Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Tax Processor position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

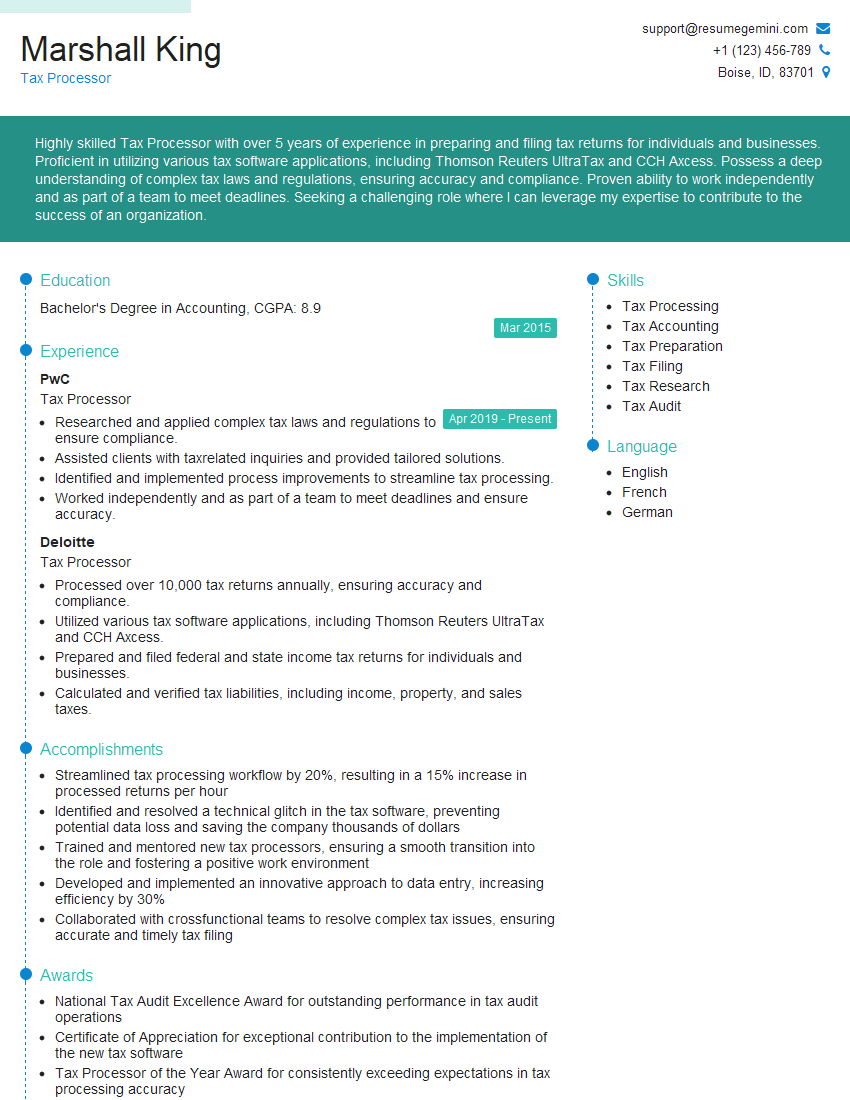

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Tax Processor

1. Describe the key responsibilities of a Tax Processor.

As a Tax Processor, my primary responsibilities would include:

- Preparing and processing individual and business tax returns.

- Ensuring accuracy and completeness of tax information.

- Calculating tax liabilities, deductions, and credits.

- Providing customer support and answering tax-related inquiries.

- Staying up-to-date on tax laws and regulations.

2. What are the essential tax laws and regulations that you are familiar with?

Tax Code

- Internal Revenue Code (IRC)

- State and local tax codes

Regulations

- Treasury Regulations

- Revenue Rulings and Procedures

3. Describe your experience with tax software programs.

I have extensive experience working with tax software programs, including:

- Intuit ProSeries

- Thomson Reuters UltraTax CS

- CCH Axcess Tax

I am proficient in using these programs to prepare and file both personal and business tax returns.

4. How do you ensure accuracy and completeness of tax information?

I employ several methods to ensure accuracy and completeness of tax information, including:

- Thoroughly reviewing taxpayer documents and data.

- Verifying information with the taxpayer or third-party sources.

- Using tax software programs that perform automated calculations and error checks.

- Consulting with colleagues or tax professionals to resolve complex issues.

5. What are some common challenges that you have faced as a Tax Processor?

Some common challenges that I have faced as a Tax Processor include:

- Maintaining up-to-date knowledge of tax laws and regulations.

- Handling complex or unusual tax situations.

- Dealing with taxpayer inquiries and resolving their concerns.

- Meeting deadlines during tax season.

6. How do you stay current with changes to tax laws and regulations?

To stay current with changes to tax laws and regulations, I regularly engage in the following activities:

- Reading tax publications and attending workshops.

- Subscribing to tax newsletters and updates.

- Consulting with tax professionals and other resources.

7. What are your strengths and weaknesses as a Tax Processor?

My strengths as a Tax Processor include:

- Strong technical knowledge of tax laws and regulations.

- Proficiency in using tax software programs.

- Excellent attention to detail and accuracy.

- Strong problem-solving skills.

My weakness is that I am still relatively new to the field and have not yet had the opportunity to work on a wide range of tax returns.

8. Why are you interested in this position?

I am interested in this position because I am passionate about taxation and believe that I have the skills and experience to be a valuable asset to your team.

In my previous role, I was responsible for preparing and filing both personal and business tax returns, and I have a strong understanding of tax laws and regulations.

I am confident that I can use my skills and experience to help your firm provide excellent service to your clients.

9. What are your salary expectations?

My salary expectations are in line with the market average for Tax Processors with my experience and qualifications.

I am open to discussing a salary range and benefits package that is fair and competitive.

10. Do you have any questions for me?

I do not have any questions at this time, but I appreciate the opportunity to interview for this position.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Tax Processor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Tax Processor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Tax Processors are responsible for a variety of tasks related to tax preparation, filing, and auditing. Their primary duty is to ensure that all tax-related documents are accurate and complete, and that they are filed in a timely manner.

1. Data Entry and Processing

Tax Processors are responsible for entering data into tax software and processing tax returns. This data includes taxpayer information, income, deductions, and credits.

- Enter data into tax software accurately and efficiently.

- Process tax returns in accordance with tax laws and regulations.

- Review tax returns for accuracy and completeness.

2. Customer Service

Tax Processors often interact with taxpayers to answer questions about their tax returns. They also provide guidance on tax-related issues, such as how to calculate deductions or credits.

- Answer taxpayer questions about tax returns.

- Provide guidance on tax-related issues.

- Resolve tax-related issues in a timely and efficient manner.

3. Auditing

Tax Processors may also be responsible for auditing tax returns. This involves reviewing tax returns for accuracy and completeness, and identifying any potential errors or fraud.

- Review tax returns for accuracy and completeness.

- Identify potential errors or fraud.

- Recommend adjustments to tax returns as necessary.

4. Compliance

Tax Processors are responsible for ensuring that all tax-related documents are filed in a timely manner. They also need to keep up-to-date on changes to tax laws and regulations.

- File tax-related documents in a timely manner.

- Keep up-to-date on changes to tax laws and regulations.

- Comply with all applicable tax laws and regulations.

Interview Preparation

1. Research the Company and Position

It is important to research the company and the position you are applying for. This will help you understand the company’s culture, values, and goals, and how the position fits into the overall organization.

- Visit the company’s website.

- Read the job description carefully.

- Talk to people who work at the company.

2. Prepare Answers to Common Interview Questions

There are a number of common interview questions that you should be prepared to answer. These questions typically include:

- Tell me about yourself.

- Why are you interested in this position?

- What are your strengths and weaknesses?

- What is your experience with tax preparation?

- How do you stay up-to-date on changes to tax laws and regulations?

3. Practice Your Answers

Once you have prepared your answers to common interview questions, it is important to practice them. This will help you feel more confident and prepared during the interview.

- Ask a friend or family member to interview you.

- Record yourself answering interview questions and watch it later.

- Attend a mock interview workshop.

4. Dress Professionally

It is important to dress professionally for your interview. This shows the interviewer that you are serious about the position and that you respect the company.

- Wear a suit or business casual attire.

- Make sure your clothes are clean and pressed.

- Avoid wearing strong scents or jewelry.

5. Be Punctual

It is important to be punctual for your interview. This shows the interviewer that you are respectful of their time.

- Arrive at the interview location on time.

- If you are running late, call the interviewer to let them know.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Tax Processor interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!