Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Tax Manager position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

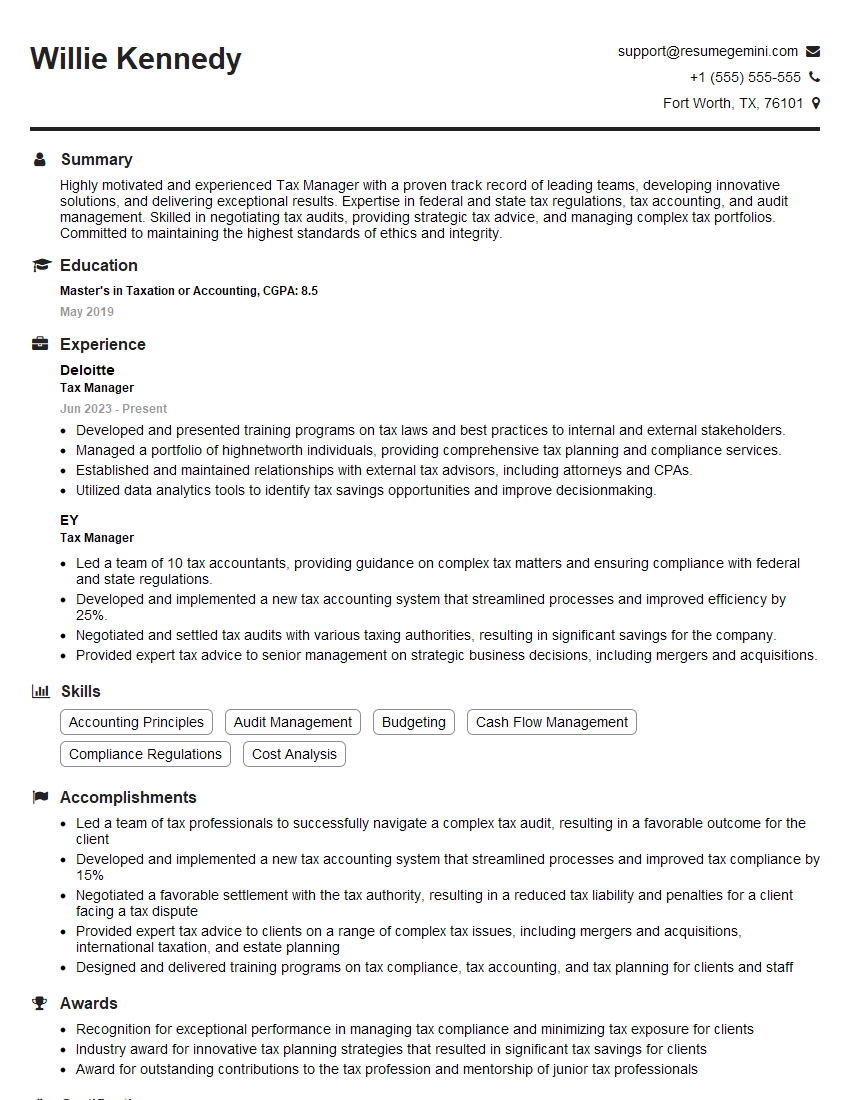

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Tax Manager

1. Can you explain the different types of tax credits available to individuals and businesses?

Answer the question here in detail and mention points using ul tag as done below

- Individual Tax Credits: Dependent Care Credit, Child Tax Credit, Earned Income Tax Credit, Retirement Savings Contribution Credit, American Opportunity Tax Credit

- Business Tax Credits: Research and Development Tax Credit, Work Opportunity Tax Credit, Low-Income Housing Tax Credit, Renewable Energy Tax Credit

2. How do you stay updated on the latest tax laws and regulations?

Continuing Education

- Attend conferences and seminars

- Online courses and webinars

- Tax-related publications (e.g., Tax Notes, Journal of Taxation)

Professional Development

- Join professional organizations (e.g., American Institute of CPAs)

- Network with other tax professionals

- Engage in discussions on tax forums and online communities

Research and Analysis

- Monitor tax legislation and agency guidance

- Review court cases and administrative rulings

- Use tax research tools (e.g., CCH, RIA)

3. What is your experience with international taxation?

Answer the question here in detail and mention points using ul tag as done below

- Taxation of Foreign Income: Foreign Tax Credit, Subpart F Income, GILTI

- Taxation of US Income by Foreign Persons: Withholding Tax, Effectively Connected Income, FIRPTA

- Cross-Border Transactions: Transfer Pricing, Treaty Benefits, International Tax Planning

4. Can you describe your approach to tax planning for a complex corporate structure?

Answer the question here in detail and mention points using ul tag as done below

- Analyze Corporate Structure: Identify legal entities, ownership interests, and business operations

- Identify Tax Planning Opportunities: Explore tax credits, deductions, and other strategies to reduce tax liability

- Consider Tax Consequences of Transactions: Analyze mergers, acquisitions, and other transactions for potential tax implications

- Coordinate with Other Advisors: Consult with legal counsel, accountants, and other professionals to ensure a comprehensive approach

- Implement and Monitor Tax Plan: Execute tax planning strategies and track results for compliance and optimization

5. How do you prioritize your workload and manage multiple projects efficiently?

Answer the question here in detail and mention points using ul tag as done below

- Establish Clear Priorities: Identify the most critical and time-sensitive tasks

- Create a Realistic Schedule: Break down large projects into smaller, manageable steps

- Utilize Technology: Project management software, task lists, and reminders can help track progress

- Delegate Responsibilities: Assign tasks to team members based on their skills and availability

- Communicate Regularly: Keep stakeholders informed about project status and address any potential roadblocks

6. Can you discuss your experience with tax audits and how you prepare for them?

Answer the question here in detail and mention points using ul tag as done below

- Gather and Organize Documents: Collect all relevant tax returns, supporting documents, and financial records

- Review Tax Laws and Regulations: Refresh knowledge of applicable tax laws and precedents

- Prepare Audit Response Plan: Outline the approach to address auditor inquiries and potential adjustments

- Communicate with Auditor: Establish a professional and cooperative relationship

- Negotiate and Resolve Issues: Discuss findings, propose solutions, and reach mutually acceptable outcomes

7. What are the ethical considerations that you keep in mind when providing tax advice?

Answer the question here in detail and mention points using ul tag as done below

- Maintain Confidentiality: Protect client information and communications

- Provide Competent Advice: Offer well-informed and diligent advice based on sound professional judgment

- Avoid Conflicts of Interest: Disclose potential conflicts and take steps to avoid bias

- Uphold Tax Laws: Comply with all applicable tax laws and regulations

- Act with Integrity: Maintain a high standard of ethical conduct and avoid any actions that could compromise professional integrity

8. How do you stay abreast of emerging trends and best practices in tax management?

Answer the question here in detail and mention points using ul tag as done below

- Attend Industry Conferences: Engage with experts and learn about the latest developments

- Subscribe to Professional Journals: Stay informed through publications like Tax Notes, Journal of Taxation, and Bloomberg Tax

- Participate in Online Forums: Join professional organizations and engage in discussions on tax-related topics

- Conduct Internal Research: Regularly review internal data and industry reports to identify trends

- Consult with Advisors: Seek guidance from external experts, such as tax lawyers or accountants, on complex issues

9. Can you describe your experience with tax controversy and dispute resolution?

Answer the question here in detail and mention points using ul tag as done below

- Representation in Tax Audits: Defended clients’ interests before tax authorities during audits

- Appeals and Litigation: Filed appeals and represented clients in tax court and other legal proceedings

- Negotiation and Settlement: Negotiated settlements and alternative dispute resolution mechanisms

- Tax Controversy Planning: Advised clients on strategies to minimize the risk of tax disputes

- Collaboration with Other Professionals: Worked closely with tax attorneys and accountants to provide comprehensive dispute resolution services

10. How do you manage a team of tax professionals and ensure high performance?

Answer the question here in detail and mention points using ul tag as done below

- Set Clear Expectations: Communicate goals, responsibilities, and performance standards

- Foster Collaboration: Encourage teamwork, knowledge sharing, and open communication

- Provide Training and Development: Invest in professional development opportunities to enhance team skills

- Recognize and Reward Success: Acknowledge and appreciate contributions and achievements

- Create a Positive Work Environment: Promote a supportive and inclusive workplace culture

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Tax Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Tax Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Tax Managers are responsible for providing guidance and management on all tax-related matters for their organization.

1. Tax Compliance

Supervising and ensuring the accuracy and completeness of tax filings.

- Preparation and filing of federal, state, and local tax returns.

- Establish and maintain tax accounting systems and practices.

2. Tax Planning

Developing and implementing tax strategies to minimize tax liability.

- Identify tax-saving opportunities through proactive tax planning.

- Structuring transactions to minimize tax impact.

3. Tax Audit and Controversy

Representing the organization in tax audits and disputes.

- Prepare for and respond to tax audit inquiries and notices.

- Negotiate with tax authorities to resolve disputes.

4. Tax Consulting

Providing tax advice and guidance to other departments and external stakeholders.

- Advise on tax implications of business transactions.

- Develop and conduct tax training programs.

Interview Tips

Preparing for an interview for a Tax Manager position requires a combination of technical expertise and interview skills.

1. Research the Company and Position

Thoroughly research the company’s industry, size, and recent financial performance. Understand the specific responsibilities of the Tax Manager role.

- Review the company’s website, financial reports, and press releases.

- Utilize LinkedIn to connect with current or former employees in the tax department.

2. Highlight Your Technical Skills

Demonstrate your proficiency in tax accounting, tax laws, and tax planning strategies. Showcase your experience with specific tax software and industry-specific tax regulations.

- Quantify your accomplishments in previous tax roles.

- Discuss complex tax issues you have successfully resolved.

3. Emphasize Your Communication and Interpersonal Skills

Tax Managers need to be able to clearly and effectively communicate tax-related information to both technical and non-technical audiences. Highlighting your written and verbal communication skills is essential.

- Provide examples of presentations or reports you have delivered on tax topics.

- Demonstrate your ability to simplify complex tax concepts for a non-technical audience.

4. Prepare for Common Interview Questions

Anticipate common interview questions and prepare thoughtful responses. Practice answering questions related to your tax expertise, management style, and problem-solving abilities.

- Prepare specific examples of tax strategies you have implemented and their impact.

- Practice answering questions about your leadership and team management skills.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Tax Manager role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.