Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Stock Grader interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Stock Grader so you can tailor your answers to impress potential employers.

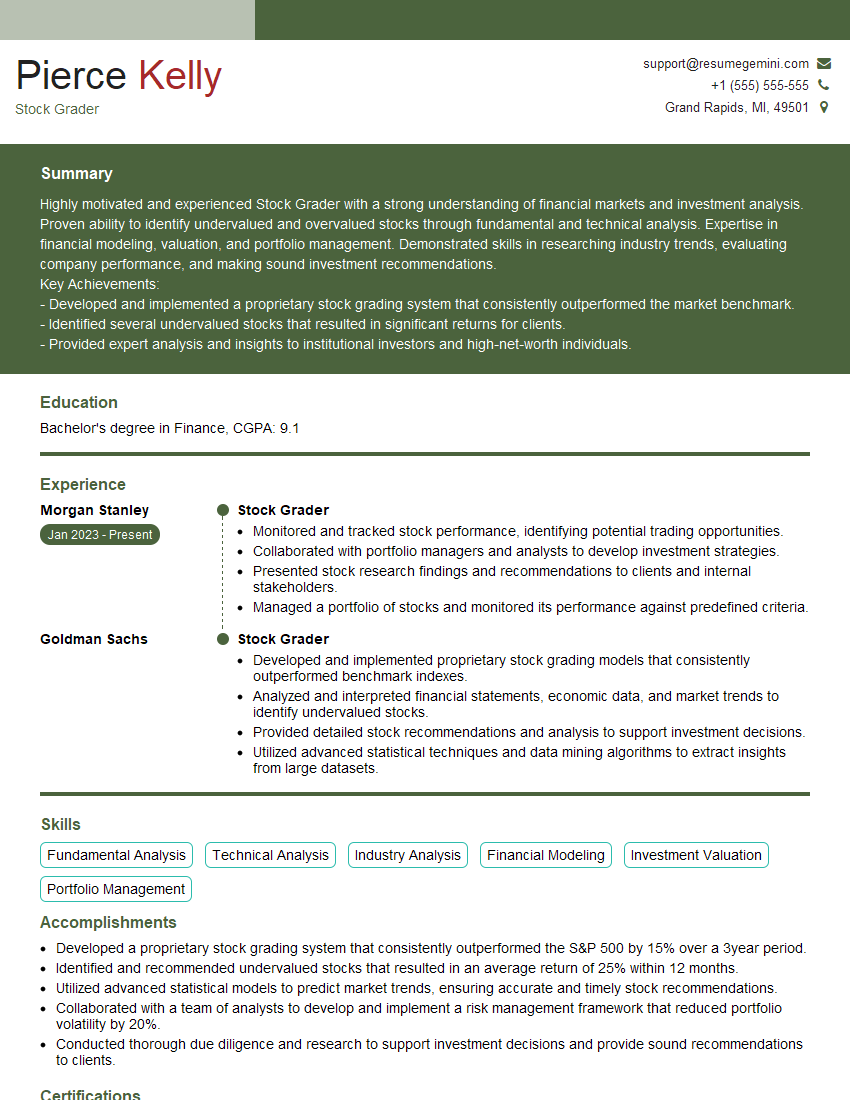

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Stock Grader

1. How do you determine the intrinsic value of a stock, and how do you use this information to identify undervalued or overvalued stocks?

- The intrinsic value of a stock is its true value based on an analysis of the company’s financial statements, market conditions, and industry outlook.

- By comparing the intrinsic value with the current market price, I can identify stocks that are undervalued or overvalued.

2. Discuss the different quantitative and qualitative factors you consider when evaluating a stock.

Quantitative Factors

- Financial ratios (e.g., P/E, P/B, ROE)

- Earnings per share

- Revenue growth

Qualitative Factors

- Management team

- Business model

- Competitive landscape

3. How do you assess the risk and reward profile of a stock, and how does this information influence your investment decisions?

- I analyze factors like volatility, beta, and correlation to assess the risk profile.

- I evaluate the potential return based on financial projections and industry trends.

- Based on this, I determine the risk-reward balance and make investment decisions that align with my risk tolerance.

4. Describe the different investment strategies you employ as a stock grader, and how you select the appropriate strategy for different market conditions.

- Value investing: Acquiring stocks trading below their intrinsic value.

- Growth investing: Investing in companies with high growth potential and strong competitive advantages.

- Income investing: Investing in stocks that pay regular dividends.

- I select the strategy based on factors like market volatility, economic indicators, and industry trends.

5. How do you stay up-to-date on the latest market trends and developments, and how does this knowledge influence your stock grading process?

- I monitor financial news, read industry publications, and attend conferences.

- I follow company earnings reports and announcements.

- This knowledge helps me identify emerging trends and anticipate market movements, which I incorporate into my stock grading process.

6. How do you communicate your stock grading analysis and recommendations to clients, and how do you ensure that they understand and can make informed decisions?

- I create written reports and presentations that summarize my analysis.

- I meet with clients to discuss my findings and recommendations.

- I use clear and concise language and provide examples to help clients understand the rationale behind my grading.

7. How do you handle situations where your stock grading differs from the consensus view or from your colleagues’ assessments?

- I respect the opinions of others but maintain my own independent judgment.

- I thoroughly explain the reasons for my differing views.

- I am open to constructive criticism and willing to adjust my grading based on logical arguments.

8. How do you measure and evaluate the accuracy and effectiveness of your stock grading process?

- I track the performance of stocks I recommend over time.

- I compare my grading accuracy to industry benchmarks.

- I seek feedback from clients to gauge their satisfaction and understand areas for improvement.

9. Describe a situation where your stock grading analysis led to a significant investment decision for a client, and discuss the positive outcomes it yielded.

- Example: Recommended a value stock that was significantly undervalued.

- The stock appreciated significantly after the recommendation.

- The client achieved substantial returns on their investment.

10. How do you stay motivated and continue to develop your skills as a stock grader in a rapidly evolving industry?

- I am passionate about investing and enjoy the challenge.

- I attend industry conferences and webinars to stay abreast of best practices.

- I regularly read financial literature and seek opportunities for professional development.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Stock Grader.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Stock Grader‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Stock Grader is responsible for evaluating and assessing the financial performance and stability of companies to make informed recommendations on the investment potential of their stocks.

1. Stock Analysis and Research

Conduct in-depth research on companies, industries, and markets to identify potential investment opportunities.

- Analyze financial statements, industry reports, and economic data.

- Evaluate company management, competitive landscape, and market trends.

2. Stock Valuation and Grading

Develop models and methodologies to assess the intrinsic value of stocks.

- Utilize fundamental, technical, and quantitative analysis techniques.

- Assign investment grades (e.g., buy, hold, sell) based on the evaluation.

3. Report Writing and Presentation

Document and communicate stock grading results and recommendations to clients or investment managers.

- Create written reports outlining the analysis, methodology, and investment thesis.

- Present findings to internal and external stakeholders.

4. Portfolio Management and Performance Monitoring

Assist in the development and management of investment portfolios.

- Monitor portfolio performance and make recommendations for adjustments.

- Track market trends and identify potential risks or opportunities.

Interview Tips

Preparing for a Stock Grader interview requires a solid understanding of the industry and the key skills and responsibilities of the role. Here are some tips to help you ace the interview:

1. Research the Company and Industry

Familiarize yourself with the company you’re applying to, including their investment philosophy, investment process, and recent performance.

- Research the industry trends, market conditions, and economic factors that impact stock grading.

- Follow industry news, reports, and publications to stay up-to-date.

2. Practice Stock Analysis

Demonstrate your analytical skills by practicing stock analysis using different valuation methods.

- Analyze historical financial data, conduct industry comparisons, and evaluate company management.

- Present your findings in a clear and concise way, highlighting your insights and investment recommendations.

3. Showcase Your Communication Skills

Stock Graders need to effectively convey their findings and recommendations to clients and stakeholders.

- Practice presenting your analysis and investment thesis in a compelling and persuasive manner.

- Be prepared to answer questions about your assumptions and the limitations of your analysis.

4. Highlight Your Technical Skills

Discuss your proficiency in financial modeling, data analysis, and industry-specific software.

- Emphasize your experience with quantitative and statistical analysis techniques.

- Demonstrate your ability to use financial databases and research tools.

5. Prepare Behavioral Questions

Be ready to answer behavioral questions that assess your teamwork, problem-solving abilities, and adherence to ethical guidelines.

- Describe a challenging investment decision you made and how you evaluated the risks and potential rewards.

- Explain a situation where you had to manage conflicting viewpoints and reach a consensus.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Stock Grader interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!