Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Tax Examining Technician position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

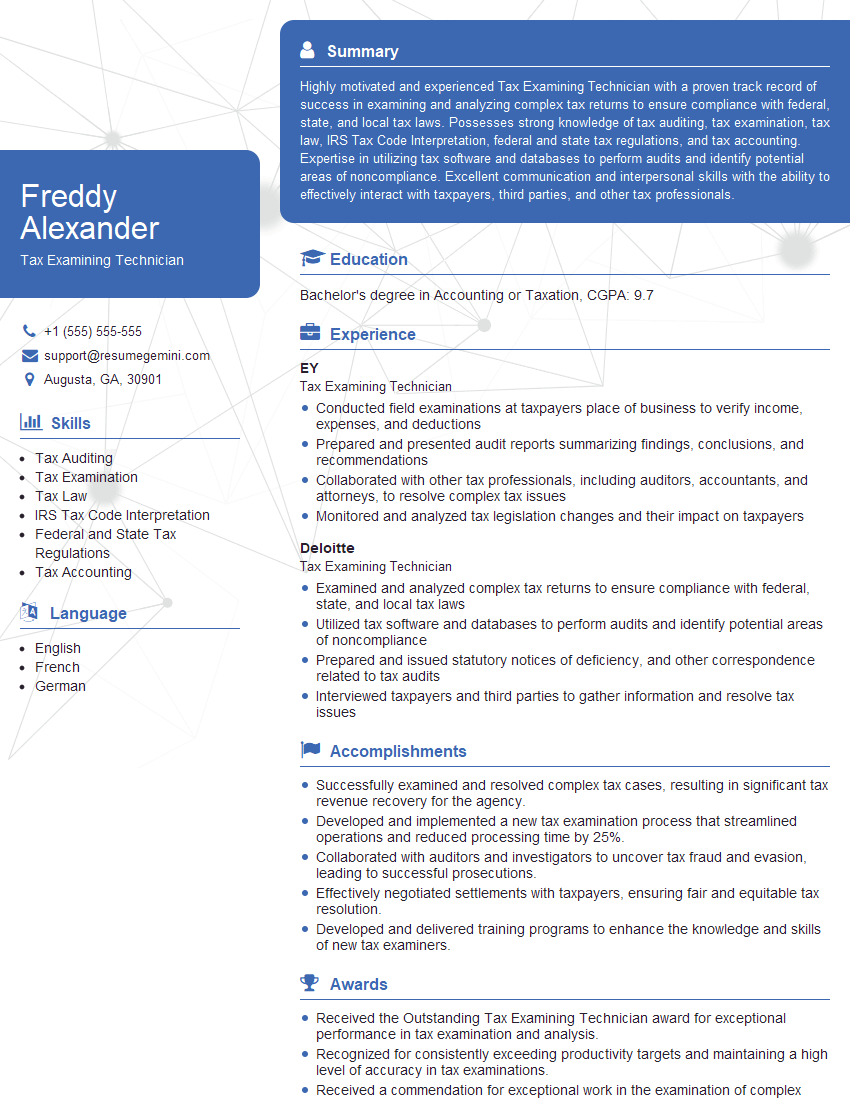

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Tax Examining Technician

1. Explain the steps involved in auditing a tax return?

- Planning:

- Examination:

- Review:

- Issuance of Report:

- Recommendation and Follow-up:

2. What are the common errors that you encounter during tax audits?

Errors Calculations

- Mathematical errors.

- Errors in applying tax rates.

Errors in Reporting

- Incorrect reporting of income.

- Incorrect reporting of deductions.

Errors in Interpretation

- Incorrect interpretations of tax laws.

- Incorrect interpretations of tax forms.

3. How do you stay up-to-date on changes in tax laws and regulations?

- Attending training and seminars.

- Reading tax publications and journals.

- Subscribing to tax newsletters.

- Using online tax resources.

4. Describe your experience in using tax auditing software.

- Proficient.

- Experience with various tax auditing software applications.

- Used tax auditing software to identify errors and inconsistencies.

5. How do you handle complex tax issues?

- Research relevant tax laws and regulations.

- Consult with tax experts.

- Analyze previous audit findings.

- Identify potential areas of risk.

6. How do you maintain confidentiality during tax audits?

- Follow established confidentiality protocols.

- Only access taxpayer information on a need-to-know basis.

- Secure taxpayer information in a locked cabinet or safe.

- Dispose of taxpayer information securely.

7. What are the ethical considerations that you must keep in mind while conducting tax audits?

- Objectivity and Independence:

- Integrity:

- Confidentiality:

- Professional Competence and Due Care:

8. How do you handle taxpayers who are uncooperative or resistant during audits?

- Maintain a professional and respectful demeanor.

- Explain the purpose of the audit and the taxpayer’s rights.

- Provide clear instructions and deadlines.

- Follow up regularly to ensure cooperation.

9. Describe a situation where you successfully resolved a complex or challenging tax audit.

- Identified a significant error that resulted in a substantial tax refund for the taxpayer.

- Effectively negotiated with the taxpayer to resolve a complex tax issue.

- Resolved a dispute with the taxpayer through mediation.

10. Why are you interested in working as a Tax Examining Technician for our organization?

- Align with organization’s values.

- Contribute to the organization’s mission.

- Develop and grow within the organization.

- Learn from and collaborate with experienced professionals.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Tax Examining Technician.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Tax Examining Technician‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Tax Examining Technicians assist in auditing and examining tax returns to ensure compliance with tax laws and regulations. They play a crucial role in the tax administration process by analyzing financial records and ensuring accurate tax calculations. Here are some of the key job responsibilities of a Tax Examining Technician:

1. Tax Return Examination

Examining various tax returns, including individual, corporate, and partnership returns, to verify the accuracy of reported income, deductions, and credits.

- Analyzing tax documents, such as W-2s, 1099s, and financial statements, to ensure proper reporting.

- Calculating tax liability, penalties, and interest based on applicable tax laws and regulations.

2. Identify Tax Discrepancies and Issues

Identifying potential discrepancies and issues in tax returns that warrant further investigation.

- Reviewing tax returns for missing or incomplete information, incorrect calculations, and potential fraud.

- Conducting research and gathering additional information to support or refute any identified issues.

3. Communication and Correspondence

Communicating with taxpayers and their representatives regarding tax audits and examinations.

- Explaining the audit process, discussing tax issues, and resolving discrepancies.

- Preparing audit reports and issuing notices of assessment.

4. Case Management

Managing and tracking tax cases throughout the audit process.

- Maintaining case files, documenting audit procedures, and keeping track of deadlines.

- Coordinating with other team members and supervisors to ensure efficient case resolution.

Interview Tips

Preparing for an interview for a Tax Examining Technician position requires a combination of technical knowledge, analytical skills, and effective communication abilities. Here are some interview preparation tips and hacks to help you ace the interview:

1. Research the Position and Company

Thoroughly research the specific Tax Examining Technician position and the organization you are applying to. Understand the responsibilities of the role and how they align with your skills and experience.

- Visit the company website to learn about their mission, values, and recent news.

- Check industry publications and online resources for insights into the tax field and the company’s reputation.

2. Know Your Tax Laws and Regulations

As a Tax Examining Technician, you must have a solid understanding of tax laws, regulations, and accounting principles. Brush up on the latest tax codes and any recent changes or updates.

- Review relevant tax laws, such as the Internal Revenue Code and state tax regulations.

- Familiarize yourself with tax accounting concepts, depreciation rules, and other tax-related topics.

3. Prepare for Technical Questions

Expect to encounter technical questions during the interview. Be prepared to discuss your knowledge of tax auditing procedures, data analysis techniques, and case management strategies.

- Practice answering questions about tax return examination, discrepancy identification, and communication with taxpayers.

- Highlight your proficiency in using tax software and other technology tools relevant to the role.

4. Demonstrate Analytical and Problem-Solving Skills

Tax Examining Technicians must possess strong analytical and problem-solving skills. Showcase your ability to analyze complex tax returns, identify potential issues, and develop solutions.

- Use examples from your previous experience where you successfully resolved tax-related problems.

- Discuss your approach to analyzing data, drawing conclusions, and making recommendations.

Next Step:

Now that you’re armed with the knowledge of Tax Examining Technician interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Tax Examining Technician positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini