Feeling lost in a sea of interview questions? Landed that dream interview for Surety Bond Agent but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Surety Bond Agent interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

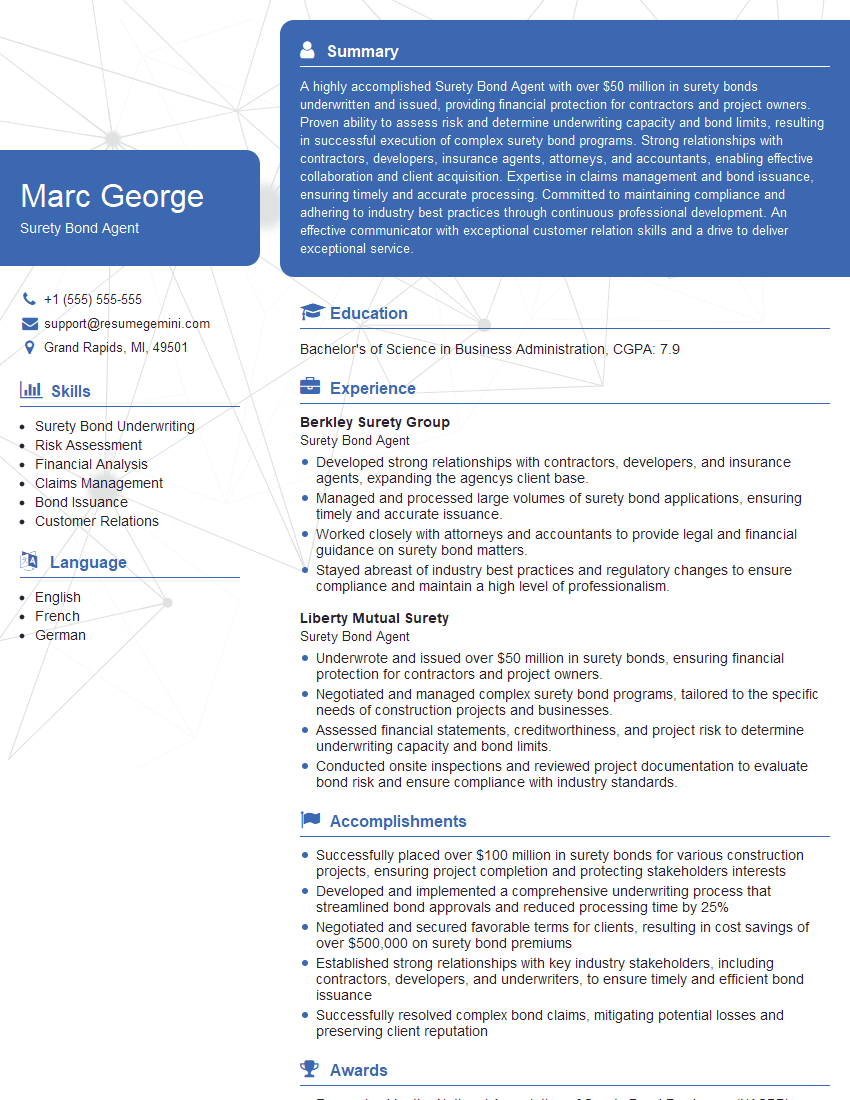

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Surety Bond Agent

1. Explain the key underwriting factors you consider when evaluating a surety bond application?

- Industry experience: The applicant’s experience and reputation in their field.

- Credit history: The applicant’s financial stability and ability to repay any claims.

- Contracts: The terms and conditions of the contracts that the applicant is bidding on.

- Collateral: Any assets that the applicant can offer as security for the bond.

- Character: The applicant’s honesty and integrity.

2. Describe the different types of surety bonds and their specific uses?

Commercial Surety Bonds

- Contract Bonds: Guarantees the completion of a construction project or other contractual obligation.

- License and Permit Bonds: Guarantees compliance with professional, regulatory or licensing requirements.

Judicial Surety Bonds

- Fiduciary Bonds: Protects the interests of beneficiaries in probate, estate, and guardianship cases.

- Court Bonds: Guarantees the payment of court fees, costs, or judgments.

3. How do you determine the appropriate bond amount for a specific project?

- Contract amount: The value of the construction or service contract.

- Risk factors: The complexity of the project, the contractor’s experience, and the project’s location.

- Bonding requirements: Set by regulatory agencies, project owners, or lending institutions.

4. What are the steps involved in processing a surety bond application?

- Review application: Gather and assess the applicant’s financial, business, and character information.

- Underwriting: Analyze the risk and determine if the applicant qualifies for a bond.

- Pricing: Calculate the premium based on the bond amount and the applicant’s risk profile.

- Issuance: Generate and issue the bond document once payment is received.

5. How do you handle claims against a surety bond?

- Investigate: Gather evidence and determine if the claim is valid.

- Negotiate: Attempt to settle the claim amicably with the principal and obligee.

- Pay: If necessary, make payment to cover the claim amount.

- Subrogate: Pursue legal action against the principal to recover the paid claim.

6. What are the ethical considerations and legal requirements for surety bond agents?

- Licensing and Compliance: Maintain all required licenses and follow industry regulations.

- Due Diligence: Conduct thorough underwriting and comply with anti-money laundering and fraud prevention laws.

- Conflicts of Interest: Avoid representing parties with conflicting interests.

- Confidentiality: Protect sensitive applicant and client information.

7. How do you stay up-to-date on changes in the surety industry?

- Attend conferences and webinars: Network with industry professionals and learn about emerging trends.

- Read industry publications: Stay informed about regulatory updates, case law, and best practices.

- Participate in professional associations: Engage with fellow surety bond agents and share knowledge.

8. How do you handle objections or resistance from clients or principals?

- Active listening: Understand the client’s or principal’s concerns and perspectives.

- Clear communication: Explain the underwriting process, bond requirements, and potential risks.

- Negotiation: Explore alternative solutions that meet the client’s or principal’s needs while maintaining bond integrity.

9. What is your strategy for marketing and developing new business relationships?

- Networking: Attend industry events, join local business organizations, and build connections with potential clients.

- Referrals: Foster relationships with existing clients and encourage them to refer new business.

- Online presence: Optimize website and social media profiles to showcase expertise and attract prospects.

10. Describe a challenging situation you faced as a surety bond agent and how you resolved it?

- Situation: A principal faced financial difficulties and was unable to complete a construction project.

- Actions: Conducted an investigation, negotiated with the obligee, and worked with the principal to develop a payment plan to satisfy the claim.

- Resolution: Preserved the bond’s integrity, maintained a positive relationship with the obligee, and assisted the principal in fulfilling their obligations.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Surety Bond Agent.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Surety Bond Agent‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Surety bond agents act as intermediaries between surety companies and businesses seeking surety bonds. They are responsible for underwriting, issuing, and managing surety bonds, as well as advising clients on the different types of bonds available and their suitability for their specific needs.

1. Underwriting Surety Bonds

Assess the creditworthiness of potential customers to determine the level of risk associated with issuing a surety bond.

- Analyze financial statements, credit reports and other relevant data.

- Determine the appropriate bond amount and premium based on the risk assessment.

2. Issuing Surety Bonds

Prepare and issue surety bonds in accordance with underwriting guidelines and regulatory requirements.

- Draft bond documents, including the penal sum, surety obligation and specific conditions.

- Ensure that all required signatures and notarizations are obtained.

3. Managing Surety Bonds

Monitor and manage surety bond accounts, including renewals, cancellations and claims.

- Provide ongoing support to clients and ensure compliance with bond terms.

- Investigate and process claims, working closely with underwriters and legal counsel.

4. Advising Clients

Provide expert advice on surety bonds to clients, including the different types of bonds available, their benefits and the underwriting process.

- Identify potential bonding needs and develop tailored solutions.

- Educate clients on industry best practices and regulatory requirements.

Interview Tips

Preparing thoroughly for an interview is crucial for success. Here are some tips and hacks to help you ace your interview for a Surety Bond Agent position:

1. Research the Company and Industry

Familiarize yourself with the surety company you’re applying for, including its history, products and market position.

- Visit the company’s website and social media pages.

- Review industry news and publications to stay up-to-date on trends and developments.

2. Highlight Your Skills and Experience

Emphasize your relevant skills and experience in underwriting, issuing and managing surety bonds. Quantify your accomplishments whenever possible.

- Prepare specific examples of successful bonding transactions you’ve handled.

- Showcase your understanding of different types of surety bonds and their applications.

3. Demonstrate Your Knowledge of Surety Regulations

Stay abreast of industry regulations and compliance requirements related to surety bonds.

- Familiarize yourself with the Surety Bond Guarantee Act and other relevant laws.

- Demonstrate your commitment to ethical and professional conduct.

4. Practice Your Answers to Common Interview Questions

Prepare thoughtful answers to common interview questions, such as:

- Tell me about your experience in underwriting surety bonds.

- How do you determine the appropriate bond amount and premium?

- What are the different types of surety bonds and their uses?

- How do you handle claims and disputes?

- Why are you interested in working for this company?

5. Dress Professionally and Arrive on Time

First impressions matter. Dress appropriately for the interview and arrive on time to demonstrate your professionalism and respect for the interviewer.

- Choose business attire that is clean, pressed and fits well.

- Plan your route and leave early to avoid any unexpected delays.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Surety Bond Agent role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.