Feeling lost in a sea of interview questions? Landed that dream interview for Tax Evaluator but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Tax Evaluator interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

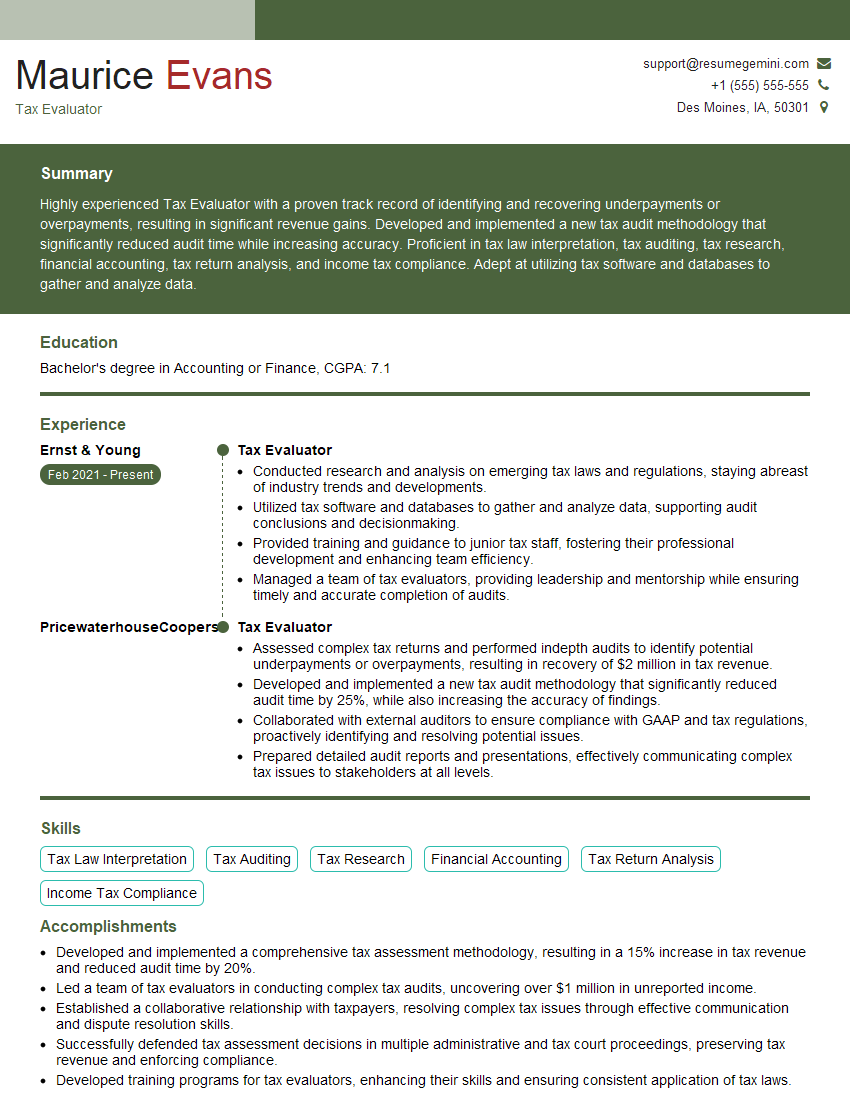

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Tax Evaluator

1. What are the different types of property taxes?

There are several types of property taxes, including:

- Ad valorem taxes, which are based on the assessed value of the property

- Specific taxes, which are based on the square footage or other specific characteristics of the property

- Special assessments, which are levied to pay for specific projects or improvements that benefit the property

- Intangible taxes, which are levied on personal property such as stocks, bonds, and other financial assets

2. What are the factors that affect the assessed value of a property?

The assessed value of a property is determined by a number of factors, including:

- The location of the property

- The size of the property

- The age and condition of the property

- The type of property

- The current real estate market

3. How do tax exemptions and abatements work?

Tax exemptions and abatements are two ways to reduce the amount of property taxes that a property owner has to pay:

- Tax exemptions are permanent reductions in the assessed value of a property, while abatements are temporary reductions in the amount of taxes that are due.

- There are a variety of tax exemptions and abatements available, depending on the state and local government where the property is located.

4. What are the consequences of not paying property taxes?

Failure to pay property taxes can result in a number of consequences, including:

- Late payment penalties

- Interest charges

- Foreclosure on the property

5. What are the different methods of property valuation?

There are three main methods of property valuation:

- Comparable sales approach: Compares the property to similar properties that have recently sold in the same area.

- Cost approach: Estimates the cost of replacing the property.

- Income approach: Estimates the potential income that the property could generate.

6. What are the challenges of property tax assessment?

There are a number of challenges associated with property tax assessment, including:

- ensuring that all properties are assessed fairly and equitably

- keeping up with changes in the real estate market

- dealing with appeals from property owners who believe that they are being over-assessed

7. What are the ethical considerations in property tax assessment?

Tax evaluators must adhere to a number of ethical considerations, including:

- Objectivity: Assessors must be impartial and unbiased in their assessments.

- Confidentiality: Assessors must keep all taxpayer information confidential.

- Accuracy: Assessors must ensure that their assessments are accurate and fair.

- Independence: Assessors must be independent of any political or financial influences.

8. What are the current trends in property tax assessment?

There are a number of current trends in property tax assessment, including:

- The use of technology to improve the accuracy and efficiency of assessments

- The development of new assessment methods that are more sensitive to property values

- The increasing use of data analytics to identify and address disparities in assessments

9. What are the challenges and opportunities for tax evaluators in the future?

Tax evaluators will face a number of challenges and opportunities in the future, including:

- Changing real estate markets

- The need for new assessment methods

- The increasing use of technology

10. What is your experience with property tax assessment?

I have worked as a tax evaluator for the past five years. In this role, I have been responsible for assessing the value of a variety of properties, including residential, commercial, and industrial properties.

I have a strong understanding of the assessment process and the factors that affect the value of property. I am also proficient in the use of technology to assist in the assessment process.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Tax Evaluator.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Tax Evaluator‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Tax Evaluators play a crucial role in ensuring the accuracy and fairness of property tax assessments. Their key responsibilities include:

1. Property Value Evaluation

Inspecting properties to determine their value based on market conditions, comparable sales, and property characteristics.

- Conducting site visits, taking measurements, and assessing the condition of properties.

- Researching comparable properties and market data to determine appropriate values.

2. Assessment Review and Analysis

Examining property tax assessments to ensure they are accurate, equitable, and compliant with regulations.

- Verifying that assessments reflect the property’s actual value and condition.

- Analyzing assessment data to identify discrepancies and inconsistencies.

3. Taxpayer Communication

Responding to taxpayer inquiries, explaining assessments, and resolving disputes.

- Providing clear and timely information about tax assessments and valuation processes.

- Mediating disputes and negotiating settlements with property owners.

4. Tax Policy Analysis and Development

Collaborating with other departments and stakeholders to develop and implement tax policies that promote fairness and efficiency.

- Conducting research and analyzing data to identify areas for policy improvement.

- Participating in public hearings and stakeholder meetings to gather feedback and input.

Interview Tips

Preparing for an interview for a Tax Evaluator position requires understanding the job responsibilities and showcasing your relevant skills and experience. Here are some interview preparation tips to help you ace the interview:

1. Research the Role and Company

Familiarize yourself with the specific responsibilities of a Tax Evaluator at the company you are applying to. Visit their website, read industry publications, and connect with current or former employees to gain insights into the role.

- Emphasize your understanding of the company’s mission, values, and tax assessment process.

- Example: “I have thoroughly researched your company’s website and am impressed by your commitment to providing accurate and equitable property tax assessments.”

2. Highlight Your Skills and Experience

Identify the key skills and experiences that align with the Tax Evaluator position. Quantify your accomplishments and provide specific examples that showcase your abilities.

- Focus on your proficiency in property valuation techniques, assessment analysis, and taxpayer communication.

- Example: “In my previous role, I successfully evaluated over 500 properties annually, resulting in an average assessment accuracy rate of 98%.”

3. Demonstrate Your Knowledge of Tax Policies and Regulations

Tax Evaluators must have a thorough understanding of tax policies and regulations. Demonstrate your knowledge by referring to relevant legislation, industry standards, and case studies.

- Show that you are up-to-date with the latest changes in tax laws and assessment practices.

- Example: “I am familiar with the recent amendments to the Property Tax Assessment Code and can effectively apply them in my evaluations.”

4. Emphasize Your Communication and Interpersonal Skills

Tax Evaluators interact with taxpayers, colleagues, and other stakeholders. Highlight your ability to communicate clearly, resolve conflicts, and build relationships.

- Describe your experience in handling difficult conversations and mediating disputes.

- Example: “I am an effective communicator with excellent interpersonal skills. I am confident in my ability to explain complex tax concepts to taxpayers and negotiate resolutions that satisfy both parties.”

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Tax Evaluator role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.