Are you gearing up for an interview for a Tax Economist position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Tax Economist and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

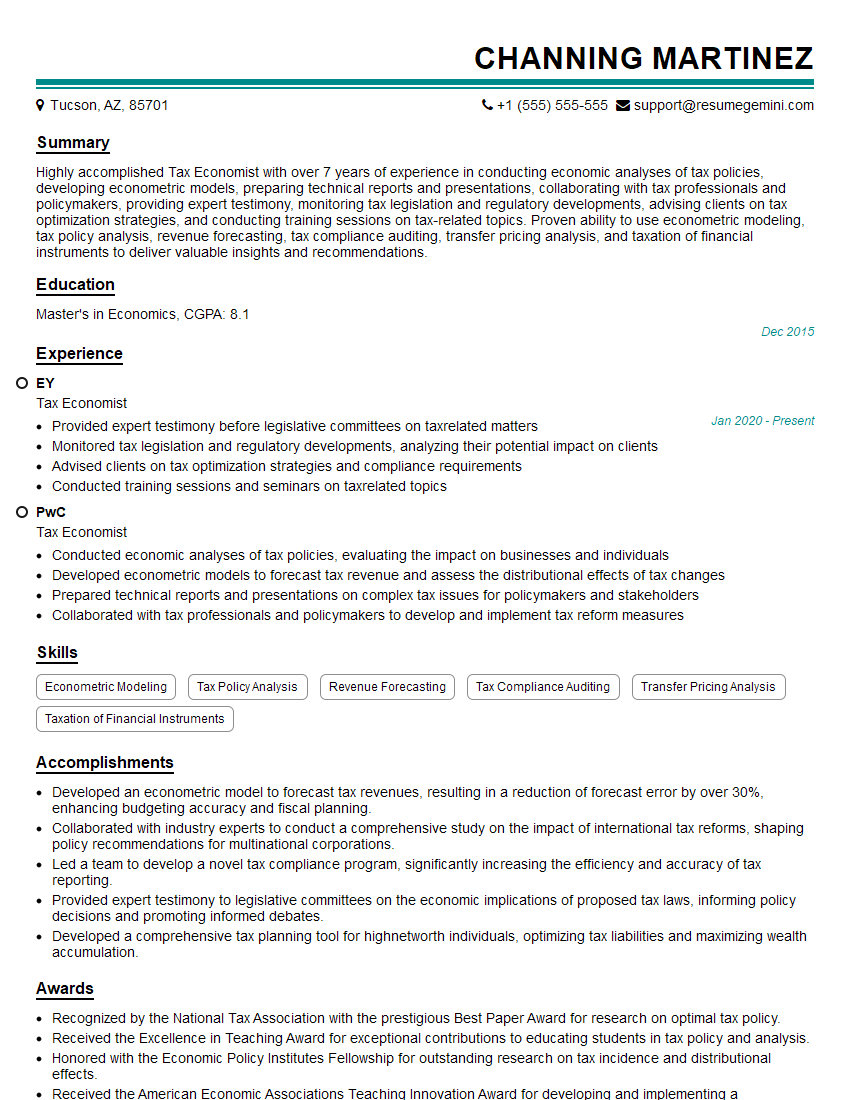

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Tax Economist

1. Explain the concept of tax incidence and discuss its relevance in tax policy analysis?

Tax incidence refers to the ultimate distribution of the burden of a tax across different individuals or groups within an economy. It is important in tax policy analysis as it helps policymakers understand who actually bears the cost of a tax and how it affects their behavior. Factors that determine tax incidence include elasticity of demand and supply, market structure, and the ability of individuals to shift the tax burden to others.

2. How would you assess the impact of a carbon tax on the economy?

Impact on Economic Efficiency

- Carbon tax internalizes the negative externalities of carbon emissions, leading to a more efficient allocation of resources.

- It encourages businesses and consumers to reduce their carbon footprint by investing in cleaner technologies and consuming less carbon-intensive goods.

Impact on Economic Growth

- Short-term costs associated with transitioning to a low-carbon economy may slow economic growth in the short run.

- However, the long-term benefits of reduced pollution and climate change mitigation can contribute to sustained economic growth.

3. Describe the different methods used to measure the elasticity of demand for cigarettes?

- Own-Price Elasticity: Measures the responsiveness of cigarette demand to changes in its own price.

- Cross-Price Elasticity: Measures the responsiveness of cigarette demand to changes in the price of substitute or complementary goods (e.g., tobacco products).

- Income Elasticity: Measures the responsiveness of cigarette demand to changes in consumer income.

- Time-Series Analysis: Uses historical data to estimate the relationship between cigarette prices and consumption over time.

- Econometric Modeling: Employs statistical models to estimate demand elasticity from cross-sectional or time-series data.

4. Discuss the role of tax incentives in encouraging investment and innovation?

- Tax Credits: Direct subsidies that reduce the cost of investment in specific areas, such as research and development.

- Tax Deductions: Allow businesses to deduct certain expenses from their taxable income, providing incentives for investments.

- Accelerated Depreciation: Allows businesses to write off capital expenses more quickly, reducing the upfront cost of investments.

- Patent Exemptions: Reduce the tax burden on revenue generated from patented innovations.

- Special Economic Zones: Offer reduced tax rates or exemptions to attract investment in specific geographic areas.

5. How would you analyze the regressivity or progressivity of a tax system?

- Calculate the effective tax rate for different income groups by dividing the total tax paid by the total income.

- Lorenz Curve: Graphical representation that shows the cumulative distribution of income and tax payments.

- Gini Coefficient: Numerical measure of inequality, ranging from 0 (perfect equality) to 1 (perfect inequality).

- Effective Marginal Tax Rate: The increase in taxes paid as a percentage of the increase in income.

6. Explain the concept of tax avoidance and tax evasion and discuss the measures that can be taken to address them?

Tax Avoidance: Legal means of reducing tax liability by exploiting loopholes or deductions.

Tax Evasion: Illegal activities such as underreporting income or falsifying tax returns.

- Strengthening Tax Enforcement: Increasing audits, penalties, and prosecution for tax evasion.

- Closing Loopholes: Revising tax laws to eliminate opportunities for avoidance.

- Tax Education: Raising awareness about tax obligations and the consequences of non-compliance.

- International Cooperation: Sharing information and coordinating efforts to combat cross-border tax evasion.

7. Describe the key features of a consumption tax and discuss its advantages and disadvantages?

-

Features of a Consumption Tax:

- Levies a tax on the consumption of goods and services.

- Typically implemented as a value-added tax (VAT) or sales tax. Advantages:

- Promotes economic efficiency by shifting the tax burden from investment and savings to consumption.

- Can be more difficult to evade than income tax. Disadvantages:

- Can be regressive, disproportionately impacting lower-income households.

- May reduce incentives for saving and investment.

8. Explain how behavioral economics can be applied to tax policy design?

- Identify and address cognitive biases and heuristics that influence taxpayer behavior.

- Design tax policies that make it easier for individuals to comply with tax laws.

- Use nudges and other behavioral interventions to encourage tax compliance and responsible financial decision-making.

9. Describe the different types of tax models and discuss their strengths and limitations?

-

Computable General Equilibrium (CGE) Models:

- Simulate the entire economy to assess the macroeconomic effects of tax changes. Strengths: Captures interactions between different sectors and agents. Limitations: Complex and data-intensive. Partial Equilibrium Models:

- Focus on a specific market or sector to analyze the effects of tax changes. Strengths: Simpler and less data-intensive. Limitations: Do not capture economy-wide effects.

10. Explain how you would approach the task of reforming a country’s tax system?

- Assess the current system: Identify inefficiencies, inequities, and compliance issues.

- Set clear objectives: Define the desired outcomes of the reform, such as improving fairness, boosting economic growth.

- Consider various options: Explore different tax policies and their potential impact using tax models and economic analysis.

- Engage with stakeholders: Consult with representatives from businesses, taxpayers, and government agencies to gather input and address concerns.

- Implement and evaluate: Phase in tax reforms gradually and monitor their effects to make necessary adjustments.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Tax Economist.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Tax Economist‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Tax economists bridge the gap between economics and taxation by conducting research and analysis to inform policy decisions.

1. Research and Analysis

Conduct in-depth research on tax policies, their effects on the economy, and the behavior of taxpayers.

- Estimate the economic impact of proposed tax changes using econometric models and other analytical techniques.

- Evaluate the effectiveness of existing tax policies in meeting their objectives.

2. Policy Analysis

Provide analysis and insights on tax policy issues to inform decision-makers, such as legislators, government agencies, and businesses.

- Identify and assess the potential economic, social, and political implications of different tax policy options.

- Develop recommendations for tax policy changes that align with economic principles and policy objectives.

3. Forecasting and Modeling

Develop and use economic models to forecast tax revenues and the impact of tax policies on economic growth, employment, and income distribution.

- Track economic trends and data, such as GDP, inflation, and unemployment rates.

- Use econometric models to simulate and predict the effects of different tax scenarios.

4. Communication and Presentation

Communicate complex economic and tax policy issues to a variety of audiences, including policymakers, the public, and the media.

- Prepare written reports, presentations, and policy briefs that clearly articulate research findings and policy recommendations.

- Engage in public speaking and participate in panels and conferences to share knowledge and insights.

Interview Tips

Preparing for a tax economist interview is essential. Here are some tips to help you ace the interview:

1. Research the Company and Position

Read the job description carefully. Understand the company’s mission, culture, and industry. Explore the company’s website and news articles to gain insights into their tax policies and business strategies.

2. Highlight Relevant Skills and Experience

Emphasize your analytical skills, research experience, and knowledge of economic and tax principles. Showcase projects where you applied econometric modeling or conducted impact assessments related to taxation.

3. Prepare for Technical Questions

Review basic economic and tax concepts. Be prepared to discuss current tax policy issues and the potential effects of tax changes. You may also be asked to solve analytical problems or interpret economic data.

4. Practice Answering Behavioral Questions

Behavioral questions assess your work style and personality. Prepare for questions about teamwork, problem-solving, and your approach to challenges. Use the STAR method (Situation, Task, Action, Result) to structure your answers.

5. Prepare Questions for the Interviewer

Asking thoughtful questions demonstrates your engagement and interest in the role. Prepare questions about the company’s tax strategy, the specific responsibilities of the position, and the opportunities for professional development.

6. Dress Professionally and Be Confident

First impressions matter. Dress appropriately for a professional setting and maintain a confident demeanor. Show enthusiasm for the role and demonstrate your commitment to making a valuable contribution.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Tax Economist, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Tax Economist positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.