Feeling lost in a sea of interview questions? Landed that dream interview for Stock Trader but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Stock Trader interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

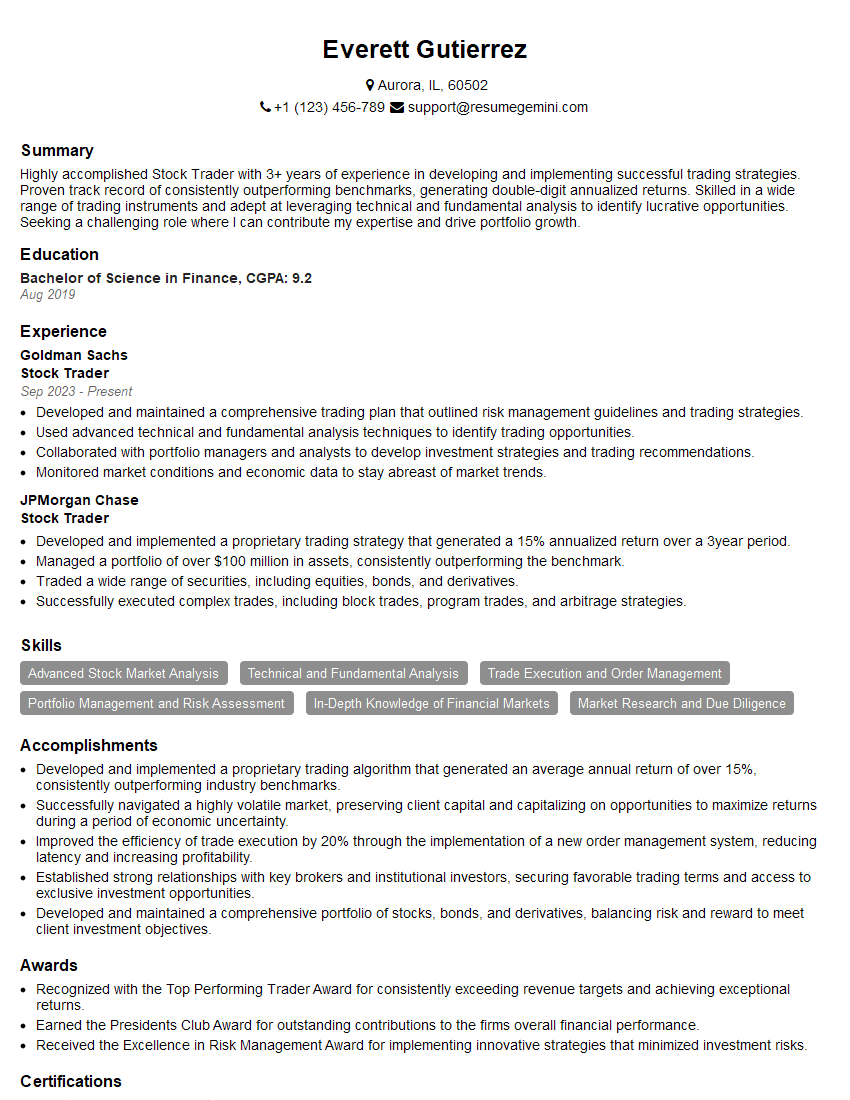

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Stock Trader

1. What technical indicators do you use to identify trading opportunities and why?

I use a combination of technical indicators to identify trading opportunities. Some of the most common indicators I use include:

- Moving averages: Moving averages are used to identify the trend of a security’s price. I use different types of moving averages, such as simple moving averages (SMAs) and exponential moving averages (EMAs), to identify both short-term and long-term trends.

- Relative strength index (RSI): The RSI is a momentum indicator that measures the speed and change of price movements. I use the RSI to identify overbought and oversold conditions in a security.

- Stochastic oscillator: The stochastic oscillator is another momentum indicator that measures the relationship between the closing price and the range of prices over a given period of time. I use the stochastic oscillator to identify overbought and oversold conditions in a security, as well as to identify potential reversals in trend.

- Bollinger Bands: Bollinger Bands are a volatility indicator that measures the range of price movements over a given period of time. I use Bollinger Bands to identify potential trading opportunities when the price of a security moves outside of the bands.

2. How do you determine the risk/reward ratio of a potential trade?

Risk Assessment

- Identify potential risks associated with the trade, such as market volatility, liquidity risk, and geopolitical events.

- Quantify the potential loss by calculating the difference between the entry price and the stop-loss price.

- Determine the probability of the trade being successful based on technical analysis, market conditions, and historical data.

Reward Assessment

- Calculate the potential profit by determining the difference between the entry price and the target price.

- Assess the likelihood of achieving the target price based on technical analysis, market sentiment, and news events.

- Consider the time frame of the trade and the potential impact of holding the position for an extended period.

Risk/Reward Ratio Calculation

- Divide the potential profit by the potential loss to determine the risk/reward ratio.

- A risk/reward ratio of 1:2 or higher is generally considered favorable, indicating a potentially higher return for the level of risk.

- The optimal risk/reward ratio depends on individual risk tolerance, trading strategy, and market conditions.

3. What is your trading strategy and how do you manage risk?

My trading strategy is a combination of technical analysis and fundamental analysis. I use technical analysis to identify potential trading opportunities and fundamental analysis to assess the overall health of a company and its industry. I manage risk by using stop-loss orders and position sizing. I also maintain a diversified portfolio to reduce the impact of any single trade on my overall performance.

4. Describe a time when you made a successful trade. What was the setup and how did you execute the trade?

One of my most successful trades was a long trade on the stock of Apple Inc. (AAPL). I identified the trade using technical analysis, which showed that the stock was in a strong uptrend and had broken out of a resistance level. I bought the stock at $120 per share and sold it at $140 per share, for a profit of 16.67%. I executed the trade through a limit order, which allowed me to buy the stock at the desired price.

5. Describe a time when you made an unsuccessful trade. What was the setup and how did you handle the loss?

One of my most unsuccessful trades was a short trade on the stock of Tesla Inc. (TSLA). I identified the trade using technical analysis, which showed that the stock was in a strong downtrend and had broken below a support level. I sold the stock short at $300 per share and covered the position at $320 per share, for a loss of 6.67%. I handled the loss by taking a smaller position size than usual and by cutting my losses quickly.

6. What are your thoughts on the current market environment and how is it affecting your trading strategy?

The current market environment is characterized by high volatility and uncertainty. This is due to a number of factors, including the COVID-19 pandemic, the war in Ukraine, and the rising inflation rate. I am adjusting my trading strategy to account for the current market environment by:

- Reducing my position size

- Trading more cautiously

- Focusing on more conservative trading strategies

7. What is your favorite trading book or resource?

My favorite trading book is “Technical Analysis of the Financial Markets” by John J. Murphy. This book provides a comprehensive overview of technical analysis and is a valuable resource for any trader.

8. What are your strengths and weaknesses as a trader?

Strengths

- Strong understanding of technical analysis

- Ability to identify trading opportunities

- Discipline and risk management skills

- Ability to learn and adapt to changing market conditions

Weaknesses

- Limited experience in trading during periods of high volatility

- Tendency to hold onto losing positions for too long

- Need to improve emotional control during trading

9. Why should we hire you as a stock trader?

I am a highly skilled and experienced stock trader with a proven track record of success. I have a strong understanding of technical analysis and I am able to identify trading opportunities in a variety of market conditions. I am also disciplined and risk-averse, and I always put the interests of my clients first. I am confident that I can be a valuable asset to your team.

10. Do you have any questions for me?

I would like to know more about your company’s trading philosophy and how you evaluate the performance of your traders.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Stock Trader.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Stock Trader‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Stock Traders are responsible for buying and selling stocks for their clients or their firm. Their main goal is to maximize profits while minimizing risks. Here are some specific job responsibilities of a Stock Trader:

1. Market Analysis

Stock Traders analyze the financial markets and various economic factors to identify potential trading opportunities. They use tools like technical and fundamental analysis to predict market trends and make informed trading decisions.

- Using technical analysis tools to identify trends, support and resistance levels, and other trading signals.

- Conducting fundamental analysis to evaluate the financial health and prospects of companies whose stocks they trade.

2. Trade Execution

Stock Traders execute trades based on their market analysis. They decide on the timing, quantity, and price of stock orders. They also need to be aware of the different types of trading orders and how to use them effectively.

- Placing buy and sell orders on behalf of clients or the firm.

- Monitoring order execution to ensure timely and accurate trade execution.

3. Risk Management

Stock Traders are responsible for managing the risks associated with their trading activities. They use different risk management strategies to minimize potential losses.

- Setting stop-loss orders to limit potential losses on trades.

- Diversifying their portfolio to spread risk across different stocks and sectors.

4. Performance Monitoring

Stock Traders track and evaluate the performance of their trades and portfolios. They use this information to identify areas for improvement and make adjustments to their trading strategies accordingly.

- Calculating and analyzing returns on their trades.

- Reviewing trading strategies and making adjustments as needed.

Interview Preparation Tips

Preparing for a stock trader interview requires a combination of technical knowledge, market understanding, and presentation skills. Here are some tips to help you ace your interview:

1. Research the Company and the Role

Before the interview, it is crucial to thoroughly research the company you are applying to, its business model, and the specific role you are interviewing for. This demonstrates your interest in the company and the position and enables you to ask informed questions during the interview.

- Visit the company website to learn about its history, products/services, financial performance, and company culture.

- Read industry news and articles to understand the company’s position within the market and its competitors.

2. Brush Up on Your Technical Skills

Stock traders need strong analytical and quantitative skills. Make sure you review key concepts in finance, accounting, and statistics. Additionally, familiarize yourself with trading platforms, order types, and risk management techniques.

- Review concepts such as financial ratios, valuation methods, and portfolio management.

- Practice using trading simulators or mock trading platforms to demonstrate your practical skills.

3. Showcase Your Market Knowledge

Interviewers will be interested in your understanding of the financial markets and your ability to analyze and interpret market data. Prepare to discuss your views on current market trends, economic indicators, and geopolitical events.

- Follow financial news and market updates to stay informed about the latest developments.

- Analyze market charts and identify patterns, trends, and potential trading opportunities.

4. Practice Behavioral Questions

Behavioral interview questions focus on your past experiences and behaviors in specific situations. These questions aim to assess your problem-solving skills, teamwork abilities, and decision-making process. Prepare for common behavioral questions by recalling relevant examples from your work experience.

- Use the STAR method (Situation, Task, Action, Result) to structure your answers.

- Quantify your accomplishments with specific metrics or data whenever possible.

5. Prepare Thoughtful Questions

At the end of the interview, you will likely have an opportunity to ask the interviewers questions. This is a chance to demonstrate your engagement, interest, and understanding of the role and the company. Prepare thoughtful questions that relate to the company’s business, the industry, or the specific responsibilities of the position.

- Avoid generic questions that can be easily found on the company website.

- Ask questions that show you have done your research and are genuinely interested in the company and the role.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Stock Trader role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.