Are you gearing up for an interview for a Stock Speculator position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Stock Speculator and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

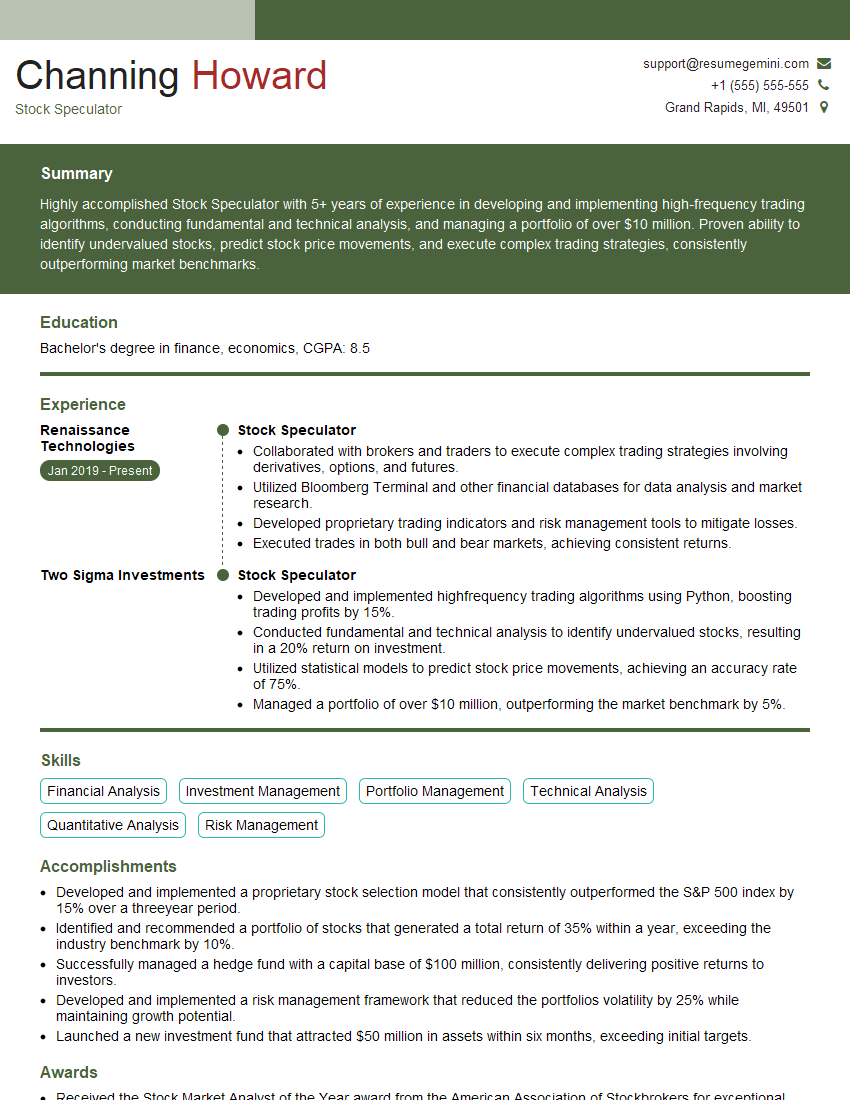

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Stock Speculator

1. What are the key technical indicators you use in your stock analysis? Explain how you interpret each indicator and how you use them to make trading decisions.

- Moving Averages: These indicators show the average price of a stock over a specified period. I use them to identify trends and support and resistance levels.

- Relative Strength Index (RSI): This indicator measures the magnitude of recent price changes to evaluate whether a stock is overbought or oversold.

- Stochastic Oscillator: This indicator compares the closing price with the price range over a specific period. I use it to identify potential overbought or oversold conditions.

- Bollinger Bands: These bands show the standard deviation above and below a moving average. They help identify volatility and potential trading opportunities.

2. Describe your process for identifying undervalued or overvalued stocks. What financial ratios and metrics do you consider?

- Price-to-Earnings (P/E) Ratio: This ratio compares a stock’s price to its earnings per share. A low P/E ratio may indicate an undervalued stock.

- Price-to-Book (P/B) Ratio: This ratio compares a stock’s price to its book value. A low P/B ratio may suggest an undervalued stock.

- Debt-to-Equity (D/E) Ratio: This ratio measures a company’s financial leverage. A high D/E ratio may indicate financial risk.

- Dividend Yield: This metric shows the percentage of a stock’s price paid as dividends. A high dividend yield may indicate an undervalued stock.

3. How do you assess the liquidity and volatility of a stock? What factors do you consider?

- Trading Volume: High trading volume indicates liquidity and can impact volatility.

- Average Daily Range: This measures the average price fluctuation of a stock. High volatility may suggest a riskier investment.

- Historical Volatility: Volatility can be assessed by analyzing historical price data using measures such as standard deviation or beta.

- News and Market Sentiment: Events, news, and overall market conditions can influence liquidity and volatility.

4. Explain how you use charting techniques to identify trading opportunities. What patterns and formations do you look for?

- Candlestick Patterns: I use patterns like bullish engulfing and bearish engulfing to identify potential reversals.

- Trendlines: These lines connect support or resistance points, indicating potential price movements.

- Moving Average Convergence Divergence (MACD): This indicator shows the relationship between two moving averages and can identify potential trading signals.

- Fibonacci retracement levels: These levels are used to identify potential support and resistance areas based on historical price movements.

5. How do you manage risk in your trading strategies? What stop-loss and position-sizing techniques do you employ?

- Stop-Loss Orders: I set these orders to limit potential losses by automatically selling a stock if it falls below a specified price.

- Position Sizing: I determine the amount of capital allocated to each trade based on risk tolerance and expected return.

- Risk-Reward Ratio: I assess the potential reward of a trade against the potential risk to ensure a favorable risk-reward profile.

6. What are the different types of market orders and how do you use them in your trading?

- Market Order: This order executes at the best available market price, ensuring immediate execution.

- Limit Order: This order executes only when the stock price reaches a specified limit price, allowing for more precise entries and exits.

- Stop Order: This order becomes a market order only when the stock price reaches a specified stop price, used for triggering trades based on technical levels.

7. How do you stay informed about market trends and company news? What sources do you rely on?

- Financial News Outlets: I follow reputable news sources like Bloomberg, Reuters, and The Wall Street Journal.

- Stock Market Websites: I use platforms like Yahoo Finance and Google Finance for real-time data and company information.

- Company Filings: I analyze SEC filings like 10-Ks and 10-Qs for financial performance and corporate updates.

8. Describe your experience in algorithmic trading. How do you design, develop, and backtest trading algorithms?

- Coding Languages: I am proficient in Python and R for algorithm development.

- Algorithm Design: I leverage technical indicators, statistical techniques, and machine learning models to create trading strategies.

- Backtesting: I simulate historical data and analyze algorithm performance to optimize parameters and evaluate profitability.

9. How do you handle emotional challenges in stock trading? What techniques do you use to maintain discipline and objectivity?

- Trading Plan: I adhere to a defined trading plan to avoid impulsive decisions.

- Risk Management: Strict risk management measures help me control emotions and prevent excessive losses.

- Mental Preparation: I practice mindfulness techniques to stay focused and manage stress.

10. What are your thoughts on current market trends and how are you adapting your trading strategies accordingly?

(This answer will vary depending on current market conditions.)

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Stock Speculator.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Stock Speculator‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Stock Speculators are finance professionals who engage in the buying and selling of stocks with the primary objective of generating profits from short-term price movements. Their key responsibilities encompass a wide range of activities essential for effective stock market operations.

1. Market Research and Analysis

Stock Speculators conduct thorough research and analysis of market trends, company financials, and industry dynamics to identify potential investment opportunities. They use technical and fundamental analysis techniques to predict future price movements and make informed trading decisions.

- Identify undervalued or overvalued stocks based on market research and analysis.

- Analyze financial statements, earnings reports, and industry trends to assess company performance and potential.

2. Risk Management

Stock Speculators must possess a deep understanding of risk management concepts to mitigate potential losses. They develop and implement risk management strategies to control risk exposure and protect their capital.

- Establish stop-loss orders to limit potential losses from adverse price movements.

- Diversify investments across different sectors, industries, and assets to reduce concentrated risk.

3. Execution and Trade Management

Stock Speculators execute trades based on their research and analysis, adhering to specific entry and exit points. They monitor market movements and adjust trades as needed to maximize profits and minimize losses.

- Place buy and sell orders using various trading platforms and techniques.

- Monitor market conditions and make timely adjustments to trade positions based on market developments.

4. Performance Evaluation

Stock Speculators regularly evaluate their performance to identify areas for improvement and refine their strategies. They track and analyze trading results to assess profitability, risk exposure, and overall effectiveness.

- Conduct performance reviews to assess return on investment, Sharpe ratio, and other performance metrics.

- Identify areas for improvement and adjust strategies based on performance evaluation findings.

Interview Preparation Tips

To ace an interview for a Stock Speculator position, candidates should focus on showcasing their research and analysis skills, risk management knowledge, trading experience, and financial literacy. Additionally, practicing common interview questions and preparing questions for the interviewer will demonstrate your enthusiasm and engagement.

1. Research the Company and Industry

Research the investment firm and the industry in which they operate. Familiarize yourself with their investment strategy, track record, and any recent news or developments. This will help you tailor your answers to the specific role and demonstrate your interest in the company.

- Visit the company’s website to learn about their services, management team, and investment approach.

- Read industry publications and news articles to stay up-to-date on market trends and investment strategies.

2. Practice Common Interview Questions

Prepare for common interview questions that assess your knowledge of the financial markets, trading strategies, and risk management principles. Practice answering these questions clearly and concisely, highlighting your expertise and confidence.

- Describe your investment philosophy and how you approach stock selection.

- Explain your risk management strategies and how you manage risk exposure in your trades.

- Provide an example of a successful trade you executed and discuss the factors that contributed to its success.

3. Prepare Questions for the Interviewer

Asking thoughtful questions during the interview demonstrates your interest in the role and the company. Prepare specific questions about the investment firm’s trading strategies, performance expectations, and opportunities for professional development.

- What is the firm’s investment horizon and target rate of return?

- How does the firm evaluate and track the performance of its traders?

- What opportunities are there for professional development and career advancement within the firm?

4. Highlight Your Skills and Experience

Emphasize your relevant skills and experience in your resume and during the interview. Quantify your accomplishments whenever possible to demonstrate your impact and contributions. Use specific examples to illustrate your proficiency in research and analysis, risk management, trade execution, and performance evaluation.

- Highlight your trading experience, including the types of stocks you have traded, your average holding period, and your return on investment.

- Quantify your risk management expertise by describing how you have managed risk in your trades and the results you have achieved.

- Discuss your analytical skills by providing examples of how you have used technical and fundamental analysis to identify investment opportunities.

5. Be Confident and Enthusiastic

Confidence and enthusiasm are essential for success in the financial industry. During the interview, maintain eye contact, speak clearly and assertively, and convey your passion for stock trading. Your enthusiasm for the role and the industry will be evident to the interviewer and will make a positive impression.

- Research the company and the industry to demonstrate your genuine interest in the role.

- Practice your answers to common interview questions to build your confidence and deliver polished responses.

- Maintain a positive and enthusiastic demeanor throughout the interview to convey your passion for trading.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Stock Speculator interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!