Are you gearing up for an interview for a Tax Collection Coordinator position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Tax Collection Coordinator and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

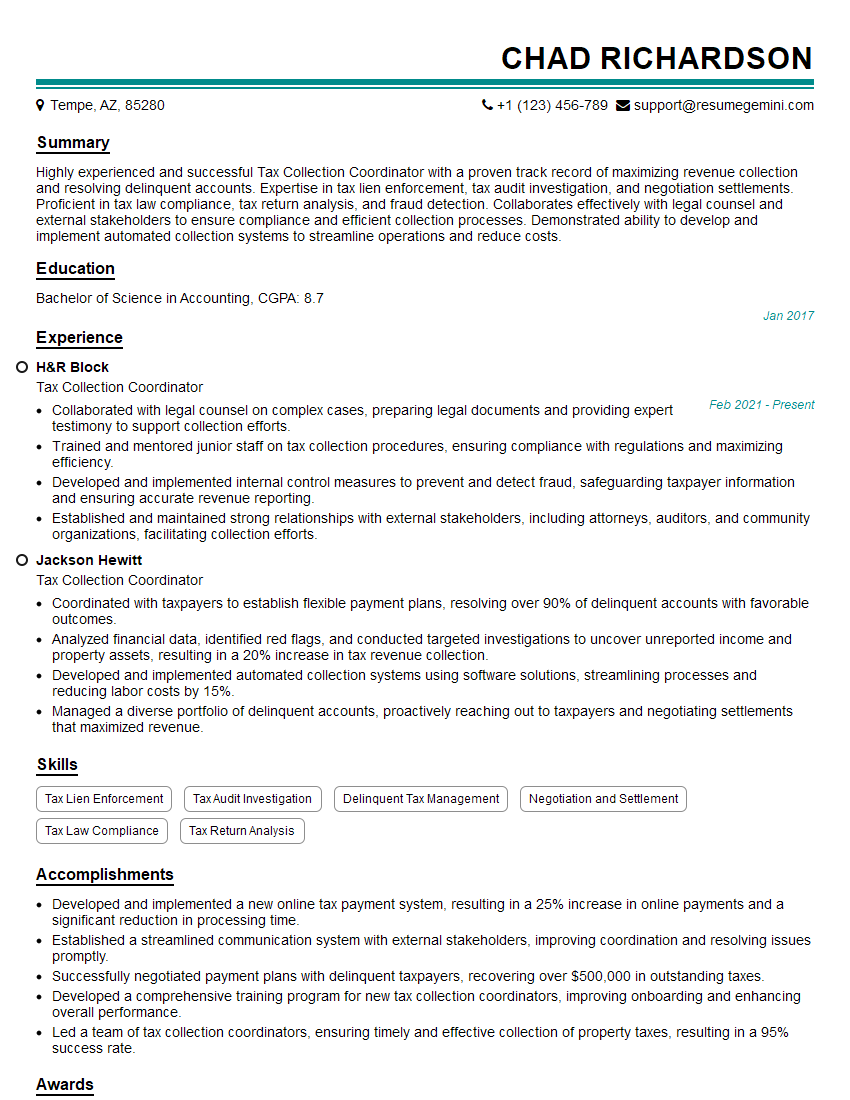

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Tax Collection Coordinator

1. What is the difference between a tax lien and a tax levy?

A tax lien is a legal claim against your property that gives the government the right to seize and sell it if you don’t pay your taxes. A tax levy is an actual seizure of your property by the government to satisfy a tax debt.

2. What are the different types of taxes that individuals and businesses must pay?

Federal taxes

- Income tax

- Payroll taxes

- Excise taxes

State taxes

- Income tax

- Sales tax

- Property tax

Local taxes

- Property tax

- Sales tax

- Occupation tax

3. What are the qualifications for working as a Tax Collection Coordinator?

- Associate’s or bachelor’s degree in accounting, finance, or a related field

- 2-4 years of experience in tax accounting or collection

- Strong knowledge of tax laws and regulations

- Excellent communication and interpersonal skills

- Ability to work independently and as part of a team

4. What are the key responsibilities of a Tax Collection Coordinator?

- Review and process tax returns

- Resolve tax disputes

- Collect delinquent taxes

- Prepare and file tax liens and levies

- Maintain accurate records of tax collections

5. What are the challenges of working as a Tax Collection Coordinator?

- Dealing with taxpayers who are uncooperative or hostile

- Enforcing tax laws and regulations that can be complex and confusing

- Keeping up with changes in tax laws and regulations

- Balancing the need to collect taxes with the need to provide customer service

6. What is your favorite thing about working as a Tax Collection Coordinator?

I enjoy the challenge of helping taxpayers understand their tax obligations and resolving their tax disputes. I also appreciate the opportunity to make a positive impact on the community by ensuring that taxes are collected fairly and efficiently.

7. What is your least favorite thing about working as a Tax Collection Coordinator?

The most challenging part of the job can be dealing with taxpayers who are uncooperative or hostile. It can be frustrating to try to help someone who is not willing to help themselves.

8. What is your proudest accomplishment as a Tax Collection Coordinator?

I am most proud of the time I was able to help a taxpayer who was facing a large tax debt. I was able to work with the taxpayer to develop a payment plan that allowed them to pay off their debt over time. This was a great relief to the taxpayer, and I was happy to be able to help them.

9. What is your biggest pet peeve as a Tax Collection Coordinator?

My biggest pet peeve is when taxpayers do not file their tax returns on time. This can cause a lot of problems, including penalties and interest charges. I encourage all taxpayers to file their returns on time to avoid these problems.

10. What are your career goals?

My career goal is to become a Tax Manager. I would like to continue to develop my skills and knowledge in tax accounting and collection. I believe that my experience as a Tax Collection Coordinator has given me a strong foundation for a successful career in tax management.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Tax Collection Coordinator.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Tax Collection Coordinator‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Tax Collection Coordinators are responsible for managing the collection of taxes, ensuring that all taxes are paid on time and in full. They work closely with taxpayers, accountants, and other stakeholders to resolve any issues or concerns related to tax collection.

1. Manage Tax Collection Process

Coordinators oversee the entire tax collection process, from initial billing to final payment. They ensure that all tax payments are processed accurately and on time.

- Review and process tax returns, ensuring accuracy and completeness.

- Calculate and issue tax bills.

- Manage taxpayer accounts, including tracking payments and resolving discrepancies.

2. Communicate with Taxpayers and Stakeholders

Coordinators act as the primary point of contact for taxpayers and stakeholders. They provide information, answer questions, and resolve any issues or concerns.

- Respond to taxpayer inquiries and provide guidance on tax-related matters.

- Negotiate payment plans and settlement agreements with taxpayers.

- Collaborate with accountants, attorneys, and other professionals to resolve complex tax issues.

3. Enforce Tax Laws

Coordinators are responsible for enforcing tax laws and ensuring compliance. They may need to take action against taxpayers who fail to pay their taxes or who violate tax laws.

- Investigate cases of tax fraud or evasion.

- Impose penalties or take legal action against non-compliant taxpayers.

4. Maintain Tax Records

Coordinators maintain accurate and up-to-date tax records. This includes keeping track of all tax payments, taxpayer accounts, and correspondence.

- Maintain electronic and paper records of tax-related transactions.

- Prepare reports and summaries on tax collection activities.

Interview Tips

Preparing for an interview for a Tax Collection Coordinator position requires thorough knowledge of the job responsibilities and industry-specific skills.

1. Research the Position

Familiarize yourself with the specific responsibilities of the role and the organization you are applying to. Visit the company website, read job descriptions, and research the industry to gain a clear understanding of the expectations.

- Identify the key skills and qualifications required for the position.

- Tailor your resume and cover letter to highlight your relevant experience and abilities.

2. Practice Common Interview Questions

Prepare for common interview questions related to tax collection, such as:

- “Can you describe your experience in managing tax collection processes?”

- “How do you handle challenging taxpayers or complex tax issues?”

- “What are your strategies for enforcing tax laws and ensuring compliance?”

3. Emphasize Your Communication and Interpersonal Skills

Highlight your ability to effectively communicate with taxpayers, accountants, and other stakeholders. Showcase your strong interpersonal skills and ability to build rapport and resolve conflicts.

- Provide examples of successful interactions with taxpayers.

- Explain how you negotiate and reach agreements with individuals from diverse backgrounds.

4. Showcase Your Knowledge of Tax Laws and Regulations

Demonstrate your understanding of tax laws and regulations. Be prepared to discuss specific tax codes or provisions relevant to the position.

- Provide examples of how you have applied your knowledge to resolve tax-related issues.

- Stay up-to-date on recent tax law changes and industry trends.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Tax Collection Coordinator role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.