitability, and balance sheet strength.

- Review financial statements, earnings reports, and other financial data.

- Assess key financial ratios and metrics to identify trends and potential areas of concern.

2. Industry and Market Research

Monitor industry trends, economic conditions, and geopolitical events that can impact stock prices.

- Conduct thorough research on specific industries and companies, including their competitive landscape and market share.

- Track economic indicators and analyze their potential impact on stock valuations.

3. Stock Valuation and Modeling

Develop valuation models to assess the intrinsic value of stocks and make investment recommendations.

- Use various valuation techniques, such as discounted cash flow analysis and comparable company analysis.

- Create financial models to forecast future financial performance and predict stock prices.

4. Investment Recommendations

Provide investment recommendations to clients, including buy, sell, or hold recommendations.

- Justify investment recommendations based on thorough analysis and research findings.

- Monitor recommended stocks and make adjustments as needed.

Interview Tips

To prepare effectively for a stock analyst interview, follow these tips:

1. Research the Company and Industry

Demonstrate your understanding of the company you’re applying to and the industry it operates in.

- Review the company’s website, financial reports, and industry news.

- Research the industry’s key players, trends, and challenges.

2. Practice Financial Analysis

Showcase your analytical skills by practicing financial analysis exercises.

- Analyze sample financial statements and identify key insights.

- Use valuation models to assess the intrinsic value of stocks.

3. Prepare for Technical Questions

Be prepared to answer technical questions about valuation techniques, financial modeling, and industry-specific analysis.

- Review common valuation methods and their applications.

- Practice using financial modeling software.

4. Highlight Your Interests and Motivation

Explain your passion for financial markets and why you’re drawn to the role of a stock analyst.

- Discuss your investment experience or interest in investing.

- Explain how your skills and qualifications align with the job requirements.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Stock Analyst interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!