Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Tariff Counsel position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

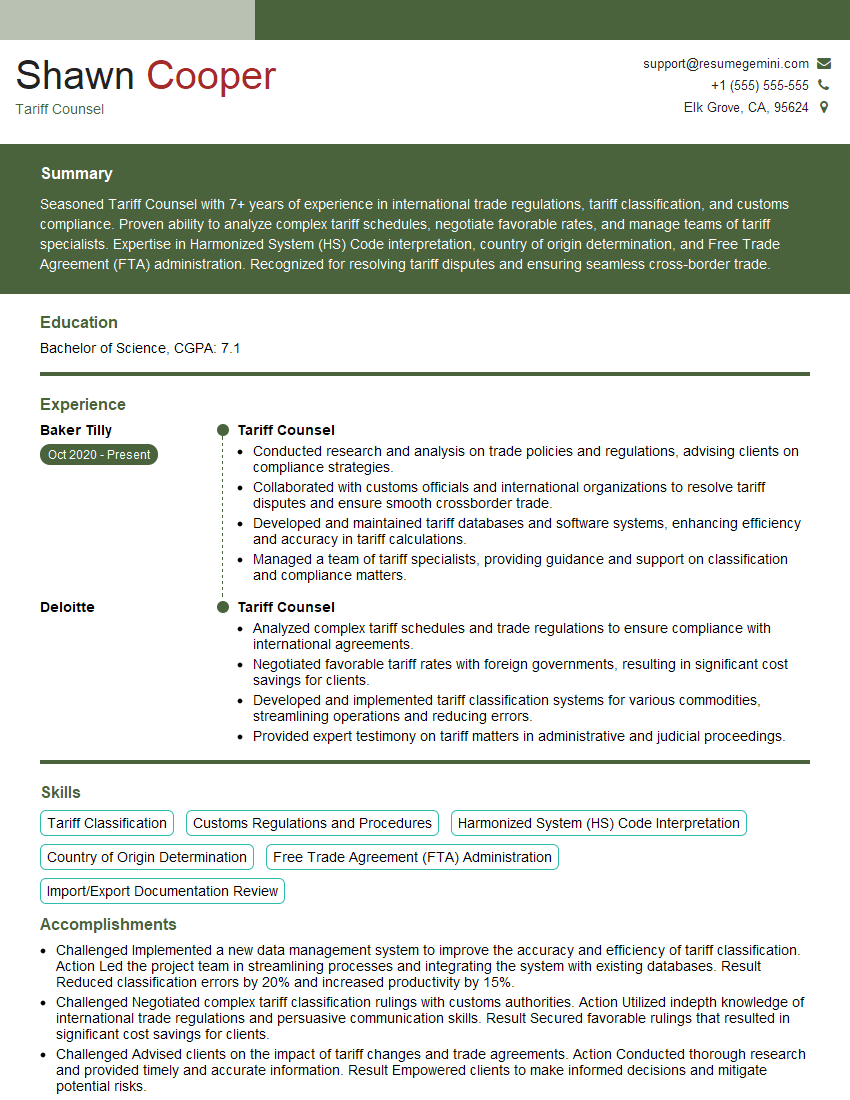

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Tariff Counsel

1. What are the key responsibilities of a Tariff Counsel?

The key responsibilities of a Tariff Counsel include:

- Advising clients on the application of tariffs and other trade regulations.

- Representing clients before government agencies and international organizations.

- Negotiating tariff rates and other trade concessions.

- Developing and implementing tariff strategies.

- Providing training on tariff matters.

2. What are the different sources of tariff law?

The different sources of tariff law include:

- Statutes

- Regulations

- Case law

- International agreements

3. What are the different types of tariffs?

The different types of tariffs include:

- Ad valorem tariffs

- Specific tariffs

- Compound tariffs

- Preferential tariffs

4. What are the different methods of tariff classification?

The different methods of tariff classification include:

- Brussels Nomenclature

- Harmonized System

- North American Free Trade Agreement (NAFTA)

5. What are the different remedies available to importers who believe that they have been overcharged duties?

The different remedies available to importers who believe that they have been overcharged duties include:

- Filing a protest with the U.S. Customs and Border Protection (CBP)

- Requesting a binding ruling from CBP

- Filing a lawsuit in the Court of International Trade

6. What are the different types of trade agreements?

The different types of trade agreements include:

- Free trade agreements

- Preferential trade agreements

- Customs unions

- Common markets

- Economic unions

7. What are the different international organizations that deal with tariff matters?

The different international organizations that deal with tariff matters include:

- World Trade Organization (WTO)

- World Customs Organization (WCO)

- International Chamber of Commerce (ICC)

- United Nations Conference on Trade and Development (UNCTAD)

8. What are the different ethical issues that Tariff Counsel may face?

The different ethical issues that Tariff Counsel may face include:

- Conflicts of interest

- Confidentiality

- Misrepresentation

- Unfair competition

9. What are the different career paths for Tariff Counsel?

The different career paths for Tariff Counsel include:

- Private practice

- Government service

- International organizations

- Academia

10. What are the different professional development opportunities available to Tariff Counsel?

The different professional development opportunities available to Tariff Counsel include:

- Continuing legal education (CLE)

- Conferences and seminars

- Mentoring

- Networking

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Tariff Counsel.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Tariff Counsel‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Tariff Counsel is a highly specialized legal professional responsible for advising clients on complex tariff and trade laws and regulations.

1. Tariff Classification

Classifies products and goods under the Harmonized Tariff Schedule of the United States (HTSUS) to determine applicable duties and import fees.

- Analyze product specifications, invoices, and other documents

- Interpret tariff laws, regulations, and precedents

2. Duty Mitigation and Drawback

Advises clients on strategies to minimize customs duties and optimize duty recovery.

- Identify duty-free or reduced-duty programs, such as Foreign Trade Zones and preferential trade agreements

- Assist clients in recovering duties paid through drawback claims

3. Customs Compliance

Ensures clients’ compliance with customs regulations to avoid penalties and minimize import delays.

- Review import documentation and procedures

- Advise on recordkeeping requirements and audits

4. Trade Policy and Advocacy

Monitors and analyzes trade policy developments and advocates for clients’ interests.

- Participate in rulemaking and policy discussions before government agencies and international organizations

- Represent clients in trade negotiations and disputes

Interview Tips

To excel in a Tariff Counsel interview, it’s crucial to demonstrate expertise in tariff laws, strong attention to detail, and the ability to think strategically.

1. Research and Preparation

Thoroughly research the company, industry, and specific role. Familiarize yourself with the HTSUS, current trade policies, and any recent relevant cases.

- Review the company’s website, annual reports, and industry news to understand its business and operations

- Practice explaining technical concepts in a clear and concise manner

2. Showcase Your Expertise

Highlight your understanding of tariff classification, duty mitigation strategies, and customs compliance. Provide specific examples of how you have successfully resolved tariff-related issues for clients.

- Emphasize your ability to interpret complex regulations and apply them to real-world scenarios

- Quantify your accomplishments, such as the amount of duties saved or the number of compliance issues resolved

3. Demonstrate Analytical and Strategic Skills

Showcase your ability to analyze trade data, forecast trends, and develop effective strategies for clients. Highlight your experience in negotiating with government officials and representing clients in disputes.

- Describe how you have used market research and data analysis to identify opportunities and risks

- Explain how you have successfully resolved complex trade disputes or advocated for clients’ interests at government hearings

4. Highlight Your Communication and Presentation Skills

A Tariff Counsel must be able to clearly communicate technical information to both legal and non-legal professionals. Emphasize your proficiency in written and oral communication.

- Provide examples of presentations you have given or reports you have written on tariff-related topics

- Practice articulating complex legal concepts in a way that is easy for laypersons to understand

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Tariff Counsel interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!