Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Tax Expert position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

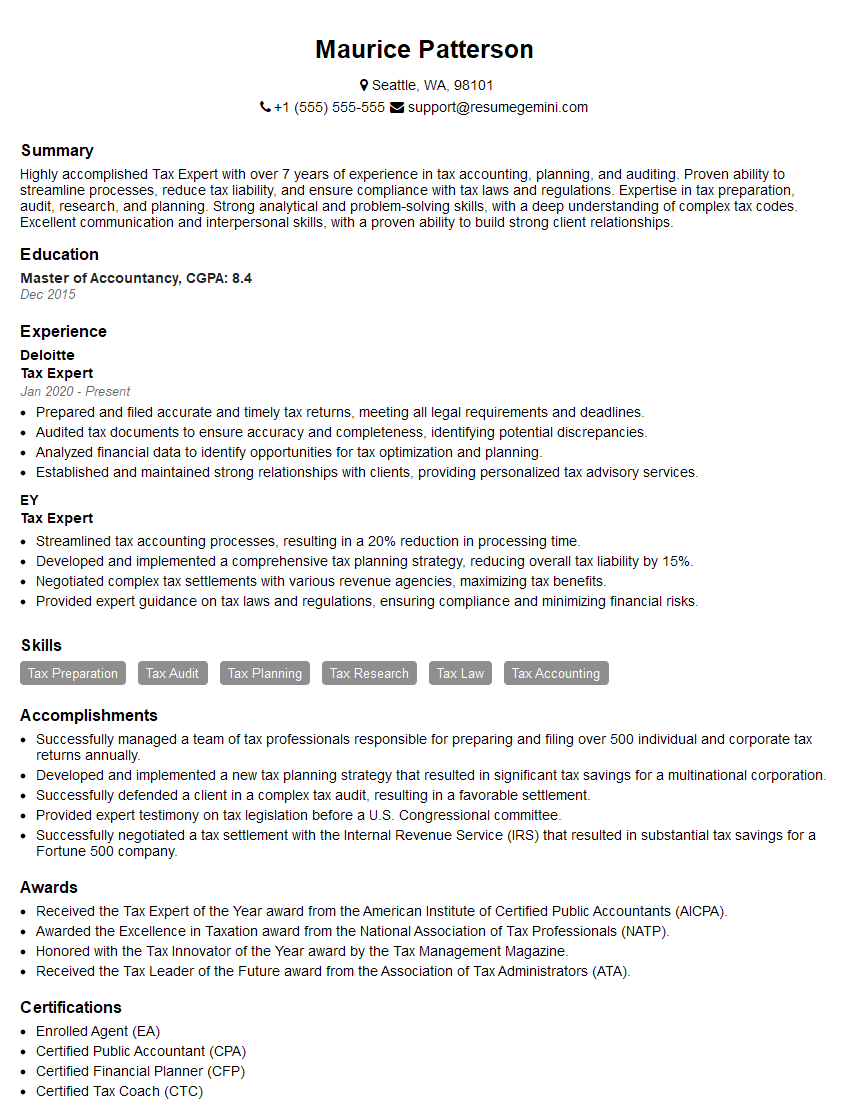

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Tax Expert

1. What are the key tax laws and regulations that impact businesses in the industry that you are applying for?

Answer:

- Income Tax Act

- Goods and Services Tax Act

- Customs Act

- Central Excise Act

- Foreign Exchange Management Act

2. What are the common tax planning strategies for businesses in this industry?

Answer:

Income Tax Planning Strategies

- Optimizing depreciation and amortization deductions

- Utilizing tax credits and incentives

- Structuring business entities for tax efficiency

GST Planning Strategies

- Optimizing GST input tax credit utilization

- Classifying goods and services correctly

- Using GST exemptions and concessions

3. What are the ethical considerations that tax experts must be aware of?

Answer:

- Maintaining confidentiality

- Avoiding conflicts of interest

- Providing unbiased advice

- Complying with tax laws and regulations

4. What are the latest trends and developments in tax law that could impact businesses?

Answer:

- Digitalization of tax administration

- Increased focus on tax audits and investigations

- Globalization of tax systems

- Tax implications of emerging technologies, such as cryptocurrency

5. How do you stay up-to-date on the latest tax laws and regulations?

Answer:

- Attending industry conferences and seminars

- Reading tax journals and publications

- Participating in continuing professional education courses

- Consulting with tax experts and advisors

6. What are your strengths and weaknesses as a tax expert?

Answer:

Strengths:

- In-depth knowledge of tax laws and regulations

- Strong analytical and problem-solving skills

- Excellent communication and interpersonal skills

Weaknesses:

- Limited experience in a specific industry

- Need to improve time management skills

- Sometimes struggle to prioritize tasks

7. What is your understanding of transfer pricing?

Answer:

- Transfer pricing is the process of setting prices for transactions between related parties

- It is used to allocate profits and losses between different entities within a multinational corporation

- Transfer pricing can be used to optimize tax payments and mitigate risk

8. What are the challenges of tax compliance for multinational corporations?

Answer:

- Dealing with different tax laws and regulations in multiple jurisdictions

- Managing transfer pricing and other intercompany transactions

- Staying up-to-date on changes in tax laws and regulations

9. What are the tax implications of cross-border transactions?

Answer:

- Withholding taxes

- Transfer pricing

- Permanent establishment

- Double taxation

10. What is your experience in tax audit and litigation?

Answer:

- Assisted clients in preparing for and responding to tax audits

- Represented clients in tax litigation proceedings

- Negotiated settlements with tax authorities

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Tax Expert.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Tax Expert‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Tax Experts are responsible for providing expert advice and guidance on tax matters to individuals, businesses, and organizations. They work closely with clients to understand their financial situation and tax obligations, and develop strategies to minimize their tax liability and ensure compliance with tax laws and regulations.

1. Tax Planning and Preparation

Develop and implement tax planning strategies to minimize clients’ tax liability.

- Analyze financial records to identify potential tax deductions and credits.

- Prepare and file tax returns for individuals, businesses, and trusts.

2. Tax Research and Analysis

Research and analyze tax laws and regulations to stay abreast of changes and provide accurate advice to clients.

- Monitor tax legislation and case law to identify potential implications for clients.

- Conduct due diligence and risk assessments to identify potential tax issues.

3. Client Representation

Represent clients before tax authorities in audits, appeals, and other proceedings.

- Negotiate with the IRS and state tax agencies on behalf of clients.

- Prepare and present appeals and other documents to tax authorities.

4. Consulting and Advisory Services

Provide consulting and advisory services to clients on various tax-related matters.

- Advise clients on tax implications of business transactions and investments.

- Develop and implement tax-efficient structures for businesses and individuals.

Interview Tips

Preparing for a tax expert interview requires a combination of technical knowledge, industry updates, and soft skills. Here are some tips to help you ace your interview:

1. Research the Company and Position

Thoroughly research the company’s industry, culture, and specific requirements for the tax expert role.

- Visit the company’s website, read industry news articles, and connect with current or former employees on LinkedIn.

2. Practice Your Technical Skills

Review tax laws, regulations, and accounting principles relevant to the position.

- Solve sample tax problems or case studies to demonstrate your analytical abilities.

3. Highlight Your Communication Skills

Tax experts often need to explain complex tax concepts to clients, colleagues, and tax authorities.

- Prepare examples of presentations or written reports you’ve created that effectively convey tax-related information.

4. Emphasize Your Attention to Detail

Accuracy is crucial in tax matters.

- Quantify your experience in reviewing and analyzing financial data with a high degree of accuracy.

5. Stay Updated on Tax Laws

Tax laws and regulations are constantly changing.

- Demonstrate your commitment to continuous learning by highlighting your involvement in professional development activities or certifications.

6. Prepare for Behavioral Questions

Behavioral questions are common in interviews and assess your soft skills and work style.

- Use the STAR method (Situation, Task, Action, Result) to structure your answers and provide specific examples of your problem-solving, teamwork, and communication abilities.

7. Dress Professionally and Arrive Punctually

First impressions matter.

- Dress in business formal attire and arrive on time for your interview.

8. Prepare Questions for the Interviewer

Asking thoughtful questions shows your interest and engagement in the position and company.

- Prepare questions about the company’s tax strategies, the team you’ll be working with, or industry trends.

9. Follow Up

Within 24 hours of the interview, send a thank-you note to the interviewer reiterating your interest in the position and highlighting your key skills.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Tax Expert interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!