Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Stock Buyer position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

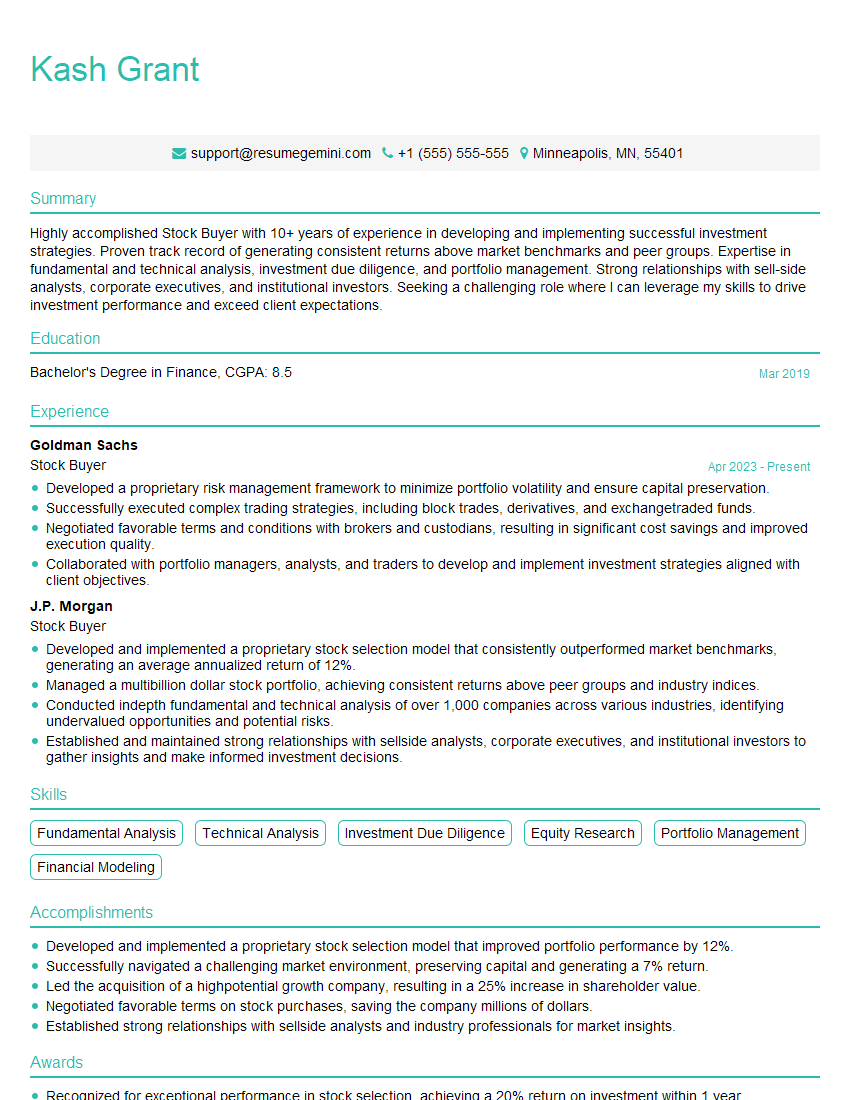

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Stock Buyer

1. How do you stay updated on the latest market trends and news?

- Regularly read industry publications and reports

- Attend industry conferences and webinars

- Follow financial experts and analysts on social media

- Utilize financial data platforms and news aggregators to monitor market movements

2. Describe your process for evaluating and selecting stocks for purchase.

Fundamental Analysis

- Review financial statements for revenue, earnings, and cash flow

- Conduct industry and competitive analysis

- Assess management effectiveness and company strategy

Technical Analysis

- Study price charts and identify patterns and trends

- Use technical indicators to identify overbought or oversold conditions

- Consider support and resistance levels to determine potential buy and sell points

3. How do you manage risk in your stock portfolio?

- Diversify holdings across different asset classes (e.g., stocks, bonds, commodities)

- Invest only in companies with strong financial profiles and sound business models

- Use stop-loss orders to limit potential losses

- Regularly monitor portfolio performance and make adjustments as needed

4. How do you determine the appropriate valuation for a stock before investing?

- Use fundamental analysis to assess intrinsic value based on financial metrics

- Employ valuation models such as discounted cash flow (DCF) or comparable company analysis

- Consider market sentiment and technical indicators to identify potential undervaluation or overvaluation

5. What factors do you consider when making investment decisions for clients?

- Client’s risk tolerance, investment goals, and time horizon

- Current market conditions and economic outlook

- Company’s financial health and industry dynamics

- Long-term growth potential and potential for return on investment

6. How do you monitor and track the performance of your stock portfolio?

- Regularly review financial statements and industry news

- Track key financial metrics such as earnings per share (EPS), price-to-earnings (P/E) ratio, and return on equity (ROE)

- Compare portfolio performance to benchmarks and industry peers

- Seek feedback from clients and other investment professionals

7. What are the ethical considerations you adhere to as a Stock Buyer?

- Maintain confidentiality of client information and transactions

- Avoid conflicts of interest and disclose any potential biases

- Follow industry regulations and best practices

- Act in the best interests of clients and prioritize their financial well-being

8. How do you stay abreast of emerging trends in the stock market?

- Attend conferences and workshops on industry advancements

- Read research papers and articles on emerging technologies and investment strategies

- Network with other professionals and seek insights from industry leaders

- Monitor news and market data for indications of potential game-changing trends

9. Describe your experience in using financial modeling and valuation tools to inform investment decisions.

- Proficient in spreadsheet software such as Excel for financial modeling and analysis

- Experienced in using financial modeling tools to forecast revenue, expenses, and cash flow

- Skilled in valuation techniques such as DCF, comparable company analysis, and precedent transactions

- Utilized financial modeling and valuation tools to support investment recommendations and portfolio management

10. How do you handle situations where there is limited or incomplete financial information available for a potential investment?

- Conduct thorough due diligence and gather available information from multiple sources

- Make assumptions and estimates based on industry benchmarks and historical data

- Consider qualitative factors and market sentiment to supplement financial data

- Disclose any limitations or uncertainties to clients and obtain their consent before making investment decisions

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Stock Buyer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Stock Buyer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Stock Buyers are finance professionals who are responsible for making buy and sell decisions for their firm’s investment portfolio. They analyze market trends, company financials, and economic data to make informed investment decisions. Stock Buyers typically work for investment banks, hedge funds, mutual funds, or other financial institutions.

1. Market Analysis

Stock Buyers must have a strong understanding of the financial markets and the factors that influence stock prices. They use this knowledge to identify undervalued stocks that have the potential to generate high returns. Stock Buyers also monitor market trends and economic data to identify potential risks and opportunities.

- Conduct thorough research on companies and industries to identify potential investment opportunities.

- Analyze financial statements, market data, and news to assess the financial health and growth potential of companies.

- Monitor market trends, economic indicators, and geopolitical events to identify potential risks and opportunities.

2. Portfolio Management

Stock Buyers are responsible for managing their firm’s investment portfolio. They make buy and sell decisions based on their market analysis and investment strategy. Stock Buyers also monitor the performance of their portfolio and make adjustments as needed.

- Develop and implement investment strategies based on the firm’s risk tolerance and return objectives.

- Buy and sell stocks in accordance with the firm’s investment strategy.

- Monitor the performance of the portfolio and make adjustments as needed.

3. Risk Management

Stock Buyers must be able to manage risk effectively. They use a variety of risk management tools and techniques to protect their firm’s investments. Stock Buyers also work with other members of the investment team to develop and implement risk management policies.

- Identify and assess potential risks to the portfolio.

- Implement risk management strategies to mitigate potential losses.

- Monitor the portfolio’s risk exposure and make adjustments as needed.

4. Client Relations

Stock Buyers often work with clients to help them achieve their investment goals. They provide clients with investment advice and recommendations, and they answer client questions. Stock Buyers must be able to communicate effectively with clients and build strong relationships.

- Provide investment advice and recommendations to clients.

- Answer client questions and address their concerns.

- Build and maintain strong relationships with clients.

Interview Tips

Here are some tips to help you ace your Stock Buyer interview:

1. Research the Firm

Before your interview, take some time to research the firm you are interviewing with. This will help you understand the firm’s investment strategy, culture, and values. You can find information about the firm on their website, in news articles, and on social media.

- Visit the firm’s website to learn about their investment strategy, team, and culture.

- Read news articles and industry reports to stay up-to-date on the firm’s performance and recent developments.

2. Practice Your Answers

Take some time to practice your answers to common interview questions. This will help you feel more confident and prepared during your interview. Some common interview questions for Stock Buyers include:

- Tell me about your investment experience.

- How do you analyze companies for investment?

- What are your thoughts on the current market environment?

3. Be Prepared to Discuss Your Portfolio

If you have a personal investment portfolio, be prepared to discuss it with your interviewer. This is a great way to demonstrate your investment skills and knowledge.

- Highlight your investment strategy and how you have implemented it in your portfolio.

- Discuss the performance of your portfolio and how you have managed risk.

4. Dress Professionally

First impressions matter, so it is important to dress professionally for your interview. This shows the interviewer that you are taking the interview seriously and that you respect the firm.

- Wear a suit or business casual attire.

- Make sure your clothes are clean and pressed.

- Accessorize with a watch, briefcase, and other professional items.

5. Be Confident

Be confident in your abilities and your knowledge. This will help you make a positive impression on the interviewer and show them that you are the right person for the job.

- Make eye contact with the interviewer.

- Speak clearly and concisely.

- Be enthusiastic and passionate about your work.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Stock Buyer interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!