Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Tariff Clerk interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Tariff Clerk so you can tailor your answers to impress potential employers.

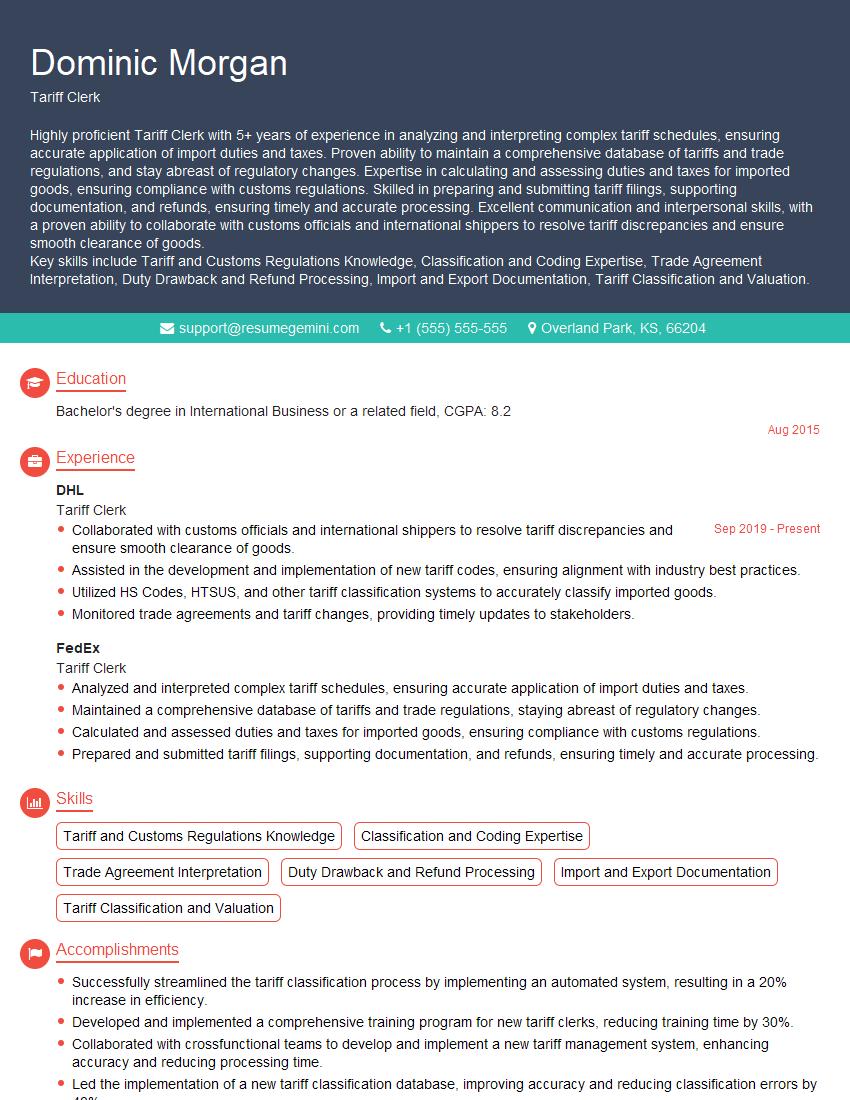

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Tariff Clerk

1. Describe the key responsibilities of a Tariff Clerk.

- Classify and code goods according to tariff schedules.

- Calculate and apply duties, taxes, and other charges on imported goods.

2. What are the different types of tariffs?

Ad valorem tariffs

- Levied as a percentage of the value of the imported goods.

Specific tariffs

- Levied as a fixed amount per unit of the imported goods.

Compound tariffs

- Combination of ad valorem and specific tariffs.

3. How do you stay up-to-date on changes to tariff regulations?

- Review official government publications.

- Attend industry conferences and seminars.

- Network with other Tariff Clerks.

4. What is the Harmonized System (HS) code?

- An international system for classifying goods for customs purposes.

- Used by over 200 countries and territories.

5. What are the most common errors made by Tariff Clerks?

- Incorrectly classifying goods.

- Applying the wrong duty rate.

- Failing to consider exemptions or preferential treatment.

6. What are the consequences of making errors in tariff classification?

- Incorrect duty payments.

- Delayed shipments.

- Penalties or fines.

7. How do you handle complex tariff classification issues?

- Consult with a supervisor or specialist.

- Review relevant documentation and case law.

- Consider the commercial and legal implications of the classification.

8. What is the difference between a dutiable and a non-dutiable item?

- Dutiable items are subject to import duties.

- Non-dutiable items are exempt from import duties.

9. What are the different types of documents required for tariff classification?

- Commercial invoice.

- Packing list.

- Bill of lading.

- Certificate of origin.

10. How do you use technology to assist with tariff classification?

- Use software programs that can help identify HS codes.

- Access online databases of tariff information.

- Attend webinars and online training programs.

11. What are the challenges you have faced as a Tariff Clerk?

- Keeping up with changes in tariff regulations.

- Classifying complex or unusual goods.

- Dealing with difficult customers.

12. How do you stay motivated in your work?

- The importance of my work in ensuring fair and accurate duty payments.

- The challenge of constantly learning and staying up-to-date on tariff regulations.

- The opportunity to work with a team of dedicated professionals.

13. Describe a time when you went above and beyond to help a customer.

14. What are your career goals?

- To become a more experienced and knowledgeable Tariff Clerk.

- To take on additional responsibilities, such as training new employees or developing new procedures.

- To eventually advance to a management position.

15. Why are you interested in working for our company?

- The company’s reputation for excellence in the industry.

- The opportunity to work with a team of experienced professionals.

- The company’s commitment to professional development.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Tariff Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Tariff Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Tariff Clerk is responsible for calculating and applying tariffs, duties, and other charges on imported and exported goods. They ensure that the correct amount of duty is paid on all goods entering or leaving the country, and they maintain records of all transactions.

1. Calculate and apply tariffs, duties, and other charges

Tariff Clerks use specialized software to calculate the correct amount of duty that should be paid on imported goods. They also apply any other applicable charges, such as value-added tax (VAT) or excise duty.

- Calculate the value of imported goods, using the correct method of valuation.

- Classify imported goods according to the Harmonized System (HS) code.

- Determine the applicable duty rate for each HS code.

- Calculate the amount of duty payable for each item.

2. Maintain records of all transactions

Tariff Clerks maintain records of all transactions, including the date of import or export, the description of the goods, the value of the goods, the duty paid, and the name of the importer or exporter.

- Record all import and export transactions in a database or spreadsheet.

- Maintain a record of all duty payments.

- File all relevant documents, such as invoices and customs declarations.

3. Provide information to importers and exporters

Tariff Clerks can provide information to importers and exporters about the tariffs and duties that apply to their goods. They can also help them to classify their goods and calculate the amount of duty that they will need to pay.

- Answer telephone and email inquiries.

- Provide information about tariffs, duties, and other charges.

- Help importers and exporters to classify their goods.

- Calculate the amount of duty payable on imported goods.

4. Monitor changes to tariffs and duties

Tariff Clerks must keep up-to-date with changes to tariffs and duties. They can do this by reading trade publications, attending conferences, and networking with other professionals.

- Monitor changes to tariffs and duties in the relevant countries.

- Keep up-to-date with changes to the Harmonized System (HS) code.

- Attend conferences and seminars on international trade.

Interview Tips

Preparing for an interview can be daunting, but with the right approach, you can increase your chances of success. Here are a few tips to help you prepare for your Tariff Clerk interview:

1. Research the company and the position

Take some time to research the company you’re applying to and the specific position you’re interviewing for. This will help you understand the company’s culture, values, and goals, and it will also give you a better idea of what the job entails.

- Visit the company’s website.

- Read the job description carefully.

- Look for news articles and other information about the company.

2. Practice answering common interview questions

There are a few common interview questions that you’re likely to be asked, such as “Tell me about yourself” and “Why are you interested in this position?” It’s a good idea to practice answering these questions in advance so that you can deliver your responses confidently and concisely.

- Prepare a brief introduction of yourself.

- Highlight your skills and experience that are relevant to the position.

- Explain why you’re interested in the position and the company.

3. Dress professionally and arrive on time

First impressions matter, so it’s important to dress professionally and arrive on time for your interview. This shows the interviewer that you’re serious about the position and that you respect their time.

- Choose appropriate business attire.

- Arrive for your interview on time.

- Make eye contact and greet the interviewer with a firm handshake.

4. Be confident and enthusiastic

Confidence is key in an interview. Believe in yourself and your ability to do the job. Be enthusiastic about the position and the company. This will show the interviewer that you’re genuinely interested in the opportunity.

- Speak clearly and confidently.

- Maintain eye contact with the interviewer.

- Smile and be enthusiastic.

5. Ask questions

Asking questions at the end of an interview shows that you’re interested in the position and that you’re taking the interview seriously. It also gives you an opportunity to learn more about the company and the position.

- Prepare a few questions to ask the interviewer.

- Ask questions about the company, the position, and the team.

- Avoid asking personal questions.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Tariff Clerk interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!