Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Tariff Inspector position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

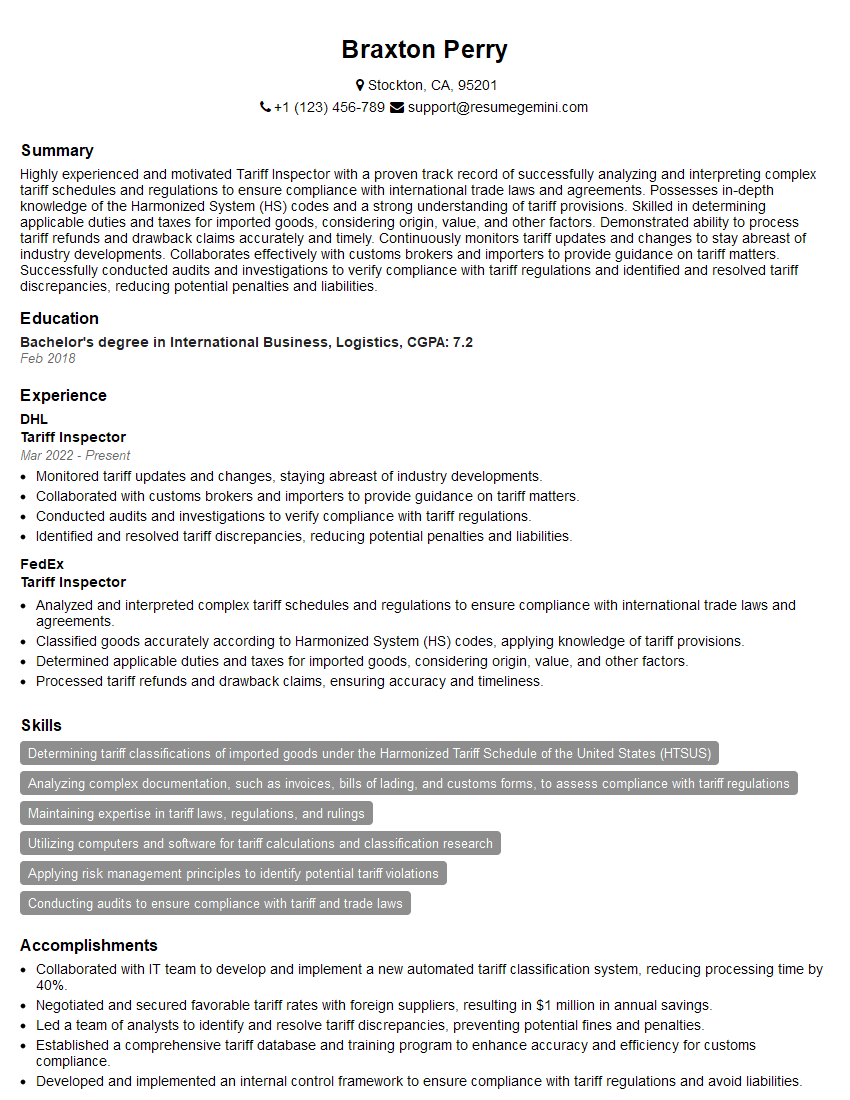

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Tariff Inspector

1. Explain the Harmonized System (HS) and its role in international trade?

The Harmonized System (HS) is a standardized system of classifying goods for customs purposes. It was developed by the World Customs Organization (WCO) and is used by over 200 countries and territories worldwide. The HS provides a common language for describing and classifying goods, which helps to facilitate international trade and prevent disputes.

- The HS is a hierarchical system, with goods classified into chapters, headings, subheadings, and items. Each chapter covers a broad category of goods, such as live animals, food, or machinery. The headings within each chapter provide more specific descriptions of the goods, and the subheadings and items provide even more detail.

- The HS is used for a variety of purposes, including:

- Classifying goods for customs purposes

- Calculating duties and taxes

- Compiling trade statistics

- Determining the origin of goods

- Preventing the smuggling of illegal goods

2. Describe the different methods of tariff valuation?

Ad valorem

- Ad valorem duties are based on the value of the goods.

- This is the most common method of tariff valuation.

- The value of the goods is usually determined by the transaction value, which is the price actually paid or payable for the goods.

Specific

- Specific duties are based on the physical characteristics of the goods, such as weight, volume, or number of units.

- This method of valuation is often used for bulk commodities, such as oil or grain.

Compound

- Compound duties are a combination of ad valorem and specific duties.

- This method of valuation is often used for goods that have both a physical characteristic and a value component.

3. What are the different types of tariff exemptions?

- Temporary exemptions: These exemptions are granted for a limited period of time, such as for goods that are imported for use in a specific project.

- Permanent exemptions: These exemptions are granted for an indefinite period of time, such as for goods that are imported for educational purposes.

- Conditional exemptions: These exemptions are granted subject to certain conditions, such as the goods being used for a specific purpose or being imported by a specific type of organization.

4. Describe the process of tariff classification?

- The first step in tariff classification is to determine the chapter under which the goods fall.

- The chapter headings provide a broad description of the goods, such as “live animals,” “food,” or “machinery.”

- Once the chapter has been determined, the next step is to determine the heading under which the goods fall.

- The headings provide a more specific description of the goods, such as “live bovine animals,” “meat and edible meat offal,” or “machinery for working rubber or plastics.”

- Once the heading has been determined, the next step is to determine the subheading under which the goods fall.

- The subheadings provide an even more specific description of the goods, such as “live bovine animals of a weight exceeding 500 kg,” “meat of bovine animals, fresh or chilled,” or “machinery for working rubber or plastics, other than extruders.”

- Once the subheading has been determined, the next step is to determine the item under which the goods fall.

- The items provide the most specific description of the goods, such as “live bovine animals of a weight exceeding 500 kg, other than purebred breeding animals.”

5. What are the different types of tariff rates?

- Bound rates: These are the maximum rates of duty that a country can impose on a particular product.

- Applied rates: These are the actual rates of duty that a country imposes on a particular product.

- Preferential rates: These are rates of duty that are granted to certain countries or groups of countries.

6. What are the different methods of duty drawback?

- Total drawback: This is a refund of all duties paid on goods that are exported.

- Partial drawback: This is a refund of only a portion of the duties paid on goods that are exported.

- Manufacturing drawback: This is a refund of duties paid on imported goods that are used in the manufacture of exported goods.

7. What are the different types of tariff quotas?

- Absolute quotas: These quotas limit the quantity of goods that can be imported into a country at a particular tariff rate.

- Tariff-rate quotas: These quotas allow a certain quantity of goods to be imported at a lower tariff rate, after which the higher tariff rate applies.

8. What are the different methods of tariff negotiation?

- Bilateral negotiations: These are negotiations between two countries.

- Multilateral negotiations: These are negotiations between three or more countries.

- Regional trade agreements: These are agreements between countries in a particular region.

9. What are the different types of trade remedies?

- Anti-dumping duties: These duties are imposed on goods that are being sold at a price below their fair value.

- Countervailing duties: These duties are imposed on goods that are being subsidized by their government.

- Safeguard measures: These measures are imposed to protect domestic industries from injury caused by increased imports.

10. What are the different types of tariff administration?

- Centralized administration: This is a system in which all tariff matters are handled by a central government agency.

- Decentralized administration: This is a system in which tariff matters are handled by regional or local government agencies.

- Private sector administration: This is a system in which tariff matters are handled by private sector organizations, such as customs brokers.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Tariff Inspector.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Tariff Inspector‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Tariff Inspectors play a crucial role in ensuring accurate import and export tariffs are collected. They possess expertise in tariff classification and regulations, enabling them to provide expert guidance to businesses on customs compliance.

1. Tariff Classification

Accurately classify imported and exported goods based on the Harmonized System (HS) codes and other relevant regulations to determine applicable tariffs.

2. Tariff Rate Determination

Research and analyze relevant tariff schedules, trade agreements, and preferential programs to calculate the appropriate tariff rates for imported goods.

3. Compliance Verification

Examine shipping documents, invoices, and other supporting materials to ensure proper classification, valuation, and payment of tariffs.

4. Internal Audits

Conduct internal audits to identify potential errors or inconsistencies in tariff classification, valuation, and duty payments. Develop recommendations for improvement.

5. External Audits

Assist external auditors in reviewing tariff-related practices and compliance, providing expert guidance and support to ensure accuracy and transparency.

6. Stakeholder Engagement

Effectively communicate with importers, exporters, brokers, and other stakeholders to provide guidance on tariff regulations and resolve inquiries.

Interview Tips

To ace an interview for a Tariff Inspector position, it’s essential to prepare well both technically and professionally.

1. Research the Position

Thoroughly review the job description to understand the specific responsibilities and qualifications required. Familiarize yourself with the organization’s mission, values, and industry.

2. Practice Tariff Classification

Sharpen your skills in classifying goods using the HS codes system and other relevant regulations. Practice with a variety of hypothetical scenarios to demonstrate your knowledge.

3. Prepare Questions

Come prepared with thoughtful questions for the interviewer, demonstrating your interest and engagement in the role. Ask about the company’s import/export operations, specific challenges the inspector faces, and professional development opportunities.

4. Highlight Compliance Expertise

Emphasize your knowledge of import/export regulations and your commitment to compliance. Discuss your experience in conducting audits and identifying errors in tariff classification or payments.

5. Communication Skills

Showcase your strong communication skills by clearly explaining complex tariff regulations and findings to stakeholders. Demonstrate your ability to build relationships with individuals from diverse backgrounds.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Tariff Inspector, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Tariff Inspector positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.