Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Tariff Compiling Clerk position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

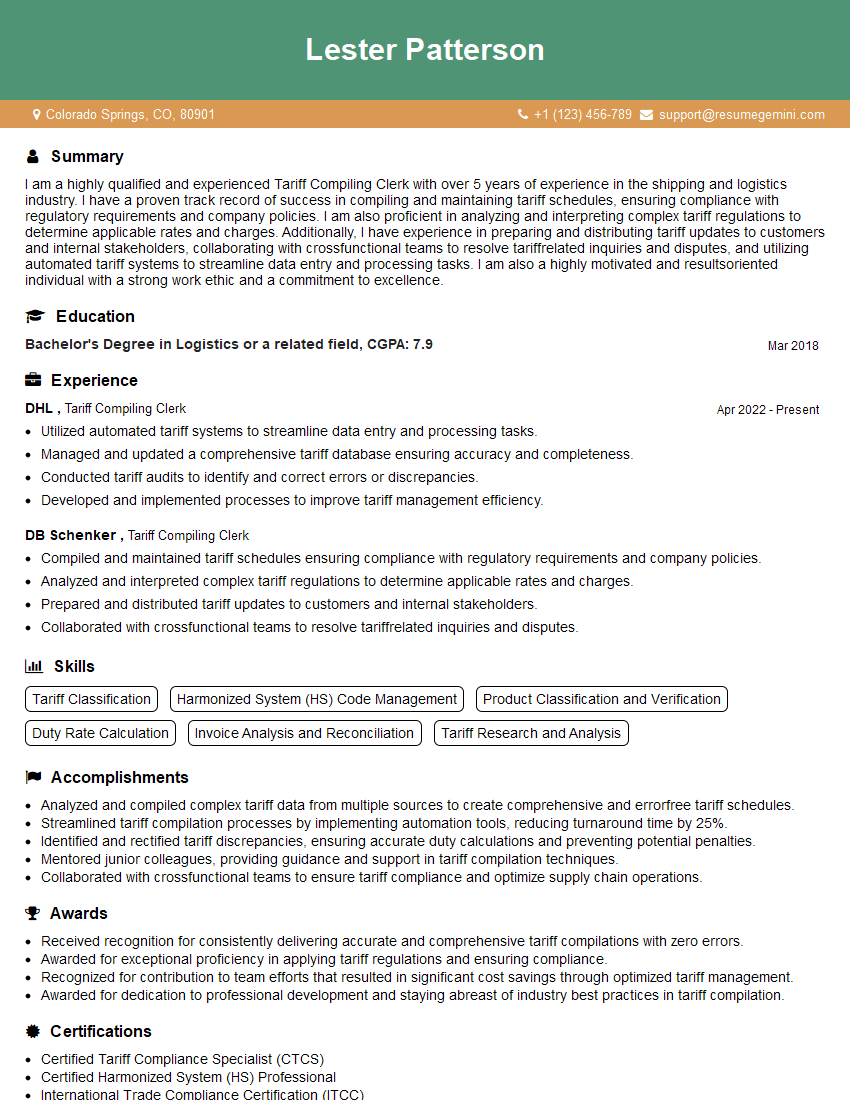

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Tariff Compiling Clerk

1. What are the key responsibilities of a Tariff Compiling Clerk?

As a Tariff Compiling Clerk, I would be responsible for:

- Compiling and classifying tariff schedules for various goods and services

- Researching and analyzing tariff regulations and changes to ensure accurate and up-to-date information

- Preparing shipping documents and calculating duties and taxes based on applicable tariffs

- Assisting customers with inquiries related to tariffs and customs procedures

- Working with customs officials and other stakeholders in the import/export industry

2. How do you ensure the accuracy and consistency of your tariff calculations?

Maintaining Current Knowledge

- Regularly review and update knowledge of tariff regulations and changes

- Stay informed about industry best practices and emerging trends in tariff classification

Thorough Research

- Conduct thorough research to identify applicable tariff codes based on product descriptions, technical specifications, and origin

- Use a variety of resources, including online databases, reference materials, and expert consultations

Cross-Checking and Verification

- Cross-check calculations with colleagues to minimize errors

- Verify results against multiple sources to ensure accuracy

Continuous Improvement

- Regularly review and refine processes to identify areas for improvement

- Seek feedback from stakeholders to enhance the accuracy and efficiency of tariff calculations

3. How do you handle discrepancies or conflicts in tariff information?

Discrepancies or conflicts in tariff information can arise from various sources, such as outdated regulations, misinterpretations, or inconsistencies between different customs authorities. To address these situations, I would:

- Identify the source of the discrepancy and gather relevant documentation

- Research and analyze the applicable regulations and policies thoroughly

- Consult with subject matter experts, such as customs officials or legal professionals, to seek clarification

- Document the resolution and update internal processes to prevent future occurrences

4. How do you stay up-to-date with the latest changes in tariff regulations?

- Subscribe to industry publications and newsletters

- Attend conferences and webinars related to tariff classification and customs compliance

- Monitor government websites and official announcements for updates

- Network with professionals in the field to stay informed about current trends and best practices

5. What software and tools are you familiar with for tariff classification and calculation?

- Tariff classification software (e.g., TariffCodes, Harmonized System Database)

- Duty calculation tools (e.g., DutyCalculator, Global Trade Management systems)

- Enterprise resource planning (ERP) systems that integrate tariff management modules

- Online databases and resources for tariff lookup and research

6. How do you ensure compliance with international trade regulations?

- Maintain a deep understanding of international trade agreements, conventions, and regulations

- Stay informed about updates and amendments to relevant regulations

- Collaborate with legal counsel and customs authorities to ensure compliance with applicable laws

- Implement internal controls and procedures to minimize risks and ensure adherence to regulations

7. How do you handle high-volume tariff classification and calculation tasks?

- Utilize technology and automation tools to streamline processes

- Establish clear workflows and delegation of responsibilities

- Work closely with data entry and verification teams to ensure accuracy and efficiency

- Continuously monitor and evaluate processes to identify areas for improvement and optimization

8. How do you prioritize tasks and manage your workload effectively?

- Establish a clear understanding of priorities based on deadlines and business impact

- Utilize project management tools and techniques to track progress and manage dependencies

- Delegate tasks effectively to ensure efficient utilization of resources

- Communicate regularly with stakeholders to manage expectations and mitigate potential risks

9. How do you maintain confidentiality and data security in your role?

- Adhere to strict confidentiality agreements and data protection policies

- Limit access to sensitive information on a need-to-know basis

- Use secure communication channels and encryption for data transfer

- Report any breaches or suspected security incidents promptly

10. How do you stay motivated and maintain a high level of performance in your role?

- Set clear goals and track progress regularly

- Continuously seek opportunities for professional development and learning

- Maintain a positive attitude and collaborate effectively with colleagues

- Recognize and celebrate achievements to maintain motivation

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Tariff Compiling Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Tariff Compiling Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Tariff Compiling Clerk is responsible for compiling and maintaining tariffs, which are documents that list the rates and charges for goods and services. This individual ensures the accuracy and completeness of the tariffs, and may communicate with customers and other stakeholders to resolve any issues.

1. Compile and Maintain Tariffs

The primary responsibility of a Tariff Compiling Clerk is to compile and maintain tariffs. This involves gathering information from various sources, such as government agencies, shipping companies, and manufacturers. The clerk must then organize and format this information into a clear and concise tariff.

- Gather information from various sources, such as government agencies, shipping companies, and manufacturers

- Organize and format information into a clear and concise tariff

2. Ensure Accuracy and Completeness of Tariffs

It is crucial that tariffs are accurate and complete. A Tariff Compiling Clerk must carefully review all information before including it in the tariff. The clerk must also be aware of any changes to regulations or rates, and update the tariff accordingly

- Carefully review all information before including it in the tariff

- Be aware of any changes to regulations or rates, and update the tariff accordingly

3. Communicate with Customers and Other Stakeholders

A Tariff Compiling Clerk may need to communicate with customers and other stakeholders to resolve any issues with the tariff. This may involve explaining the tariff to customers, or working with other departments to resolve any discrepancies.

- Explain the tariff to customers

- Work with other departments to resolve any discrepancies

4. Other Duties

In addition to the above, a Tariff Compiling Clerk may also perform other duties, such as:

- Maintain records of tariffs

- Assist with the development of new tariffs

- Provide training on tariffs to other employees

Interview Tips

Preparing for an interview can be stressful, but there are a few things you can do to increase your chances of success.

1. Research the Company and Position

Before you go to the interview, take some time to research the company and the position you are applying for. This will show the interviewer that you are interested in the job and that you have taken the time to learn about the company’s culture and values.

- Visit the company’s website

- Read articles about the company in the news

- Talk to people who work at the company

2. Practice Answering Common Interview Questions

There are a few common interview questions that you are likely to be asked, such as “Tell me about yourself” and “Why are you interested in this job?” It is helpful to practice answering these questions in advance so that you can deliver your answers confidently and concisely.

- Use the STAR method to answer interview questions

- Practice answering questions with a friend or family member

3. Dress Professionally and Arrive on Time

First impressions matter, so it is important to dress professionally for your interview. You should also arrive on time, or even a few minutes early, to show that you are respectful of the interviewer’s time.

- Choose your outfit the night before

- Arrive at the interview location 10-15 minutes early

4. Be Yourself and Be Enthusiastic

It is important to be yourself during your interview. The interviewer wants to get to know the real you, so don’t try to be someone you’re not. Be enthusiastic about the job and the company, and let the interviewer know why you are the best person for the position.

- Be honest and authentic

- Show your enthusiasm for the job and the company

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Tariff Compiling Clerk interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!