Feeling lost in a sea of interview questions? Landed that dream interview for Stockbroker but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Stockbroker interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

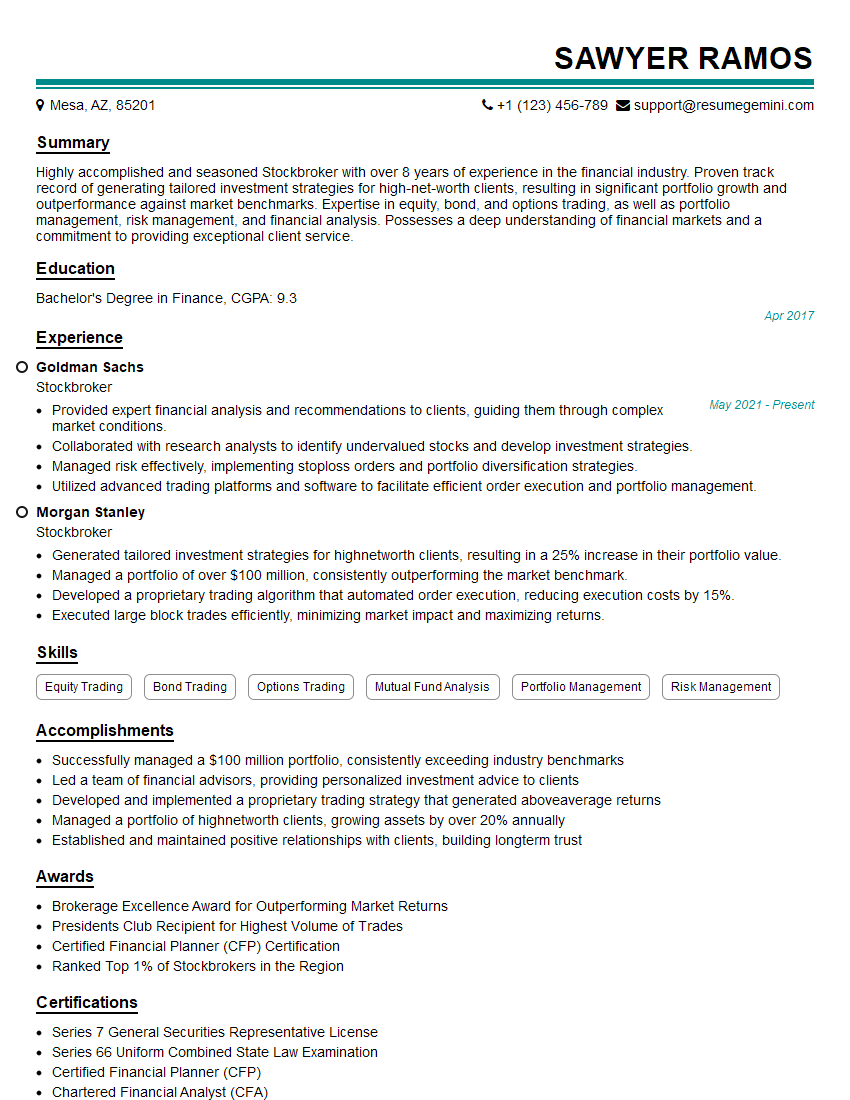

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Stockbroker

1. Explain the process of executing a stock trade from start to finish?

- Receiving an order from a client

- Verifying the order and checking for errors

- Sending the order to the appropriate exchange or market

- Matching the order with a buyer or seller

- Executing the trade and confirming it with the client

- Settling the trade, including clearing and payment

2. What are the different types of stock orders and when would you use each one?

Market Order

- Executed immediately at the current market price

- Used when you want to get into or out of a position quickly

Limit Order

- Executed only at a specified price or better

- Used when you want to buy or sell a stock at a specific price

Stop Order

- Executed when the stock price reaches a specified stop price

- Used to protect profits or limit losses

3. What are the key factors to consider when evaluating a stock?

- Company’s financial health

- Industry outlook

- Management team

- Competitive landscape

- Valuation

4. What are the different types of investment strategies and which ones are most appropriate for different types of investors?

- Growth investing

- Value investing

- Income investing

- Speculative investing

The most appropriate strategy for a particular investor will depend on their investment goals, risk tolerance, and time horizon.

5. What are the ethical considerations that stockbrokers must be aware of?

- Fiduciary duty to clients

- Prohibition on insider trading

- Suitability rule

- Best execution rule

- Conflicts of interest

6. What are the different types of stock markets and how do they differ?

- Primary market

- Secondary market

- Over-the-counter (OTC) market

The primary market is where new stocks are issued, while the secondary market is where existing stocks are traded. The OTC market is a decentralized market where stocks are traded directly between buyers and sellers.

7. What are the different types of financial instruments that stockbrokers can trade?

- Stocks

- Bonds

- Mutual funds

- ETFs

- Options

- Futures

8. What are the different types of risk that stockbrokers should be aware of?

- Market risk

- Interest rate risk

- Inflation risk

- Liquidity risk

- Political risk

9. What are the different types of financial analysis that stockbrokers can use to evaluate stocks?

- Fundamental analysis

- Technical analysis

- Quantitative analysis

10. What are the different types of stockbroker compensation structures?

- Commission-based

- Fee-based

- Salary-based

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Stockbroker.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Stockbroker‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Stockbrokers are professionals who buy and sell stocks and other financial instruments on behalf of their clients. Their primary responsibilities include:

1. Client Relationship Management

Stockbrokers are responsible for building and maintaining strong relationships with their clients. They need to understand their clients’ investment goals, risk tolerance, and financial situation.

- Meet with clients to discuss their investment goals and objectives.

- Develop and implement investment strategies tailored to each client’s needs.

- Provide regular updates on market conditions and account performance.

2. Market Analysis

Stockbrokers must stay abreast of market trends and economic factors that could impact their clients’ investments. They need to be able to analyze market data and identify potential investment opportunities.

- Monitor market movements and identify potential investment opportunities.

- Conduct research on companies and industries to evaluate their financial health and growth potential.

- Develop and execute trading strategies based on their analysis.

3. Transaction Execution

Stockbrokers are responsible for executing trades on behalf of their clients. They need to be able to place orders quickly and accurately, and to monitor trades to ensure they are executed at the best possible price.

- Place buy and sell orders for clients’ accounts.

- Monitor trades to ensure they are executed as per client instructions.

- Resolve any trading issues or errors that may arise.

4. Risk Management

Stockbrokers are responsible for managing risk for their clients. They need to be able to identify and mitigate potential risks associated with investing.

- Identify and assess potential risks associated with investments.

- Develop and implement risk management strategies to protect clients’ accounts.

- Monitor clients’ accounts and adjust strategies as needed to manage risk.

Interview Tips

Preparing for a stockbroker interview requires thorough research and practice. Here are some tips to help you ace your interview:

1. Research the Firm and Industry

Before attending an interview, take the time to research the brokerage firm and the financial industry as a whole. Understand the firm’s history, its products and services, and its target clients.

- Visit the firm’s website and social media pages to gather information.

- Read industry news and publications to stay up-to-date on current events.

- Network with professionals in the industry to gain insights.

2. Practice Your Technical Skills

Stockbrokers need to have strong technical skills in finance and investing. Brush up on your knowledge of financial markets, investment strategies, and risk management techniques.

- Review concepts such as equity valuation, portfolio management, and financial analysis.

- Practice analyzing financial statements and conducting market research.

- Familiarize yourself with different trading platforms and order types.

3. Prepare Your Behavioral Responses

Interviewers often use behavioral questions to assess your skills and experience. Be prepared to provide specific examples from your previous work or academic experience that demonstrate your abilities.

- Prepare for questions about your investment philosophy, risk management approach, and client relationship management skills.

- Use the STAR method (Situation, Task, Action, Result) to structure your answers and provide details.

- Practice your responses aloud to improve your delivery and confidence.

4. Showcase Your Communication and Interpersonal Skills

Stockbrokers need to be able to effectively communicate complex financial concepts and build strong relationships with clients. Demonstrate your communication and interpersonal skills during the interview.

- Speak clearly and confidently, using industry-specific terminology.

- Be patient and understanding when explaining financial concepts to non-experts.

- Show empathy and a genuine interest in your client’s needs.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Stockbroker role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.