Are you gearing up for an interview for a Stock Selector position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Stock Selector and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

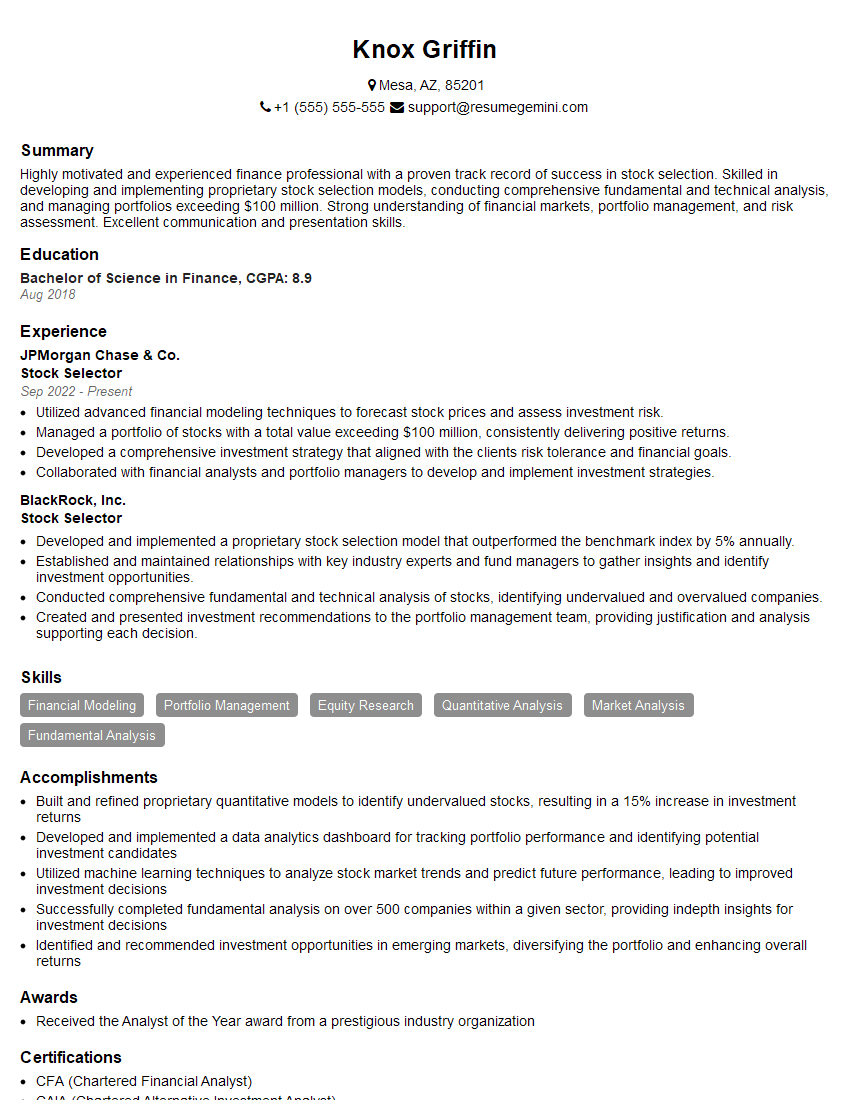

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Stock Selector

1. Describe your approach to identifying undervalued stocks?

- Conduct thorough fundamental analysis, examining financial statements, industry trends, and competitive landscape.

- Utilize valuation models, such as DCF and comparable company analysis, to determine intrinsic value.

- Identify companies with strong competitive advantages, sustainable earnings growth, and low valuations relative to their growth potential.

- Seek out companies with hidden value, such as undervalued assets or unrecognized earnings streams.

- Monitor market conditions and news events to identify potential opportunities or risks.

2. How do you assess the geopolitical and macroeconomic environment when making investment decisions?

subheading of the answer

- Monitor global economic indicators, such as GDP growth, inflation, and interest rates.

- Analyze the impact of geopolitical events, trade policies, and government regulations on different industries and companies.

- Consider the potential implications of macroeconomic factors on currency markets, commodity prices, and investment returns.

subheading of the answer

- Identify opportunities or risks arising from changes in the geopolitical and macroeconomic landscape.

- Adjust investment strategies accordingly, such as overweighting certain sectors or geographies.

3. How do you determine the risk and return profile of a stock?

- Analyze historical price data, volatility measures, and earnings stability.

- Assess the company’s financial leverage, liquidity, and industry risk.

- Evaluate the potential impact of economic, competitive, and geopolitical factors on the company’s operations and earnings.

- Compare the stock’s risk and return profile to those of similar companies and the broader market.

- Assign a risk rating and expected return range based on the analysis.

4. How do you manage risk in your portfolio?

- Diversify investments across different asset classes, industries, and geographies.

- Implement risk management strategies, such as hedging, position sizing, and stop-loss orders.

- Monitor portfolio risk metrics, such as beta, volatility, and correlation.

- Rebalance the portfolio periodically to maintain desired risk and return levels.

- Consider the impact of correlation and market downturns on overall portfolio risk.

5. How do you stay up-to-date with market trends and company news?

- Read industry publications, research reports, and financial news websites.

- Attend industry conferences and webinars.

- Monitor social media platforms and company announcements.

- Network with other professionals in the investment industry.

- Conduct regular company and industry research to stay informed about developments.

6. Describe your experience in using financial modeling and data analysis tools.

- Proficient in Excel, including advanced formula and charting capabilities.

- Experience in using financial modeling software, such as Bloomberg, FactSet, and Capital IQ.

- Ability to manipulate and analyze large datasets using statistical and data visualization tools.

- Comfortable with programming languages for data analysis, such as Python or R.

- Demonstrate strong analytical and problem-solving skills through the use of these tools.

7. How do you collaborate with other members of the investment team?

- Participate actively in team meetings and discussions.

- Share research findings and insights with colleagues.

- Seek input and feedback from team members with different expertise.

- Work effectively in both independent and collaborative settings.

- Contribute to the team’s collective knowledge and decision-making process.

8. What ethical considerations do you take into account when making investment decisions?

- Adhere to industry regulations and best practices.

- Avoid conflicts of interest and maintain confidentiality.

- Consider the environmental, social, and governance (ESG) impact of investments.

- Respect the rights of investors and shareholders.

- Act with integrity and transparency at all times.

9. How do you handle pressure and make decisions in fast-paced environments?

- Remain calm and composed under pressure.

- Analyze the situation quickly and prioritize tasks.

- Make timely decisions based on available information.

- Communicate decisions clearly and effectively to team members.

- Adapt to changing circumstances and make adjustments as necessary.

10. Why are you interested in this role and how do you think your skills can contribute to our team?

- Explain interest in the company’s investment approach and track record.

- Highlight relevant skills and experience that align with the responsibilities of the role.

- Emphasize ability to work collaboratively and contribute to the team’s success.

- Express enthusiasm for learning and growing within the organization.

- Demonstrate commitment to delivering exceptional results and adding value to the team.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Stock Selector.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Stock Selector‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Stock Selector plays a critical role in investment decision-making, evaluating and analyzing stocks to identify potential investment opportunities. Below are key job responsibilities that define this role:1. Market Analysis and Due Diligence

Conduct thorough market research to identify potential investment opportunities.

- Conduct fundamental analysis to assess the financial health, competitive advantage, and growth potential of companies.

- Use technical analysis to identify trends, patterns, and support and resistance levels in stock prices.

2. Investment Research and Stock Selection

Develop investment recommendations and build stock portfolios that align with investment goals.

- Analyze the investment objectives and risk tolerance of clients to tailor recommendations.

- Select stocks based on criteria such as industry trends, company fundamentals, and value assessments.

3. Investment Monitoring and Portfolio Management

Continuously monitor stock performance and make adjustments to portfolios as needed.

- Track and analyze portfolio performance against benchmarks and market indices.

- Identify underperforming stocks and make recommendations for adjustments or divestments.

- Rebalance portfolios to maintain desired risk and return profiles.

4. Reporting and Client Communication

Communicate investment findings and recommendations effectively to clients.

- Provide regular reports on investment performance and market trends.

- Answer client inquiries and explain investment decisions and recommendations.

- Maintain open and transparent communication with clients to foster long-term relationships.

Interview Tips

To ace the interview for a Stock Selector position, it’s crucial to prepare thoroughly and demonstrate your knowledge and skills. Here are some interview tips and hacks to help you excel:1. Practice and Research Thoroughly

Practice answering common interview questions related to stock selection, investment analysis, and portfolio management.

- Research the company, the industry, and the specific role you’re applying for.

- Be prepared to discuss your investment philosophy, stock selection criteria, and risk management strategies.

2. Highlight Your Analytical and Technical Skills

Showcase your proficiency in financial analysis, data interpretation, and technical analysis.

- Provide examples of your successful stock recommendations and investment decisions.

- Discuss your experience using financial modeling tools, data analysis software, and charting platforms.

3. Demonstrate Your Portfolio Management Skills

Emphasize your ability to construct and manage investment portfolios.

- Highlight your experience in portfolio diversification, risk assessment, and performance evaluation.

- Present examples of how you have optimized portfolios for different investment objectives.

4. Convey Your Communication and Interpersonal Skills

Stock Selectors are expected to communicate effectively with clients and colleagues.

- Practice communicating your investment recommendations clearly and persuasively.

- Show that you can build strong relationships and work effectively in a team environment.

5. Ask Thoughtful Questions

Asking insightful questions during the interview shows your interest and engagement.

- Ask about the company’s investment philosophy, portfolio characteristics, and performance expectations.

- Inquire about the team’s structure, collaboration, and professional development opportunities.

Next Step:

Now that you’re armed with the knowledge of Stock Selector interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Stock Selector positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini