Are you gearing up for a career in Tax Accountant? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Tax Accountant and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

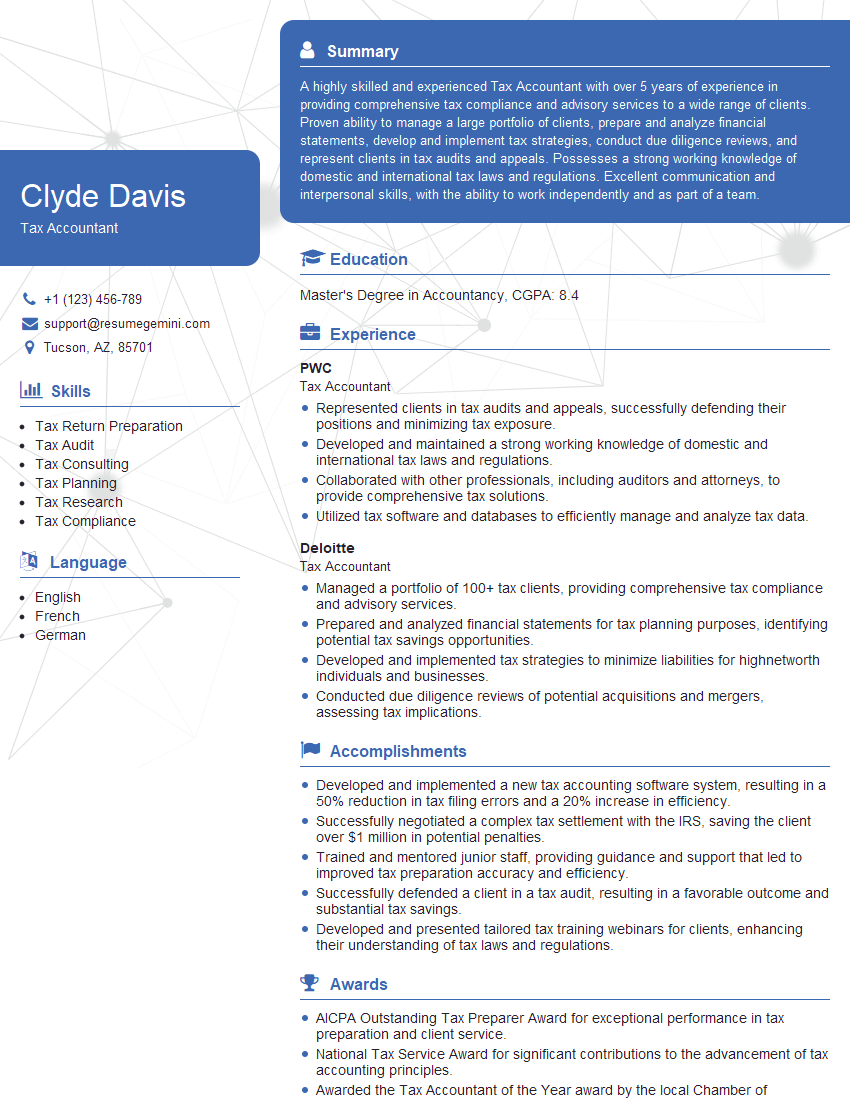

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Tax Accountant

1. Explain the concept of tax incidence and tax shifting. How do they affect different economic sectors?

Answer:

- Tax incidence: Refers to the initial burden of a tax, falling on the entity legally responsible for paying it (e.g., consumer, producer).

- Tax shifting: Occurs when the initial taxpayer passes on the tax burden to another party, ultimately changing the intended distribution of the tax.

- Impact on sectors:

- Consumer goods: Tax shifting can lead to higher prices for consumers.

- Capital goods: Tax incidence on producers can deter investment and economic growth.

- Services: Tax shifting may result in higher costs for service providers.

2. Describe the different methods of depreciation and their impact on taxable income.

Depreciation methods

- Straight-line method: Depreciates an asset evenly over its useful life.

- Declining-balance method: Depreciates an asset at a higher rate in the early years.

- Units-of-production method: Depreciates an asset based on its usage.

Impact on taxable income

- Different methods result in varying depreciation expenses.

- Higher depreciation expenses reduce taxable income in the early years, potentially lowering tax liabilities.

3. Discuss the tax implications of different types of business structures (e.g., sole proprietorship, partnership, LLC).

Answer:

- Sole proprietorship:

- Not a separate legal entity.

- Business income is taxed as personal income.

- Partnership:

- Separate legal entity.

- Partners report their share of income and expenses on individual tax returns.

- LLC:

- Hybrid entity with elements of both partnerships and corporations.

- Can elect to be taxed as a sole proprietorship, partnership, or corporation.

4. How do you stay up-to-date with constantly changing tax laws and regulations?

Answer:

- Subscribe to professional journals and newsletters.

- Attend industry conferences and webinars.

- Utilize online resources, such as the IRS website and professional databases.

- Network with other tax professionals and exchange information.

5. Describe your experience with tax audit representation. What strategies do you employ to minimize tax liabilities?

Answer:

- During audit:

- Review audit notices carefully.

- Prepare and organize necessary documentation.

- Communicate effectively with the auditor.

- Minimizing liabilities:

- Utilize tax deductions and credits to reduce taxable income.

- Negotiate with the auditor to resolve disputes.

- Consider alternative tax planning strategies, if appropriate.

6. How do you handle complex tax issues and make recommendations to clients?

Answer:

- Research and analysis:

- Review relevant tax laws and regulations.

- Consult with industry experts or specialists.

- Consultation:

- Discuss the issue with the client, understanding their goals.

- Present multiple options, explaining potential tax implications.

- Recommendation:

- Provide a comprehensive recommendation, supported by research and analysis.

- Document the decision-making process, including rationale and potential risks.

7. What are the ethical considerations you must adhere to as a Tax Accountant?

Answer:

- Confidentiality: Maintain the privacy of client information.

- Integrity: Conduct business with honesty and professionalism.

- Objectivity: Avoid conflicts of interest and provide unbiased advice.

- Due care: Exercise reasonable diligence and competence in performing services.

8. Describe your experience with using tax software. Which software are you proficient in?

Answer:

- List relevant tax software proficiency, such as:

- ProConnect Tax Online

- Drake Tax

- Lacerte

- Highlight key features and functions you are familiar with.

- Discuss how you utilize software to enhance efficiency and accuracy.

9. How do you prioritize and manage multiple projects with varying deadlines?

Answer:

- Organization and planning:

- Use project management tools or techniques.

- Create a clear schedule with realistic deadlines.

- Prioritization:

- Identify critical tasks and allocate resources accordingly.

- Utilize the “Eisenhower Matrix” to categorize tasks based on urgency and importance.

- Delegation and collaboration:

- Delegate tasks to capable colleagues when possible.

- Seek support or consult with others to maximize efficiency.

- Time management:

- Utilize time-tracking tools to monitor progress.

- Take breaks and avoid burnout to maintain productivity.

10. Why are you interested in this particular role, and how do your skills and experience align with our company’s needs?

Answer:

- Express enthusiasm for the specific role and responsibilities.

- Highlight relevant skills and experiences that match the job requirements.

- Research the company and its values to demonstrate alignment.

- Explain how your contributions could benefit the team and organization.

- Be prepared to discuss specific aspects of your background that make you a suitable candidate.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Tax Accountant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Tax Accountant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Tax Accountants are responsible for a wide range of duties, including:

1. Tax Return Preparation

Preparing individual, business, and trust income tax returns, ensuring that they are accurate and compliant with tax laws and regulations.

- Analyse financial documents to determine taxable income and deductions.

- Calculate tax liability and prepare tax returns using tax software or manual methods.

2. Tax Planning

Advising clients on tax saving strategies and helping them minimize their tax liability.

- Identify and recommend tax deductions and credits to reduce clients’ tax liability.

- Plan for future tax consequences of financial decisions.

3. Tax Research

Conducting research on tax laws and regulations to stay up-to-date on changes and ensure compliance.

- Interpret and apply complex tax laws and regulations.

- Stay informed of tax law changes and updates through continuing education.

4. Auditing and Review

Auditing and reviewing tax returns to ensure accuracy and compliance with tax laws and regulations.

- Review tax returns for potential errors or inconsistencies.

- Respond to audit inquiries and provide necessary documentation.

Interview Tips

To ace the interview for a Tax Accountant position, candidates should follow these tips:

1. Research the Company and the Role

Familiarize yourself with the company’s size, industry, and tax compliance requirements. Learn about the specific responsibilities of the Tax Accountant role and how your skills and experience align with them.

- Check the company’s website, annual reports, and press releases.

- Read the job description and identify the key skills and qualifications required.

2. Prepare for Technical Questions

Tax Accountants need to have a strong understanding of tax laws and regulations. Be prepared to answer questions about specific tax codes, tax deductions, and tax planning strategies. Practice solving tax problems and be ready to demonstrate your analytical and problem-solving skills.

- Review basic tax concepts, such as taxable income, deductions, and tax credits.

- Practice solving sample tax problems using tax software or manual methods.

3. Highlight Your Soft Skills

In addition to technical skills, Tax Accountants need to possess strong soft skills, such as communication, interpersonal skills, and attention to detail. During the interview, emphasize your ability to work independently, meet deadlines, and effectively communicate complex tax matters to clients and colleagues.

- Provide examples of your work experience where you demonstrated these skills.

- Be prepared to answer behavioural interview questions that focus on your teamwork, problem-solving, and communication abilities.

4. Show Enthusiasm and Passion

Tax accounting can be challenging and complex. During the interview, show your passion for the field and your desire to learn and grow. Express your interest in staying up-to-date on tax law changes and your commitment to providing excellent service to clients.

- Describe your interest in tax accounting and why you are passionate about it.

- Discuss your career goals and how the Tax Accountant role aligns with them.

Next Step:

Now that you’re armed with the knowledge of Tax Accountant interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Tax Accountant positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini