Are you gearing up for a career in Tax Assistant? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Tax Assistant and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

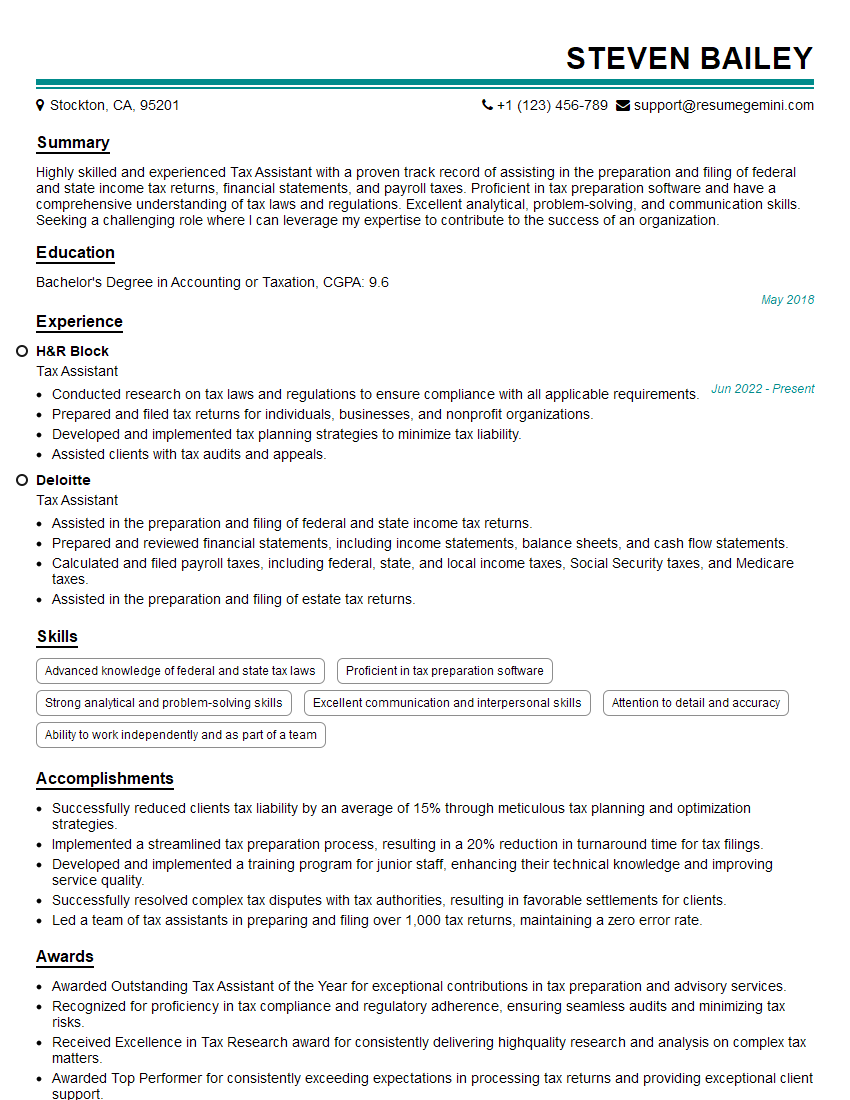

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Tax Assistant

1. What are the different types of taxes that individuals and businesses are required to pay?

There are various types of taxes that individuals and businesses are required to pay. Here are a few of the most common ones:

- Individuals: Income tax, property tax, sales tax, and excise tax.

- Businesses: Corporate income tax, payroll tax, sales tax, and property tax.

2. What are the different methods of tax calculation?

Gross Income Method

- Total income is calculated by adding up all sources of income.

- Taxable income is determined by subtracting allowable deductions and exemptions from gross income.

Net Income Method

- Taxable income is calculated by subtracting allowable expenses from total revenue.

- Tax liability is then determined by applying the appropriate tax rates to the taxable income.

3. What are the most common tax deductions and credits that individuals and businesses can claim?

- Individuals: Standard deduction, personal exemptions, mortgage interest deduction, charitable contributions, and retirement savings contributions.

- Businesses: Business expenses, depreciation, and research and development costs.

4. What are the penalties for failing to file or pay taxes on time?

- Late filing penalty: A percentage of the unpaid tax is charged for each month the return is late, up to a maximum penalty of 25%.

- Late payment penalty: A percentage of the unpaid tax is charged for each month the payment is late, up to a maximum penalty of 25%.

- Interest: Interest is charged on the unpaid tax from the due date until the date it is paid.

- Civil penalties: The IRS may impose civil penalties for willful neglect or fraud.

- Criminal penalties: In severe cases, the IRS may pursue criminal charges, which can result in imprisonment.

5. What are the different types of tax audits?

- Field audit: An IRS agent visits the taxpayer’s business or home to review records and conduct interviews.

- Office audit: The taxpayer sends records to the IRS office for review.

- Correspondence audit: The IRS sends the taxpayer a letter requesting additional information or documentation.

- Random audit: The IRS randomly selects tax returns for audit.

6. What is the process for filing an amended tax return?

- Gather the necessary documentation to support the changes being made.

- Complete the appropriate amended tax return form (Form 1040-X for individuals).

- Mail the amended return to the IRS.

- The IRS will review the amended return and make any necessary adjustments.

7. What are some of the ethical considerations that tax professionals must be aware of?

- Confidentiality: Tax professionals have a duty to maintain the confidentiality of their clients’ tax information.

- Conflicts of interest: Tax professionals must avoid situations where their personal interests conflict with their professional responsibilities.

- Competence: Tax professionals must maintain their knowledge and skills to provide competent tax advice.

- Objectivity: Tax professionals must be objective in their advice and avoid bias or personal opinions.

8. What are some of the key tax laws that have been enacted in recent years?

- Tax Cuts and Jobs Act (TCJA) of 2017: This law made significant changes to the individual and corporate tax codes.

- American Rescue Plan Act (ARPA) of 2021: This law provided economic relief to individuals and businesses during the COVID-19 pandemic.

- Infrastructure Investment and Jobs Act (IIJA) of 2021: This law invested in infrastructure projects and made changes to the tax code.

9. What are some of the emerging trends in the field of taxation?

- Increased use of technology: The IRS is increasingly using technology to improve its efficiency and effectiveness.

- Globalization: Tax professionals need to be aware of the tax implications of cross-border transactions.

- Sustainability: Tax laws and policies are increasingly being used to promote sustainability.

10. How do you stay up-to-date on the latest tax laws and regulations?

- Read professional journals and attend industry conferences.

- Subscribe to tax publications and email updates from the IRS.

- Participate in continuing education courses.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Tax Assistant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Tax Assistant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

As a Tax Assistant, you will be responsible for providing support to tax professionals in a variety of tasks related to tax preparation, planning, and compliance. Your key responsibilities will include:

1. Data Entry and Processing

Entering and processing tax-related data, such as financial information, client information, and tax forms.

- Ensuring the accuracy and completeness of data entered into tax software.

- Maintaining and organizing tax-related files and documents.

2. Tax Return Preparation

Preparing individual and/or business tax returns, including federal, state, and local returns.

- Calculating tax liability and identifying deductions and credits.

- Reviewing tax returns for accuracy and completeness before submission.

3. Tax Research and Analysis

Conducting research on tax laws and regulations to stay up-to-date on changes and trends.

- Analyzing tax implications of financial transactions and investments.

- Providing guidance to clients on tax planning and compliance issues.

4. Client Communication and Support

Communicating with clients to gather information, answer questions, and provide updates on tax matters.

- Responding to client inquiries and resolving tax-related issues.

- Maintaining open and professional communication with clients and colleagues.

Interview Tips

Preparing thoroughly for a job interview is crucial to making a strong impression and increasing your chances of success. Here are some tips to help you ace your Tax Assistant interview:

1. Research the Company and Position

Familiarize yourself with the company’s website, industry, and recent news to demonstrate your interest and enthusiasm for the role.

- Review the job description carefully to understand the specific requirements and expectations of the position.

- Research the company’s culture and values to ensure that you are a good fit.

2. Practice Common Interview Questions

Anticipate and prepare for common interview questions, such as:

- Tell me about yourself.

- Why are you interested in this position?

- What are your strengths and weaknesses?

Practice answering these questions concisely and confidently, highlighting your relevant skills and experience.

3. Showcase Your Technical Abilities

Demonstrate your proficiency in tax-related software and applications, such as tax preparation software and research databases.

- Provide specific examples of how you have used these tools to complete tax-related tasks.

- Highlight your understanding of tax laws and regulations.

4. Emphasize Your Soft Skills

In addition to technical abilities, emphasize your soft skills, such as:

- Communication and interpersonal skills.

- Attention to detail and accuracy.

- Problem-solving and analytical abilities.

Provide examples of how you have utilized these skills in your previous work experience.

5. Follow Up After the Interview

Within 24-48 hours of the interview, send a thank-you note to the interviewer.

- Reiterate your interest in the position.

- Thank the interviewer for their time and consideration.

- Inquire about the next steps in the hiring process.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Tax Assistant interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.