Are you gearing up for a career in Tax Adjuster? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Tax Adjuster and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

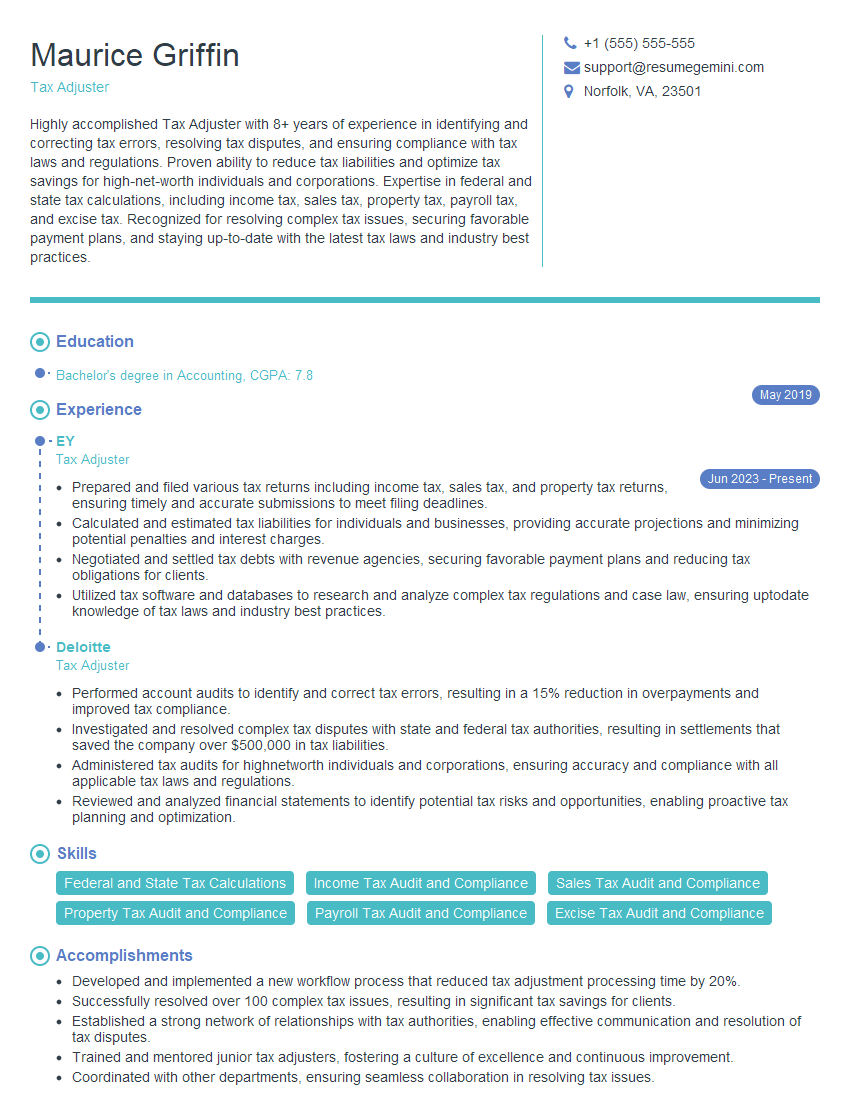

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Tax Adjuster

1. Explain the steps involved in adjusting a tax return?

- Review the tax return to identify any errors or omissions.

- Research the applicable tax laws and regulations to determine the correct tax treatment.

- Calculate the revised tax liability.

- Prepare an amended tax return.

- Submit the amended tax return to the appropriate tax authority.

2. What are the common reasons for tax adjustments?

Mathematical Errors

- Incorrect calculations on the tax return.

- Errors in entering data into the tax software.

Oversights

- Forgot to include income or deductions.

- Failed to claim eligible tax credits.

Changes in Tax Laws

- Retroactive tax law changes.

- New tax laws that affect the tax return.

3. What are the consequences of filing an incorrect tax return?

- Additional tax liability and penalties.

- Interest charges on the unpaid taxes.

- Criminal prosecution in some cases.

4. What are the ethical responsibilities of a tax adjuster?

- Maintain confidentiality of taxpayer information.

- Provide accurate and unbiased advice.

- Avoid conflicts of interest.

- Comply with all applicable tax laws and regulations.

5. Describe your experience with tax software.

- Name the tax software you have used.

- Describe your proficiency in using the software.

- Explain how you use tax software to adjust tax returns.

6. What are the key differences between individual and corporate tax returns?

- Filing requirements: Individuals file Form 1040, while corporations file Form 1120.

- Tax rates: Corporations are subject to different tax rates than individuals.

- Deductions and credits: Different deductions and credits are available to individuals and corporations.

7. How do you stay up-to-date on tax laws and regulations?

- Attend tax seminars and webinars.

- Read tax publications and articles.

- Consult with tax professionals.

8. What is your strategy for resolving tax disputes with the IRS?

- Gather all relevant documentation.

- Research the applicable tax laws and regulations.

- Negotiate with the IRS.

- File an appeal if necessary.

9. What are your strengths as a tax adjuster?

- Strong understanding of tax laws and regulations.

- Excellent analytical and problem-solving skills.

- Ability to communicate complex tax issues clearly.

- Attention to detail and accuracy.

10. What are your weaknesses as a tax adjuster?

- Acknowledge any areas where you need to improve.

- Explain how you are working to overcome your weaknesses.

- Emphasize your strengths and how they outweigh your weaknesses.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Tax Adjuster.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Tax Adjuster‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Tax Adjusters play a vital role in the financial world, ensuring accuracy, compliance, and efficiency in tax-related matters. Their responsibilities encompass diverse aspects of tax preparation, analysis, and management.

1. Tax Return Examination

Tax Adjusters meticulously examine tax returns to ensure accuracy, completeness, and compliance with tax laws and regulations. They analyze financial statements, supporting documentation, and other relevant data to identify potential errors or omissions.

- Reviewing tax returns for accuracy and compliance

- Identifying discrepancies and potential errors in tax calculations

2. Tax Adjustments and Corrections

Based on their examination findings, Tax Adjusters determine whether adjustments or corrections to tax returns are necessary. They calculate appropriate adjustments, prepare amended returns, and ensure that all required documentation is submitted to the relevant tax authorities.

- Making necessary tax adjustments to optimize tax outcomes

- Preparing and filing amended tax returns with accuracy and timeliness

3. Tax Liability Analysis

Tax Adjusters analyze tax liabilities to assess potential risks and identify opportunities for tax optimization. They review tax codes, regulations, and industry best practices to stay updated on the latest tax laws and changes that may impact tax liability.

- Evaluating tax liabilities to minimize risks and maximize tax savings

- Applying complex tax strategies to optimize client outcomes

4. Communication and Representation

Tax Adjusters communicate effectively with clients, tax authorities, and other professionals to ensure seamless tax resolution. They represent clients before tax agencies, provide technical explanations, and negotiate on their behalf to resolve tax-related issues.

- Communicating effectively with clients and tax authorities

- Representing clients in tax audits and dispute resolution

Interview Tips

To ace the interview for a Tax Adjuster position, preparation and a confident demeanor are essential. Here are some tips to help you succeed:

1. Research the Company and the Role

Take the time to thoroughly research the company you are applying to and the specific Tax Adjuster role. Understanding the company’s culture, values, and business objectives will help you tailor your answers and demonstrate your alignment with their needs.

- Visit the company’s website and review their mission statement, core values, and recent news

- Analyze the job description to identify the key responsibilities and qualifications required for the role

2. Highlight Your Skills and Experience

In your interview, be prepared to articulate your relevant skills and experience that make you an ideal candidate for the Tax Adjuster position. Focus on highlighting your technical expertise in tax preparation, analysis, and adjustments.

- Quantify your accomplishments using specific metrics and examples

- Emphasize your proficiency in tax software and accounting principles

3. Demonstrate Your Problem-Solving Abilities

Tax Adjusters are often faced with complex tax-related challenges. During the interview, be ready to demonstrate your problem-solving and critical-thinking skills. Describe how you have successfully resolved tax issues and optimized tax outcomes for clients.

- Use the STAR method (Situation, Task, Action, Result) to provide structured answers to behavioral interview questions

- Showcase your ability to analyze complex tax scenarios and develop effective solutions

4. Be Confident and Enthusiastic

Confidence and enthusiasm are highly valued traits in Tax Adjusters. Convey your passion for tax matters and your eagerness to contribute to the success of the team. Show the interviewer that you are confident in your abilities and excited about the prospect of working for their company.

- Maintain eye contact and a positive body language throughout the interview

- Ask thoughtful questions that show your interest and engagement

5. Practice Your Answers

Preparation is key to a successful interview. Practice your answers to common interview questions related to tax adjusting. This will help you feel more confident and articulate during the actual interview.

- Use mock interview platforms or practice with a friend or family member

- Prepare stories and examples that highlight your skills and experience

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Tax Adjuster interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!