Feeling lost in a sea of interview questions? Landed that dream interview for Stock Dealer but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Stock Dealer interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

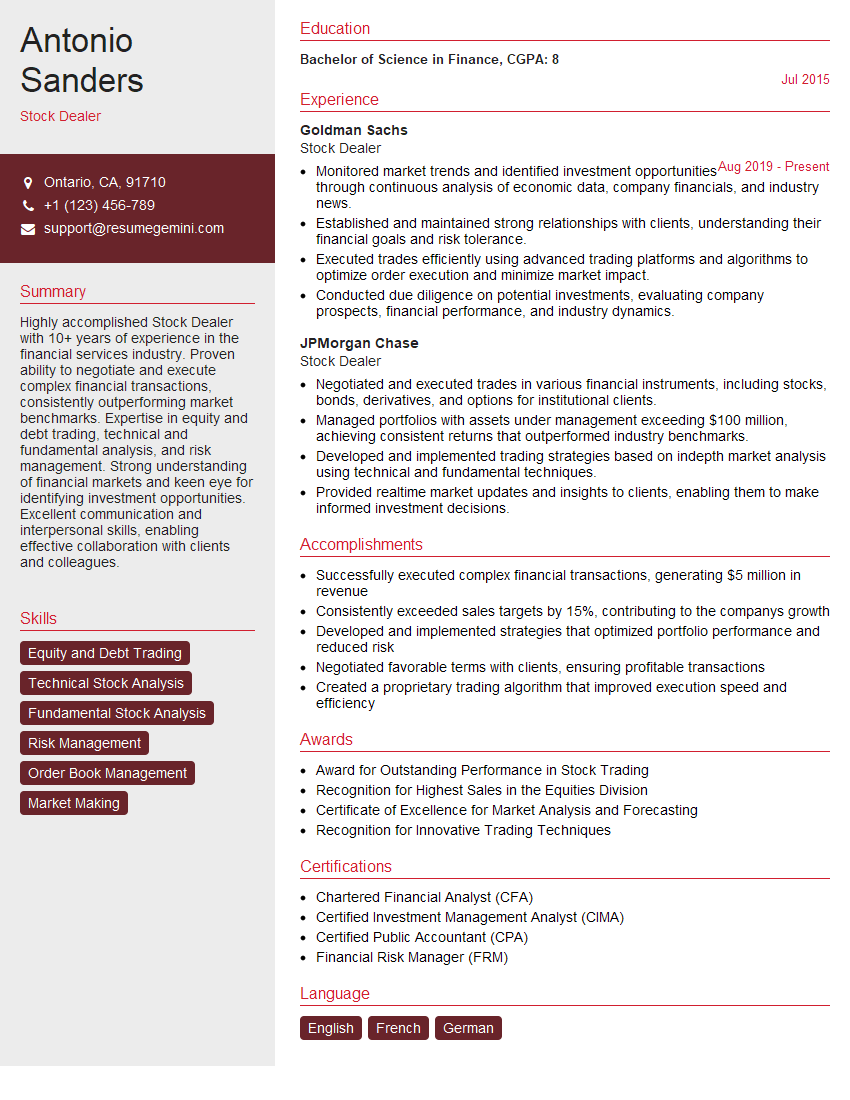

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Stock Dealer

1. Explain the concept of bid and ask prices in stock trading.

- The bid price is the highest price a buyer is willing to pay for a stock.

- The ask price is the lowest price a seller is willing to sell a stock.

- The difference between the bid and ask prices is called the spread.

2. What are the different types of stock orders?

Market Order

- Executed immediately at the current market price.

- No guarantee of execution at a specific price.

Limit Order

- Executed only when the stock reaches a specified price.

- Provides more control over execution price.

Stop Order

- Triggered when the stock reaches a specified price.

- Used to limit losses or lock in profits.

3. How do you determine the fair value of a stock?

- Discounted Cash Flow (DCF) analysis

- Comparable company analysis

- Asset-based valuation

- Market multiples

4. What are the key factors that influence stock prices?

- Earnings reports

- Economic conditions

- Interest rates

- Political events

- Investor sentiment

5. What are the advantages and disadvantages of investing in individual stocks?

Advantages

- Higher potential returns

- More control over investments

- Diversification

Disadvantages

- Higher risk

- Time-consuming

- Requires knowledge and experience

6. How do you manage risk in stock trading?

- Diversification

- Hedging

- Stop-loss orders

- Position sizing

- Risk tolerance assessment

7. Explain the concept of technical analysis.

- The study of historical price data to identify trends and patterns.

- Uses charts and indicators to analyze price movements.

- Can help identify potential trading opportunities.

8. What are the most important indicators used in technical analysis?

- Moving averages

- Relative Strength Index (RSI)

- Bollinger Bands

- Fibonacci retracements

- Ichimoku Cloud

9. How do you stay up-to-date on market trends and news?

- Financial news websites

- Newsletters

- Social media

- Market research reports

10. What are the ethical considerations of being a stock dealer?

- Fiduciary duty to clients

- Avoiding conflicts of interest

- Maintaining confidentiality

- Adhering to regulatory guidelines

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Stock Dealer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Stock Dealer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Stock Dealer is primarily responsible for buying and selling stocks and other financial instruments for clients or on their own account, with the aim of maximizing profit and minimizing losses.

1. Market Analysis

Analyze market trends, economic conditions, and company performance to identify trading opportunities and assess risks.

- Keep up-to-date with industry news, financial reports, and economic indicators.

- Conduct thorough due diligence on potential investments.

2. Execution of Trades

Execute buy and sell orders for clients or on behalf of their firm, ensuring timely and efficient execution.

- Negotiate prices and manage risk by using various trading strategies.

- Monitor portfolios and adjust positions as needed to meet client objectives.

3. Client Management

Build and maintain relationships with clients, understand their investment goals, and provide personalized advice.

- Meet with clients regularly to discuss their financial needs and risk tolerance.

- Develop tailored investment plans that align with client objectives.

4. Risk Management

Maintain a comprehensive understanding of risk management principles and implement strategies to mitigate potential losses.

- Monitor market volatility and adjust positions accordingly.

- Use stop-loss orders and other risk-management tools.

Interview Tips

Preparing for a Stock Dealer interview requires a thorough understanding of the industry, strong analytical skills, and the ability to communicate complex financial concepts effectively.

1. Research the Industry

Demonstrate your knowledge of the financial markets, key economic indicators, and current industry trends.

- Read industry publications and attend industry events.

- Stay up-to-date with the latest financial news and economic data.

2. Practice Financial Modeling

Showcase your ability to analyze financial statements, build financial models, and assess investment opportunities.

- Use financial modeling software such as Excel or Bloomberg.

- Practice valuing companies using various valuation methods.

3. Develop a Strong Portfolio

Create a portfolio that showcases your trading experience, analytical skills, and investment performance.

- Include real-world examples of successful trades you have executed.

- Highlight your ability to manage risk and achieve consistent returns.

4. Prepare for Behavioral Questions

Interviewers will assess your teamwork skills, ethical decision-making, and stress tolerance.

- Use the STAR method (Situation, Task, Action, Result) to answer behavioral questions.

- Provide specific examples that demonstrate your positive qualities.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Stock Dealer interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!