Are you gearing up for an interview for a Stock Pitcher position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Stock Pitcher and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

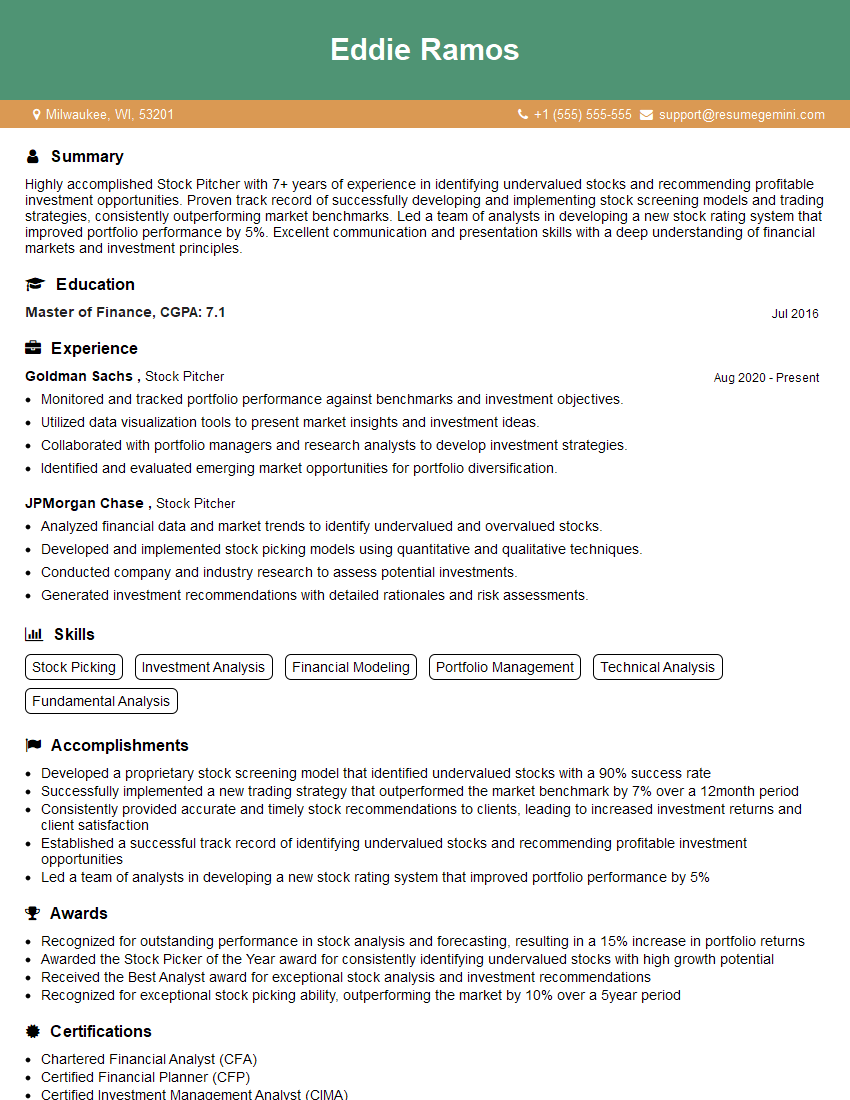

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Stock Pitcher

1. How would you determine if a company is financially healthy?

To determine the financial health of a company, I would analyze key financial ratios and metrics. These include:

- Profitability ratios: Gross profit margin, operating profit margin, net profit margin. These ratios measure the company’s ability to generate profits from its operations.

- Liquidity ratios: Current ratio, quick ratio. These ratios assess the company’s ability to meet its short-term obligations and maintain solvency.

- Solvency ratios: Debt-to-equity ratio, debt-to-asset ratio. These ratios evaluate the company’s financial leverage and its ability to manage its debt obligations.

- Efficiency ratios: Inventory turnover, accounts receivable turnover. These ratios measure the company’s operational efficiency and its ability to manage its assets effectively.

2. What are some common valuation methods used in stock analysis?

- Discounted cash flow (DCF) analysis: This method involves forecasting future cash flows and then discounting them back to the present value at a specified discount rate to determine the company’s intrinsic value.

- Comparable company analysis: This method involves comparing the company’s financial metrics and valuation multiples to those of similar companies in the same industry.

- Asset-based valuation: This method determines the company’s value based on the value of its tangible and intangible assets, such as inventory, equipment, and intellectual property.

- Multiples approach: This method involves multiplying the company’s revenue, earnings, or other financial metrics by industry-specific multiples to estimate its value.

3. How do you assess the competitiveness of an industry?

- Porter’s Five Forces: This framework analyzes the industry’s competitive forces, including the threat of new entrants, buyer power, supplier power, competitive rivalry, and the threat of substitutes.

- Market share analysis: Evaluating the market shares of different competitors can provide insights into the industry’s competitive landscape and identify potential threats.

- SWOT analysis: Conducting a SWOT analysis for each competitor helps to identify their strengths, weaknesses, opportunities, and threats, providing a comprehensive understanding of the industry’s competitiveness.

4. What are some key technical indicators used in stock market analysis?

- Moving averages: These indicators smooth out price data and help identify trends and support and resistance levels.

- Relative strength index (RSI): This indicator measures a stock’s momentum and identifies when it is overbought or oversold.

- Bollinger bands: These bands display the volatility of a stock and can help identify potential trading opportunities.

- Fibonacci retracement levels: These levels represent potential areas of support or resistance and are based on the Fibonacci sequence.

5. How would you approach evaluating the growth potential of a company?

- Revenue growth rate: Analyzing the historical and projected revenue growth rate can provide insights into the company’s growth potential.

- Market share analysis: Assessing the company’s market share and the growth potential of the overall market can help determine the company’s ability to capture future growth.

- Product pipeline analysis: Reviewing the company’s pipeline of new products or services can indicate its commitment to innovation and future growth.

- Expansion plans: Examining the company’s plans for expanding into new markets or segments can provide information about its potential for growth.

6. What are some of the ethical considerations you take into account when making investment decisions?

- ESG investing: Incorporating environmental, social, and governance (ESG) factors into investment decisions to ensure sustainability and responsible investing practices.

- Avoiding conflicts of interest: Disclosing and managing any potential conflicts of interest to maintain objectivity and ethical conduct.

- Respect for client preferences: Understanding and adhering to the investment objectives and risk tolerance of clients while making investment recommendations.

- Fiduciary duty: Always acting in the best interests of clients and putting their financial well-being first.

7. How do you stay up-to-date with the latest financial news and market trends?

- Financial news websites and publications: Regularly reading reputable sources such as Bloomberg, CNBC, and the Wall Street Journal.

- Industry conferences and webinars: Attending industry events to network and learn about the latest developments.

- Social media platforms: Following industry experts and analysts on platforms like Twitter and LinkedIn for real-time updates.

- Continuing education courses: Pursuing certifications and courses to enhance knowledge and stay current with industry best practices.

8. What are your strengths and weaknesses as a stock pitcher?

Strengths:

- Strong analytical skills and ability to interpret complex financial data.

- Expertise in various valuation methods and investment strategies.

- Excellent communication and presentation skills for effectively conveying insights.

Weaknesses:

- Limited experience in portfolio management and practical investment implementation.

- Working on improving my knowledge of emerging markets and international investing.

9. How do you handle making investment recommendations when faced with uncertainty and conflicting information?

- Thorough research and analysis: Conducting in-depth analysis of all available information, considering both bullish and bearish perspectives.

- Scenario planning: Evaluating different potential market scenarios and their impact on investment outcomes.

- Consult with experts: Seeking input from other analysts, portfolio managers, or industry professionals to gain diverse perspectives.

- Risk management: Implementing appropriate risk management strategies to mitigate potential losses and protect client portfolios.

10. What are your long-term career goals as a stock pitcher?

- Grow my knowledge and expertise in investment management and financial planning.

- Assume a leadership role within the investment industry, influencing decision-making and shaping investment strategies.

- Use my skills to contribute to the success of investors and help them achieve their financial goals.

- Continue to stay abreast of industry trends and advancements, ensuring my knowledge remains current and relevant.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Stock Pitcher.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Stock Pitcher‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Stock Pitchers are responsible for identifying and presenting investment opportunities to potential investors. They are expected to have a deep understanding of financial markets, investment strategies, and valuation techniques.

1. Financial Analysis

Conduct thorough financial analysis of companies, including reviewing financial statements, analyzing industry trends, and assessing competitive landscapes.

- Use financial models and tools to evaluate company performance and identify potential investment opportunities.

- Develop financial projections and forecasts to support investment decisions.

2. Market Research

Stay abreast of market trends, economic conditions, and industry news that may impact investment decisions.

- Monitor stock market activity, including price movements, volume trends, and analyst ratings.

- Conduct due diligence on potential investment targets, including reviewing company filings, market research, and news articles.

3. Investment Pitching

Prepare and deliver investment pitches to potential investors, outlining the rationale for the investment, the potential risks and rewards, and the expected returns.

- Use persuasive communication skills to articulate the investment thesis and convince investors of the potential upside.

- Respond to investor questions and address any concerns or objections.

4. Portfolio Management

Manage investment portfolios, including monitoring performance, rebalancing asset allocations, and making investment decisions based on market conditions.

- Monitor and track portfolio performance against benchmarks and investment objectives.

- Identify and implement strategies to optimize portfolio returns and manage risks.

Interview Tips

Preparing for a Stock Pitcher interview requires a comprehensive understanding of the role and the industry. Here are some tips to help you ace your interview:

1. Research the Industry

Familiarize yourself with the financial markets, investment strategies, and valuation techniques used in the industry.

- Read industry publications, attend conferences, and network with professionals in the field.

- Stay up-to-date on the latest financial news and market trends.

2. Practice Pitching

Prepare and practice investment pitches for different types of companies and investment scenarios.

- Use clear and concise language to explain your investment thesis and the potential risks and rewards.

- Be prepared to answer questions from investors and address any concerns or objections.

3. Demonstrate Analytical Skills

Showcase your analytical skills by providing examples of financial models and tools you have used to evaluate investment opportunities.

- Describe how you have used financial ratios, discounted cash flow analysis, or other valuation techniques to assess company performance.

- Explain how your analysis has helped you identify potential investment opportunities and make informed investment decisions.

4. Highlight Your Experience

Emphasize your experience in financial analysis, market research, or investment pitching.

- Describe projects or assignments where you have successfully identified and evaluated investment opportunities.

- Quantify your results and provide specific examples of how your contributions have impacted investment decisions.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Stock Pitcher interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!