Feeling lost in a sea of interview questions? Landed that dream interview for Tax Preparer but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Tax Preparer interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

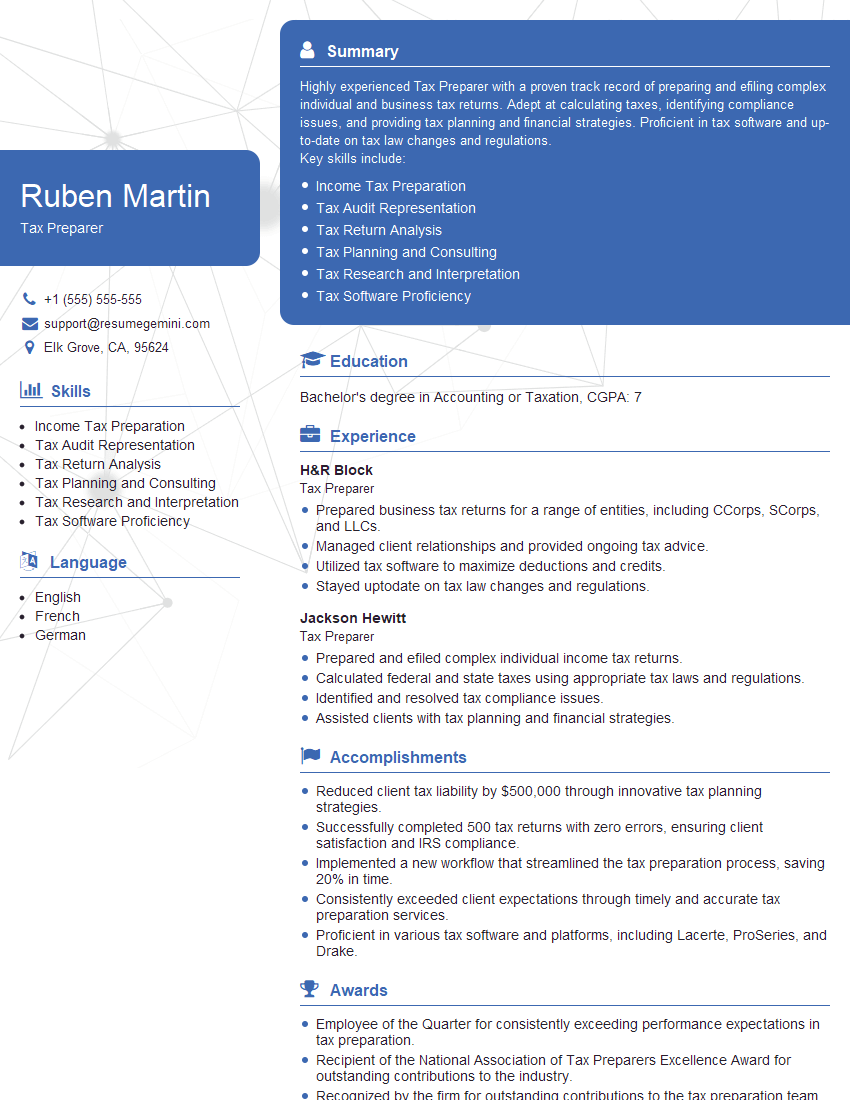

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Tax Preparer

1. What are the common tax deductions and credits that you are familiar with?

- Federal income tax deduction

- State and local income tax deduction

- Mortgage interest deduction

- Student loan interest deduction

- Child tax credit

- Earned income tax credit

2. Explain the difference between standard deduction and itemized deduction. For which type of taxpayer is itemized deduction more beneficial?

Standard deduction

- A flat amount that can be deducted from taxable income

- Simpler and easier to claim

- Available to all taxpayers

Itemized deduction

- A deduction for specific expenses allowed by the tax code

- Can be more valuable than the standard deduction if expenses are high enough

- Requires detailed record-keeping

- Not available to taxpayers who claim the standard deduction

Itemized deduction is more beneficial for taxpayers with high expenses, such as mortgage interest, property taxes, and charitable contributions.

3. How do you stay up-to-date with the latest tax laws and regulations?

- Attend tax seminars and webinars

- Read tax journals and publications

- Subscribe to tax update services

- Consult with tax professionals

4. What is the difference between a W-2 and a 1099 form?

- W-2 is issued to employees by their employers and reports wages, salaries, tips, and other compensation.

- 1099 is issued to independent contractors and reports payments made for services rendered.

5. What are the most common errors you see taxpayers make on their tax returns?

- Math errors

- Incorrectly reporting income

- Missing or incorrect deductions

- Filing status errors

- Not filing on time

6. What is the difference between a tax credit and a tax deduction?

- Tax credit reduces the amount of tax you owe dollar for dollar.

- Tax deduction reduces the amount of taxable income, which can result in a lower tax bill.

7. How do you handle complex tax situations, such as those involving self-employment or investments?

- Research the relevant tax laws and regulations

- Consult with tax professionals

- Use tax software or online resources

- Attend tax seminars and webinars

8. What is your experience with tax audit?

- Explain your role in the audit process

- Describe the steps involved in an audit

- Discuss any challenges you have faced during an audit

9. What is your understanding of the tax implications of cryptocurrency?

- Cryptocurrency is treated as property for tax purposes

- Capital gains or losses are recognized when cryptocurrency is sold or exchanged

- Mining cryptocurrency may be subject to self-employment tax

10. What is the most challenging aspect of tax preparation?

- Keeping up with the ever-changing tax laws and regulations

- Dealing with complex tax situations

- Ensuring accuracy and avoiding errors

- Meeting deadlines

- Communicating effectively with clients

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Tax Preparer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Tax Preparer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Tax Preparers play a vital role in ensuring the accuracy and completeness of tax returns. Their responsibilities encompass a wide range of tasks, including:

1. Tax Return Preparation

They meticulously prepare and file individual, business, and other tax returns in compliance with applicable tax laws and regulations.

- Gathering and verifying taxpayer information, including financial statements and supporting documents

- Calculating tax liability and determining applicable deductions and credits

- Using tax software and reference materials to ensure accuracy and adherence to tax codes

2. Tax Research and Analysis

Staying abreast of ever-changing tax laws and regulations, Tax Preparers conduct thorough research and analysis to stay current on tax-related matters.

- Reviewing tax publications, circulars, and other resources to stay informed about tax law updates

- Analyzing complex tax situations and providing guidance to taxpayers

- Interpreting tax regulations and applying them to specific cases

3. Client Communication and Consultation

Tax Preparers maintain open communication channels with clients, promptly addressing their questions and concerns.

- Explaining tax laws and regulations to clients in a clear and understandable manner

- Responding to client inquiries and providing updates on the status of tax returns

- Negotiating with tax authorities on behalf of clients, if necessary

4. Quality Control and Accuracy Assurance

Ensuring the accuracy and completeness of tax returns is paramount for Tax Preparers. They implement rigorous quality control measures.

- Reviewing tax returns for errors and inconsistencies before submission

- Adhering to the firm’s quality control standards and procedures

- Staying up-to-date on tax-related developments to maintain a high level of proficiency

Interview Tips

Preparing for a Tax Preparer interview requires careful planning and execution. Here are some essential tips to help you stand out as a qualified candidate:

1. Research the Company and Position

Demonstrating knowledge about the company’s values, mission, and the specific role you’re applying for will show that you’re genuinely interested in the position.

- Visit the company’s website to learn about their services, industry standing, and recent developments

- Read industry publications and news articles to stay informed about the latest tax-related trends

2. Highlight Your Skills and Experience

Tailor your resume and cover letter to showcase your relevant skills and experience that align with the job requirements.

- Quantify your accomplishments and use specific examples to demonstrate your proficiency in tax preparation, research, and client communication

- If you have experience using specific tax software, such as TurboTax or Lacerte, be sure to mention it

3. Practice Common Interview Questions

Prepare for common interview questions by researching and rehearsing your answers. Practice with a friend or family member to gain confidence and improve your delivery.

- Some common questions include “Tell me about your experience with tax preparation,” “How do you stay up-to-date on tax laws and regulations,” and “Why are you interested in working for our company?”

- Use the STAR method (Situation, Task, Action, Result) to structure your answers and provide specific examples

4. Be Professional and Enthusiastic

First impressions matter, so dress professionally and arrive on time for your interview. Maintain eye contact, speak clearly, and demonstrate a positive attitude.

- Be prepared to talk about your strengths and weaknesses, but focus on presenting yourself as a confident and capable individual

- Ask thoughtful questions at the end of the interview to show that you’re engaged and interested in the position

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Tax Preparer, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Tax Preparer positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.