Are you gearing up for a career in Tax Consultant? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Tax Consultant and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

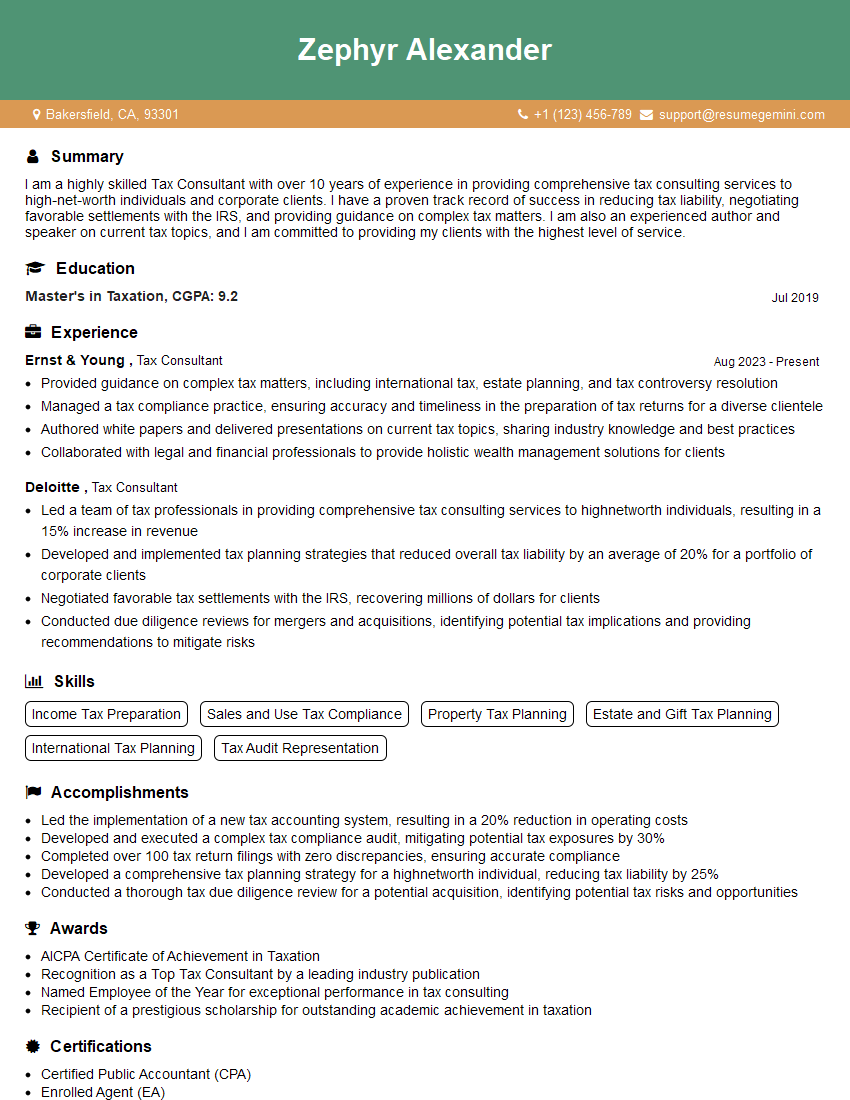

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Tax Consultant

1. Explain the concept of Transfer Pricing and its significance in multinational corporations?

Transfer pricing is the setting of prices for goods and services that are transferred between different divisions or subsidiaries of a multinational corporation (MNC). It is a complex and challenging task, as it must be done in a way that is both fair to all parties involved and that complies with tax laws and regulations in all of the jurisdictions in which the MNC operates.

There are a number of different methods that can be used to set transfer prices, and the choice of method will depend on a number of factors, including the nature of the goods or services being transferred, the level of integration between the different divisions or subsidiaries, and the tax laws and regulations in the relevant jurisdictions.

Transfer pricing can be used to achieve a number of different objectives, including:

- Minimizing the overall tax liability of the MNC

- Shifting profits from high-tax jurisdictions to low-tax jurisdictions

- Encouraging or discouraging certain activities within the MNC

2. Describe the role of a Tax Consultant in the context of international taxation?

Technical Expertise

- In-depth understanding of domestic and international tax laws and regulations

- Expert knowledge of tax treaties and their interpretation

- Strong analytical and problem-solving skills

Advisory and Compliance Services

- Providing advice on cross-border transactions and tax planning strategies

- Assisting clients with tax compliance obligations in multiple jurisdictions

- Representing clients before tax authorities during audits and disputes

Collaboration and Communication

- Working closely with clients to understand their business operations and tax needs

- Collaborating with other professionals, such as accountants and lawyers, to provide comprehensive tax solutions

- Effectively communicating complex tax concepts and strategies to clients and stakeholders

3. Discuss the recent developments in the taxation of digital services?

The taxation of digital services is a complex and rapidly evolving area. In recent years, there has been a growing consensus among policymakers that the current international tax rules are not adequate to address the challenges posed by the digital economy.

One of the key challenges is the fact that digital businesses often operate on a global scale, but do not have a physical presence in many of the countries in which they operate. This makes it difficult for tax authorities to collect taxes from these businesses.

Another challenge is the fact that digital businesses often rely on intangible assets, such as data and intellectual property. These assets can be difficult to value, which makes it difficult to determine how much tax should be paid on them.

In response to these challenges, a number of countries have introduced new tax rules for digital services. These rules vary from country to country, but they generally involve some form of withholding tax on payments made to digital businesses.

The Organization for Economic Co-operation and Development (OECD) is also working on developing a global solution to the taxation of digital services. In 2021, the OECD released a set of proposals for a new global tax framework. These proposals are currently being negotiated by countries around the world.

4. How do you stay up-to-date on the latest tax laws and regulations?

In order to provide the best possible service to my clients, it is essential that I stay up-to-date on the latest tax laws and regulations. I do this through a variety of means, including:

- Attending conferences and webinars

- Reading tax journals and articles

- Taking continuing education courses

- Networking with other tax professionals

I also make it a point to stay informed about current events and economic trends, as these can often have a significant impact on tax laws and regulations.

5. What are some of the most common tax planning strategies that you use for your clients?

The specific tax planning strategies that I use for my clients will vary depending on their individual circumstances. However, some of the most common strategies include:

- Tax-efficient investment strategies

- Retirement planning

- Estate planning

- Business succession planning

- International tax planning

I always take a holistic approach to tax planning, considering all of my client’s financial and personal goals. My goal is to help my clients minimize their tax liability while also helping them achieve their financial objectives.

6. What is your experience with tax audits?

I have experience with both federal and state tax audits. In my experience, it is important to be well-prepared for an audit and to have a clear understanding of the tax laws and regulations that apply to your situation.

During an audit, I work closely with my clients to gather the necessary documentation and to prepare their responses to the auditor’s questions. I also represent my clients at audit hearings and negotiations.

7. What are your strengths and weaknesses as a Tax Consultant?

My strengths as a Tax Consultant include my:

- In-depth knowledge of tax laws and regulations

- Strong analytical and problem-solving skills

- Ability to communicate complex tax concepts clearly and effectively

- Dedication to providing excellent client service

My weakness is that I am relatively new to the field of tax consulting. However, I am eager to learn and grow, and I am confident that I can quickly develop the experience and skills necessary to be successful in this role.

8. Why are you interested in working as a Tax Consultant for our firm?

I am interested in working as a Tax Consultant for your firm because I am impressed by your firm’s reputation for providing high-quality tax services to its clients. I am also attracted to your firm’s commitment to professional development and growth.

I believe that my skills and experience would be a valuable asset to your firm. I am confident that I can quickly become a productive member of your team and help you provide your clients with the best possible tax services.

9. What are your salary expectations?

My salary expectations are in line with the market rate for Tax Consultants with my level of experience and qualifications. I am willing to negotiate a salary that is fair and competitive.

10. Do you have any questions for me?

I do have a few questions for you:

- What is the firm’s culture like?

- What are the opportunities for professional development within the firm?

- What is the firm’s commitment to diversity and inclusion?

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Tax Consultant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Tax Consultant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Tax Consultants are highly skilled professionals who provide expert advice and guidance on tax-related matters. They play a crucial role in helping businesses and individuals navigate complex tax laws and regulations, ensuring compliance and optimizing tax strategies.

1. Tax Planning and Compliance

Analyze tax laws and regulations to identify potential tax-saving opportunities and minimize tax liabilities.

- Develop and implement comprehensive tax plans for individuals, businesses, and organizations.

- Provide guidance on tax-efficient business structures, investment strategies, and estate planning.

2. Tax Return Preparation and Representation

Prepare and file various tax returns for individuals, businesses, and non-profit organizations.

- Represent clients before tax authorities during audits and in resolving tax disputes.

- Negotiate with tax authorities to secure favorable settlements and minimize tax liabilities.

3. Tax Research and Advisory

Conduct in-depth research on tax laws, regulations, and case precedents to provide expert advice.

- Draft tax advisory opinions and reports on complex tax issues affecting businesses and individuals.

- Stay abreast of the latest tax developments and legislative changes to provide up-to-date guidance to clients.

4. Client Management and Communication

Build and maintain strong relationships with clients by providing personalized tax consulting services.

- Effectively communicate complex tax concepts and strategies to clients in a clear and understandable manner.

- Manage client expectations and provide proactive updates on tax-related matters.

Interview Tips

Preparing for an interview for a Tax Consultant position requires a combination of technical expertise, industry knowledge, and effective communication skills. Here are some tips to help you ace your interview:

1. Master the Technical Jargon

Ensure you have a solid understanding of tax laws, regulations, and accounting principles.

- Familiarize yourself with the specific tax codes and precedents relevant to the industry.

- Brush up on your knowledge of tax preparation software and tools.

2. Showcase Your Problem-Solving Abilities

Tax Consultants are often faced with complex tax issues that require creative solutions.

- Prepare examples of how you have successfully resolved challenging tax problems in the past.

- Demonstrate your analytical thinking and problem-solving skills through case studies or hypothetical scenarios.

3. Highlight Your Communication and Interpersonal Skills

Effective communication is essential for Tax Consultants who need to convey complex tax information to clients.

- Practice presenting your tax knowledge and advice in a clear and concise manner.

- Demonstrate your ability to build rapport and maintain positive relationships with clients.

4. Research the Company and Industry

Show the interviewer that you have taken the time to learn about their company and the industry.

- Visit the company’s website, read industry news, and follow relevant professionals on social media.

- Prepare specific questions about the company’s tax practices and challenges.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Tax Consultant interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!