Feeling lost in a sea of interview questions? Landed that dream interview for Tariff Compiler but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Tariff Compiler interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

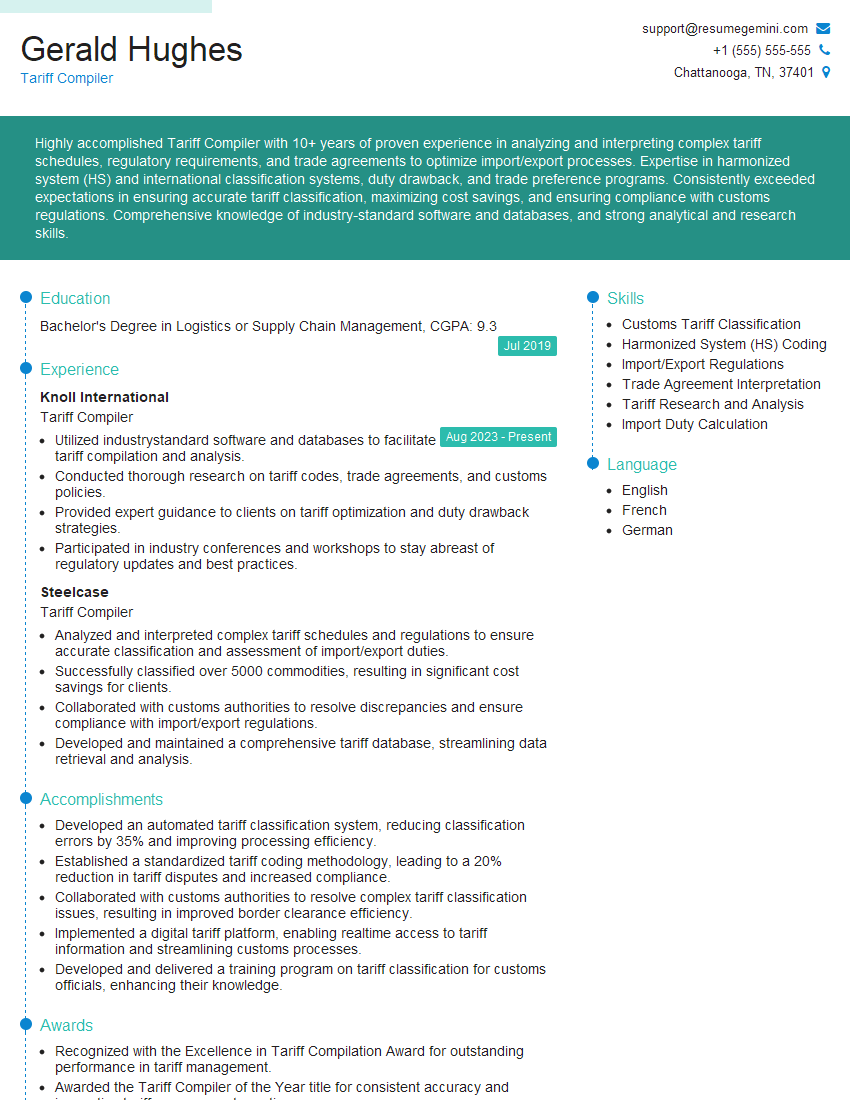

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Tariff Compiler

1. Describe the process of creating a new tariff item in the tariff compiler system.

The process of creating a new tariff item in the tariff compiler system involves the following steps:

- Gather all necessary information, including the product description, tariff classification, and applicable duty rates.

- Identify the appropriate section and chapter in the tariff schedule.

- Create a new item record and enter the required information.

- Review and validate the information entered.

- Submit the item for approval.

- Once approved, the new tariff item will be added to the system and made available to users.

2. Explain the difference between an ad valorem duty and a specific duty.

- An ad valorem duty is a percentage of the value of the imported goods.

- A specific duty is a fixed amount of money per unit of imported goods.

Advantages and Disadvantages of Ad Valorem Duties

- Advantages: Ad valorem duties are relatively easy to administer and can be adjusted to reflect changes in the value of goods.

- Disadvantages: Ad valorem duties can be subject to fraud and can lead to higher prices for consumers.

Advantages and Disadvantages of Specific Duties

- Advantages: Specific duties are difficult to avoid and can provide a stable source of revenue for governments.

- Disadvantages: Specific duties can be complex to administer and can lead to higher prices for certain goods.

3. What are the different types of tariff preferences that can be applied to imported goods?

- Generalized System of Preferences (GSP): A system of tariff preferences that provides reduced or duty-free treatment for imports from developing countries.

- Bilateral trade agreements: Agreements between two countries that provide for reciprocal tariff preferences.

- Regional trade agreements: Agreements between multiple countries that provide for preferential tariff treatment within a region.

- Free trade zones: Areas where goods can be imported and exported without paying duties.

4. How do you stay up-to-date on changes to tariff laws and regulations?

- Regularly review official government websites and publications.

- Attend industry conferences and workshops.

- Subscribe to trade journals and newsletters.

- Network with other professionals in the field.

5. What is your favorite feature of the tariff compiler system and why?

My favorite feature of the tariff compiler system is its user-friendly interface. The system is easy to navigate and provides clear and concise instructions. I also appreciate the system’s ability to store and retrieve data quickly and efficiently.

6. What is the most challenging aspect of working as a tariff compiler?

The most challenging aspect of working as a tariff compiler is keeping up with the constant changes to tariff laws and regulations. The tariff landscape is constantly evolving, and it can be difficult to stay abreast of all the changes. However, I find that the challenge is also what makes the job interesting and rewarding.

7. What are your strengths and weaknesses as a tariff compiler?

Strengths

- Strong attention to detail

- Excellent research skills

- Ability to work independently and as part of a team

- Proficient in the use of tariff compiler software

Weaknesses

- Limited experience with certain types of tariff classifications

- Not fluent in all of the languages used in international trade

8. Why are you interested in working as a tariff compiler?

I am interested in working as a tariff compiler because I am passionate about international trade and customs regulations. I believe that tariff compilers play an important role in facilitating global trade and ensuring that businesses comply with import and export laws. I am also eager to use my skills and knowledge to contribute to the efficiency and accuracy of the tariff compilation process.

9. What are your career goals?

My career goal is to become a leading expert in the field of tariff compilation. I am particularly interested in developing new and innovative ways to improve the efficiency and accuracy of the tariff compilation process. I also hope to use my knowledge and experience to help businesses navigate the complex world of international trade.

10. What questions do you have for me?

- What are the biggest challenges facing the tariff compilation industry today?

- What are your company’s plans for the future of tariff compilation?

- What opportunities are there for professional development within your company?

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Tariff Compiler.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Tariff Compiler‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Tariff Compiler plays a crucial role in analyzing, classifying, and documenting import and export tariffs. Their primary responsibilities include:

1. Tariff Classification

Accurately classifying goods according to harmonized codes and international tariff schedules

- Using classification tools and reference materials

- Interpreting customs regulations and guidelines

2. Tariff Research

Conducting thorough research to determine the applicable tariffs, duties, and taxes

- Analyzing trade agreements, regulations, and economic data

- Keeping up-to-date with changes in tariff policies

3. Tariff Documentation

Preparing and maintaining tariff schedules, invoices, and other documentation

- Ensuring accuracy and compliance with legal requirements

- Updating tariffs to reflect rate changes or classification revisions

4. Communication and Consultation

Collaborating with customs officials, brokers, and clients to provide information and resolve queries

- Advising on import and export procedures

- Providing technical support and guidance on tariff matters

Interview Tips

To ace your Tariff Compiler interview, consider these preparation tips and hacks:

1. Research the Company and Industry

Familiarize yourself with the company’s business, its market position, and the industry landscape. Research relevant trends and developments to demonstrate your understanding.

2. Practice Tariff Classification

Tariff classification is a core skill for Tariff Compilers. Practice classifying goods using harmonized codes and reference materials to showcase your proficiency.

3. Prepare Examples of Tariff Research

Provide examples of your research skills and how you’ve successfully determined applicable tariffs and duties. Highlight your ability to navigate complex trade regulations.

4. Showcase Your Communication Skills

Tariff Compilers must be able to convey technical information effectively. Practice articulating complex tariff concepts and resolving queries in a clear and concise manner.

5. Prepare for Common Interview Questions

Anticipate questions such as:

- Tell us about your experience in tariff classification.

- How do you stay updated on changes in tariff policies?

- Describe a complex tariff issue you’ve resolved.

Next Step:

Now that you’re armed with the knowledge of Tariff Compiler interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Tariff Compiler positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini