Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Tax Collector interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Tax Collector so you can tailor your answers to impress potential employers.

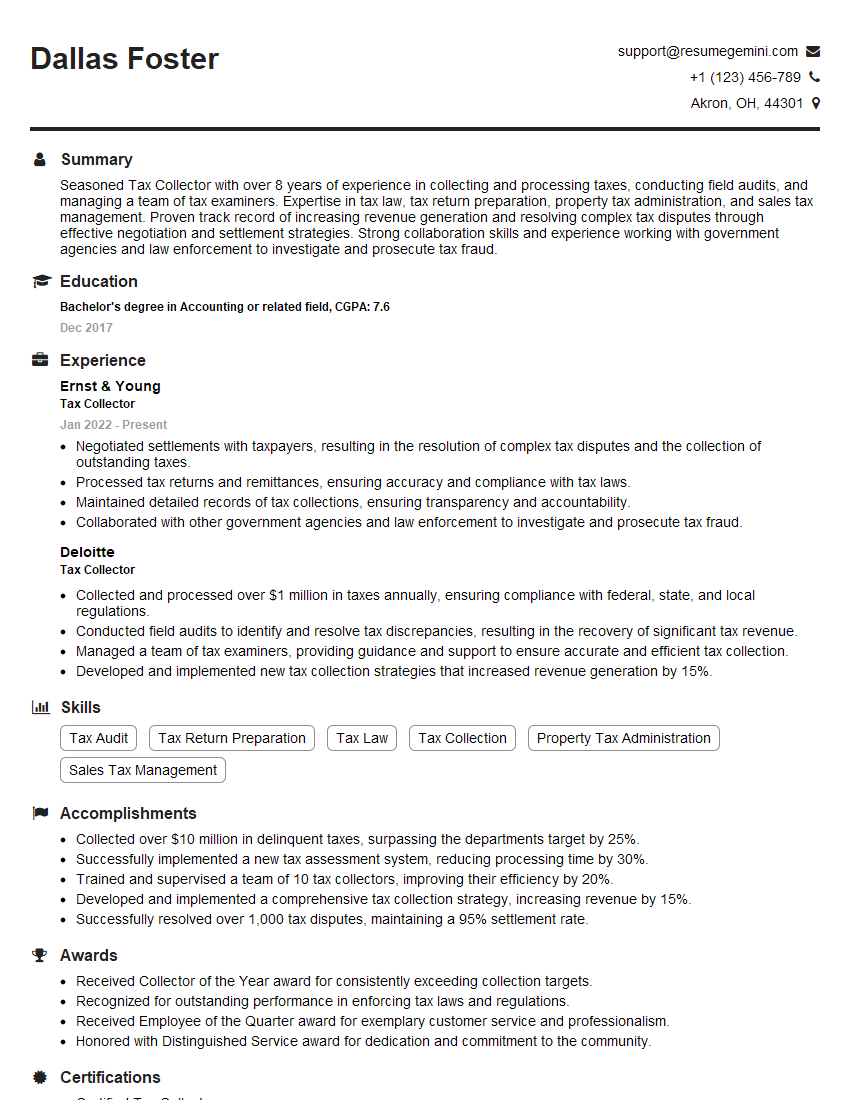

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Tax Collector

1. Explain the process of tax collection in your jurisdiction, including the steps involved in processing tax returns and issuing refunds.

- The tax collection process typically involves the following steps:

- Taxpayers file their tax returns with the tax authority, reporting their income, deductions, and credits.

- The tax authority processes the returns and calculates the amount of tax owed.

- Taxpayers pay the tax owed or receive a refund if they have overpaid.

- The tax authority may conduct audits to ensure that taxpayers are complying with the tax laws.

2. What are the common challenges faced by tax collectors and how do you overcome them?

Maintaining accurate records

- Tax collectors must maintain accurate records of all tax payments and refunds.

- This can be challenging, as there are a large number of taxpayers and transactions.

- To overcome this challenge, tax collectors use computerized systems to track payments and refunds.

Enforcing tax laws

- Tax collectors are responsible for enforcing tax laws.

- This can be challenging, as some taxpayers may try to avoid paying taxes.

- To overcome this challenge, tax collectors use a variety of tools, such as audits and collections.

3. How do you stay up-to-date on changes in tax laws and regulations?

- I stay up-to-date on changes in tax laws and regulations by reading professional journals and attending training courses.

- I also regularly consult with other tax professionals to share information and best practices.

- In addition, I am a member of several professional organizations that provide me with access to resources and training opportunities.

4. Describe your experience in using tax software and technology to process tax returns.

- I have extensive experience using tax software and technology to process tax returns.

- I am proficient in using a variety of tax software programs, including [list of software programs].

- I also have experience using technology to research tax issues and to communicate with taxpayers.

5. What is your understanding of tax exemptions and deductions, and how do you apply them when processing tax returns?

- Tax exemptions and deductions are two important ways to reduce your taxable income.

- Exemptions are a specific dollar amount that you can subtract from your income before you calculate your taxes.

- Deductions are expenses that you can subtract from your income before you calculate your taxes.

- There are many different types of exemptions and deductions, and the specific ones that you can claim will depend on your individual circumstances.

- When processing tax returns, I carefully review the taxpayer’s information to determine which exemptions and deductions they are eligible to claim.

- I also use tax software to help me calculate the taxpayer’s tax liability.

6. How do you handle situations where taxpayers owe back taxes?

- When a taxpayer owes back taxes, I first try to contact them to discuss their options.

- I explain the amount of taxes that they owe and the penalties and interest that may be due.

- I also discuss the different payment options that are available.

- If the taxpayer is unable to pay the full amount of taxes owed, I may work with them to set up a payment plan.

- In some cases, I may refer the taxpayer to a tax relief program.

7. What is your experience with tax audits, and how do you prepare for them?

- I have experience with both internal and external tax audits.

- In preparation for an audit, I gather all of the necessary documentation and review the taxpayer’s tax return.

- I also research the relevant tax laws and regulations.

- During the audit, I answer the auditor’s questions and provide them with the requested documentation.

- After the audit, I review the auditor’s findings and prepare a response.

8. How do you build and maintain strong relationships with taxpayers?

- I build and maintain strong relationships with taxpayers by being professional, courteous, and responsive.

- I also try to understand the taxpayer’s individual circumstances and to provide them with the best possible service.

- I am always willing to answer questions and to help taxpayers resolve any issues that they may have.

9. What is your understanding of the ethical responsibilities of a tax collector?

- As a tax collector, I have a responsibility to uphold the highest ethical standards.

- This includes being honest, fair, and impartial in all of my dealings with taxpayers.

- I also have a responsibility to protect taxpayer confidentiality.

- I am committed to following all applicable laws and regulations.

10. Why are you interested in this position, and what do you think you can bring to our team?

- I am interested in this position because I am passionate about public service.

- I believe that as tax collector, I can make a real difference in the lives of taxpayers, assisting them to meet their tax obligations with easy.

- I am a highly motivated and results-oriented individual with a strong work ethic.

- I am also a team player and I am confident that I can make a positive contribution to your team.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Tax Collector.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Tax Collector‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Tax Collectors play a crucial role in ensuring the efficient functioning of any government or organization by collecting taxes from individuals and businesses. This role demands a high level of accuracy and integrity, along with strong communication and interpersonal skills. Here are the key job responsibilities of a Tax Collector:

1. Tax Collection and Processing

Collects various types of taxes, such as income tax, property tax, sales tax, and other levies, from individuals and businesses.

- Examines financial records, tax returns, and other documents to ensure accuracy and compliance with tax laws.

- Issues tax bills, notices, and reminders to taxpayers and maintains detailed records of all payments.

2. Taxpayer Assistance and Education

Provides assistance and guidance to taxpayers regarding tax laws, regulations, and filing procedures.

- Answers inquiries from taxpayers via phone, email, or in person, resolving their queries and explaining tax policies.

- Develops and delivers educational materials to enhance taxpayer understanding of their tax obligations.

3. Compliance Enforcement

Monitors taxpayer activities and investigates suspected cases of tax evasion or fraud.

- Conducts audits, inspections, and investigations to verify the accuracy of tax returns and compliance with tax laws.

- Imposes penalties and fines on taxpayers who fail to meet their tax obligations or engage in illegal practices.

4. Data Management and Reporting

Maintains accurate and up-to-date tax records, including taxpayer information, payments, and enforcement actions.

- Prepares and submits regular reports on tax collections, compliance activities, and any relevant trends or issues.

- Utilizes specialized software and systems to manage tax data and facilitate efficient operations.

Interview Tips

To help candidates ace their Tax Collector interview, here are some crucial tips and preparation hacks:

1. Research the Organization and Position

Thoroughly research the government agency or organization you are applying to, including its mission, values, and the specific department or division where the Tax Collector position is located.

- Visit the organization’s website to gather information about its tax collection practices, any recent initiatives, or any specific areas of focus in tax compliance or enforcement.

- Review the job description carefully to identify the key responsibilities, qualifications, and any preferred skills or experience required for the role.

2. Highlight Relevant Experience and Skills

In your resume and during the interview, emphasize your relevant experience and skills that align with the key job responsibilities of a Tax Collector.

- Showcase your experience in tax collection, auditing, compliance enforcement, or taxpayer assistance.

- Highlight your proficiency in tax laws and regulations, as well as your experience in interpreting and applying them in practical situations.

- Demonstrate your strong communication, interpersonal, and analytical skills, as these are essential qualities for effective tax collection and taxpayer interactions.

3. Practice Answering Common Interview Questions

Prepare for common interview questions related to the Tax Collector role by practicing your responses.

- Describe your experience in tax collection and enforcement, and provide specific examples of how you have successfully resolved tax compliance issues.

- Explain how you would handle a situation where a taxpayer is resistant or evasive in providing information or making payments.

- Discuss your understanding of the latest tax laws and regulations, and how you stay updated with changes in the tax code.

4. Demonstrate Your Commitment to Accuracy and Ethics

Emphasize your commitment to accuracy, integrity, and ethical conduct in all aspects of your work.

- Explain how you maintain confidentiality and protect sensitive taxpayer information.

- Discuss your understanding of the ethical obligations of a Tax Collector and how you would handle potential conflicts of interest.

5. Be Prepared to Discuss Your Career Goals

Be prepared to discuss your career goals and how the Tax Collector position aligns with your long-term aspirations.

- Explain how your skills and experience make you a suitable candidate for the role and how you intend to contribute to the organization’s tax collection efforts.

- Express your interest in professional development opportunities and how you plan to enhance your knowledge and expertise in the field of taxation.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Tax Collector role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.