Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Tax Clerk position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

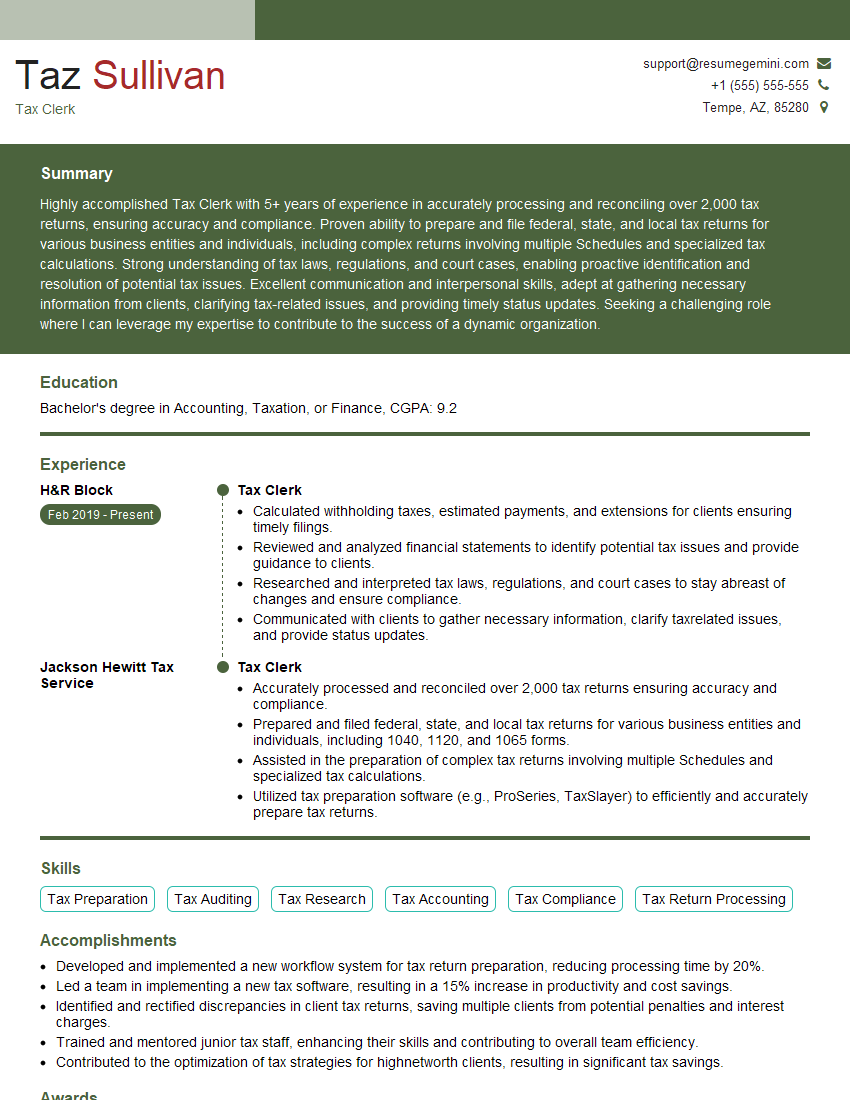

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Tax Clerk

1. Explain the different types of taxes that individuals and businesses are responsible for?

As a Tax Clerk, I am well-versed in the various types of taxes that individuals and businesses are responsible for. These include:

- Income tax: Tax levied on the income earned by individuals and businesses. This can include salaries, wages, profits, and investments.

- Sales tax: Tax imposed on the sale of goods and services. This is typically collected at the point of purchase and is a common source of revenue for state and local governments.

- Property tax: Tax levied on real estate and other property owned by individuals and businesses. This tax is typically used to fund local services such as schools, roads, and libraries.

- Payroll tax: Tax deducted from employee wages and paid by both the employee and employer. This tax funds Social Security and Medicare programs.

- Estate tax: Tax imposed on the transfer of assets from a deceased individual to their heirs. This tax is only applicable to estates that exceed a certain value threshold.

2. What is the difference between a deduction and a credit on a tax return?

Deductions

- Reduce taxable income, thereby lowering the amount of tax owed.

- Examples include itemized deductions for expenses like mortgage interest, charitable contributions, and medical expenses, or the standard deduction.

Credits

- Directly reduce the amount of tax owed, dollar-for-dollar.

- Examples include the child tax credit, earned income tax credit, and education credits.

3. Describe the process of filing a tax return.

The process of filing a tax return involves the following steps:

- Gather necessary documents: This includes W-2 forms, 1099 forms, and any other relevant tax documents.

- Choose a filing method: Taxpayers can file their returns electronically, by mail, or through a tax preparer.

- Complete the tax forms: This involves inputting personal information, income, deductions, and credits into the appropriate tax forms.

- Calculate the tax liability: Taxpayers must calculate the amount of tax they owe based on their taxable income and applicable tax rates.

- Make tax payments: If any tax is owed, taxpayers must make payments to the IRS. Electronic payments, direct debit, or mailing a check are common payment methods.

- File the return: Once the tax return is complete and any necessary payments are made, taxpayers can file their returns by the tax filing deadline.

4. What are the common mistakes that taxpayers make when filing their returns?

Taxpayers often make the following mistakes when filing their returns:

- Math errors: Simple math errors can lead to incorrect tax calculations.

- Missing or incorrect information: Failing to include all relevant information or providing incorrect information can result in errors.

- Incorrect filing status: Choosing the wrong filing status can impact tax liability.

- Overlooking deductions and credits: Taxpayers may miss out on deductions and credits that they are eligible for.

- Filing late: Filing a tax return after the deadline can result in penalties and interest.

5. What are your strengths and weaknesses as a Tax Clerk?

Strengths:

- Strong understanding of tax laws and regulations

- Excellent attention to detail and accuracy

- Proficient in using tax software and preparing various tax returns

- Ability to handle multiple tasks and meet deadlines

- Good communication and interpersonal skills

Weaknesses:

- Limited experience with complex tax issues (willingness to learn and grow)

- Working on tight deadlines can sometimes lead to stress

6. How do you stay up-to-date with changes in tax laws and regulations?

To stay up-to-date with changes in tax laws and regulations, I:

- Regularly review tax publications and newsletters.

- Attend tax seminars and webinars.

- Consult with tax professionals and industry experts.

- Monitor the IRS website and other official sources for updates.

7. What is the importance of maintaining confidentiality when handling taxpayer information?

Maintaining confidentiality when handling taxpayer information is of utmost importance for the following reasons:

- Protects taxpayer privacy: Taxpayer information contains sensitive personal and financial data that must be kept confidential.

- Ensures compliance with laws and regulations: Tax laws and ethical guidelines require tax professionals to maintain confidentiality.

- Builds trust with taxpayers: Taxpayers trust tax professionals to handle their information responsibly, which is essential for maintaining a positive relationship.

- Prevents misuse and fraud: Safeguarding taxpayer information helps prevent it from falling into the wrong hands and being used for illegal purposes.

8. Can you explain the concept of depreciation and its application in tax calculations?

Depreciation is a tax deduction that allows businesses to recover the cost of certain assets, such as property, equipment, and vehicles, over their useful lives. By spreading the cost of these assets over multiple years, businesses can reduce their taxable income and potentially save on taxes.

The amount of depreciation that a business can claim each year is determined by the asset’s cost, its estimated useful life, and the depreciation method used.

9. What is the difference between a tax audit and a tax review?

Tax Audit

- In-depth examination of a taxpayer’s tax return and supporting documents.

- Conducted by the IRS or state tax agencies.

- May involve requests for additional information, interviews, and financial statement analysis.

- Can result in adjustments to tax liability, penalties, and interest.

Tax Review

- Less comprehensive examination of a tax return.

- May be conducted by tax professionals or internal auditors.

- Typically involves a review of key areas or specific transactions.

- Aims to identify potential errors or areas of concern, but does not usually result in adjustments to tax liability.

10. How would you handle a situation where a taxpayer disagrees with your interpretation of a tax law or regulation?

If a taxpayer disagrees with my interpretation of a tax law or regulation, I would take the following steps:

- Listen attentively to the taxpayer’s concerns: Understand their perspective and the reasons for their disagreement.

- Review the relevant tax laws and regulations: Ensure my interpretation is accurate and supported by the applicable rules.

- Discuss the matter with the taxpayer: Explain my interpretation and provide evidence to support my position.

- Be willing to consider alternative interpretations: If the taxpayer presents a valid argument, I am open to considering alternative interpretations.

- Refer the taxpayer to a tax professional: If we cannot reach an agreement, I would recommend the taxpayer seek guidance from a tax attorney or CPA.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Tax Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Tax Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Tax Clerks perform a crucial role in ensuring accuracy and compliance in financial operations. Their key responsibilities include:

1. Data Entry and Verification

Accurately entering and verifying tax-related data from various sources, such as invoices, receipts, and financial statements.

2. Tax Calculation and Preparation

Calculating taxes owed based on applicable tax laws and regulations, and preparing tax returns for individuals and businesses.

3. Recordkeeping and Filing

Maintaining accurate records of tax transactions, including receipts, invoices, and tax returns, ensuring compliance with tax regulations.

4. Customer Service

Providing excellent customer service by answering tax-related inquiries, resolving issues, and assisting with tax preparation.

5. Compliance and Reporting

Keeping up-to-date with changes in tax laws and regulations, ensuring compliance and preparing tax reports for the organization.

Interview Tips

To ace your Tax Clerk interview, consider the following tips:

1. Research the Company and Industry

Thoroughly research the company, its values, and its industry to gain insights into their tax practices and expectations.

Example: Explain how your understanding of the company’s complex financial structure aligns with the role’s responsibilities.

2. Highlight Relevant Skills and Experience

Emphasize your proficiency in tax calculation, data entry, and recordkeeping, supporting your claims with specific examples from your previous roles.

Example: Describe a situation where you successfully navigated a complex tax audit, demonstrating your attention to detail and compliance expertise.

3. Demonstrate Customer Service and Communication Skills

Showcase your ability to communicate effectively, handle inquiries professionally, and build rapport with clients.

Example: Share an experience where you resolved a tax issue for a client, highlighting your empathy and problem-solving skills.

4. Stay Up-to-Date on Tax Laws and Regulations

Demonstrate your commitment to ongoing professional development by staying informed about recent changes in tax laws and regulations.

Example: Discuss a recent tax law update and its potential impact on the company’s tax strategy.

5. Prepare Questions for the Interviewer

Asking thoughtful questions shows your engagement and interest in the role. Consider questions about the company’s tax strategy, growth plans, or opportunities for professional development.

Example: Request insights into the company’s approach to tax optimization and how the Tax Clerk role contributes to that strategy.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Tax Clerk, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Tax Clerk positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.