Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Tax Auditor position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

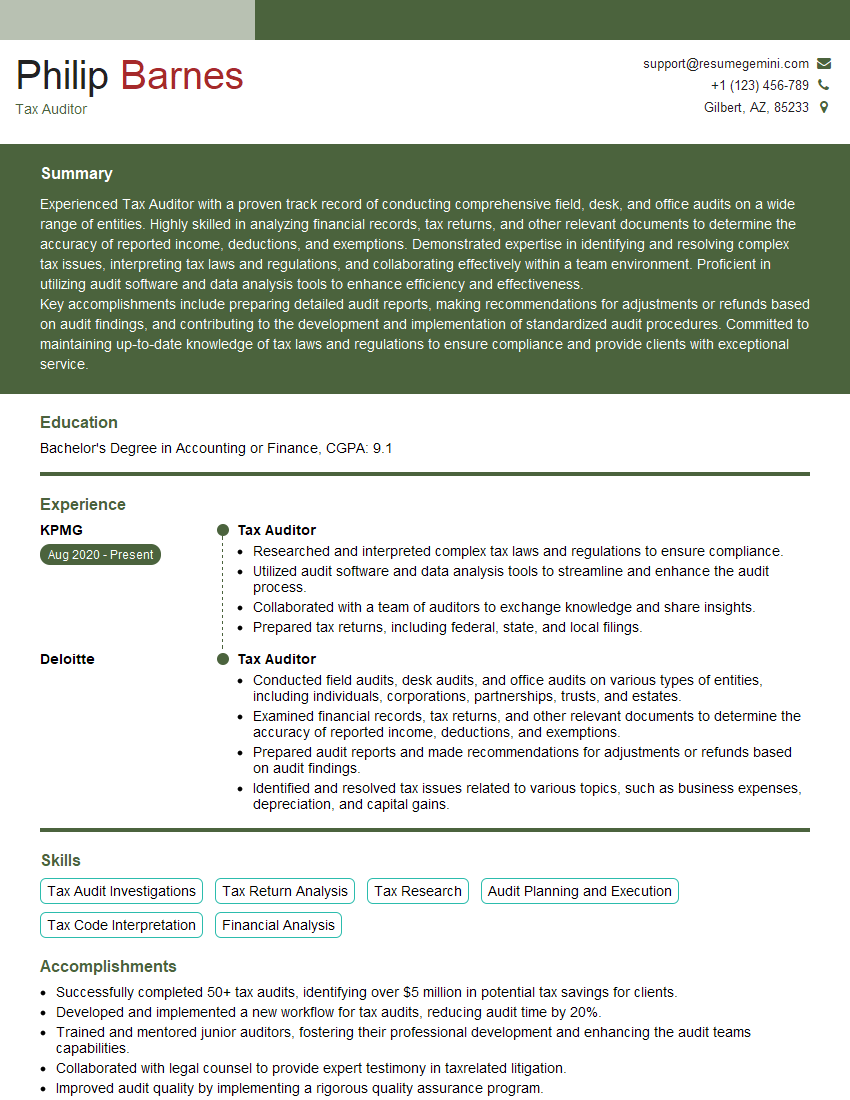

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Tax Auditor

1. Explain the process of conducting a tax audit, including the steps involved and the methods used?

Answer:

- Planning phase: Gather information about the taxpayer, identify potential risk areas, and develop an audit plan.

- Execution phase: Examine taxpayer records, interview personnel, and perform analytical procedures to verify compliance with tax laws and regulations.

- Reporting phase: Prepare an audit report that summarizes findings, identifies deficiencies, and recommends adjustments.

2. What are the key tax laws and regulations that a Tax Auditor should be familiar with?

Answer:

- Internal Revenue Code (IRC)

- Treasury Regulations

- State and local tax codes

- Generally Accepted Accounting Principles (GAAP)

- International Financial Reporting Standards (IFRS)

3. How do you stay up-to-date on changes in tax laws and regulations?

Answer:

- Regularly reviewing professional journals and publications

- Attending industry conferences and seminars

- Consulting with tax experts and professionals

- Subscribing to online tax research services

4. What are the common types of tax audits and how do they differ?

Answer:

- Field audit: Conducted at the taxpayer’s premises, involving a physical examination of records.

- Office audit: Conducted at the IRS office, based on information provided by the taxpayer through mail or email.

- Correspondence audit: Conducted solely through correspondence, with the taxpayer responding to inquiries by mail or email.

- Electronic audit: Conducted using electronic records and communications.

5. How do you ensure the accuracy and reliability of the information you obtain during a tax audit?

Answer:

- Verifying original documents and records

- Performing analytical procedures to identify inconsistencies

- Interviewing multiple sources to obtain corroborating evidence

- Consulting with independent experts

6. What are the ethical considerations that a Tax Auditor must adhere to?

Answer:

- Maintaining confidentiality

- Avoiding conflicts of interest

- Acting with integrity and professionalism

- Following all applicable laws and regulations

7. How do you handle situations where the taxpayer is not cooperative or provides false information?

Answer:

- Document all interactions and communications

- Request additional information or documentation

- Consult with legal counsel

- Consider issuing a subpoena or summons

8. What are the potential consequences of a failed tax audit?

Answer:

- Tax deficiencies and penalties

- Civil or criminal charges

- Reputational damage

- Loss of business or investment

9. What is the role of technology in modern tax auditing?

Answer:

- Data analytics and visualization

- Automated document review

- Risk assessment and fraud detection

- Electronic filing and communication

- Collaboration and data sharing

10. What are the key skills and qualities that are essential for a successful Tax Auditor?

Answer:

- Analytical and critical thinking skills

- Strong knowledge of tax laws and regulations

- Excellent communication and interpersonal skills

- Attention to detail and accuracy

- Independence and objectivity

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Tax Auditor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Tax Auditor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Tax Auditors are responsible for ensuring that individuals and businesses are complying with tax laws and regulations. Their primary duties include:

1. Reviewing tax returns

Tax Auditors examine tax returns for accuracy and completeness. They verify that all income and deductions are properly reported and that the correct amount of tax is paid.

2. Conducting audits

Tax Auditors conduct audits to verify the accuracy of tax returns. They may request additional documentation from taxpayers and interview company executives to gather the necessary information.

3. Enforcing tax laws

Tax Auditors have the authority to enforce tax laws and regulations. They may impose penalties on taxpayers who are found to be non-compliant.

4. Providing tax advice

Tax Auditors may also provide tax advice to taxpayers. They can help taxpayers understand their tax obligations and make sure that they are paying the correct amount of tax.

Interview Tips

Preparing for a Tax Auditor interview can help you increase your chances of success. Here are a few tips to help you ace the interview:

1. Research the company and the position

Before the interview, take some time to research the company and the position you are applying for. This will help you understand the company’s culture and the specific requirements of the job.

2. Practice your answers to common interview questions

There are a number of common interview questions that you can expect to be asked, such as “Why are you interested in this position?” and “What are your strengths and weaknesses?”. Practicing your answers to these questions ahead of time will help you feel more confident and prepared during the interview.

3. Dress professionally

First impressions matter, so make sure to dress professionally for your interview. This means wearing a suit or business casual attire.

4. Be on time

Punctuality is important, so arrive on time for your interview. If you are running late, be sure to call or email the interviewer to let them know.

5. Be yourself

The most important thing is to be yourself during the interview. Let the interviewer get to know the real you, and don’t try to be someone you’re not.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Tax Auditor interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.