Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Tax Compliance Officer position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

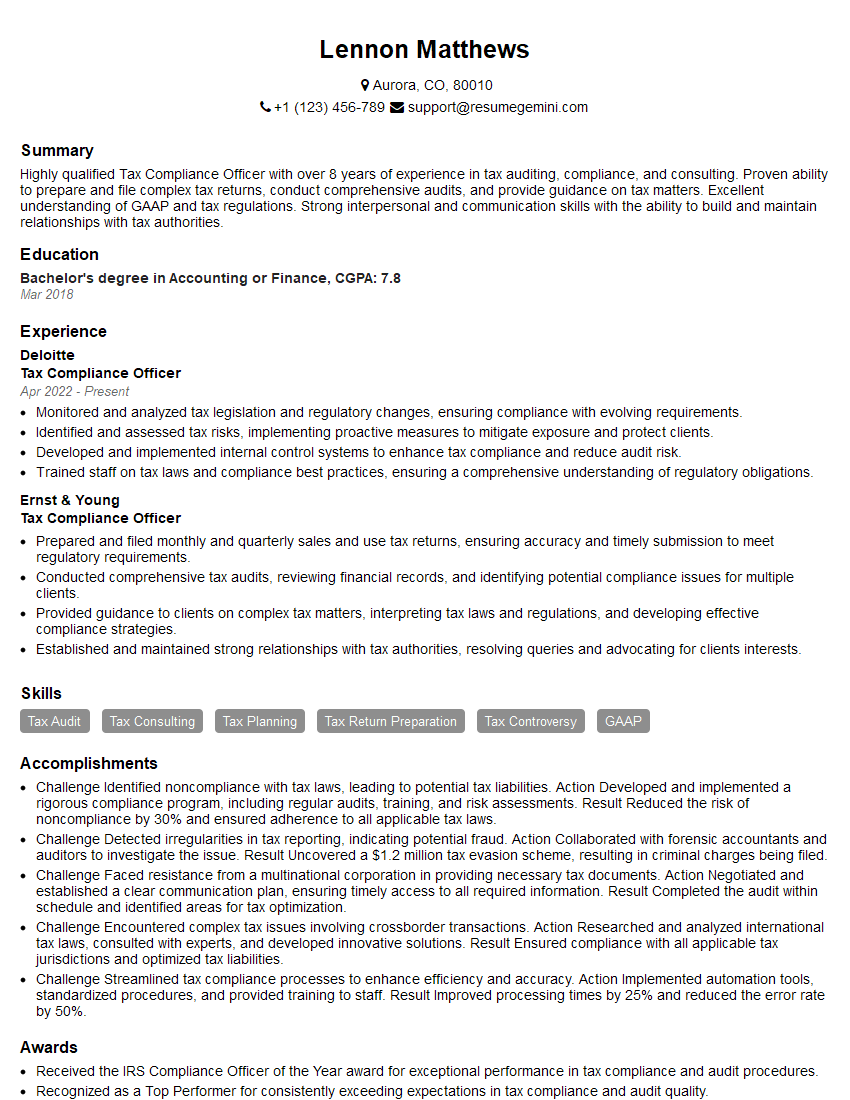

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Tax Compliance Officer

1. Explain the key responsibilities of a Tax Compliance Officer?

As a Tax Compliance Officer, I am responsible for ensuring that the organization adheres to all applicable tax regulations and reporting requirements. This includes:

- Preparing and filing tax returns

- Auditing tax records

- Providing advice on tax matters

- Representing the organization in tax audits

- Developing and implementing tax compliance policies and procedures

2. Describe the different types of taxes that organizations are required to pay?

Federal Taxes

- Income tax

- Payroll tax

- Sales tax

- Excise tax

State and Local Taxes

- Income tax

- Sales tax

- Property tax

3. What are the common tax planning strategies that organizations use?

- Deferring income

- Accelerating deductions

- Claiming tax credits

- Utilizing tax-exempt entities

4. What are the potential consequences of non-compliance with tax laws?

- Penalties

- Interest

- Jail time

- Loss of business license

5. What are the key skills and qualifications that are required for a Tax Compliance Officer?

- Bachelor’s degree in accounting or taxation

- CPA or EA certification

- Strong knowledge of tax laws and regulations

- Excellent communication and interpersonal skills

- Experience in tax compliance

6. How do you stay up-to-date on the latest tax laws and regulations?

- Attend conferences and seminars

- Read tax journals and publications

- Participate in online forums and discussion groups

7. What are the ethical considerations that Tax Compliance Officers must be aware of?

- Confidentiality

- Independence

- Objectivity

8. How do you handle a situation where you are asked to do something that you believe is unethical?

- Discuss the issue with your supervisor

- Seek guidance from a professional organization

- Report the issue to the appropriate authorities

9. What are the challenges that you face as a Tax Compliance Officer?

- The ever-changing tax landscape

- The need to stay up-to-date on the latest laws and regulations

- The pressure to meet deadlines

- The need to balance compliance with the need to minimize tax liability

10. What are your career goals?

- I would like to continue to develop my knowledge and skills in the field of tax compliance

- I am interested in eventually becoming a Tax Manager or Tax Director

- I am also interested in becoming a Certified Public Accountant (CPA)

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Tax Compliance Officer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Tax Compliance Officer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Tax Compliance Officers are responsible for ensuring that their organization meets all applicable tax laws and regulations. This involves a wide range of duties, including:

1. Tax Compliance Planning

Developing and implementing tax compliance plans to minimize tax liabilities and ensure compliance with tax laws.

- Reviewing and interpreting tax laws and regulations.

- Identifying and assessing tax risks.

2. Tax Return Preparation

Preparing and filing tax returns for the organization, including income tax returns, sales tax returns, and payroll tax returns.

- Gathering and analyzing financial data.

- Calculating tax liabilities.

3. Tax Audits

Responding to tax audits from federal, state, and local tax authorities.

- Preparing and presenting documentation to support the organization’s tax positions.

- Negotiating with tax authorities to resolve tax disputes.

4. Tax Training

Providing training to employees on tax-related matters.

- Developing and delivering training materials.

- Answering questions and providing guidance on tax-related issues.

Interview Tips

Here are some tips and hacks to help you ace your interview for a Tax Compliance Officer position:

1. Research the Company and the Position

Take the time to learn about the company you’re applying to and the specific position you’re interviewing for. This will help you understand the company’s culture, tax compliance needs, and the key responsibilities of the position.

- Visit the company’s website.

- Read the job description carefully.

- Talk to people in your network who work in the industry.

2. Highlight Your Relevant Experience

In your interview, be sure to highlight your relevant experience in tax compliance. This could include experience in:

- Preparing and filing tax returns.

- Responding to tax audits.

- Providing tax training.

3. Demonstrate Your Knowledge of Tax Laws and Regulations

Tax Compliance Officers need to have a strong understanding of tax laws and regulations. In your interview, be prepared to discuss your knowledge of these laws and regulations. You should also be able to explain how you stay up-to-date on changes in tax laws and regulations.

- Read tax journals and articles.

- Attend tax conferences and seminars.

- Get certified in tax compliance.

4. Be Prepared to Answer Behavioral Questions

Behavioral questions are common in interviews for Tax Compliance Officer positions. These questions are designed to assess your skills and abilities in specific situations. In your interview, be prepared to answer questions about your experience in:

- Working with others.

- Solving problems.

- Managing your time.

5. Ask Thoughtful Questions

At the end of your interview, be sure to ask the interviewer some thoughtful questions. This will show that you’re interested in the position and the company. It will also give you an opportunity to learn more about the company and the role.

- What are the biggest challenges facing the company in terms of tax compliance?

- What are the company’s goals for tax compliance in the next year?

- What opportunities are there for professional development in the company?

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Tax Compliance Officer role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.