Are you gearing up for a career in Stripe Matcher? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Stripe Matcher and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Stripe Matcher

1. What is the Stripe Matcher?

Stripe Matcher is a tool that helps businesses match their customers with the right payment methods. It uses a variety of data points, including the customer’s address, IP address, and email address, to determine the best payment method for each customer. This can help businesses reduce fraud, increase conversion rates, and improve customer satisfaction.

2. How does Stripe Matcher work?

The Stripe Matcher process involves the following steps:

- Collecting data about the customer. This data can include the customer’s address, IP address, email address, and other information.

- Analyzing the data to identify the customer’s payment preferences. This analysis takes into account a variety of factors, including the customer’s location, past payment history, and other data.

- Matching the customer with the right payment method. Stripe Matcher uses a variety of algorithms to match customers with the payment methods that are most likely to be successful.

Stripe Matcher uses a variety of data sources to collect information about customers, including:

- Stripe’s own data, which includes information about the customer’s payment history and preferences.

- External data sources, such as credit bureaus and fraud prevention services.

3. What are the benefits of using Stripe Matcher?

There are a number of benefits to using Stripe Matcher, including:

- Reduced fraud. Stripe Matcher can help businesses reduce fraud by identifying customers who are at high risk of committing fraud.

- Increased conversion rates. Stripe Matcher can help businesses increase conversion rates by matching customers with the payment methods that are most likely to be successful.

- Improved customer satisfaction. Stripe Matcher can help businesses improve customer satisfaction by providing customers with a seamless and secure payment experience.

4. How do I set up Stripe Matcher?

Setting up Stripe Matcher is a simple process. You can follow these steps to set up Stripe Matcher for your business:

- Log in to your Stripe account.

- Click on the “Settings” tab.

- Click on the “Payment Methods” tab.

- Click on the “Stripe Matcher” tab.

- Follow the instructions on the screen to complete the setup process.

5. How do I use Stripe Matcher?

Once you have set up Stripe Matcher, you can start using it to match your customers with the right payment methods. You can do this by following these steps:

- When a customer is ready to make a payment, pass their information to Stripe Matcher.

- Stripe Matcher will analyze the customer’s information and match them with the most appropriate payment method.

- Stripe Matcher will then return the payment method to you, and you can use it to process the payment.

6. What are the pricing options for Stripe Matcher?

Stripe Matcher is a free service for all Stripe users.

7. What are the support options for Stripe Matcher?

Stripe provides a number of support options for Stripe Matcher, including:

- Documentation. Stripe provides extensive documentation on Stripe Matcher, which can be found on the Stripe website.

- Support forum. Stripe provides a support forum where users can ask questions and get help from Stripe engineers.

- Email support. Stripe provides email support to users who have questions or need help with Stripe Matcher.

8. What are the future plans for Stripe Matcher?

Stripe is constantly working to improve Stripe Matcher. Some of the future plans for Stripe Matcher include:

- Expanding the data sources that Stripe Matcher uses to collect information about customers.

- Improving the algorithms that Stripe Matcher uses to match customers with the right payment methods.

- Adding new features to Stripe Matcher, such as the ability to match customers with multiple payment methods.

9. What are the best practices for using Stripe Matcher?

There are a number of best practices for using Stripe Matcher, including:

- Make sure that you are passing all of the relevant information about the customer to Stripe Matcher.

- Use Stripe Matcher to match customers with multiple payment methods.

- Monitor the performance of Stripe Matcher and make adjustments as needed.

10. What are some of the challenges of using Stripe Matcher?

There are a number of challenges that you may encounter when using Stripe Matcher, including:

- Stripe Matcher may not be able to match all of your customers with the right payment methods.

- Stripe Matcher may make mistakes, so it is important to monitor its performance and make adjustments as needed.

- Stripe Matcher may not be suitable for all businesses.

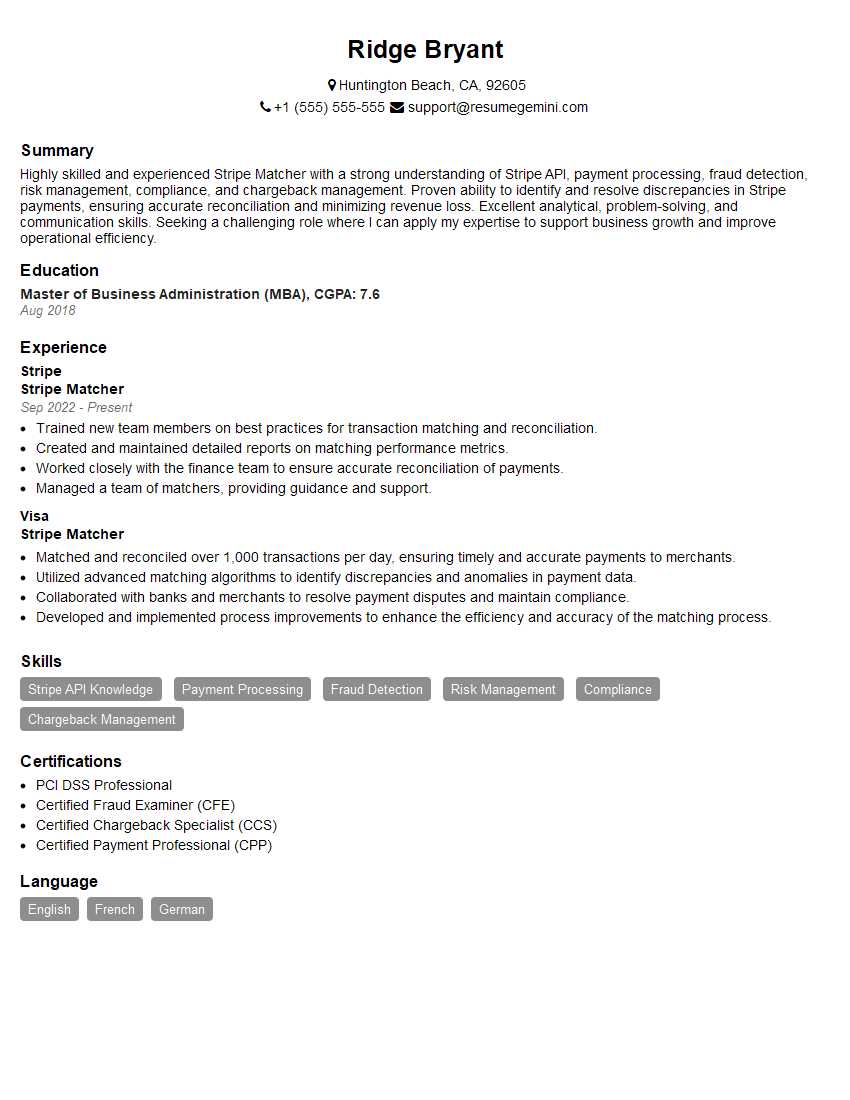

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Stripe Matcher.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Stripe Matcher‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Stripe Matcher plays a critical role in ensuring the seamless processing of financial transactions by matching payments to the correct accounts and records. Key responsibilities include:1. Payment Matching

Matching incoming and outgoing payments to the appropriate accounts and records

- Using automated tools and manual processes to match payments

- Resolving discrepancies and investigating unmatched payments

2. Account Reconciliation

Reconciling financial accounts to ensure accuracy and completeness

- Comparing bank statements and other financial records

- Identifying and correcting errors or discrepancies

3. Customer Support

Providing support to customers regarding payment matching and account reconciliation issues

- Answering inquiries and resolving complaints

- Providing guidance on payment processing and account management

4. Data Analysis

Analyzing payment and account data to identify trends and improve processes

- Identifying areas for improvement in payment matching and reconciliation

- Creating reports and recommendations to enhance operational efficiency

Interview Tips

To ace an interview for the Stripe Matcher position, consider the following preparation tips:

1. Research the Company and Position

Thoroughly research Stripe to understand its business, values, and the specific role of a Stripe Matcher

- Visit the company website and read about its products and services

- Review the job description carefully to identify the key responsibilities and qualifications

2. Practice Common Interview Questions

Prepare for common interview questions related to payment matching, account reconciliation, and customer support

- Example Question: “Describe your experience in matching payments to the correct accounts.”

- Example Question: “How do you handle discrepancies or errors in payment matching?”

3. Highlight Relevant Skills and Experience

Showcase your skills and experience in payment matching, account reconciliation, and customer support

- Quantify your achievements and provide specific examples

- Emphasize your ability to work independently and as part of a team

4. Prepare Questions for the Interviewer

Asking thoughtful questions shows your interest and engagement in the role

- Example Question: “What are the company’s expectations for the Stripe Matcher in the first 90 days?”

- Example Question: “How does the company handle payment disputes or chargebacks?”

5. Dress Professionally and Arrive on Time

First impressions matter. Arrive on time and dress professionally to demonstrate your respect for the interviewer and the opportunity

- Consider wearing business attire or a smart casual outfit

- Be punctual and allow ample time for transportation and check-in

Next Step:

Now that you’re armed with the knowledge of Stripe Matcher interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Stripe Matcher positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini