Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Tax Investigator position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

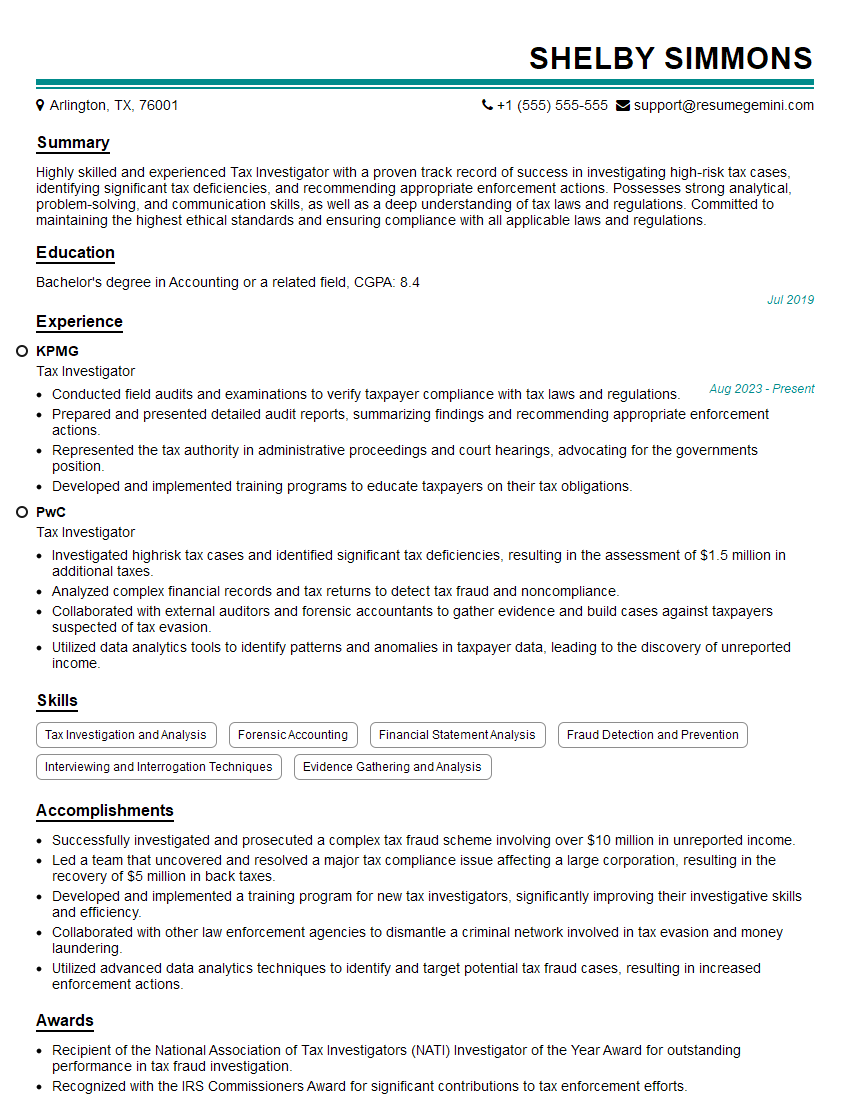

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Tax Investigator

1. How would you approach an investigation involving a complex tax scheme?

Sample Answer:

- Begin by gathering background information and interviewing key personnel

- Conduct a thorough review of financial records and transaction patterns

- Analyze potential indicators of tax evasion or avoidance

- Identify and interview witnesses or third parties involved in the scheme

- Review applicable tax laws and regulations to assess potential violations

- Prepare a comprehensive report summarizing findings and recommending appropriate actions

2. Describe the different types of tax fraud you have investigated.

Sample Answer:

- Income tax fraud (e.g., underreporting income, claiming false expenses)

- Sales tax fraud (e.g., failing to collect or remit sales tax)

- Property tax fraud (e.g., misrepresenting the value of property)

- Payroll tax fraud (e.g., failing to withhold or remit payroll taxes)

- Identity theft and tax refund fraud

- Tax shelter fraud (e.g., promoting or selling fraudulent tax schemes)

3. Explain the role of forensic accounting in tax investigations.

Sample Answer:

- Uncover hidden or misrepresented financial transactions

- Reconstruct financial data and identify anomalies or inconsistencies

- Trace and analyze complex financial flows to identify potential fraud

- Provide expert testimony and support in tax court proceedings

- Assist in asset recovery and seizure from individuals or entities involved in tax fraud

4. How do you stay updated on the latest tax laws and regulations?

Sample Answer:

- Attend conferences and seminars led by tax professionals

- Subscribe to professional journals and newsletters

- Participate in continuing education courses

- Review and analyze recent tax court rulings and legal precedents

- Consult with legal counsel and tax advisors for expert guidance

5. Describe a situation where you had to make a difficult decision during an investigation.

Sample Answer:

- Explain the ethical or legal considerations involved

- Describe the decision-making process and the factors you considered

- Discuss the outcome of the decision and any subsequent actions taken

- Highlight your ability to make sound judgments under pressure

6. How do you prioritize and manage your workload effectively?

Sample Answer:

- Use to-do lists and prioritize tasks based on urgency and importance

- Delegate tasks to others when appropriate to ensure timely completion

- Break down complex investigations into smaller, manageable components

- Communicate regularly with supervisors to keep them informed of progress

7. Explain your approach to maintaining confidentiality and protecting taxpayer information.

Sample Answer:

- Adhere to the ethical and legal obligations of tax law

- Use secure storage methods for sensitive taxpayer information

- Limit access to taxpayer data on a need-to-know basis

- Maintain professional discretion and avoid discussing taxpayer information outside of work

8. Describe your experience working with other law enforcement agencies.

Sample Answer:

- Discuss collaborations with local, state, and federal law enforcement agencies

- Explain how you coordinate investigations and share information effectively

- Highlight any successes or challenges encountered in interagency partnerships

9. How do you keep up with advances in technology and its impact on tax investigations?

Sample Answer:

- Attend workshops and training on forensic accounting software

- Stay informed about emerging technologies and their potential applications

- Collaborate with technical experts to leverage advanced data analytics

10. What do you believe are the most important qualities for a successful tax investigator?

Sample Answer:

- Strong analytical and problem-solving skills

- Excellent communication and interpersonal skills

- High ethical standards and integrity

- Attention to detail and meticulous record-keeping

- Ability to work independently and as part of a team

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Tax Investigator.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Tax Investigator‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Tax Investigators are responsible for ensuring compliance with tax laws and regulations by conducting audits, investigations, and examinations. They work independently and as part of a team to ensure that individuals and businesses are paying their fair share of taxes. Key job responsibilities include:

1. Conducting audits and investigations

Tax Investigators conduct audits and investigations to ensure compliance with tax laws and regulations. They examine financial records, interview taxpayers, and analyze data to identify potential areas of noncompliance. They may also conduct criminal investigations into suspected tax fraud or evasion.

- Plan and conduct audits and investigations to verify the accuracy and completeness of tax returns.

- Interview taxpayers, witnesses, and other parties involved in the investigation.

- Examine financial records, including bank statements, invoices, and receipts.

- Analyze data to identify potential areas of noncompliance.

2. Preparing reports and making recommendations

Tax Investigators prepare reports summarizing their findings and make recommendations for corrective action. They may also prepare briefs for use in court proceedings. They communicate effectively both orally and in writing and explain complex tax laws and regulations to taxpayers and other stakeholders.

- Prepare reports summarizing the findings of the audit or investigation.

- Make recommendations for corrective action.

- Prepare briefs for use in court proceedings.

3. Testifying in court

Tax Investigators may be required to testify in court about their findings. They must be able to clearly and concisely explain their conclusions and be able to withstand cross-examination.

- Testify in court about their findings.

- Be able to withstand cross-examination.

4. Keeping up-to-date on tax laws and regulations

Tax Investigators must keep up-to-date on tax laws and regulations. They must be able to interpret and apply these laws and regulations to complex tax situations.

- Keep up-to-date on tax laws and regulations.

- Interpret and apply tax laws and regulations to complex tax situations.

Interview Tips

Preparing for a Tax Investigator interview can be daunting, but with the right preparation, you can increase your chances of success. Here are a few tips to help you ace your interview:

1. Research the organization and the position

Before your interview, take some time to research the organization and the position you’re applying for. This will help you understand the organization’s culture and the specific requirements of the job. You can find information about the organization on its website, social media pages, and news articles. You can also find information about the position in the job description.

- Visit the organization’s website and social media pages.

- Read news articles about the organization.

- Review the job description carefully.

2. Practice answering common interview questions

There are a few common interview questions that you’re likely to be asked in a Tax Investigator interview. These questions include:

- Tell me about your experience with tax audits and investigations.

- What are your strengths and weaknesses as a Tax Investigator?

- Why are you interested in working for our organization?

Take some time to practice answering these questions before your interview. You can practice with a friend or family member, or you can record yourself answering the questions and then listen back to your answers. This will help you feel more confident and prepared during your interview.

3. Dress professionally

First impressions matter, so it’s important to dress professionally for your interview. This means wearing a suit or business casual attire. You should also make sure your clothes are clean and pressed.

4. Be on time for your interview

Punctuality is important for any interview, but it’s especially important for a Tax Investigator interview. This is because Tax Investigators are responsible for meeting deadlines and managing their time effectively. If you’re late for your interview, it will reflect poorly on you and may hurt your chances of getting the job.

5. Be yourself

It’s important to be yourself during your interview. Don’t try to be someone you’re not, because the interviewer will be able to tell. Just be confident in your abilities and let your personality shine through.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Tax Investigator role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.