Are you gearing up for a career in Structurer? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Structurer and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

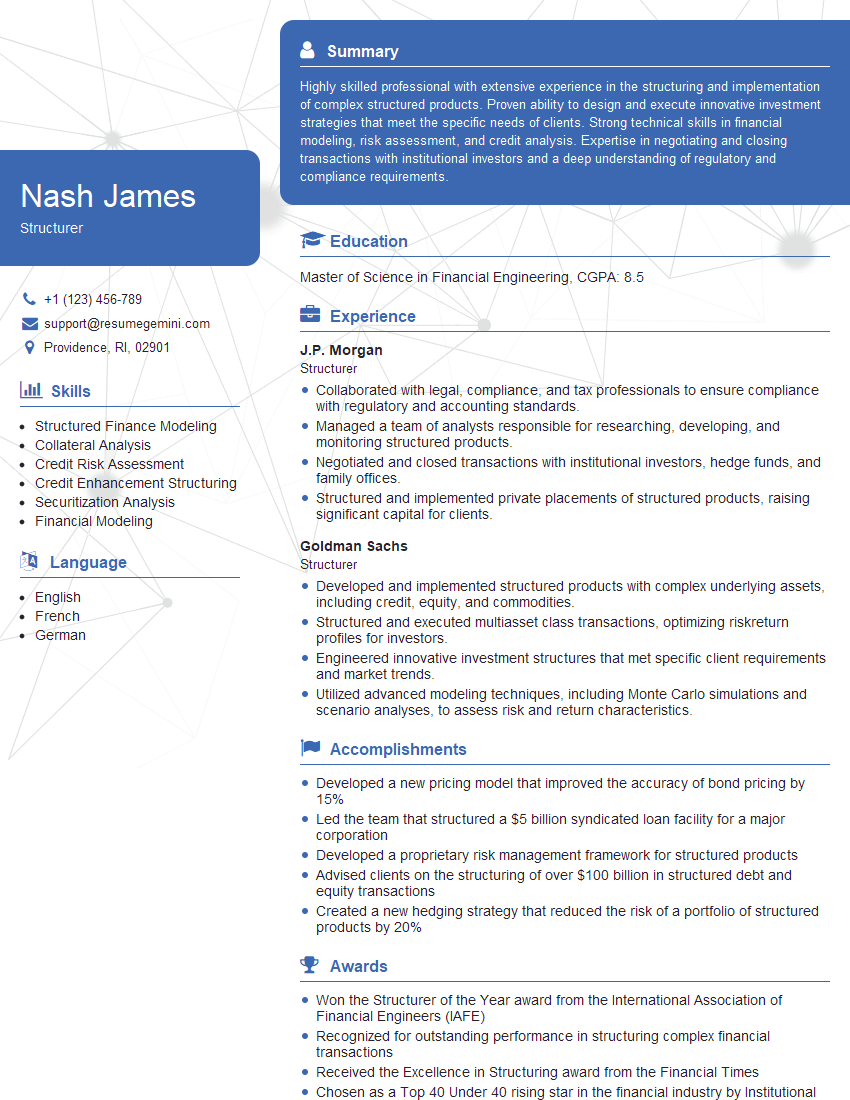

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Structurer

1. What are the key responsibilities of a Structurer in a financial institution?

The key responsibilities of a Structurer in a financial institution typically include:

- Designing and developing new financial products and structures

- Analyzing market trends and developing innovative solutions

- Pricing and hedging financial instruments

- Managing risk and ensuring compliance with regulations

- Collaborating with other departments, such as sales, trading, and risk management

2. Describe the different types of financial instruments that you have experience structuring.

Structured Notes

- Designed and structured various types of structured notes, including principal-protected notes, inverse floaters, target redemption notes, and callable notes

- Analyzed market conditions and identified opportunities for creating innovative note structures

Equity-Linked Products

- Structured equity-linked products, such as convertible bonds, equity swaps, and warrants

- Analyzed underlying equity securities and developed hedging strategies to mitigate risk

3. What is your approach to pricing and hedging financial instruments?

My approach to pricing and hedging financial instruments involves:

- Utilizing a combination of market data, analytical models, and industry best practices

- Developing hedging strategies tailored to the specific risks associated with each instrument

- Continuously monitoring market conditions and adjusting hedges as necessary

4. How do you stay up-to-date on the latest developments in the financial markets?

To stay up-to-date on the latest developments in the financial markets, I:

- Regularly read industry publications and attend conferences

- Network with other professionals in the field

- Conduct independent research and analysis

- Utilize online resources and data providers

5. What are some of the challenges that you have faced in your previous roles as a Structurer?

Some of the challenges that I have faced in my previous roles as a Structurer include:

- Developing innovative and compliant products in a rapidly evolving regulatory environment

- Managing risk effectively in complex and volatile markets

- Collaborating with cross-functional teams to execute complex transactions

- Staying up-to-date on the latest industry trends and best practices

6. What are your career goals and how do you see this role contributing to your professional development?

My career goal is to become a leading Structurer in the financial industry. I believe that this role will contribute to my professional development by:

- Providing me with the opportunity to work on a wide range of complex and innovative transactions

- Developing my skills in financial modeling, pricing, and hedging

- Expanding my knowledge of the financial markets and regulatory environment

- Gaining experience in managing a team of professionals

7. What is your understanding of the current regulatory environment for financial institutions?

I have a strong understanding of the current regulatory environment for financial institutions, including:

- The Dodd-Frank Wall Street Reform and Consumer Protection Act

- The Basel III capital and liquidity requirements

- The Markets in Financial Instruments Directive (MiFID II)

- The General Data Protection Regulation (GDPR)

8. How do you handle working under pressure and tight deadlines?

I am able to handle working under pressure and tight deadlines by:

- Prioritizing tasks and managing my time effectively

- Communicating regularly with my team and stakeholders

- Staying calm and focused under pressure

- Taking breaks when necessary to avoid burnout

9. What is your experience with using financial modeling software?

I am proficient in using a variety of financial modeling software, including:

- Bloomberg

- Excel

- MATLAB

- Python

10. What is your understanding of the role of a Structurer in the context of ESG investing?

In the context of ESG investing, the role of a Structurer is to:

- Develop and implement ESG-focused investment strategies

- Identify and evaluate ESG-related risks and opportunities

- Structure financial products that meet the ESG criteria of investors

- Engage with stakeholders to promote ESG principles

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Structurer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Structurer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Structurer plays a pivotal role in the financial sector by designing and structuring complex financial instruments and transactions. Their responsibilities encompass:

1. Financial Instrument Design

Devising and structuring innovative financial products, such as securitizations, bonds, and derivatives, to meet specific client needs and market demands.

- Analyzing market trends, regulations, and risk profiles to create tailored solutions.

- Conducting thorough due diligence on underlying assets and counterparties.

2. Transaction Execution

Managing the execution of structured transactions, including negotiations, documentation, and regulatory approvals.

- Preparing legal agreements, prospectuses, and other transaction-related documentation.

- Liaising with investment banks, lawyers, auditors, and other stakeholders.

3. Risk Management

Assessing and mitigating risks associated with structured products and transactions.

- Developing risk models and stress testing to analyze potential financial outcomes.

- Monitoring market conditions and adjusting structures as necessary to manage risk.

4. Client Relationship Management

Building and maintaining strong relationships with clients and investors.

- Understanding client objectives and customizing solutions to meet their specific needs.

- Providing ongoing support and guidance to clients throughout the transaction lifecycle.

Interview Tips

To ace your Structurer interview, consider the following tips:

1. Research and Preparation

It’s crucial to thoroughly research the company and the specific role you’re applying for. Understand the organization’s industry, its financial products, and its competitive landscape.

- Review the company website, financial reports, and industry publications.

- Practice answering common interview questions related to structuring, risk management, and financial markets.

2. Case Studies and Modeling Skills

Expect to encounter case studies and modeling questions during the interview. Prepare by practicing your analytical and problem-solving abilities.

- Review financial modeling techniques and industry-specific software, such as Excel and Bloomberg.

- Familiarize yourself with different types of structured products and how they are used to achieve specific investment objectives.

3. Communication and Presentation Skills

Structurers must effectively convey complex financial concepts to both technical and non-technical audiences. Hone your verbal and written communication skills.

- Practice presenting your ideas clearly and persuasively.

- Demonstrate your ability to explain financial jargon in a way that is easily understood.

4. Market Knowledge and Industry Trends

Stay up-to-date on financial market trends and regulatory changes. This knowledge will showcase your industry expertise and adaptability.

- Monitor financial news and publications to gain insights into current market conditions.

- Attend industry conferences and seminars to network and stay informed about emerging trends.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Structurer interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!